Adding the domestic private sector

By Eric Tymoigne and L. Randall Wray

[Part I] [Part II] [Part III] [Part IV] [Part V] [Part VI]

In the previous installment, we focused mostly on the government side of the circuit. In this piece, we study the interaction between the government and nongovernment sectors while retaining the consolidation hypothesis.

For the purposes of the analysis, we will think of the nongovernment sector as equivalent to the domestic private sector, however, the analysis could just as well include state and local (nonsovereign) levels of government as well as the foreign sector in the nongovernment sector.

We will further address the issue of potential inflationary pressures raised by Palley, the reasons behind the holding of government currency, and issues of net saving and financial instability raised by Fiebiger.

As we argued previously, we do believe that it is useful to look to our historical past to learn something about the way that the monetary system operates. While Massachusetts-Bay governments emphasized the importance of a tax system for the stability of their monetary system, they also noted that taxes tended to drain too many bills out of the economic system compared to what was desired by private economic units. This created a dilemma:

The retirement of a large proportion of the circulating medium through annual taxation, regularly produced a stringency from which the legislature sought relief through postponement of the retirements. If the bills were not called in according to the terms of the acts of issue, public faith in them would lessen, if called in there would be a disturbance of the currency. On these points there was a permanent disagreement between the governor and the representatives. (Davies 1901, 21)

Private economic agents desired to hold bills for other purposes than the payment of tax liabilities, namely daily expenses, private debt settlements, portfolio choices, and precautionary savings. However, by draining all or most of the bills via taxes, the government prevented the domestic private sector from accumulating the amount of bills it desired.

At the same time, taxes were at the foundation of the monetary system so they needed to be imposed and collected as expected. Ultimately, the governments of colonies were unsure how to proceed in terms of the amount of bills to recall.

Some knowledge of national accounting helps to solve this dilemma. Let us start with the flow of funds accounts. This accounting approach uses balance sheets to analyze the three main economic sectors of an economy: the domestic private sector (DP), the government sector (G), and the rest of the world/foreign sector (F) (Ritter 1963). For the moment, the foreign sector will be left to the side.

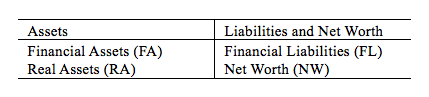

A balance sheet is an accounting document that records what an economic unit owns (assets) and owes (liabilities and net worth) (Figure 3).

A balance sheet must balance, that is, the following equality must always hold:

FA + RA ≡ FL + NW or NW – RA ≡ FA – FL.

Each macroeconomic sector has a balance sheet (Figure 4).

Financial assets are claims on other economic sectors. Financial liabilities are claims of other economic units on an economic sector. For every lender there is a borrower, so if one adds together the claims of the lender and the borrower they must cancel out:

(FADP – FLDP) + (FAG – FLG) ≡ 0

Thus, summing across sectors, it is true that the sum of all net worth equals the sum of real assets, that is, only real assets are a source of wealth for the whole economy.

(NWDP – RADP) + (NWG – RAG) ≡ 0

Given that the previous identities hold in terms of levels, they also hold in terms of changes in levels (“flows”):

Δ(FADP – FLDP) + Δ(FAG – FLG) ≡ 0

Δ(FA – FL) is called net lending or net financial accumulation. If an economic sector accumulates more claims on the other sectors than the other sectors accumulate claims on it, that economic sector is a net lender: Δ(FA – FL) > 0.

It is quite straightforward to conclude that not all sectors can be net lenders at the same time. That is, if one sector accumulates a net amount of financial claims, another must be accumulating a net amount of financial debts. Usually, the domestic private sector is a net “lender” (in the terminology normally adopted; i.e. it records a net accumulation of financial claims) and the government sector is a net borrower (i.e. it issues more debt than the volume of financial assets it accumulates).

This accounting framework is not theory but it provides a context to set proper policy goals. Indeed, regardless of the amount of economic adjustments—changes in the exchange rate, interest rate changes, aggregate income fluctuations, etc.—some desired financial outcomes can never be achieved and it is highly destructive to continue policies that aim at achieving incompatible desires.

The most important policy implication is that, in a closed economy, it is inconsistent for a government to put in place policies that promote thriftiness in the private sector while aiming to reach a government surplus: if the private sector runs a surplus by definition the government sector is running a deficit (in the closed economy).

{In an open economy, both the domestic private sector and the government sector could run surpluses, but that would mean that the rest of the world runs a current account deficit. Obviously, for every current account surplus there must be a current account deficit, so there is no way that all countries could be in surplus. That, in turn, means that it is not feasible for all countries to simultaneously pursue domestic private sector surpluses and government budget surpluses.}

Beyond ensuring feasibility of policy prescriptions, the accounting identities also provide a framework to set up a theory.

