Adding the Central Bank

By Eric Tymoigne and L. Randall Wray

[Part I] [Part II] [Part III] [Part IV] [Part V] [Part VI]

Beyond the inflationary aspect of MMT, Palley (2013) argues that MMT does not account for the flooding of reserves in the economic system that results from a monetary financing of government spending. In this case, a deficit leads to a decline in interest rates and potential financial instability.

Fiebiger (2012a, 2013) argues that Treasury operations do not lead to a change in the level of central bank liabilities and so there is no monetary creation, and that it is disingenuous to exclude the Treasury General Account at the Fed (TGA) from the money supply. He also wonders why the Treasury continues to issues bonds when the fed funds rate (FFR) is effectively zero today, if, following MMT, bond offerings are voluntary operations used to drain excess reserves.

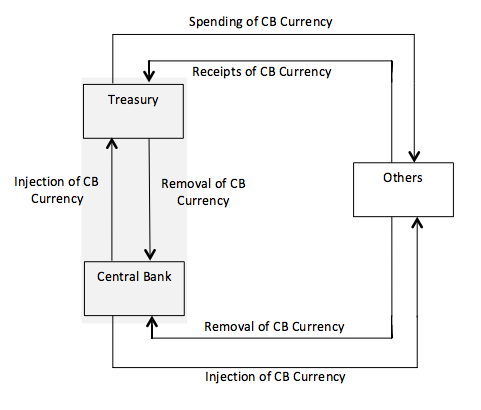

In order to address these issues, this installment removes the consolidation hypothesis by distinguishing between the central bank and the Treasury in the federal government sector (grey area in the figure below). To simplify, a strict separation is also made between what the Treasury does and the central bank does (Figure 4, see below).

Treasury is the only federal government entity involved in injecting CB currency through operations on goods and services (spending of CB currency).[1] These operations involve the exchange of financial assets for real assets (“fiscal policy”)[2]. Receipts of CB currency due to the Treasury come from taxes and bond offerings, and so the Treasury is also involved in some financial transactions but merely to remove CB currency from the nongovernment sector and to obtain credits to the Treasury’s account at the CB.

We will assume the central bank only injects CB currency through financial operations that is, through open market purchases of treasuries, and outright purchases of non-federal government financial instruments. Central bank operations (“monetary policy”) do not change the mix between real and financial assets of the non-federal government sectors.

In practice, the distinction is not that clear as the central bank is involved in limited operations on goods and services (it hires labor and buys office supplies, for example), and the Treasury is involved in financial operations (various kinds of loans and loan guarantees, for example).

There are three sources of injection of CB currency into the non-federal sector: advances, purchases of financial assets, and purchases of goods and services. There are four sources of removal of CB currency from the non-federal sector: repayment of advances, taxes, sales of financial assets, and sales of goods and services by government.

Figure 4 assumes that the central bank can directly advance funds to the Treasury which may not true for all real world cases. Whether such activity is permitted is not that relevant for the logic at play (and so for MMT as we will explain). Indeed, the crucial elements in this circuit are injections and removals of CB currency that occurs between the grey area (federal sector) and the non-federal sectors. The reason is that transactions within the federal sector have no direct impact on macroeconomic variables.

For example, purchases of treasuries by the central bank directly from the Treasury do not lead to an injection of CB currency in the non-federal sectors, and so have no direct impact on the interest rate as long as the Treasury does not spend. However, there could be an indirect effect if financial market participants account for a new buyer in the primary market (so they assume fewer treasuries will be sold into financial markets). But that ultimately depends on how the central bank bids in the primary market in terms of yield and quantities.

Again, it is logical that injections of CB currency must come before removal of CB currency from the non-federal sectors can occur. This means that the central bank must advance CB currency either to the non-federal sectors or to the Treasury before any of the following can occur: tax collection, treasuries purchases by non-federal sectors, and spending by Treasury.

