By Eric Tymoigne and L. Randall Wray

[Part I] [Part II] [Part III] [Part IV] [Part V] [Part VI]

This is Part 1 of a six part series in which we deal with critics of MMT. As readers of this blog know, our critics continually raise the same old tired critiques of MMT. They scapegoat MMT by attributing to us claims we’ve never made. They take our words out of context to build up a strawman that they attempt to destroy. No matter how many times we respond to a particular critique, another critic tries to use it again. Warren Mosler used to use the analogy of the “Bop a Gopher” game at the arcades: you bop one and another pops up.

While we know that it’s a Sisyphean task to disabuse the critics of their cherished and wrong-headed arguments, we thought it would be useful for those who come to MMT with less prejudice to have at hand responses to five categories of critiques. Today we will provide an introduction to the series. Each of the next five posts will deal with one of the critiques. We’ll also append a list of the references used for this entire series.

For those who want to skip to the chase, you can go to Levy Institute to download the full working paper on which this series is based. Those who prefer bite-sized pieces can wait for the posts. As we go along we’ll respond to comments and will make adjustments to clarify the argument.

For long-time readers of NEP, none of this will be particularly difficult. It will, however, be long. Perseverance will be required. We mean to be as thorough as we can be. Bopping gophers requires diligence.

One of the main contributions of Modern Money Theory (MMT) has been to explain why monetarily sovereign governments[1] have a very flexible policy space that is unencumbered by hard financial constraints. Not only can they issue their own currency[2] to pay public debts denominated in their own unit of account, but also any self-imposed constraint on their budgetary operations can be by-passed by changing rules. As such, this type of government is not financially constrained in the way that nonsovereign units are, so that it can focus on issues such as full employment and price stability.

Through a detailed analysis of the institutions and practices surrounding the fiscal and monetary operations of the Treasury and central bank of nations like the U.S., Brazil, Canada, Argentina, the Eurozone, and Australia, MMT has provided institutional and theoretical insights about the inner workings of economies with monetarily sovereign and non-sovereign governments (Mosler 1999; Bell 2000; Bell and Nell 2003; Bell and Wray 2002; Wray 1998, 2003a, 2003b, 2003c, 2007, 2012; Fullwiler 2006, 2009, 2011, 2013; Kelton, Fullwiler and Wray 2012; Mitchell and Mosler 2002; Muysken and Mitchell 2008; Rezende 2009).

The institutional insights concern the central role of the Treasury in monetary policy, the way the central bank implements monetary policy, the balance-sheet implications of Treasury and central bank operations, the importance of national accounting identities, and the economic irrelevance of—but the political relevance of—self-imposed financial constraints.

The theoretical conclusions of MMT concern the usefulness of combining the Treasury and central bank into a government sector, causalities between desired and actual macroeconomic financial balances, the functional role of taxes and bonds, and the relevant constraints on government. All these institutional and theoretical elements are summarized by saying that monetarily sovereign governments are always solvent, and can afford to buy anything for sale in their domestic unit of account even though they may face inflationary and political constraints.[3]

MMT has also provided policy insights with respect to financial stability, price stability and full employment. It argues these are important goals that have to be met independently from one another by putting in place structural policies that work independently of the current political climate, and that manage as directly as possible the goal that needs to be achieved. MMT rejects the traditional trade-off between inflation and unemployment, and does not rely on economic growth and fine-tuning to reach full employment. Economic growth and full employment are seen as independent policy goals.

Critiques of MMT can be classified according to five categories:

- views about origins of money and the role of taxes in the acceptance of government currency,

- views about fiscal policy,

- views about monetary policy,

- the relevance of MMT conclusions for developing economies, and

- the validity of the policy recommendations of MMT.

This series addresses each of these categories using the circuit approach and national accounting identities, and by progressively adding additional economic sectors.

Part 2 of the series focuses on the government sector. The post shows the importance of taxes for the smooth working of a government-based monetary system, and starts to deal with the consolidation hypothesis.

Part 3 focuses on the domestic private economy and draws some conclusions about the conduct of fiscal policy and the proper stance of the government fiscal balance.

Part 4 adds the central bank and studies the interactions among the central bank, the Treasury and the domestic economy.

Part 5 adds the foreign sector and studies the impact on fiscal policy, the role of exchange-rate regimes as well as the level of development of a country.

The final post focuses on the policy framework and conclusions of MMT.

Here we will provide a very quick review of the basics of MMT that will help you to follow the exposition we use in the subsequent posts.

We find the French-Italian PK circuit approach particularly useful for driving home the point that the finance for spending must come from somewhere. Most recognize that to finance a purchase one needs to use income, to sell an asset, or to borrow. At the individual level that is certainly true. Yet, the “finance” that comes from income flows as well as the receipts from sales of assets also must come from somewhere—and an “infinite regress” is not logically compelling. The typical neoclassical deus ex machina source of finance is saving—but if saving is in financial form it must have been generated by someone else’s spending, another infinite regress.

Hence, when the circuitiste begins with a bank loan to finance purchase of commodities (to be used to produce commodities) all logical problems are resolved.

