The Simplest Case: The Circuit with a Consolidated Government

By Eric Tymoigne and L. Randall Wray

[Part I] [Part II] [Part III] [Part IV] [Part V] [Part VI]

MMT is frequently criticized for consolidating the treasury and the central bank. (Palley 2012; JKH 2012a, 2012b; Lavoie 2013; Fiebiger 2012a, 2012b; Rochon and Vernango 2003; Gnos and Rochon 2002). They note that this hypothesis does not describe the current institutional framework of developed countries, and claim it pushes MMT into unnecessary strong logical claims. In this post, we will address these issues by tackling problems surrounding the nature of money and the role of taxes, and by beginning to deal with the consolidation argument.

The theory of the circuit discussed in Part 1 is a good starting point. Like all theories, it simplifies the existing economic system in order to draw causalities from logical reasoning. From the circuit theory, one can better understand Keynes’s point that spending is what makes saving possible (Keynes 1939), and the importance of distinguishing financing (initial finance) from funding (final finance). Parguez (2002) and Bougrine and Seccareccia (2002) have shown how the circuit theory can be extended to include the state, and reached similar conclusions to MMT.

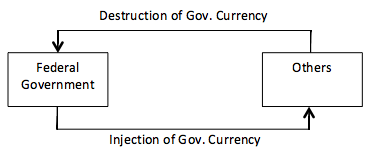

Let us first assume a very simple economy (Figure 1), with a federal government that injects currency by spending and imposes a tax that must be paid with this currency. The (federal) government also provides advances of government currency to the other sectors (private domestic sector, domestic state and local governments, foreign sector) that must be serviced by repaying government currency. This government is assumed to be free of any self-imposed constraint on its financial operations. (This example is similar to the case of two hundred years ago when governments issued currency in the form of coins, tally sticks, and bills of credit, and imposed taxes to be paid with the same financial instruments.)

The monetarily sovereign government is the monopoly supplier of its currency and can issue currency of any denomination in physical or non-physical forms. As such the government has an unlimited capacity to pay for the things it wishes to purchase and to fulfill promised future payments, and has an unlimited ability to provide funds to the other sectors. Thus, insolvency and bankruptcy of this government is not possible. It can always pay.[1]

Another important logical conclusion is that the injection of government currency (through expenditures or advances) into the other sectors must occur before the destruction of the government currency (through tax enforcement and repayment of advances). In an economic system in which a sovereign government operates through its own monetary system, spending (or lending) must occur before taxing. In addition, taxes are not a funding source in that logic. They are part of the destruction of government currency, i.e. they return currency to the issuing government.

Thus, the government “budget constraint”[2] is more relevantly interpreted as an ex-post identity that shows the sources of injection and destruction of government currency. It is not an equation describing the choices to fund government expenditures. Within that logic, a fiscal deficit represents a net injection of currency that usually needs to be drained as explained in Part 4.

A third logical conclusion is that taxing, “borrowing”, and monetary creation are not mutually exclusive methods of funding a government. Indeed, all occur but at different stages of the circuit. They are complementary means for the government to work smoothly with the rest of the economy. Injection of the currency allows the government to obtain what it wants by fulfilling the desire of the non-government sectors for government liabilities (both high powered money and bonds—we will come back later to what creates that desire). Tax enforcement is part of the reflux mechanism, that is, it allows government currency to return to its issuer.

One may wonder why that reflux is necessary. The reason is found in the logic of finance. All monetary instruments are financial instruments and so they must obey the rules of finance to have a value. A central means to give value to a financial instrument is through the necessity of its issuer to take back that financial instrument in the future.[3]

Households promise to take back their mortgage notes (when they repay their mortgages), businesses promise to take back their bonds (repaying principal due when bonds mature). When your neighbor returns to you your “cup of sugar” IOU, you must accept it and provide the sugar or another mutually acceptable payment.

