By J.D. Alt

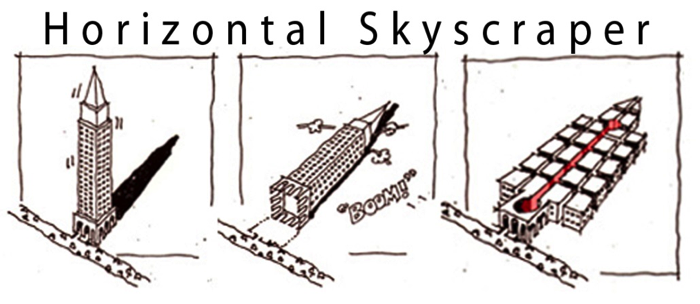

This past month I have been diligently working to complete my entry in a design competition to envision the “Residential Tower of the 21st Century”. At first, I did not intend to enter the competition because I have believed, for many years, that the challenge of future architectural development was horizontal rather than vertical—how to organize and “enable” high density , “piecemeal development” into horizontal communities (using people-mover technologies as a “horizontal elevator” core.) I even named this development model “The Horizontal Skyscraper”.

So I began a letter to the competition sponsors complaining about how they had framed their challenge in a way that precluded the best solution—but, halfway through explaining all of this this, I suddenly realized that what I have for so long been calling “enabling structures” really could—and should—go UP as well as sideways. So I hit the delete button on the letter and began working on my Tower. The bigger surprise came when I got to the part describing how the Tower would be paid for.

In an earlier essay (MMT and the Struggles of Political Democracy) I ventured to suggest a strategy for bypassing the budgeting gridlock that grips our political democracy—a gridlock that prevents Sovereign Spending from buying the goods and services we really need to improve the quality of our collective lives (like, for example, urban people-movers that would enable us to organize our architecture in more cohesive, sustainable, and economically vibrant clusters.) The fact that our “democracy” seems to have been wholly seized by the plutocratic power structure of giant corporations (which are now considered by our Supreme Court to be “people” in the fullest sense) is a special difficulty that will be hard to overcome. (Recall that John D. Rockefeller, founder of Standard Oil, had all the electric streetcar systems in the United States bought up, then tore the tracks from the streets to make way for gasoline powered buses! It was something he no doubt thought he had the right to do because he had the financial means to make it happen.)

As I suggested in the earlier essay, If people are to seize hold of the real power of their democracy, it seems to me that MMT will have to play a leading role in the effort. That’s why I’m enthusiastic with how my “Residential Tower for the 21st Century” has turned out—especially the part about how it is to be paid for. Before I make a fool of myself, however, I thought it might be a good idea to run it by the NEP community for comments and input. Here is the text portion of that page in the design entry:

“THE ADVENT of Modern Money Theory makes way for SOHO Towers to be among the first examples of ‘democratized’ Sovereign Spending (DSS) in the 21st century. DSS goes beyond acknowledging the Federal Government’s unique power to issue Fiat Currency (money) to achieve public goals and purposes. DSS enables local, non-profit groups to envision, engineer, and then implement specific projects for their collective benefit. While Congress will continue to negotiate budgets to achieve and ensure the general welfare, DSS enables well-organized, cooperative groups to avoid the politicization of Congress and directly tap Sovereign Spending to create collective goods at the local level.

“As an example, the SOHO Tower proposed here would be designed, financed, and built as follows:

- A non-profit cooperative is formed for the purpose developing and owning a vertical Co-Housing Tower.

- A regional Economic Development Bank provides a “DSS Project Team” which works with the Co-op group to develop the project.

- The Economic Development Bank then assists in preparing a low-interest, “consul” bond issue with a value equal to the projected development costs of the project. (A “consul” is a bond with no maturity date for the principal, paying interest-only on a long-term basis.)

- The Sovereign Central Bank (the Federal Reserve in the U.S.) purchases the “consul” bond, making an electronic dollar deposit in the Co-op’s local bank account. As the Co-Housing Tower is constructed, costs and expenses are paid for out of this account.

- The Co-op makes a relatively small, annual, interest-only payment to the Sovereign Central Bank—a payment which is shared by the Co-op members.”

There is an exploded illustration of a portion of the Tower which makes clear which part of the architecture is “collective infrastructure” owned by the Co-op (and financed with the low-interest “consul”)—and which part of the architecture is privately owned and paid for with market-based financing. The captions explaining the illustration are as follows:

“The small-scale, Design-Build projects lease the Loft-Shells from the Co-op, and pay for their individual build-outs with conventional, market-based financing. The completed units can be family-owned or rented. In either case, their amortized “cost” is affordable because it does NOT include the costs of the SOHO Tower & Shell infrastructure.

“The SOHO Tower & Shell infrastructure is owned as a “collective utility” by the non-profit Co-op. This “building-site infrastructure” is paid for by issuing interest-only “consul” bonds, which are purchased by the Federal Reserve (Sovereign Central Bank) thus injecting Sovereign Spending directly into a local, democratic process to create collective goods.”

I’m especially indebted to Joe Firestone for planting the notion of “consuls”—but why can’t the Federal Government buy them as well as sell them? Any ideas about this will be most appreciated.

Pingback: Democratizing Sovereign Spending | New Economic Perspectives | euzicasa