Spending and creation of “money” in the form of a bank deposit are linked. It is best to think of these as balance sheet entries: the bank accepts the IOU of the borrower and credits her demand deposit; the borrower’s IOU is offset by the credit to her deposit. Spending then simply shifts the demand deposit to a seller. Money is created “endogenously” to finance spending.

Later, when loans are repaid, the demand deposit as well as the borrower’s IOU are debited—money is destroyed. There is no magic involved, no “manna from heaven”, no separation of the “real” (say, IS curve) from the “monetary” (LM curve). As Clower would remark, money buys goods and goods buy money but goods do not buy goods. Barter is ruled out as one must first obtain money—from income flows, asset sales, or borrowing—before spending. And the money must get created with an initiating purchase.

That is the idea behind the “endogenous money” approach adopted by Post Keynesians (PKs): loans create deposits. And repayment of loans destroys deposits. Many PKs go further and adopt the “horizontalist” approach: both the supply of loans and the supply of bank reserves are horizontal, at an exogenously administered interest rate. (Moore 1988) We do not need to get into this in detail here, nor does a reader have to accept a horizontal supply of deposits and loans (we don’t!). The fundamental idea is that bank lending is never constrained by the deposits that flow into banks—since banks create deposits when they lend.

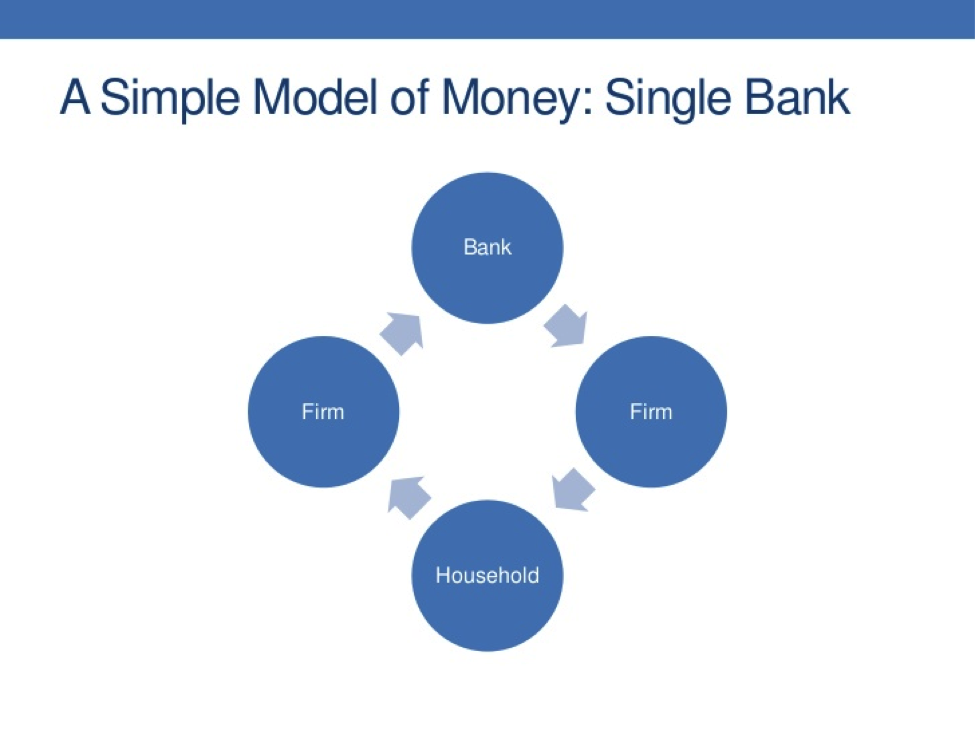

Let us begin with a simple diagram of the simplest circuit.

Here the bank makes a loan to a firm by issuing a demand deposit; the firm hires labor from the household sector, paying a wage; the bank debits the firm’s demand deposit and credits the household’s; the household purchases output from the firm; the bank debits the household’s deposit and credits the firm’s; and finally the firm uses the demand deposit to repay the loan. So long as the household does not save, and so long as demand deposits cannot be redeemed (ie, are not made convertible into reserves), the circuit “closes”.

We will not address the issues of saving or of interest payments and profits here—the results are well-known in the circuitiste literature.

What is important here is to note that the bank in this simple model cannot “run out of money” to lend. It creates the “money” (demand deposit) when it makes the loan. The only constraint is the willingness of the bank to lend and the willingness of the borrower to borrow.