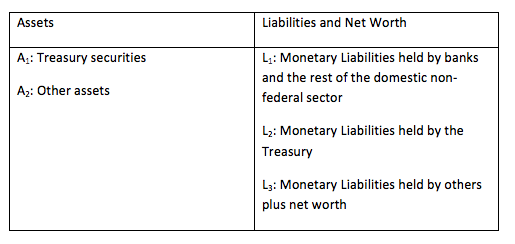

There is a more precise way to look at the sources of injection or removal of CB currency. Figure 5 shows the simplified balance sheet of the central bank of a monetarily sovereign government.

L1 is approximately the monetary base (Treasury currency held by the domestic non-federal-government sector must be added), and L2 is the outstanding amount of central bank currency held by the Treasury. Given that a balance sheet must balance we know that:

L1 ≡ A1 + A2 – L2 – L3

MMT works a lot with this identity because it shows the sources of injection and drainage of currency in the domestic private sector. MMT focuses especially on the Treasury and central bank operations that lead to changes in L1. These changes affect the federal funds rate (FFR) and are central to the economic relationship between the public and private sectors. When a consolidated government is used in the argument, the balance sheet shown in Figure 2 (presented earlier this week) is used instead.

Another point made by MMT related to the previous identity is that fiscal policy (change in L2) leads to fluctuations in L1 for reasons unrelated to the changes in the demand for monetary base by the domestic non-federal sector; it is an exogenous fluctuation (or a “vertical” injection of base) for the domestic non-federal sector even though it may be endogenous to the state of the economy.

Thus, a central bank needs to offset any change in L1 due to Treasury operations in order to maintain the amount of CB currency equal to what is demanded in the open market so as to maintain the FFR on target.

All this of course does not mean that MMT is throwing away the endogenous component of variations in L1, which are due to central bank’s defensive operations to respond to the demands of open-market participants. While Lavoie does not see any gain from “making references to vertical components” (Lavoie 2013, 8), MMT shows that these components are important for fluctuations in L1 and explain why the Treasury and central bank need to coordinate with each other. This coordination is one reason why consolidation makes sense.

To simplify, let us assume that all economic transactions involve electronic transfers of funds (no use of central bank or Treasury physical currency). As the Treasury spends in the domestic economy (L2 goes down), the amount of reserves held by banks rises (L1 goes up) simultaneously with the bank accounts of non-bank economic units. As the Treasury taxes (L2 goes up), the amount of reserves held by banks declines (L1 goes down).

If the Treasury spends more than it taxes (i.e. runs a deficit), there is a net increase in L1 due to an increase in the amount of funds at the central bank accounts of banks. Surpluses lead to exactly the opposite effect; they drain reserves out of the banking system and so reduce the monetary base.

Given that the demand for reserves by banks is highly inelastic, in normal times any[3] excess reserves will tend to push the FFR below the Fed’s target and any shortage of reserves will drive up the FFR. Thus, the central bank will need to offset Treasury’s fiscal operations unless it targets a FFR of zero percent (in which case it can leave excess reserves in the system) or gives up FFR targeting (and accepts potentially highly unstable overnight interest rates).

Both the Treasury and the central bank are involved in these reserve management operations to maintain interest-rate stability.

If one focuses on a deficit, the central bank drains excess reserves by moving A1 in the opposite direction of L2; the traditional open market operations (OMOs). OMOs involve selling treasuries to banks so that A1 declines and excess CB currency held by the banking system is drained (L1 declines). However, the central bank has a limited amount of treasuries that it can use for OMOs, so the Treasury must supply an adequate amount of treasuries for FFR targeting to be effective.

(The alternative is for the central bank to offer higher interest paying liabilities—some central banks actually issue bonds that serve the same purpose as Treasury bonds.)

More broadly, a growing economy normally requires a growing monetary base, and so a growing amount of assets held by the central bank given the FFR target, which usually means that the amount of treasuries held by the central bank must rise, which ultimately means that the Treasury must be in deficit.

If there is a fiscal surplus, the outstanding amount of treasuries shrinks which is a problem for a central bank that performs OMOs with that instrument (unless the central bank provides the reserves through discount window loans—however, without Treasury debt this will require that it is willing to accept other collateral submitted by banks).