First, MMT argues the fiscal position of the government sector is ultimately driven by the desired net financial accumulation of the non-government sectors. We know that budget accounting requires that the following applies to the government: G – T – ΔFAG + ΔFLG ≡ 0 so ΔFLG ≡ – (G – T) + ΔFAG; therefore, at equilibrium, the accounting identity requires that the fiscal position is:

(G – T)* = Δ(FADP – FLDP)d = Δ(FADP – FLDP)

A more familiar way to present this can be achieved by noting that

Δ(FADP – FLDP) ≡ Δ(NWDP – RADP) = SDP – IDP.

In that case we have:

(G – T)* = (SDP – IDP)d = (SDP – IDP)

Usually the domestic private sector desires to net save (i.e. to accumulate net worth beyond the accumulation of real assets) so the government sector must be in deficit (again, in the closed economy).

If the government fiscal position is in surplus, or in a deficit that is not consistent with the desired net saving of the domestic private sector, nominal national income will adjust as the domestic private sector changes its spending level. As national income changes so do automatic stabilizers, and so the fiscal position will move to be consistent with the level desired by the non-government sector. How national income will change (change in output and/or price) will depend on the state of the economy and how adjustments affect desires.

Second, going back to the Massachusetts dilemma, one can conclude that, as long as the domestic private sector desires to have a net accumulation of government currency, there is no need to retire all of the emitted currency through taxation, i.e. there is no need to have a balanced budget.

The question about what the proper federal fiscal stance is at full employment, or other economic states, cannot be determined independently of the non-federal government sectors’ desire in terms of net accumulation of federal government financial assets.

Thus, contrary to Palley’s argument, there is no need to assume that the fiscal balance should be balanced at full employment to prevent inflation:

There is no finance constraint on G because of the capacity to issue sovereign money. However, once the economy reaches full employment output, taxes (T) must be raised to ensure a balanced budget […] This balanced budget condition must be satisfied in order to maintain the value of fiat money. In a no growth economy, having the fiscal authority run persistent money financed deficits will cause the money supply to increase relative to GDP, in turn causing inflation. (Palley 2013, 8)

The fiscal balance at full employment will depend on the desired net saving of the non-government sectors at full employment income. If the desired net saving of the domestic private sector is positive at full employment income, there is no inflationary pressures from a fiscal deficit.[1] Similarly, if the budget deficit is too high relative to the desired net saving of the domestic private sector, there will be demand-led inflationary pressures around full employment as the domestic private sector spends unwanted funds. Again the Massachusetts experiment provides some great insights about wars leading to ballooning discretionary government spending and declining tax receipts and so upward pressures on prices.

However, as national income rises non-discretionary government spending will decline and taxes will rise. This will occur without changing the tax structure and without policy decisions aimed at lowering discretionary spending, but just due to automatic stabilizers.

Thus, contrary to what Palley argues, there may not be a need to proactively raise taxes (i.e. raise tax rates or impose new taxes) and cut spending as the economy does better if strong enough automatic stabilizers are in place. But this does not mean that a surplus is needed during an expansion.

To summarize, MMT certainly does not say that at full employment the fiscal position of the government cannot be balanced; it can, but that is not up to the government sector to decide.[2]

Third, the previous discussion does not mean that MMT is for a fiscal deficit, nor is it for a fiscal surplus or a balanced budget. MMT is agnostic regarding the fiscal position of a monetarily sovereign government per se.

As Abba Lerner’s “functional finance” approach insists, the fiscal position of the government is not a relevant policy objective for a monetarily-sovereign government. Price stability, financial stability, moderate growth of living standards, and full employment are the relevant macroeconomic objectives, and the fiscal position of the government has to be judged relative to these goals instead of for itself.

If there is inflation that is demand-led, the fiscal position is too loose (surplus is too small or deficit is too large); if there is non-frictional unemployment, the fiscal position is too stringent. Also if financial fragility grows due to negative net saving by the domestic private sector, the government’s stance is probably too tight.

Fourth, to ensure stability of the economic system, it is usually important that the domestic private sector not be a net borrower. Indeed, if the domestic private sector is a net borrower, this implies that the amount of net financial assets held by the domestic private sector is declining because borrowing from other sectors grows faster than the gross accumulation of financial claims on other sectors.

As a consequence net worth declines unless the nominal value of real asset grows fast enough through asset price appreciation. This is exactly what happened during the recent housing boom when the speculative boom of housing prices was rapid enough to sustain the wealth of households in spite of unprecedented borrowing.

Of course, all this is in line with Minsky’s Financial Instability Hypothesis (Tymoigne and Wray 2014). The implications of having a domestic private sector being a net lender is that the federal government sector has to be in deficit unless the foreign sector is willing to be in deficit.[3]

It is also consistent with the argument of Wynne Godley, who argued “Without an expansionary fiscal policy, real output cannot grow for long.” (Wynne Godley, 2000) While this will not apply to countries that can run chronic current account surpluses, this “Mercantilist” policy is a “beggar thy neighbor” policy in the absence of a sovereign currency. This is a point Wynne recognized back in 1992 when he argued against the set-up of the EMU: “[T]he power to issue its own money, to make drafts on its own central bank, is the main thing which defines national independence. If a country gives up or loses this power, it acquires the status of a local authority or colony.”