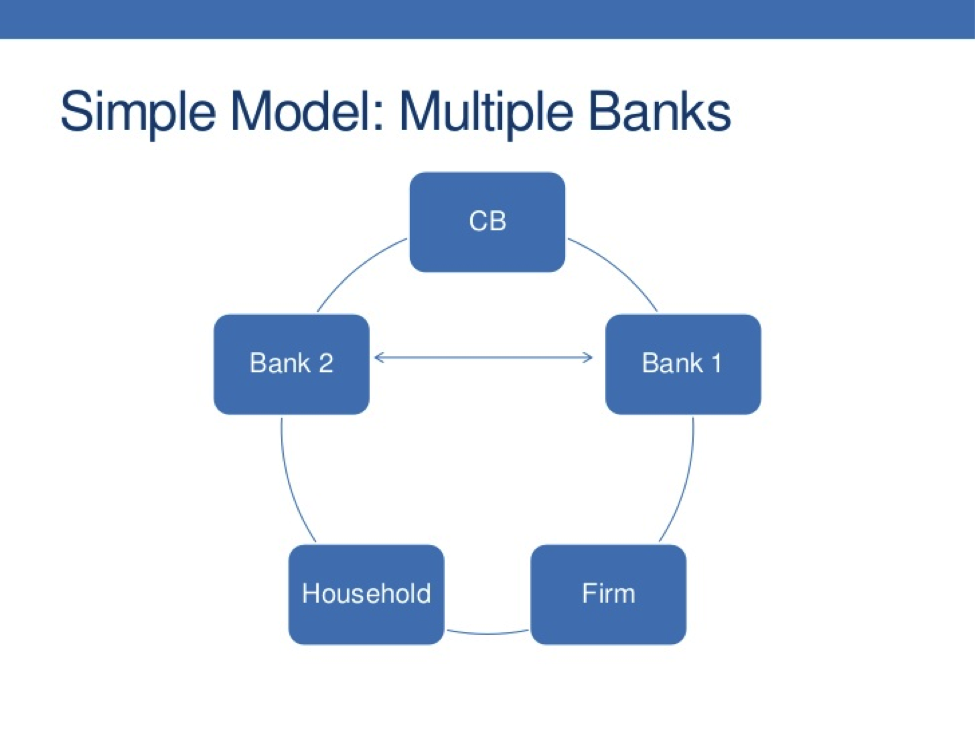

The problem, of course is that if there is more than one bank, there can be a drain from one to the other. In that case, there must be something to “drain”—something for which a demand deposit can be “redeemed”. Let’s add a central bank that issues reserves that are used by banks for clearing.

Here we ask where do the reserves come from? Does the central bank get them from the private banks? Of course not; it must “spend or lend” them into existence. Reserves are the liability of the central bank, created either through loans or through asset purchases. Can the central bank ever “run out of money”—that is, its own reserves? No, it can create them on demand.

More generally, as we know, banks must meet reserve requirements, and banks use reserves for clearing. Here is where “horizontal reserves” come into play: any central bank that administers an overnight interest rate target must supply reserves on demand—for otherwise it would lose control of the interest rate. In the PK literature, it is said that CB policy always “accommodates” the demand for reserves. Given that this demand is highly interest-inelastic, there is little room for “error” by the central bank. It must accommodate more-or-less exactly the demand.

We believe that this view is now widely accepted, even by the mainstream: modern central banks operate with an overnight interest rate target and accommodate bank demand for reserves in order to continuously achieve it.

All of this is old ground and is not controversial (or should not be).

MMT—BRINGING THE STATE INTO THE CIRCUIT

What extension does MMT make?

- The money of account, at least today, is virtually always a state money of account—a “dollar” chosen by the authorities.

- The authorities issue the currency, which consists of notes and coins denominated in that money of account, and the central bank (whether it is legally independent or not) issues bank reserves in the same unit.

- The authorities impose taxes and other obligations in the same unit, and accept their own liabilities (notes, coins and reserves, together high powered money–HPM), in payments to the state.

- The authorities issue HPM denominated in the same unit when they spend.

- The authorities sell other types of (generally longer term) liabilities denominated in the same unit, accepting their own HPM IOUs in payment for them.

We would thus insist that any modern circuit should begin with the recognition that the “bank money” created at the beginning of the circuit is denominated in the State’s money of account. Further, recognizing that banks use HPM for clearing (more specifically, the reserve balance portion of HPM), the circuit should also begin with HPM. We believe this is now accepted by circuitistes like Parguez and Seccareccia, who have explicitly put the State in the circuit. (Parguez 2002, Parguez and Seccarrecia 2000) The final point we often make is that from inception the authorities levy an obligation (fees, fines, taxes) to ensure their HPM will be accepted, however we will not try to make this case here.