Beyond the provision of an adequate supply of treasuries, the Treasury is also involved in FFR targeting through the use of the Treasury tax and loan accounts (TT&Ls). TT&Ls are accounts of the Treasury at private banks. These accounts were first set up in 1917 to receive proceeds of liberty bond offerings, and in 1948 they also began to receive tax collections. They were created to smooth the impact of fiscal operations on the supply of reserves (U.S. Treasury 1955; U.S. Senate 1958).

Bell (2000), the U.S. Treasury (1955), MacLaury (1977) and Meulendyke (1998) show that the daily coordination between the Treasury and the central bank is extensive. The Treasury will help the central bank by timing transfers between its TGA (L2) and its TT&Ls. The timing is done in relation to spending needs so has to maintain L2 relatively stable.

Rochon and Gnos unfortunately confuse the issue when they quote Wray incorrectly by stating that, according to Wray, “taxes are a means ‘to maintain stability in the market for reserves’” (Gnos and Rochon 2002, 49). If one goes back to the full quote, Wray talks about the timing of spending and transfer of tax receipts to TGA, not taxes. It is all about limiting L2 fluctuations.

Let’s put it this way: Taxes are not a tool to maintain the stability of the reserve market, they are a tool to maintain price stability; bonds and TT&Ls-TGA transfers are the tools used to maintain reserves at the right level and thus enable the central bank to hit its rate target.

Ultimately, the financial operations of the Treasury and the central bank are so intertwined that both of them are constantly in contact to make fiscal and monetary policy run smoothly. The Treasury gets involved in monetary policy and the central bank gets involved in fiscal policy. As such the independence of the central bank is rather limited and it must ultimately financially support the Treasury in one way or another (Tymoigne 2013).

MacLaury from the Federal Reserve Bank of Minneapolis summarizes all these points quite nicely:

The central bank is in constant contact with the Treasury Department which, among other things, is responsible for the management of the public debt and its various cash accounts. Prior to the existence of the Federal Reserve System, the Treasury actually carried out many monetary functions. And even since, the Treasury has often been deeply involved in monetary functions, especially during the earlier years. […] Following the 1951 accord between the Treasury and the Federal Reserve System, the central bank was no longer required to support the securities market at any particular level. In effect, the accord established that the central bank would act independently and exercise its own judgment as to the most appropriate monetary policy. But it would also work closely with the Treasury and would be fully informed of and sympathetic to the Treasury’s needs in managing and financing the public debt. […] The Treasury and the central bank also work closely in the Treasury’s management of its substantial cash payments and withdrawals of Treasury Tax and Loan account balances deposited in commercial banks, since these cash flows affect bank reserves. (MacLaury 1977)

The central bank and the Treasury must work together to support the monetary and financial systems because they are ultimately two sides of the same coin, the government sector. The most recent example occurred during the recent financial crisis when the Treasury issued bills at the request of the Fed to drain reserves (Tymoigne 2013). Thus, Fiebiger is correct when he notes that:

But it must be acknowledged that, in the modern era, the US Treasury sells bonds to acquire the funds it needs to finance deficit-spending and that without this financing operation would be short of “money” (Fiebiger 2012b, 31)

MMT does not deny this when one accounts for the entire institutional framework. The point is that, in that extreme case where nobody wants to buy bonds from the Treasury, the central bank will intervene, or the Treasury will finds ways to avoid having no fund in the coffers. They have done so for centuries now due to their privilege in the monetary system. They have done so not only to finance Treasury but also to avoid financial instability that results from a federal government that does not perform its monetary duties properly.

Thus, if one wants to account for institutional aspects in order to be more descriptive, one should account for all of them, namely those that constrain Treasury-Central Bank operations, and those that allow Treasury to bypass these constraints (Tymoigne 2013).

For example, in the US special dealer banks always stand by to purchase treasuries and the Fed ensures there are sufficient reserves to do so by supplying them through temporary repos (a matched purchase of Treasury debt with a requirement that the seller must repurchase later). While the Fed is not in that case directly buying the new issue directly from the Treasury, it uses the open market purchase to buy an existing bond in order to provide reserves needed for a private bank to buy the new security.