The same applies to government monetary instruments: the currency issuer must promise to accept the currency in payments to itself. Households meet that reflux requirement by working and earning a monetary wage, companies do it by making a monetary profit, government does it by taxing (broadly speaking—other types of payments to authorities can also be important, such as fees, fines, tithes, and tribute).

Each of these means creates a demand for the financial instrument of the specific economic unit. The broader the capacity of the domestic private sector to earn monetary earnings, the easier it is to take back its financial instruments, and so the more broadly their financial instruments will be accepted. Generally, the broader the capacity to tax, the broader the demand for the government’s currency.

Thus, taxes are essential because they help the government currency to circulate at par (thereby making the payment system more efficient) and because they promote price stability by removing some purchasing power from domestic economic units. This lesson was learned rapidly by the Massachusetts Bay colonies–so much so that while residents of the colonies were first skeptical about the value of the bills of credit for economic and political reasons, bills rapidly were used as currency and circulated at par:

When the government first offered these bills to creditors in place of coin, they were received with distrust. […] their circulating value was at first impaired from twenty to thirty per cent. […] Many people being afraid that the government would in half a year be so overturned as to convert their bills of credit altogether into waste paper, […]. When, however, the complete recognition of the bills was effected by the new government and it was realized that no effort was being made to circulate more of them than was required to meet the immediate necessities of the situation, and further, that no attempt was made to postpone the period when they should be called in, they were accepted with confidence by the entire community […] [and] they continued to circulate at par. (Davis 1901, 10, 15, 18, 20)

This lesson was “relearned” in WWII. As Beardsly Ruml (who headed the NYFed during the war) put it:

The war has taught the government, and the government has taught the people, that federal taxation has much to do with inflation and deflation, with the prices which have to be paid for the things which are bought and sold. If federal taxes are insufficient or of the wrong kind, the purchasing power in the hands of the public is likely to be greater than the output of goods and services with which this purchasing demand can be satisfied. If the demand becomes too great, the result will be a rise in prices, and there will be no proportionate increase in the quantity of things for sale. This will mean that the dollar is worth less than it was before – that is inflation. On the other hand, if federal taxes are too heavy or are of the wrong kind, effective purchasing power in the hands of the public will be insufficient to take from the producers of goods and services all the things these producers would like to make. This will mean widespread unemployment […].The dollars the government spends become purchasing power in the hands of the people who have received them. The dollars the government takes by taxes cannot be spent by the people, and therefore, these dollars can no longer be used to acquire the things which are available for sale. Taxation is, therefore, an instrument of the first importance in the administration of any fiscal and monetary policy. (Ruml 1946, 36)

Interestingly, the title of Ruml’s piece was titled “Taxes for Revenue are Obsolete”, correctly recognizing that “war finance” had taught that taxes are important for other purposes, not for financing sovereign government spending.

While this simplified monetary system is institutionally different from the current one, it does provide some valuable lessons. Notably, it shows that it is relevant to frame issues surrounding taxes in terms of capacity to control inflation and fairness, instead of looking at capacity to fund the government.

Hence, we offer two justifications for providing the simple circuit model. First, it does correspond with historically important government financing procedures (something even the critics seem to recognize).

But more importantly, it provides a logical framework for distinguishing between currency-issuers and currency-users. Any issuer can provide a potentially unlimited quantity of her own IOUs, and can agree to accept them back in payment. The trick, as Hyman Minsky said, is to get those IOUs accepted.

By imposing taxes (or other obligations such as fees and fines) the sovereign government ensures acceptability. And so long as government only promises to accept back its own IOUs in payment of the obligation, it cannot be forced to default on that promise. (Again, if it promises to convert its IOUs to scarce metal or foreign currencies, it can be forced to default on that promise.)

Further, the causal sequence is clear: those who have obligations to pay currency must obtain it before they can pay, and if government is the only supplier, then government must spend or lend the currency before taxes and other obligations can be paid. This logic then provides a framework that is useful for analyzing how modern government works, even though today’s operations are more complicated.