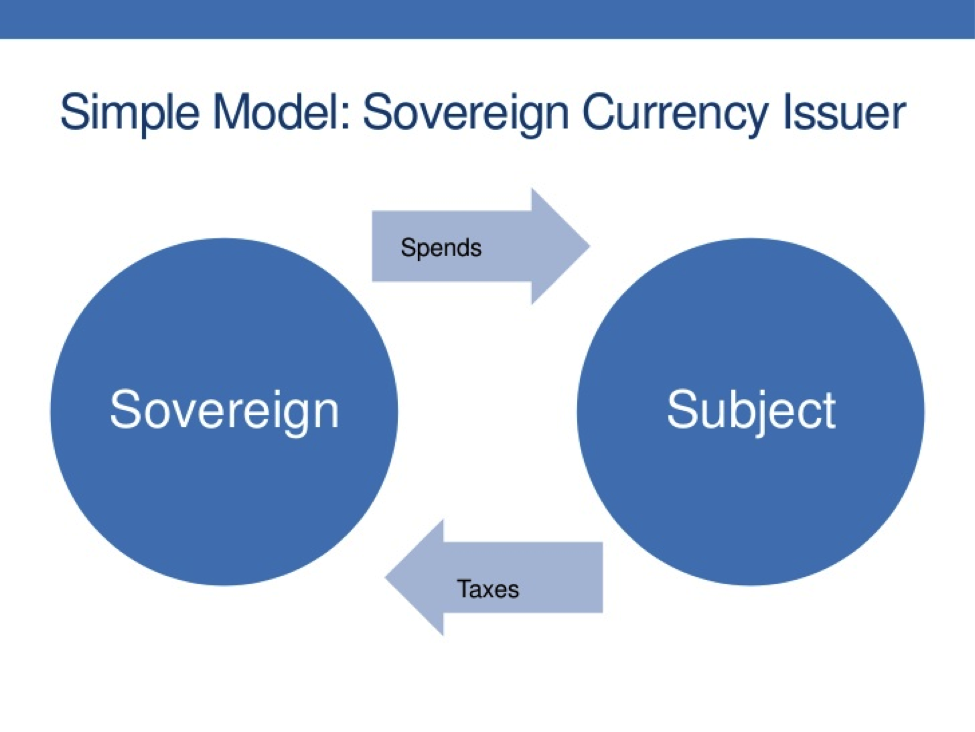

Let’s expand our simple model used above to include government. Let us first assume a very simple economy, with a government that issues currency and imposes a tax that must be paid with this currency. That would be the typical case two hundred years ago when governments issued coins or even tally sticks and spent them directly in purchase from the nongovernment sector. (Later this week we will address the issue of consolidation of central bank and treasury—which drives many of our critics crazy.)

Now, the question is, where does the currency come from? Is it manna from heaven? Is it part of humanity’s initial endowment? Does it come, initially, from taxpayers? Clearly, the answer is no. It comes from the State, as it is a State IOU denominated in the State’s money of account. Can this government ever “run out of money”—its own currency in the form of coins or tally sticks? Clearly not. Does it need to “borrow” its currency before it spends? No. Does it need tax revenue before it can spend? No. It spends the currency into existence.

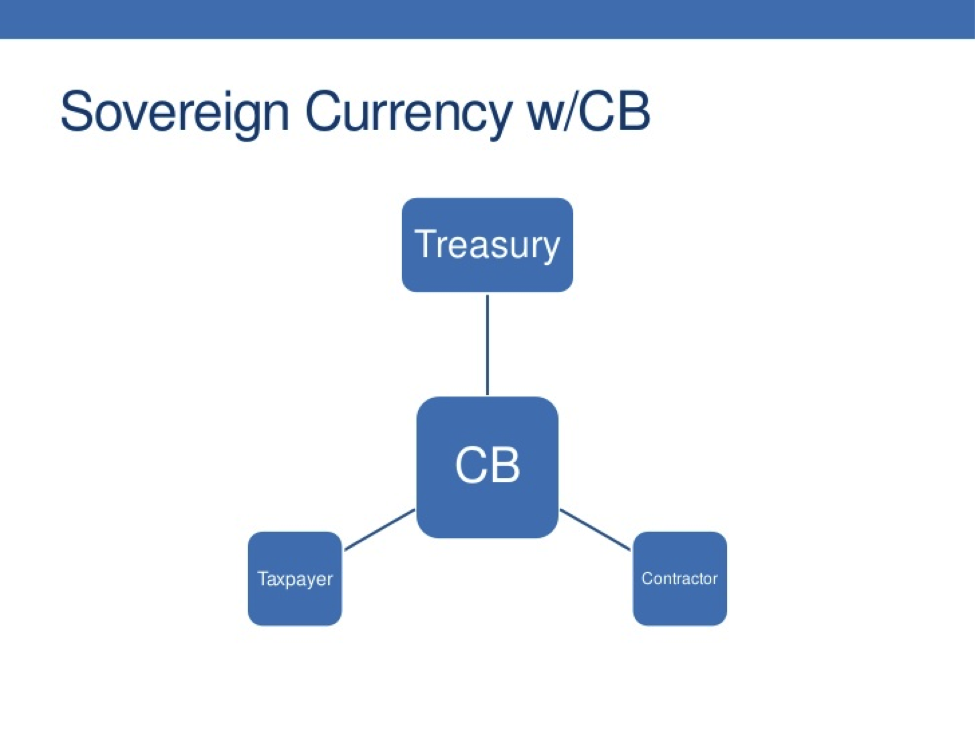

Let us proceed to broaden the analysis. Let us include a central bank that issues reserves, so we now have “high powered money” (HPM) consisting of both currency and reserves. If currency is deposited into a bank, the bank sends it to the central bank to receive a credit to its reserve deposit account; the central bank holds the currency as an asset against the reserve liability.