The end result is exactly the same as if the central bank had bought directly from the Treasury.

The reader may note that none of the preceding is a theoretical analysis. It is an analysis of balance-sheet accounting and the impact of government spending and taxes on the CB currency supply, as well as an analysis of the interaction between the central bank and the Treasury.

However, MMT does draw some conclusions from the preceding. One of them is that consolidating the central bank and the Treasury in the government sector makes theoretical sense. One could separate the Treasury and central bank instead of consolidating, but this simply adds assumptions and intermediate steps without changing the nature of the operations. Indeed, it has the potential of masking the true nature of the operations, which makes it decidedly less useful as a starting point.

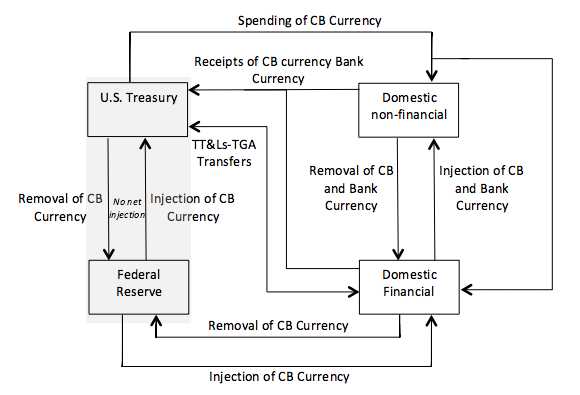

Thus, MMT does recognize that there are some self-imposed constraints on the financial operations of the government. Consider how operations are really done in the US—where the Treasury really does hold accounts in both private banks (TT&Ls) and the Fed (TGA), but can write checks only on its account at the Fed (it cannot spend bank currency, that is, its deposits at private banks).

Further, the Fed is prohibited to be a net buyer of treasuries in the primary market (and is not supposed to allow overdrafts on the Treasury’s account) and thus the Treasury must have a positive balance in its account at the Fed before it spends. Thus, the Treasury must replenish its own account at the Fed either via balances collected from tax (and other) revenues or debt issuance to “the open market”.

Fullwiler, Kelton and Wray (2012) have shown that these constraints do not change the end result of fiscal policy in terms of balance sheets, even though the order of financial transactions changes. One way or another, the Treasury gets goods and services in exchange for CB currency.

Again the circuit approach improves our understanding of the logic at play. Figure 6 shows the circuit that includes all these institutional aspects.

The circuit is complicated now but, again, before the Treasury can tax and issue bonds, an injection of CB currency must occur first. This is so even though taxes and bond offerings are implemented through bank currency because the Treasury only spends using funds on its TGA.

Thus, ultimately taxes and bond offerings drain CB currency when funds are moved from the TT&Ls and the TGA. Either the central bank advances the currency to the domestic private sector or it buys financial assets from that sector. In either case, the CB currency is then passed along to the Treasury, so the central bank is still involved in funding the fiscal operations of the Treasury, but it does so indirectly.

In addition, the Federal Reserve provides a stable refinancing source of the Treasury by buying treasuries in the primary market to replace those maturing.

To put it simply, the Fed is the monopoly supplier of CB currency, Treasury spends by using CB currency, and since the Treasury obtained CB currency by taxing and issuing treasuries, CB currency must be injected before taxes and bond offerings can occur.

Lavoie is actually on the same page and recognizes that the fact that central bank cannot directly finance the Treasury does not change the logic at play. However, he prefers not to use the consolidated government:

In a nutshell, as long as the other characteristics of a “sovereign currency” are fulfilled, it makes little difference, as the cases of Canada and the USA illustrate, whether the central bank makes direct advances and direct purchases of government securities or whether it buys treasuries on secondary markets, as long as the central bank shows determination in controlling interest rates. […] But then, if it makes no difference, why do neochartalists insist on presenting their counter-intuitive stories, based on an abstract consolidation and an abstract sequential logic, deprived of operational and legal realism. (Lavoie 2013)

MMT argues that the added complexity is counter-productive because it leads to poor understanding among economists, poor modeling, and bad policy choices. Were economists and policy makers to understand that the MMT consolidated case explains the underlying nature of government debt operations, we suggest that all three could be markedly improved.

