[Part 1] […] [Part 3] [Part 4] [Part 5]

This five part series will explore at length (warning!) and in detail (another warning—wonk alert!) the MMT perspective on the debt ratio and fiscal sustainability. While the approach suggests a macroeconomic policy mix and strategies for both fiscal and monetary policies that most neoclassical economists currently believe are unsustainable, ultimately the MMT preference for a significant role for fiscal policy in macroeconomic stabilization is shown to be consistent with traditional neoclassical views on fiscal sustainability.

This second part discusses interest rates on the national debt in the context of a currency issuer operating under flexible exchange rates.

Interest Rates and Flexible Exchange Rates

Assuming bond vigilantes can or will raise interest rates on US debt is problematic, however. Thankfully, Paul Krugman has begun to explain this over and over, even from a traditional neoclassical view—in short, Krugman shows that “because America has its own currency and a floating exchange rate, a loss of confidence would lead not to a contractionary rise in interest rates but to an expansionary fall in the dollar.” He provides a simple macro model of the open economy to explain this point, which should be required reading in every undergraduate macro course of at least intermediate level where an IS-LM or New Consensus approach is taught (if for no other reason than that they should already have understood this but usually do not, as it explains the point from the perspective of their own preferred model—that is, the Krugman’s point should be obvious to anyone that understands these textbook models). There he writes that,

As far as I know, none of the people issuing dire warnings have actually tried to write down a model of what an attack would look like. And there is, I suspect, a reason: it’s quite hard to produce a model in which bond vigilantes have major effects on a country that retains a floating exchange rate. In a simple Mundell-Fleming model (M-F is basically IS-LM applied to the open economy), an attack by bond vigilantes has very different effects on a country with a fixed exchange rate (or a shared currency) versus a country with a floating exchange rate. In the latter case, in fact, a loss of confidence is expansionary.

MMTers have long argued (and taught in our courses) much the same, including papers (to name but a few) by Warren Mosler, Stepanie Kelton and John Henry, Randy Wray and Claudio Sardoni, and myself. The key point—as Krugman lays out—is that under flexible exchange rates, the central bank’s target and thus interest on the national debt becomes a policy variable not set by markets. While the central bank might choose to follow a Taylor’s rule or similar strategy in normal times (not that I would necessarily recommend this), adjusting the rate to accommodate the whims of bond or currency market vigilantes would be a policy choice, and a particularly bad one at that.

Note that Krugman’s also fits the sector financial balances framework developed by Wynne Godley and employed often by MMTers—a choice by international investors to reduce holdings of $US assets is in fact equivalent to a choice to reduce their trade balance with the US. Those worried that the US will lose its reserve currency status have the burden of explaining which other country is currently prepared to run permanent trade deficits in order to have its currency replace the $US as the reserve currency. There are obviously only two choices for holders of government debt—the domestic private sector and the international sector. The common denominator for countries like the US, UK, and Japan that have significantly increased their debt ratios but have not faced the wrath of bond vigilantes is not the status of their trade balances with the rest of the world or who owns their national debt (obviously, since there are significant differences) but rather the fact that they are currency issuers under flexible exchange rates. On the other hand, the common denominator for countries having difficulties with bond markets is the absence of this status.

The most common counter to the MMT view on interest on the national debt the Fed sets a short-term rate, not the long-term rate, and because of this and the fact that the U. S. Treasury legally must issue debt rather than receive overdrafts in its account at the Fed, the bond markets still set the interest rate on the national debt. MMT’s response is (a) this is a self-imposed constraint not a market imposed constraint, and (b) it’s not actually an economically significant constraint, and thus not really a constraint at all. Regarding (a), as I wrote in 2010,

The overarching point here is to recognize who sits at the top of the hierarchy of money for a given monetary regime. Since under flexible exchange rates it is the currency issuing government, self-imposed constraints are simply that—self-imposed and not operational. For MMT’ers, concerns that a nation cannot “afford” to put idle capacity to use through tax cuts or appropriately targeted spending (i.e., NOT bailouts of the financial system or pet political projects—MMT’ers dislike those as much as anyone) are akin to a person with his/her shoes tied together concerned that he/she can’t run. Indeed, it is the very fact that such self-imposed constraints can be and have been disregarded in the past when it has been deemed desirable (e.g., the law requiring that the Fed only purchase Treasury obligations in the open market has been periodically relaxed) that demonstrates who is in charge—as Marshall Auerback recently put it, particularly where fiscal actions, such as military appropriations in a time of war, are deemed important, “we don’t go to China to give them a line-item veto for what we can and can’t spend. We just spend the money.”