Now there are two obvious ways HPM can get into the economy: state spending and state lending. Banks cannot get hold of HPM for clearing (or, to meet reserve requirements) unless the state lends or has spent HPM into existence. Note the analogy to bank deposits: banks must spend or lend them into existence. We have already noted that among PKs there is absolutely no disagreement so far as we are aware that “loans make deposits”—the common view that banks sit and wait for a deposit to come in before they make a loan must have the logical sequence backwards. It also has to be true that the State must spend or lend its HPM into existence before banks, firms, or households can get hold of coins, paper notes, or bank reserves.

We can complicate this further. Assume that the Treasury uses the Central Bank as its bank. Payments are made by the Central Bank on behalf of the Treasury; and the Central Bank receives tax payments for the Treasury. Assume this is accomplished by paying out and receiving central bank notes. This is shown in the next diagram.

Note we have left out of the diagram the payment of wages by the contractor, which allows taxpaying workers to pay their taxes. It would complicate the picture—you can just imagine that there’s still the circuit from contractor to pay wages to worker and spending by worker for consumption.

Can the government ever “run out of money” to spend? No. The central bank can issue notes to pay the contractor (that is an “advance” to the Treasury), and receive the notes in tax payment. Does the government need the tax revenue before it can spend? No. It spends first.

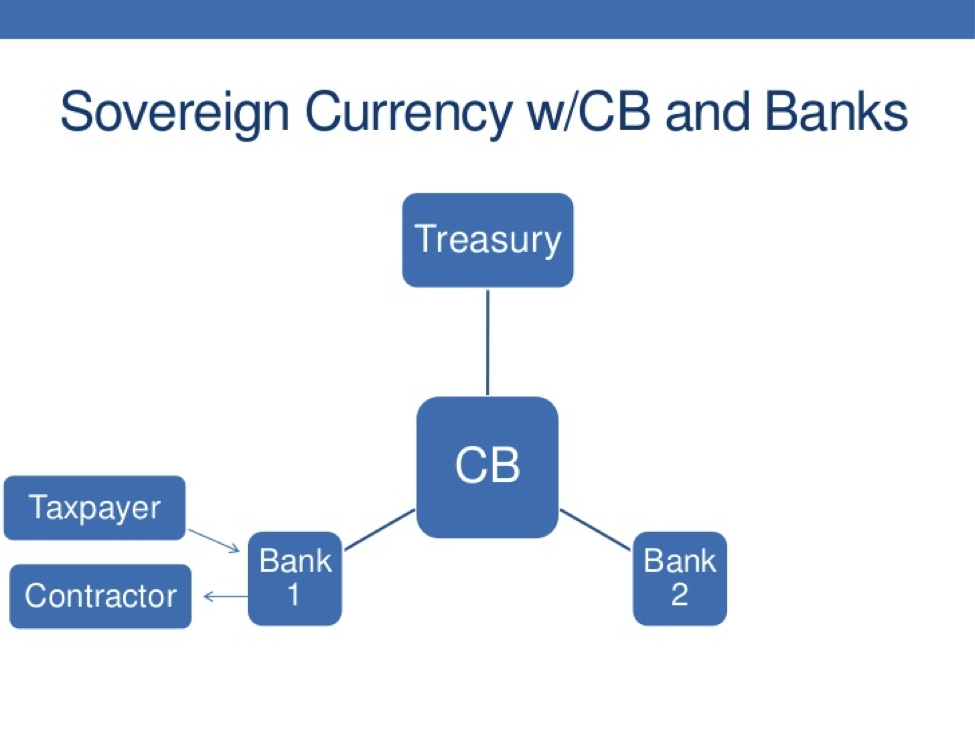

Finally, let’s include private banks so that government payments are accomplished by “cutting checks” that recipients deposit in their banks. The banks send the checks to the central bank to receive reserve credits. For simplicity we will assume that the contractor and the taxpaying worker use the same bank. Of course, if they do not, then we need to refer to the diagram above that shows clearing among banks using the central bank’s balance sheet.

To add just a bit more detail, when Treasury wants to spend, it issues a liability (warrant, consol, coin, bond) to the Central Bank, which credits its demand deposit. To spend the Treasury “cuts a check” to a contractor. The contractor deposits the check in Bank 1 (which receives a reserve credit) and hires labor to fulfill its contract with the State; the worker then receives wages as her deposit account is credited, and labor uses the deposit account to purchase output and to pay taxes. When taxes are paid, Bank 1’s reserves are debited. Government spending adds reserves; government taxes debit reserves.

To conclude: can government ever “run out of money” in this simple model? Again, the answer is no. Does it need to wait for tax receipts before it can spend? Again, no, indeed, government must spend (or lend) HPM into existence before banks can make payments to the central bank on behalf of taxpayers.

While the banks in our model can always credit the deposit accounts of taxpayers (so that they can write checks to pay taxes), the banks, themselves, cannot create reserves to be debited as taxes are paid through the central bank. To the degree that the central bank is willing to supply reserves on demand (as it must do if it “horizontally” targets an interest rate), it will lend or spend (buy assets) the reserves into existence to allow taxes to be paid even if the treasury is not spending.