Finally, MMT insists that there is nothing “natural” about the operating procedures (including restrictions) adopted—since in practice they make no difference they could be dropped to simplify procedures. So our difference with Lavoie is partly a strategic difference but also partly a way to look at—and possibly improve—policy making as shown later in Part 6.

In conclusion, Treasury spending always involves monetary creation as private bank accounts are credited, while taxation involves monetary destruction as bank accounts are debited. The question becomes how the Treasury acquired the deposits it has in its account at the central bank.

In the current institutional framework, the apparent answer is through taxation and bond offerings. While usually economists stop here, MMT goes one step further and wonders where the receipts of taxation and bond purchases came from; the answer is from the central bank. This must be the case because taxes and bond offerings drain CB currency so the central bank had to provide the funds (as it is the only source).

The logical conclusion is then that CB currency injection has to come before taxes and bond offerings. Close study of the operations involved reveals that the CB either advances them, or more commonly, provides them through open market purchases.

More broadly, the theoretical insight that MMT draws is that government spending (by the Treasury or spending and lending by the central bank) must come first, i.e. it must come before taxes or bond offerings. Spending is done through monetary creation ex-nihilo in the same way a bank lends (buying financial assets) by crediting bank accounts; taxes and bond offerings lead to monetary destruction (L1 goes down) in the same way that loan repayments destroy bank deposits.

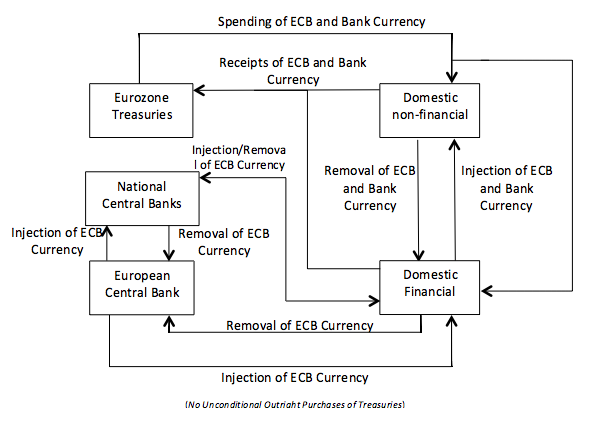

One may note that most of these conclusions also apply to the Eurozone but there are specific institutional aspects that make the Eurozone Treasuries non-monetarily sovereign (Figure 7).

First, there is no direct coordination of Eurozone Treasuries with the ECB for monetary and fiscal policy purposes (indeed this is prohibited).

Second, Eurozone Treasuries are not allowed to issue any monetary instrument whereas the US Treasury issues coins to the Federal Reserve in exchange for TGA crediting at par value.[4] And the US Treasury can issue coins of any denomination.

Third, the ECB does not perform unconditional outright purchases and sales of Eurozone Treasuries. At least, before the Securities Market Programme and Outright Market Transactions program, the ECB did not perform any outright transactions on Treasuries. Thus, if Eurozone Treasuries are in trouble, they have no means to bypass existing self-imposed constraints short of leaving the Eurozone.

Finally, the ECB does not provide a refinancing source to the Eurozone Treasuries. This does not mean that the ECB is not involved indirectly, as the Target 2 clearing mechanism operates to provide euro reserve balances to member central banks. This has always provided something of a “relief valve” for member state fiscal operations because national central banks do purchases treasuries in secondary markets. While the ECB has been reluctant to buy treasuries, it deals with national central banks on demand so the ECB is again indirectly involved in the funding of national Treasuries, albeit in a more narrow and cumbersome way.

Beyond the relevance of the consolidation of the central bank and Treasury for theoretical purpose, one can draw additional conclusions from the interaction between the central bank and Treasury in monetarily sovereign governments.

