Adding the Foreign Sector

By Eric Tymoigne and L. Randall Wray

(Revised Figure 8 on 12/6/13)

[Part I] [Part II] [Part III] [Part IV] [Part V] [Part VI]

Paul Davidson has recently written:

What is Bitcoin? According to Modern Money Theory, bitcoin can not be money since it is not accepted in payment of taxes by any government — nor is it issued by any government via the governed purchase of goods and/or services from the private sector. So what is bitcoin in terms of MMT? I do not know what MMT proponents would respond to this query?

Similarly, Tom Palley argues that government currency is demanded for reasons other than paying taxes and that foreigners who may want to hold the domestic (foreign to them) currency do not pay taxes to the domestic government. In addition, he says, in some countries the domestic private sector does not want to use the domestic government currency in many, or even most, economic transactions even though the government is imposing a tax; thus taxes do not drive currency.

Just as Davidson seems to believe that a stateless Bitcoin violates MMT, Palley seems to believe he’s come up with a fundamental critique of MMT.

In reality, MMT has always made all of these points, indeed, they are critical to understanding MMT. Note that even within a sovereign nation there are individuals who do not owe taxes but still accept the national currency, and foreign currencies can be accepted domestically even though there are no domestic taxes in those currencies. And in some countries there are things for sale only in foreign currencies.

And MMT follows Hyman Minsky, who always argued “anyone can create money, the problem lies in getting it accepted.”

All of these situations have been discussed in length by MMT. (Wray 1998)

None of this causes problems for MMT. The simple fact is that almost all monies of account are “state monies” and almost all government currencies do have taxes or other obligations (somewhere) standing behind them. Further, even if one can find a money of account and even an issued currency that has no fee, fine, tax, tribute, or tithe backing it up, that would not invalidate MMT.

Perhaps Palley and Davidson (like many other critics) do not understand the difference between “necessary” and “sufficient” conditions: a tax (or other involuntary obligation) is sufficient to drive a currency; it might not be necessary. All of MMT theory relies on the sufficient condition, not the necessary condition. When government imposes a tax (or other monetary obligation such as a fee or fine) the “trick” is done. But there might be other “tricks” that would work, too.

There is no part of MMT theory that relies on the necessary condition.

Even if critics could uncover dozens or hundreds of currencies driven without fees, fines, tithes, tribute or taxes, that would in no way invalidate MMT. It is curious, however, that so far as we know, none of the critics has found such examples documented to the standard that a serious researcher would desire. (We will not go into Bitcoin here, but Tymoigne is preparing a critical analysis for posting.)

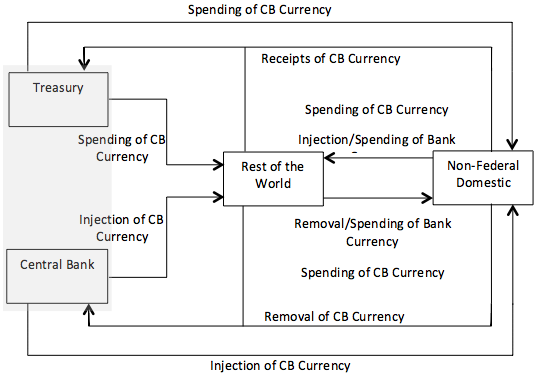

In this section operations with the foreign sector added are studied from the point of view of MMT. With the foreign sector added, we get the circuit in Figure 8. Some of the complexities presented in the previous installments have been removed to get to the point.

Foreigners can create financial instruments denominated in the domestic unit of account that promise to deliver domestic (foreign to them) government currencies, but they cannot legally create that currency. All domestic currencies come from the domestic economy either from the federal government (government currency) or from the non-federal government (for example, bank deposits).

It makes no sense to argue that foreigners supply US dollars to the US government. As foreigners cannot create US dollar currency, they must obtain it from the US. While it is true that a foreign bank can create US dollar deposits (which is done in the “Eurodollar” market), these must obtain “real US dollars” for cash withdrawals and clearing, which can only come from the US Fed or Treasury.

Most of the time, when a foreigner provides US dollars to the US government (that is, by purchasing a treasury) the payment is made by debiting the foreigner’s reserve account at the Fed. The foreigner’s holding of the purchased treasury is really just a different electronic entry, also at the Fed. The “borrowing” of dollars is just a shift on the Fed’s balance sheet.

Again the causality goes from spending by the domestic economy to saving by foreigners. Thus, a monetarily sovereign government does not need foreigners to fund itself.

While the Treasury does sell bonds to obtain CB currency, the central bank is the entity that ultimately issues the currency, not foreigners. “China” does not finance the “US.” It is the “US” that provides the dollars that “China” wants. Because China has accumulated so many dollar reserves (reserve accounts at the Fed plus holdings of US treasuries), it is true that she can buy new issues of US Treasuries using accumulated dollar reserve holdings.