We recognize that in developed countries today there is a division of responsibilities between the Treasury and the Central Bank, and that the Central Bank is in many nations nominally independent of the State. We need not quibble about the degree to which the Central Bank is legally separate (in the US, for example, there is no question that the Fed was created by an act of Congress and that it is legally subject to Congress’s will; that Congress prefers not to exercise much control over the Fed is beside the point in our view).

But as a first approximation, we prefer to consolidate treasury and central bank operations; we then separate them for further analysis. We will explain in detail later this week why we simplify, and why the simplification is not misleading.

For most purposes, the user of HPM (bank, household, firm) could care less whether it is an IOU of the Treasury or the Central Bank. They are just about perfectly substitutable. Consolidation also lets us first explain the simple proposition that “Government” IOUs have to be spent or lent into existence—just like bank IOUs. And it allows us to postpone discussion of the particular operational details on “how government really spends and lends its IOUs into existence”, as these vary across time and nation. Later we will turn to those details.

Let us conclude by summarizing the simplest, most general case that we have been examining in this post. The issuer of the currency must supply it first before the users of the currency (banks for clearing, households and firms for purchases and tax payments) have it. That makes it clear that government cannot sit and wait for tax receipts before it can spend—no more than the issuers of bank deposits (banks) can sit and wait for deposits before they lend.

Government spends or lends HPM into existence, and receives back what it spent or lent when taxes are paid or debts to government are repaid. That also means that at most, government can receive back in payments as much as it spent or lent. Over a period, of course, it might receive more or less than it spent or lent over that period. But it is impossible for government to receive cumulative payments to itself that exceed its cumulative spending and lending any more than it is possible for the banking sector to receive greater payments to retire loans than its cumulative lending–as the circuit demonstrates. It is far more likely that government will receive less—and the shortfall will exactly equal the accumulation of balances of HPM held by banks, households and firms.

Finally, not only must government spend or lend its HPM into existence before it can receive HPM in taxes, but logically government also must spend or lend HPM before government can borrow HPM. This might sound a little strange. But—again recalling the circuit—can banks in the aggregate borrow deposits before banks have created them? No, they must lend or spend (buy assets including the IOUs of their borrowers) by creating deposits before deposits can exist to be “borrowed”.

Once deposits exist, a bank can “borrow” them—issue some non-deposit liability to obtain a deposit. To be clear, a bank that has created a deposit liability on itself will not “borrow” its own deposit, but it can induce one of its depositors to give up the deposit in favor of some other bank liability—say, subordinated debt or short-term commercial paper. It can also sell such debt to depositors of other banks, in which case it will receive a clearing drain in its favor. This normally will take the form of a credit to its reserve account at the central bank, but it could be a deposit in a correspondent bank (“country” banks in England kept deposits in “city” banks in London that could be used for clearing before the creation of the Bank of England, for example).

In the case of government, its borrowing is a substitution of its HPM liabilities for bills and bonds liabilities. It must first spend or lend the HPM into existence before it can “borrow” its HPM liabilities in exchange for bills and bonds.

REFERENCES for the entire series:

Bassetto, M. and Messer, T. (2013) “Fiscal Consequences of Paying Interest on Reserves,” Federal Reserve Bank of Chicago, Working Paper No. 2013-04.

Bell, S.A. (2000) “Do Taxes and Bonds Finance Government Spending?” Journal of Economic Issues, 34 (3): 603-620.

Bell, S.A. and Nell, E.J. (2003) The State, The Market, and The Euro. Northampton: Edward Elgar.

Bell, S.A. and Wray, L.R. (2002) “Fiscal Effects on Reserves and the Independence of the Fed”, Journal of Post Keynesian Economics, 25 (2): 263-271.

Bougrine, H. and Seccareccia, M. (2002) “Money, Taxes, Public Spending, and the State within a Circuitist Perspective,” International Journal of Political Economy 32 (3): 58-79.

Buchanan, Neil. (2013) “If You’re explaining, everyone’s losing (Platinum coin edition), http://www.dorfonlaw.org/2013/01/if-youre-explaining-everyones-losing.html; last accessed 17 Oct 2013.

Cantor, R. and Parker, F. (1995) “Sovereign Credit Ratings,” Federal Reserve Bank of New York Current Issues in Economics and Finance, 1 (3): 1-6.

Commonwealth of Australia (2003) Budget Strategy and Outlook 2003-04, 2003-04 Budget Paper No. 1. Canberra: Commonwealth of Australia.

———. (2011) Budget Strategy and Outlook 2011-12, 2011-12 Budget Paper No. 1. Canberra: Commonwealth of Australia.

Davis, A.M. (1901) Currency and Banking in the Province of Massachusetts Bay. New York: Macmillan. Reprinted by Kelley Publisher, New York, 1970.

Desan, Christine (2013); “Money as a Legal Institution”, to be published in David Fox and Wolfgang Ernst, Money in the Western legal Tradition, 2014.