First, Treasury has issued securities for purposes other than funding itself. One reason is to provide a means of payment to the country, another is to help the central bank in its interest-rate stabilization operations, and a third is to help financial institutions meet their capital requirements and to provide a foundation upon which all other securities are valued by providing a proxy for the risk-free rate.

MMT argues that these reasons for issuing treasuries are much more relevant in a monetarily sovereign government, because they do not result from a self-imposed constraint. They respond to a genuine need of the economic system. Palley notes that bonds provide an important foundation for the financial system but does not seem to recognize that MMT agrees (Palley 2013, 22). Bond offerings by the Treasury are central to the stability of the financial system as long as the central bank does not pay interest on reserves. Interest-paying government liabilities are so important that Treasury may continue to issues treasuries for that purpose even if there is a fiscal surplus. Australia is a recent example of that case (Commonwealth of Australia 2003, 2011). China is an example of a case in which it is the central bank that issues interest-paying bonds when the Treasury runs a surplus.

Second, Palley argues that a permanent deficit funded monetarily without recourse to taxes and bond offering generates price and financial instability through a large “liquidity build up.”

Money-financed budget deficits increase the supply of high-powered sovereign money, which embodies latent purchasing power […]. Whereas general price inflation is unlikely in times of weak economic activity, asset price inflation can occur at any time. As with general price inflation, modeling the relation between liquidity build-ups and financial instability is extremely difficult. That relationship is not mechanical or fixed in form. Instead, liquidity is akin to latent financial energy that can accumulate, leading to greater danger of unanticipated combustion. However, because the danger cannot be deterministically modeled, that does not mean it should be ignored. Yet that appears to be the implicit recommendation in MMT’s policy of exclusive reliance on money-financing of budget deficits. (Palley 2013, 19)

Again, all this is wrongly based on a logic that sees monetary financing, taxes, and bond offerings as exclusive alternatives. We have already dealt with the point that taxes are central to price stability and are not an alternative to monetary creation. The same applies to bond offerings–they are not an alternative to monetary financing, rather they complement it by draining excess CB currency in order to maintain interest-rate stability.

Thus, it is true that a deficit that is not accompanied by a bond offering to the non-federal sector will drive down interest rates if it creates excess reserves (because L1 goes up), and that might lead to imprudent borrowing. However, the deficit-led decline in interest rates will usually not happen because the central bank will drain any excess CB currency created by a deficit in order to maintain the FFR on target.

In other words, the deficit will affect interest rates only if the CB decides to lower its target as a result of deficits. That would appear to be quite unlikely—indeed, in the presence of inflationary deficit spending by Treasury, the central bank would be more likely to raise its target rate (so it would drain excess reserves). Still, bond offerings must occur after a net monetary injection by the government unless the private sector wishes to net save in the form of government currency.

Third, Fiebiger notes that under the current institutional arrangements, Treasury operations do not lead to any net monetary creation. Taxes and bond offerings have to occur before the Treasury can spend and spending is limited to the amount of funds collected by the two previous means, so the net creation of funds is zero.

The Treasury cannot ‘net credit’ the accounts of the private sector through expenditures because the ‘credits’ to its own accounts are obtained by collecting fiscal receipts and, hence, by recording previous ‘debits’ against the accounts of the private sector (with a side note needed for the Fed’s holdings of Treasury debt). Matters are straightforward: if the Treasury wants to spend in excess of the balance in its account at the central bank (normally around $5 billion) it must first collect and then draw on fiscal revenues or else its checks will bounce. (Fiebiger 2012a, 3)

MMT does not disagree with this. We just did a circuit that shows this when one removes the consolidation hypothesis. Spending creates an injection of currency that needs to be drained by taxes to promote price stability, and by bond offerings to promote interest-rate stability. So, unless the non-federal sectors are willing to hold government currency instead of bonds (this means that a bond offering would fail to find willing holders), there will not be any net injection of currency from a fiscal operation; that is, L1 will stay the same via timing of spending and TT&Ls-TGA transfers obtained from taxes and bond offerings.