We can now address two points that Palley brings forward:

The central policy assertion of MMT is the non-existence of financial constraints on government spending below full employment. The claim is government can issue money to finance non-inflationary spending as long as the economy is below full employment. […] The only time expansionary fiscal policy pays for itself is with balanced budget fiscal policy, but that is ruled out by MMT which denies the need to finance deficits with taxes. In a static economy that means the money supply would keep growing relative to output, causing inflation that would tend to undermine the value of money. (Palley 2013, 14)

First, Palley’s critique that MMT’s “proposed” monetary financing of government spending is inflationary is wrong headed. His point rests on the view that tax and monetary creation are choices within the budget constraint of the Treasury, and so if the government funds itself through monetary creation it does not need to tax.

But as we have argued above, “money creation” and taxing are not alternatives but rather come at different points in the financing process. In other words, we are providing a description of the financing process, not a policy recommendation. Palley does not understand the logic of the financing sequence: the “money creation” must occur before the “money” is redeemed in tax payment.

Second, MMT does make a clear difference between real and financial constraints; this is one of the crucial points of MMT. Inflation is a real constraint not a financial constraint, so inflation does not prevent the government from funding itself—as such the capacity of the government to fund itself is independent of the state of the economy.

Indeed, as the currency-issuer, government can always outbid the private sector, which certainly is a concern of MMT. At full employment, increasing government spending will be inflationary; before full employment government can cause bottlenecks and inflation of the prices of key inputs.

Further, and more surprisingly, Palley seems to adopt a simplistic monetarist view of the cause of inflation when he claims that money supply growth greater than growth of output would “undermine the value of money”. Like most heterodox approaches, MMT rejects the quantity equation explanation of inflation. In our view, inflation would result if the relation between government spending and taxing were wrong, not because the ratio of money supply (however measured) and GDP were wrong. In that, we follow the traditional “endogenous money” view that the ratio of money stock to national output is an uninteresting residual.

Palley, Rochon and Vernango, find MMT to be extreme in its linking of money and taxes:

Unfortunately, MMT sets up unnecessary controversy by asserting that the obligation to pay taxes is the exclusive reason for the development of money (Palley 2013, 3)

Sovereignty, understood as the power to tax and to collect in the token of choice, is not the main explanation for the existence of money, even if modern money is ultimately chartal money. (Rochon and Vernango 2003, 57)

The word money is used too broadly in these quotes. To be more precise, MMT does argue that imposition by authorities of obligations (including taxes, fines, fees, tithes and tribute) is logically sufficient to “drive” acceptance of the government’s currency.

Some who adopt MMT (including us) believe that the historical record, such as it exists, does point to these obligations as the origin of money: government currency was first made acceptable through the imposition of an obligation, and the creation of a monetary unit of account was also initiated by a government to denominate those obligations. Once these were established, government currency was used for other purposes as explained further in section 2. Over time financial instruments issued by others were denominated in the same money unit, and some of these also began to circulate.

But to be clear, MMT does not argue that taxes are necessary to drive a currency or money—critics conflate the logical argument that taxes are sufficient by jumping to the conclusion that MMT believes there can be no other possibility. (In a recent piece, Paul Davidson also conflates the distinction between necessary and sufficient conditions . It is really amazing to us that PKs cannot understand the distinction. Indeed, it is downright embarrassing. We think this distinction is taught in every first semester economics class!)

In truth, MMT is agnostic as it waits for a logical argument or historical evidence in support of the belief of critics that there is an alternative to taxes (and other obligations). We have not seen any plausible alternative.

The orthodox-Austrian Robinson Crusoe story is unacceptable as it contains several logical flaws (Gardiner 2004; Ingham 2000; Desan 2013). The other common explanation relies on an infinite regress story: Billy-Bob accepts currency because he thinks Buffy-Sue will accept it (Buchanan 2013). In our view, that is less than satisfying. If Davidson, Palley, Rochon, or Vernango has an alternative story, we would love to see it.