Fiebiger, B. (2012a) “Modern Money Theory and the Real-World Accounting of 1-1<0: The U.S. Treasury Does Not Spend as per a Bank.” Political Economy Research Institute Working Paper No. 279. Amherst: University of Massachusetts Amherst

———. (2012b) “A Rejoinder to ‘Modern Money Theory: A Response to Critics.’” Political Economy Research Institute Working Paper No. 279. Amherst: University of Massachusetts Amherst.

———. (2013) “A constructive critique of the Levy Sectoral Financial Balance approach: resurrecting a “Robin Hood” role for the state’s taxing-and-spending functions” Real-World Economics Review, 64: 59-80.

Fullwiler, S.T. (2006) “Setting Interest Rates in the Modern Money Era,” Journal of Post Keynesian Economics, 28 (3): 495–525.

_____. (2009) “The Social Fabric Matrix Approach to Central Bank Operations: An Application to the Federal Reserve and the Recent Financial Crisis.” In Natarajan, Tara, Wolfram Elsner, and Scott Fullwiler, (eds.) Institutional Analysis and Praxis: The Social Fabric Matrix Approach, 123-169. New York, NY: Springer.

_____. (2011) “Treasury Debt Operations: An Analysis Integrating Social Fabric Matrix and Social Accounting Matrix Methodologies.” Mimeograph.

_____. (2013) “Modern Central Bank Operations: The General Principles.” In Basil Moore and Louis-Philippe Rochon (eds.), Post-Keynesian Monetary Theory and Policy: Horizontalism and Structuralism Revisited, Cheltenham: Edward Elgar.

Fullwiler, S.T, Kelton, S.A, and Wray, L.R., ‘Modern Money Theory: A Response to Critics’, Political Economy Research Institute, Working Paper 279.

Gardiner, G.W. (2004) “The Primacy of Trade Debt in the Development of Money’” in Credit and State Theories of Money: The Contribution of Mitchell A. Innes, 128-172. Northampton: Edward Elgar.

Godley, W. and Lavoie, M. (2007) Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth, New York: Palgrave Macmillan.

Gnos, C. and Rochon, L.P. (2002) “Money Creation and the State: A Critical Assessment of Chartalism,” International Journal of Political Economy, 32 (3): 41–57.

Ingham, Ingham, Geoffrey. 2000. Babylonian Madness: On the Historical and Sociological Origins of Money. In John Smithin (ed.) What Is Money. London & New York: Routledge.

Innes, A.M. (1913) “What is Money?” Banking Law Journal 30(5): 377-408. Reprinted in Wray, L. R. (ed.) Credit and State Theories of Money. Northampton: Edward Elgar. 2004.

———. (1914) “The Credit Theory of Money.” Banking Law Journal 31(2): 151–168. Reprinted in Wray, L. R. (ed.) Credit and State Theories of Money, 50-78. Northampton: Edward Elgar. 2004.

JKH. (2012a) “Treasury and the Central Bank: A Contingent Institutional Approach.” Monetary Realism. May 29, Available at http://monetaryrealism.com/treasury-and-the-central-bank-a-contingentinstitutional-approach/

———. (2012b) “Treasury and the Central Bank: A Contingent Institutional Approach.” Monetary Realism, June 3, Available at http://monetaryrealism.com/treasury-and-the-central-bank-a-contingentinstitutional-approach/#comment-7173.

Keynes, J.M. (1937) “How to avoid the slump,” The Times, January 12–14. Reprinted in D.E. Moggridge (ed.) (1973) The Collected Writings of John Maynard Keynes, vol. 21, 384-395, London: Macmillan.

———. (1939) “The process of capital formation,” Economic Journal, 49 (195): 569-574. Teprinted in D. E. Moggridge (ed.) (1973) The Collected Writings of John Maynard Keynes, vol. 14, 278-285, London: Macmillan.

Lavoie, M. (2013) “The Monetary and Fiscal Nexus of Neo-Chartalism: A Friendly Critique,” Journal of Economic Issues, 47 (1): 1-31.

Maclaury, B. (1977) “Perspectives on Federal Reserve Independence – A Changing Structure for Changing Times,” in Federal Reserve Bank of Minneapolis (ed.) 1976 Annual Report. Minneapolis: Federal Reserve Bank of Minneapolis.

Marquis, M. (2002) “Setting the Interest Rate,” Federal Reserve Bank of San Francisco Economics Newsletter, No. 2002-30.

McCulley, P. (2009) “The Shadow Banking System and Hyman Minsky’s Economic Journey” PIMCO Global Central Bank Focus, May.

http://media.pimco.com/Documents/GCB%20Focus%20May%2009.pdf

Meulendyke, A.M. (1998) U.S. Monetary Policy and Financial Markets. New York: Federal Reserve Bank of New York.

Mitchell, W.F. (2012) “Hungary helps to demonstrate MMT principles,” Billy Blog http://bilbo.economicoutlook.net/blog/?p=17645

Mitchell, W.F., and Mosler, W. (2002) “Public Debt management and Australia’s Macroeconomic Priorities” Center for Full Employment and Equity, Working Paper No. 02-13.