What MMT claims is that deficit spending increases “net financial assets” for the nongovernment sector, normally in the form of treasuries offered in redemption of reserves. In addition, the injection of currency has to occur before taxing and bond offerings can be of use to the Treasury as the Treasury spends by using CB currency.

Fourth, Fiebiger also takes issue with the exclusion of TGA from the definition of the money supply and argues that looking at L1 alone is not relevant. Net monetary creation would mean that the liability of the central bank goes up, when in fact when the Treasury spends L2 goes down by the same amount as L1 goes up.

MMT description of the money supply process [involves] arbitrary accounting practices; in particular, [and leads] to the mislaid belief that the Treasury’s account at the central bank can be “ignored” because the deposits are not ‘counted’ in any money stock measure and ‘net out’ when the public sector’s books are consolidated. (Fiebiger 2012a, 2)

When the Treasury spends the transaction only alters the composition of central bank liabilities and, therefore, is not money creation. (Ibid, 3)

There are several points to be made here.

1. Taxes and bond offerings drain CB currency as funds collected from them are moved into the Treasury’s account at the Fed. It does not matter that banks are not the main participants in the primary market. The important step is when the funds obtained are moved into the TGA because this leads to a drain of CB currency from the non-federal sector, which normally leads to a higher FFR unless the central bank intervenes.

2. Treasury spending injects reserves and this is the important point; or put in Fiebiger’s words, the change in the composition of the central bank liabilities is what matters, not the amount of liabilities of the Fed (except in the case of consolidation). The amount of central bank liabilities held by the domestic private sector increases, while the amount of central bank liabilities held by the Treasury goes down. Thus, contrary to what Fiebiger states, it is not that MMT relies on statistical definitions of money to argue that a change in L2 is not the relevant variable to study. It is changes in L1 that matters for economic analysis of a domestic economy because they reflect the interactions between the federal and non-federal sectors.

3. Fiebiger and others also tend to ignore the difference between the logic that uses the consolidation hypothesis and the argument that does not. For example Fiebiger comments:

To understand what MMT is and why it is faulty one must grasp that its proponents suppose that the federal government’s account at the Federal Reserve is the nexus of ‘State money’ creation and destruction. They transform a few billions (i.e. the normal balance in the Treasury’s account) into ‘theoretical’ trillions of net/new ‘money’ for the private sector only then to claim that in ‘practice’ the Treasury uses taxes or bond sales to ‘destroy’ all of the ‘newly-created money’ by the end of the day for “reserve / interest rate maintenance” purposes (thereby leaving no additional ‘money’ in the economy). Modern money theorists declare that all of this is just a description of the ‘real-world’ accounting practices of the Federal Reserve System but it is based on the erroneous belief that Treasury operations affect the volume of central bank liabilities outstanding rather than the composition. (Fiebiger 2012a, 5)

The fallacies here are many with the main one being that we are meant to believe that in ‘theory’ the Treasury could spend ad infinitum without transferring ‘money’ into its account at the central bank: as if its checks would not bounce once the deposit balance reached zero. The Treasury cannot create one type of central bank liabilities (↑ reserves) ad infinitum by means of drawing on another type of central bank liabilities (↓ Treasury deposits) when it pays for things. (ibid., 4)

Treasury operations do affect the volume of government currency when the consolidation hypothesis is used. If the Treasury really were to spend “trillions” then in the first instance that would create “trillions” of bank reserves, but these would be drained by “trillions” of sales of treasuries. As we have explained over and over, since the Fed normally targets an interest rate, it will not usually leave excess reserves in the system—so the Fed and Treasury cooperate to ensure securities are sold (new issues by Treasury, open market purchases by Fed).