But that cannot be a net source of US government finance, rather, it represents a portfolio change—perhaps an exchange of reserve deposits at the Fed for US treasuries. US indebtedness does not change by this portfolio adjustment, although since the term structure of interest rates is usually positive, this transaction would increase payment commitments in the future.

However, those future interest payments will be made—in the future—in the same way that all other government spending is made, through credits to the foreigner’s account at the Fed. There is nothing “special” about payments to foreigners, because the US government makes commitments in its own currency.

For a monetarily sovereign government, a debt crisis is a choice to default not an inability to make a promised payment. A debt crisis for economic reasons can occur if a government issued debts that promise to deliver a foreign currency or if a government has to defend a currency peg. For a sovereign nation that does not promise to peg, there is no process that can lead to involuntary default, although as the US Congress is proving, default by choice remains a possibility.

Now, none of this applies if a national government issues financial instruments denominated in a foreign currency—a point we have always made (indeed, it was the main reason why we criticized the formation of the EMU from inception (Wray 2003b)). Fiebiger does not seem to understand that this is a point made by MMT:

Those crises strongly support an alternative view that the critical issue when it comes to macro policy autonomy is not adoption of a “flexible exchange rate” but the currency denomination of external liabilities; and, the extent to which a nation’s currency is utilized by other nations as international money. (Fiebiger 2013, 72)

This is exactly what MMT says. MMT goes further by noting that some governments, like Hungary, can issue their own currency and have control over the interest rate but may choose to issue foreign-denominated debt, which creates problems (Mitchell 2012). Indeed, some who advocate MMT—including Wray—have argued that no sovereign government should be allowed (by its citizenry) to issue IOUs denominated in foreign currency.

The position should be clear: MMT argues that sovereign currency increases policy space, so issuing debts in foreign currencies should be avoided. Fiebiger has apparently misunderstood the MMT position.

The exchange rate regime also plays a role in a debt crisis, because countries that only issue financial instruments denominated in the domestic unit of account may default if they feel their currency peg is threatened: Russia did so in the early 2000s.

Credit rating agencies provide a rating for the national government of all countries regardless of the monetary system in place. In its 2007 Sovereign Debt Primer, Standard and Poor’s explains how the rating is determined

A sovereign rating is a forward-looking estimate of default probability. […] The key determinants of credit risk [are economic risk and political risk]. Economic risk addresses the government’s ability to repay its obligations on time and is a function of both quantitative and qualitative factors. Political risk addresses the sovereign’s willingness to repay debt. Willingness to pay is a qualitative issue that distinguishes sovereigns from most other types of issuers. Partly because creditors have only limited legal redress, a government can (and sometimes does) default selectively on its obligations, even when it possesses the financial capacity for timely debt service. (Standard and Poor’s 2007, 1, 3-4)

MMT agrees that a monetarily sovereign government can choose to default on its obligations even though it cannot be forced to do so in the case of obligations denominated in its own floating currency. Cantor and Parker (1995) provide examples of governments that defaulted on debts denominated in their own unit of account, and note that “Domestic currency defaults have usually been the result of an overthrow of an old political order—as in Russia and Vietnam—or the byproduct of dramatic economic adjustment programs aimed at curbing hyperinflation—as in Argentina and Brazil” (Cantor and Parker 1995, 3).

However, Cantor and Parker also note that this type of default is rare. If one had to estimate a default probability on monetarily sovereign governments, it would be much lower than the historical 0.02 percent five-year median default probability used for AAA corporate bonds. One could argue that it would be so low as to make it irrelevant, which is what MMT argues.[1]

The problem with S&P is that it has a shifting definition of economic risk. S&P is aware of the absence of economic risk for monetarily sovereign governments but it proceeds to argue that there is one by changing the definition of default risk to include the risk of inflation. These are two completely different risks. If one considers taxes a form of revenue that helps to pay debts, then tax revenues rise with inflation and so lower the risk of default.

By conflating inflation risk and default risk in their rating, S&P creates confusions. They also assume that the government is responsible for the inflation, when governments might have little control over what inflation exists even if they can try to contain it.

Inflation is a real constraint, not a financial constraint—in the sense that at full employment, increasing spending can only raise prices.

Beyond the insights one can get from the circuit approach, one can get additional insights from national income identities:

Δ(FADP – FLDP) + Δ(FAG – FLG) + Δ(FAF – FLF) ≡ 0

And, knowing that saving represents the change in net worth (S = ΔNW) and investment is the change in real assets (I = ΔRA), it is also true that:

(SDP – IDP) + (SG – IG) + (SF – IF) ≡ 0

Following the same logic as above, this means that now the equilibrium fiscal position of the government sector will be determined by the desired net financial accumulation of both the domestic private and the foreign sectors.