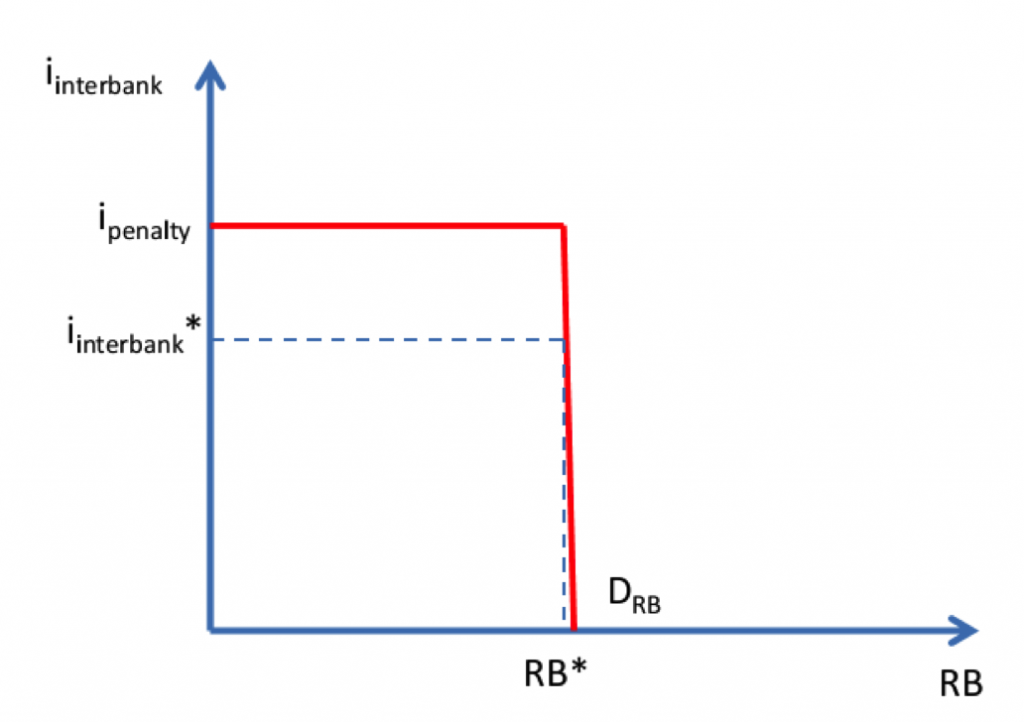

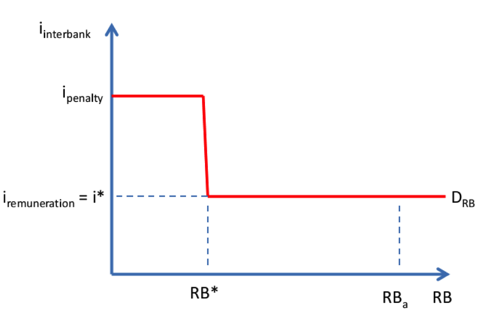

Regarding (b), consider in the first place what it would look like in the interbank market if the Treasury was to spend via overdraft from the Fed. Figure 1 shows the interbank market (federal funds market in the US) prior to interest on reserve (IOR) in October 2008. The demand for reserve balances was essentially vertical at the quantity of balances (RB*) banks desired to hold to meet reserve requirements and settle payments at the Fed’s target rate (iinterbank*) (though prior to the last few days before the end of the two-week maintenance period for meeting reserve requirements the demand curve will flatten a bit at the target rate as banks are able to substitute balances across days, at least to some degree; the flatter portion shrinks to virtually nothing by the end of the maintenance period). In the case of the Treasury receiving overdrafts, the increase in reserve balances would very quickly dwarf the very modest quantity (about $20 billion) banks demand at the target rate. In order to achieve a positive interest rate target, the Fed would have to set IOR (iremuneration) equal to the target rate (i*) or the interbank rate would fall to zero. This is basic supply and demand analysis with a quantity supplied far in excess of a highly inelastic demand curve, though the significant implications are generally not understood by neoclassical is; that is, it’s simply not operationally possible for the Treasury or the Fed to “print money” beyond banks’ demand for reserve balances without either IOR at the target rate or an interbank rate of zero—more than interesting given that so many neoclassicals argue that IOR at the target rates eliminates the inflationary impact of an excess supply of reserve balances.