Moody’s (2003) “Sovereign Bond Defaults, Rating Transitions, and Recoveries (1985-2002),” Special Comment, February.

Mosler, W. (1999) “A General Framework for the Analysis of Currencies and Commodities,” in Davidson P. and J.A. Kregel (ed) Full Employment and Price Stability in a Global Economy, 166-177. Northampton: Edward Elgar Publishing, Inc, 1999.

Muysken, J. and Mitchell, W.F. (2008) Full Employment Abandoned: Shifting Sands and Policy Failures. Cheltenham: Edward Elgar

Palley, T.I. (2012) “Money, Fiscal Policy, and Interest Rates: A Critique of Modern Monetary Theory,” mimeograph.

Parguez, A. (1999) “The Expected Failure of the European Economic and Monetary Union: A False Money Against the Real Economy,” Eastern Economic Journal 25 (1): 63-76.

———. (2002) “A Monetary Theory of Public Finance.” International Journal of Political Economy 32 (3): 80-97.

Rezende, P. (2009) “The Nature of Government Finance in Brazil,” International Journal of Political Economy, 38 (1): 81-104.

Ritter, L.S. (1963) “An exposition of the structure of the flow-of-funds accounts,” Journal of Finance, 18 (2): 219-230.

Rochon, L.-P. and Vernengo, M. (2003) “State Money and the Real World: Or Chartalism and Its Discontents,” Journal of Post Keynesian Economic 26 (1): 57-68.

Ruml, B. (1946) “Taxes for Revenue are Obsolete,” American Affairs, 8(1): 35-39.

Standard and Poor’s (2007) Sovereign Credit Ratings: A Primer. New York: Standard and Poor’s.

Tymoigne, E. (2013) “Modern Money Theory, and Interrelations between Treasury and the Central Bank: The Case of the United States,” mimeograph.

Tymoigne, E. and Wray, L.R. (2014) The Rise and Fall of Money Manager Capitalism. London: Routledge.

U.S. Senate (1958) Debt Ceiling Increase. Hearings before the Committee on Finance. 85th Congress, 2nd Session. January 27, 28, February 4 and 7, 1958. Washington, D.C.: Government Printing Office.

U.S. Treasury (1955) Annual Report of the Secretary of the Treasury on the State of the Finances for the Fiscal Year Ended June 30 1955. Washington, D.C.: Government Printing Office.

Wray, L.R. (1998) Understanding Modern Money: The Key to Full Employment and Price Stability. Northampton: Edward Elgar.

———. (2003a) “Seigniorage or sovereignty?,” in L.-P. Rochon and S. Rossi (eds) Modern

Theories of Money, 84–102, Northampton: Edward Elgar.

———. (2003b) “Is Euroland the next Argentina?” Center for Full Employment and Price Stability, Working Paper No. 23.

———. (2003c) “Functional finance and US government budget surpluses in the new millennium,” in E. J. Nell and M. Forstater (eds) Reinventing Functional Finance: Transformational Growth and Full Employment, 141–159, Northampton: Edward Elgar.

———. (2007) “The employer of last resort programme: could it work for developing countries?,” Economic and Labour Market Papers, 2007/5. Geneva: International Labour Office.

———. (2011) “The S&P Downgrade” Wall Street Pit, 23 April,

<http://wallstreetpit.com/71874-thesp-downgrade-much-ado-about-nothing-because-a-sovereign-government-cannot-go-bankrupt>.

———. (2012) Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems. New York: Palgrave.

Zivney, T.L. and Marcus, R.D. (1989) “The Day the United States Defaulted on Treasury Bills” Financial Review, 24 (3): 475-489

[1] Throughout this article we will restrict our use of the term “sovereign government” to indicate a government that issues its own currency. As we will discuss, a monetarily sovereign government can choose among alternative exchange rate regimes—fixed, managed, and floating—which impacts domestic policy space. A government that promises to convert its own currency on demand and at a fixed exchange rate is constrained by its ability to obtain that to which it promises to convert. In that sense, we can say that it is “financially constrained” even though operationally it cannot run out of its own currency. The problem is that it can be forced to default on its promise to convert (to a foreign currency or to a precious metal). For some purposes, it is useful to separate floating currency regimes from fixed and managed exchange rate regimes. Many of those who adopt MMT make such a distinction, arguing that only floating currency regimes are “fully” sovereign in the monetary sense. However, many of the principles we outline in this article apply to all currency-issuers—but it must be kept in mind that when a government promises to redeem its currency its policy space can be limited.

[2] The word currency is used broadly to mean monetary instruments with zero term to maturity (“current”) in physical or non-physical forms denominated in a unit of account and issued by government (treasury or central bank).

[3] See note 1 for the case of a country that promises to convert its currency on demand. With a fixed exchange rate, access to foreign reserves can act as another constraint.

Pingback: MMT 101: Response to the Critics Part 2 | New Economic Perspectives

Pingback: MMT 101: A Response to the Critics Part 4 | New Economic Perspectives