More importantly, as Rochon and Vernango seem to agree, modern “chartal” currency is today “driven” by taxes. In other words, even if the “origins” of money are hidden in the “mists of time”, we can look around the modern world and note that almost without exception each national government adopts its own money of account, imposes tax obligations in that unit, and issues currency as well as central bank reserves also denominated in that unit. In turn, the government accepts (and hence “destroys” in redemption) high powered money (bank reserves) in tax payment.

For government currency, it is not an oversimplification to state that taxes play a central role in the origins of today’s monetary systems. It is logical once one moves away from a commodity view of money and into the financial view of money in which the government plays a central role.

Private money-denominated IOUs developed for other reasons than the imposition of taxes, but history suggests that government provided the foundation upon which modern monetary systems developed. When new countries are formed (for example, out of the disintegrating Soviet Union), their governments adopt a new money of account, impose tax and other obligations in that unit, issue a new currency in that unit, and accept their own liabilities in tax payment. Whatever might have been the case in prehistoric times, with few exceptions we observe a familiar pattern throughout recorded history.

We now turn to the most contentious aspect of MMT. MMT argues that economies such as the Massachusetts colonies are sufficiently complex to shed light on the fiscal and monetary operations of contemporary economies with monetarily sovereign governments.[4]

For example, the U.S. Treasury’s fiscal operations and Federal Reserve’s monetary operations are constrained in multiple ways but these constraints are self-imposed and do not change the logic at play in the circuit shown above. The core purpose of taxes and bond offerings remains the same.

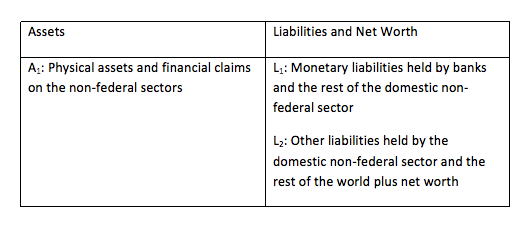

Moreover, the Treasury and Federal Reserve can, and do, bypass easily the self-imposed constraints. These points will be developed in Part 4. The essential point here is that the consolidation hypothesis is a theoretical simplification that makes sense once one understands the logic of the interrelations between the central bank and the Treasury, and between the government and non-government. The consolidated balance sheet of a monetarily sovereign government is shown in Figure 2.

L1 is the monetary base of the country. It goes up when government spends into, or advances funds to, the domestic economy (A1 goes up and L1 goes up). L1 (and A1) goes down when government taxes. Once the consolidated balance sheet is understood, it makes sense to say that “sovereign government neither has nor does not have money” (Wray 2011). There is nothing “cryptic” about that statement contrary to what Fiebiger states (Fiebiger 2012a, 10); it is rather straightforward.

Indeed, in that case the balance sheet of the government does not include any domestic monetary instrument on its asset side; it owns no money. All monetary instruments issued by the government are on its liability side and are created and destroyed with spending and taxing/bond offerings, respectively. It also makes sense to state that bond offerings are voluntary and taxes do not finance spending; tax receipts cannot be spent because taxes just reduce the liability of the government (L1 goes down).

It also makes sense to say that fiscal policy is responsible for “draining/adding reserves over a longer run” (Wray 2003a, 95) because monetary policy only involves advancing currency against collateral (including Treasury debt) and so the injection of reserves is only temporary, while fiscal policy involves outright purchases.

Palley, Fiebiger, Gnos, Rochon, and Lavoie complain that this is not descriptive of how fiscal operations work today. They claim the Massachusetts colony experiment does not provide relevant insights about current fiscal operations. The contemporary Treasury is not a bank that can keystroke funds into existence, and it can run out of funds if it does not tax and issue bonds. While the U.S. Treasury can issue its own monetary instruments (coins), it typically does not operate that way and there are institutional and political constraints that prevent the Fed from directly funding the Treasury.