4. In the same vein of confusing the consolidation hypothesis with a descriptive approach, Fiebiger asks why the Treasury continued to emit bonds when the FFR was effectively zero during from 2009 to today:

Why then has the US Treasury continued to issue bonds in the period 2009-2011Q2 (equal to $3,377bn) even though it had no reason to do so – according to MMT – because the fed funds rate was effectively zero and the Federal Reserve acquired the power to pay interest on reserves? If bond sales are a ‘voluntary’ part of fiscal policy and not needed since late 2008 for the ‘designed’ purpose of ‘interest rate maintenance’ operations, then, why did the US Treasury still issue bonds even though it bumped into the congressional ‘debt ceiling’ and nearly defaulted on its financial obligations in August 2011? (Fiebiger 2012, 6)

The first part of the answer is because the Treasury needs to fund itself according to existing procedures that we have discussed in detail—procedures that can be changed or eliminated, and indeed, are occasionally changed.

However, the second part, is that during the period of time that the Fed was operating Quantitative Easing, the Federal Reserve asked the Treasury to issue bills for the purpose of draining reserves and maintaining the FFR on target (which was near zero but positive)—and it used the Supplementary Financing Program (SFP) for such purposes. It did so even after the FFR was close to zero and even after the Fed began to pay interest on reserves because these bills helped to drain a large amount of reserves and because not all institutions with an excess of Federal Reserve currency could get a reserve account at the Fed (Tymoigne 2013).

In other words, SFP bills were issued for monetary policy purpose. As stated above, treasuries have been issued for purposes other than financing spending, and MMT argues that these other purposes are more relevant. While we will not go into details, it appears that the US Treasury issues longer maturity debt because the private wealth managers want it in their portfolios. That could be a legitimate purpose for issuing long term Treasury debt.[5]

While all these aspects relate to the fiscal and monetary policy impacts on reserves, it does not say anything about how private banks operate. Post Keynesians have worked extensively on that issue and so it is sufficient to say that the supply of bank currency is endogenous and is not based on a multiplier.

The private banking sector, however, does leverage CB currency. In the world of finance, “to leverage” signifies being able to take a position in an asset without having to provide all or any funds for the position. Banks necessarily leverage CB currency, because they acquire asset position by issuing financial instruments that promise to deliver CB currency on demand or on some contingency at a later date. They do not have to have any CB currency now to make this promise.

Thus statements like: “For chartalists, state money is exogenous, and credit money is a multiple of the former” (Rochon and Vernango 2003, 61) is not correct and simply reflects a misunderstanding of the way that terms like “leverage” are used by financial markets participants.[6] Fiscal operations result in exogenous fluctuations of CB currency, in the sense that they do not result from a demand from banks. In addition, all “state money” is also “credit money” so the difference is not relevant: all monetary instruments are financial instruments; they are all monetary claims that promise to do something. Government just promises to take back its currency on demand, while private currencies also promise to convert into government currency on demand or on some specified contingency.

Next up: Adding the Foreign Sector to our analysis.

[1] Here we use the word “currency” to include central bank notes, treasury coins, and central bank reserves (together normally called high powered money), so central bank currency includes notes and reserves. To use the term even more broadly, we could include Treasury bonds and central bank bonds (which are issued by some central banks) in our definition of currency. Bonds are simply longer maturity and reward holders with higher interest.

[2] Treasury spending also converts a legal claim against the Treasury (for example, legislated Social Security benefits) into a monetary claim.

[3] This is a simplification as banks may want to hold a small amount of excess reserves to avoid an overdraft in interbank settlements and to meet customer withdrawals (Marquis 2002).

[4] Gnos and Rochon (2002, 49) incorrectly argue that coins are bought by the Federal Reserve at cost value. Only Federal Reserve notes are bought at cost value by the Federal Reserve banks from the Bureau of Engraving and Printing.

[5] We are skeptical that a strong case can be developed for such practice, but this topic is not relevant for the purposes of our response to critics.

[6] Such mistakes are common among “ivory tower” economists who do not read the finance literature. Recall the hilarious scene in one of Michael Moore’s movies when Ken Rogoff tried to answer a question about derivatives. One of us (Wray) actually had a paper rejected by a heterodox journal (ROPE) around 1990 because it used the term “securitization”—a practice completely unknown at the time to heterodox economists, but already well-understood by financial market participants. And to some extent it is understood by all economists today, after securitization played such a huge role in producing the Global Financial Crisis!

20 responses to “MMT 101: A Response to the Critics Part 4”