Here again, not all sectors can be in surplus at the same time–at least one must be in deficit if one has a surplus. While a policy focused on achieving simultaneously three surpluses—fiscal surplus, domestic private surplus, and external surplus—is usually seen as highly desirable, it cannot be delivered unless the foreign sector is willing to have an external deficit.

If all countries aim at reaching an external surplus simultaneously then at best external balances are zero, which means that either the government sector or the domestic private sector is in deficit while the other is in surplus. For some economies to be net exporters, others need to be net importers and must have a current account deficit.

Further, some nations are in a situation in which they are necessarily net importers. In the worst case, some countries have limited real and external financial resources so their policy space is highly constrained as unskilled labor and unproductive land are the only resources they may have, and their government currency might not be accepted externally. In that case, foreign aid is crucial but some improvements can be made by using the labor force for specific public purposes that require limited external physical and financial resources. Payments in kind may also be necessary (to make sure to create a demand for the domestic production and to avoid imports of foreign products that are similar).

In the most favorable case, a country provides the international currency and the rest of the world desires to save the international reserve currency. In that case, desired net saving by foreigners is positive because they want to accumulate net worth beyond physical accumulation, and so a current account deficit by the country supplying the reserve currency is needed.

Open economies are more sensitive to fluctuations in exchange rates and may desire to curb exchange-rate fluctuations by pegging a currency. MMT notes that there are different degrees in this type of policy that influence the policy space available to a government. A crawling peg provides some policy space that varies according to the exchange rate band. A currency board, the last step before completely giving up monetary sovereignty (“dollarization”), provides almost no policy space and so makes it difficult for a government to set its own policy agenda.

Palley argues that dollarization contradicts MMT.

Small open economies with histories of high inflation have also shown themselves prone to the phenomenon of currency substitution or “dollarization” whereby domestic economic agents abandon the national money in favor of a more stable store of value. Dollarization shows that the store of value property is an important property of money, contrary to MMT denials of the significance of this property. (Palley 2013, 21)

This is a very strange claim by Palley; we know of no place where MMT denies the importance of stores of value, although like Keynes we wonder who would be sufficiently “insane” to hold cash balances if there are better alternatives. In addition, MMT does recognize that some small open economies may benefit from dollarization given that almost none of their economic activity is driven by the domestic private sector and government spending. In any case, the existence of pegged currencies cannot contradict MMT. We emphasize the greater policy space that is generally available to the country that does not peg. But we do not deny the reality that some nations choose to peg, presumably because they see advantages to doing so.

MMT just states that the demand for the government currency is determined at minimum by the tax levy and the capacity to enforce it. In a highly open economy, residents may not use the government currency for purposes other than making legal payments to the government (“taxes”). If the government has limited means to enforce legal payments, the demand for the currency will be even smaller and so the capacity to spend without generating inflationary pressures will be even more limited.

Assuming that tax enforcement is perfect and that government currency is only demanded for tax purposes, then the equilibrium fiscal position of the government will be zero. In that case, the equilibrium external balance will be determined by the desired net saving of foreign currency by the domestic private sector. Achieving that desire, however, is much harder than in the case of a monetarily sovereign government, because domestic private economic units have to rely on the desires of foreigners, and domestic economic units have limited capacity to influence this. The desired net saving of the domestic private sector and the foreign sector may not be compatible, which could lead to a painful adjustment process.

To sum up:

MMT argues that taxes imposed in the currency issued by a monetarily sovereign government are sufficient to “drive” that currency: the population will demand at least enough currency to pay the taxes.

MMT does not argue that taxes are a necessary condition to drive a currency or other monetary instrument.

MMT recognizes that one nation’s currency—say the USA dollar—might be accepted outside the issuing nation, by those who will never owe taxes in that currency.

MMT recognizes that even a large portion of payments within a nation could be denominated in another nation’s currency. There could be a strong domestic demand to hold another nation’s currency as a store of value.

MMT recognizes the theoretical possibility that there could exist a money of account, as well as media of exchange denominated in that unit of account, created by a nongovernment entity. History shows, however, that such cases are economically insignificant.

However, notwithstanding such exceptions, MMT argues that any monetarily sovereign government that imposes taxes in its own currency will be able to issue its own currency through lending and purchasing. It cannot “run out” of its own currency. It can meet obligations in its own currency. It can “afford” to purchase anything for sale that is for sale in exchange for its currency. It might not be able to buy things that are for sale only in exchange for other currencies. The difference can be important in some developing countries.

[1] Defaults for technical reasons may also have occurred but these are irrelevant because they are resolved quickly. Venezuela is counted by Moody’s as having defaulted because “the person who was supposed to sign the checks was unavailable at the time” (Moody’s 2003; 22). The U.S. also defaulted in 1979 due to “unanticipated failure of word processing equipment used to prepare check schedules” (Zivney and Marcus 1989). We would not count that as evidence that MMT is wrong.

7 responses to “MMT 101: A Response to the Critics Part 5”