Thus, they claim, one should interpret the accounting budgetary equation of the Treasury as a budget constraint with alternative choices. Bond offerings are required in case of deficits and taxes are a central source of fiscal activism that creates winners and losers, and influences incentives (Fiebiger 2013, 8). While not as critical as the previous authors, Lavoie argues that the consolidation hypothesis leads proponents of MMT to make counterintuitive and over-the-top logical conclusions that supposedly put off new readers, and prevent the contributions of MMT from being accepted more widely. Here are a series of representative quotes from our critics:

The government budget restraint shows the accounting relationship whereby governments that issue sovereign money can, in principle, finance spending by printing money. However, that also requires a particular institutional arrangement between the fiscal authority and the central bank. […]. This is an important issue of political economy. MMT dismisses this political economy and assumes there is and should be full consolidation of the fiscal authority and central bank. (Palley 2013, 6)

Wray argues that the Treasury does not need to procure funds in order to spend but creates new funds as it spends such that in ‘theory’ fiscal receipts cannot be spent. This description of fiscal policy could perhaps be applied to monetary systems that existed centuries ago, for example, when the colonial government of Massachusetts issued the first fiat paper currency in America circa 1690. The bills of credit were spent into the economy and redeemable not for a precious metal but for tax liabilities. Does the US Treasury finance its expenses in the modern era in a way comparable to the colonial experiences of the 1690s-1700s? (Fiebiger 2012a, 3)

In short there is no utility in depicting the “government” as financing all spending by net/new money creation when that claim applies only to the central bank (Fiebiger 2013, 66)

One problem with the MMT “benign neglect” / “do not worry” analyses of public finances is that the “keystroke” theme is non-descriptive. […] MMT gets fiscal policy back-to-front by supposing that the Treasury expends funds without first procuring funds. The Treasury is not a bank and if it does not collect fiscal receipts it cannot spend because it has no ‘money’ (Fiebiger 2013, 71).

While attempting to convince economists and the public that there are no financial constraints to expansionary fiscal policies (except artificially erected ones), neo-chartalists end up using arguments that become counter-productive. There is little or nothing to be gained from contending that government can spend by simply crediting a bank account; that the Treasury can act as if it were a bank; that government expenditures must precede tax collection; that the creation of high-powered money requires government deficits in the long run; that central bank advances can be called public spending; or that taxes and issues of securities do not finance government expenditures. This entire list of counter-intuitive claims follows a logic, premised on the consolidation of the government’s financial activities with the central bank’s operations, thereby modifying standard terminology. […] But MMT now brings itself to an end with a theory dependent on the counter-factual consolidation of the government and the central bank. This goes beyond a mere debate of (over-)simplification. The consolidation premise does not describe reality and it twists standard terminology (Lavoie 2013, 23)

The critique of lack of descriptiveness misses the point. The consolidation hypothesis does not aim at describing current institutional arrangements, rather, it is a theoretical simplification to get to the bottom of the causalities at play in the current monetary system. It is correct that, under current institutional arrangements, Treasury must receive funds to its account at the central bank before it spends and that this is accomplished through taxes and bond auctions, but that is not the point of MMT when using the consolidation logic.

The logic of the argument is about a government sector that combines the central bank and the Treasury into one entity that issues currency. This logic ignores current self-imposed institutional and political constraints on the Treasury and the central bank for three reasons that will be developed in more detail in Part 4:

First, the end result in terms of balance sheets is the same regardless of the institutional framework.

Second, the impact of Treasury spending, taxing, and bond offering on interest rates and aggregate income is the same with or without consolidation. Third, ultimately, the central bank and the Treasury work together to ensure that the Treasury can always meet its obligations, and that the central bank can smooth interest rates. The central bank is involved in fiscal policy and the Treasury is involved in monetary policy.