Fifth, contrary to what Palley, Rochon and Vernango, and Davidson state, MMT does not believe that the only reason for holding the government currency is because of taxes. Taxes are just a sufficient condition for acceptability of currency—not a necessary condition, however historically taxes and other obligations to authorities did play a central role in the development of modern currency going back at least to Ancient Egypt. Government currency can be held for other reasons as the Massachusetts experiment showed. This is actually why the government can run a deficit as people want to hold government financial instruments (in monetary form or not) beyond the purpose of paying taxes (Wray 2012).

It is a shame that heterodox economists do not understand the difference between necessary and sufficient conditions. They could have avoided a lot of unnecessary argument if they would notice that we argue taxes are a sufficient condition to create a demand for a government’s currency, but they might not be a necessary condition. And before we get more misguided criticism let us add that we are presuming the government that imposes the tax liability is willing and able to collect at least some taxes. If a government is not willing or able to collect any taxes, then the uncollectible tax might not be sufficient to create a demand for the currency.

Sixth, Fiebiger is perfectly correct to state that the previous accounting framework is not enough to understand how financial fragility grows within a specific subsector of the domestic private sector because financial assets and liabilities held within that subsector are eliminated from the analysis above.

However, the flow of funds identity helps greatly to conceptualize economic relationships between public and private sectors, which is one of the points of MMT.

In addition, MMT does differentiate between saving (in the flow of funds it is the change in net worth: ΔNW) and net saving (saving less investment). Net saving shows how the accumulation of net worth occurs beyond the accumulation of real assets. For the domestic private sector, this comes from a net accumulation of financial claims against the government and foreign sectors.

A central point here is that government deficits add to the saving and net saving of the private domestic sector. Lavoie notes:

While it would seem that government deficits in a growing environment are appropriate — as it provides the private sector with safe assets to grow in line with private, presumably less safe, assets — it is an entirely different matter to claim that government deficits are needed because there is a need for cash. Even if the government kept running balanced budgets, central bank money could be provided whenever the central bank makes advances to the private sector. (Lavoie 2013, 9)

This is correct but this is not the point made by MMT that relates to net saving. Providing advances does not lead to net saving of government currency as financial assets of the domestic private sector increase by the size of the increase in financial liabilities.

Stated another way, advances have to be repaid so the gain in government currency is only temporary. Only a government deficit induced by fiscal policy leads to net saving.

Monetary policy can change the composition of net saving by buying financial assets in the domestic sector in exchange for government currency, but it cannot change the size of net saving, i.e. the net accumulation of financial assets.

We can think of it this way. Normally, a central bank advances currency into existence while the Treasury spends currency into existence. The difference is important: fiscal policy creates net financial assets; monetary policy only “liquefies” financial assets. This is a normal division of responsibilities, but one can imagine a central bank that spends its notes to buy real goods and services, and a Treasury that lends. Both are branches of sovereign government and can be directed to do what the sovereign government wants them to do.

Further, there is no necessary reason for a division of these responsibilities at all, and historically sovereign governments operated without central banks, with all operations consolidated in a treasury or exchequer or finance ministry.

In the next installment we will add a detailed examination of the central bank.

[1] We recognize that inflation can result before full employment, and that government’s spending (or taxing) policies can contribute to inflation through, for example, creating full employment. Here, however, we are focused on responding to Palley’s claim that at full employment government must run a balanced budget to avoid causing inflation. We note also that Keynes reserved the term “true inflation” to indicate the situation where additional spending must cause inflation because the elasticity of output has fallen to zero when all resources are fully employed. This seems to be the scenario Palley has in mind. However, his argument that if there is a budget deficit at full employment, then there must be “true inflation” in Keynes’s sense is flawed.

[2] We do not mean to imply that government decisions have no impact. For example, a “trickle up” policy to move income to the rich might increase the private sector’s net saving desire, resulting in bigger budget deficits at full employment; a policy that uses New Deal-style job creation to achieve full employment might instead be consistent with a balanced budget. In other words, government policy can affect the private sector’s behavior.

[3] Note that state and local governments—that are nonsovereign in the currency sense—strive to have budget surpluses. In the case of the US, almost all states have constitutions that forbid budgeting for deficits. In the case of the US, outside deep recessions, state and local governments run surpluses and the foreign sector runs significant surpluses against the US. For the domestic private sector to have a surplus means the federal government must run a large deficit to balance against state and local surpluses, foreign surpluses and the domestic private sector surplus. There is no reason to expect that this would be inflationary—regardless of the level of unemployment.

43 responses to “MMT 101: Response to the Critics Part 3”