Like all theories, MMT makes simplifications that aim at laying bear the foundation of our monetary system once all the political and institutional constraints that government imposes on itself are removed. The consolidation hypothesis and ensuing conclusions are not descriptive, they are logical conclusions. However, that logic was reached after an extensive analysis of the institutional framework of monetarily sovereign governments; it does not result from ivory tower thinking.

The logic is important because it can be used to understand current debates about government, and to reframe them completely in order to provide relevant ways to solve problems for which government intervention may be needed. As shown above, this provides means to cut through the current self-imposed constraints to deal directly with the issues at stake.

Finally, we note that the technique of consolidating the central bank and Treasury is frequently adopted outside MMT, for purposes quite similar to our purposes. Even Lavoie has used this technique in the textbook he co-authored with Wynne Godley.

The government buys services and pays for them with money, which consists of pieces of paper which it prints. […] The government also levies taxes and ordains that these be paid in money, which therefore have to obtain by selling their services for it. […] this is sometimes called the cartalist or chartalist view. […] Some may regard it as an artificial assumption, others as an important and realistic assumption (Godley and Lavoie 2007, 58)

Here’s another example:

The actions of Treasury and the CB are subject to their budget constraint. It is customary in macroeconomic models to lump the two constraints into one, since in practice Treasury is a residual claimant of the profits of the CB (through the seigniorage payments) and, from a purely economic perspective, the distinction between the two agencies is superfluous. (Bassetto and Messer, 2013)

We find it remarkable that MMT’s critics waste so much ink trying to criticize a simplification that is commonly made for exposition purposes, particularly as MMT advocates have been able to relax the simplification as MMT extends analysis to account for all the real world self-imposed constraints. Consolidating the balance sheets actually does help to clarify matters. The critics do not seem to understand the implications of government finance for a monetarily sovereign government. Taxes cannot be a source of revenue in the consolidated balance sheet. They do not add monetary assets, they reduce liabilities. Similarly, Treasury offerings just change the composition of liabilities. This is clear in the consolidated balance sheet, but hidden when the two branches of government—the fiscal authority and the monetary authority—are treated separately. Hence, in MMT expositions, the consolidation not only helps to simplify the exposition but also enhances understanding.

If our critics would spend just a moment or two to think through the implications, they would stop making embarrassing mistakes.

Next time: adding the private sector.

[1] To be sure, a sovereign government can choose to default on commitments. In that case, creditors must pursue legal remedies. Sovereign government cannot be forced to default on a promise to deliver its own currency.

[2] The government budget constraint was brought into macroeconomics from the household budget constraint developed in microeconomics: Government spending = Tax revenue + treasuries offerings (borrowing) + currency issues. Of course, in difference from the household, it is recognized that government can “print money”; however this is to be avoided because it supposedly causes inflation.

[3] See Innes who poses a fundamental law of finance: The “very nature of credit throughout the world”, is “the right of the holder of the credit (the creditor) to hand back to the issuer of the debt (the debtor) the latter’s acknowledgment or obligation”. (Innes 1914, 161)

[4] While MMT is criticized for consolidating treasury and central bank operations for the purposes of a balance sheet exposition–because the Fed is supposedly “independent”–this is actually done by many others. For example, Paul McCulley argues “We pretend that the Fed’s balance sheet and Uncle Sam’s balance sheet are in entirely separate orbits because of the whole notion of the political independence of the central bank in making monetary policy. But when you think about it, not from the standpoint of making monetary policy but of providing balance sheet support to buffer a reverse Minsky journey, there’s no difference between Uncle Sam’s balance sheet and the Fed’s balance sheet. Economically speaking, they’re one and the same.” http://www.pimco.com/EN/Insights/Pages/Global%20Central%20Bank%20Focus%20May%202009%20Shadow%20Banking%20and%20Minsky%20McCulley.aspx.

Pingback: MMT 101: A Response to Critics Part 6 | New Economic Perspectives