Figure 1

Interbank Market Before IOR

Figure 2

Interbank Market with IOR and a Large Excess Supply of RBs

Consequently, the implications for (b) are the following (from the same 2010 source):

[T]o fully understand the operational realities associated with the Treasury’s account at the Fed, it must be recognized that the lowest rate the Treasury would reasonably expect to pay on the national debt in the case of overdrafts on its account would be the Fed’s target rate. Operationally, the Fed would have to pay interest on reserve balances at its target rate or otherwise offer its own time deposits at competitive rates in line with the current and anticipated target rates to drain the reserve balances and achieve its target rate (in the case that the remuneration rate on reserve balances is below the target rate or even zero), both of which reduce the Fed’s profits returned to the Treasury and act functionally like debt service for the Treasury. The situation is unchanged even if the Treasury deficit spends via a “helicopter drop” of pure cash or coins, since the private sector will deposit the vast majority in banking accounts, and banks will return excess vault cash to the Fed in exchange for reserve balances.

One can then think of three different degrees or “forms” (to borrow the taxonomy used by financial economists in describing the efficient markets hypothesis) related to deficits and interest on the national debt for a currency issuer under flexible exchange rates. The “strong form” deficits would be where the Treasury has an overdraft or similar at the Fed and interest on the national debt is essentially at the Fed’s target rate or on average a bit higher if the Fed issues time deposits to drain reserve balances. While the “strong form” is operationally “pure,” it is again obviously not current law in the US. The “semi-strong form” deficits would be where the Treasury is not provided with overdrafts and must issue its own securities to have positive balances in its account before spending again while the securities issued—given their zero-default-risk that results from operational realities and the fact that any “constraint” on the Treasury is self-imposed—mostly arbitrage with the Fed’s target (for short-term Treasuries) and the expected target rate (for longer-term Treasuries) aside from some technical effects (like convexity) and some demand/supply issues (like maturity and liquidity at different maturities). Examples of the “semi-strong form” would be here and here. The “weak-form” deficits would consider that bond markets might at some point choose to repudiate even a currency-issuer’s debt with zero default risk (the “semi-strong form” does, too, but presumes the effect is temporary as arbitrage relationships would over-rule at least in the medium-term), but recognizes that the Fed always has the ability to set the market rate on Treasuries as long as it is willing to buy all quantities offered at its bid price (and has no operational or even legal constraint for doing so). Examples would be the Fed’s “Operation Twist” or the Fed prior to the Treasury Accord, or in the non-currency issuer case, consider how the recent EMU crisis quickly faded once the ECB began purchasing the debt of troubled member nations.

All three forms, while different in degree, agree that the interest on the national debt for a sovereign currency issuer under flexible exchange rates is a policy variable—not a market-set rate—or at the very least could be if the government so desires. And note that this is the case whether or not the Treasury receives overdrafts at the Fed. In other words, since the outcome is roughly the same in all three cases, it really doesn’t matter if the Treasury receives overdrafts in its Fed account or not—if it can sell its debt at roughly the Fed’s target, then there is no economically meaningful difference from the Treasury’s perspective between the government enabling itself to obtain an overdraft and the government forbidding itself from doing so. That self-imposed “constraint” is really not a constraint at all even if it is never abandoned.

To state this differently, suppose you were offered a choice—you can issue debt at the Fed’s target rate via borrowing directly from the Fed, or you can issue debt to the private sector at roughly the Fed’s target rate. Would you then be concerned if the former option were subsequently withdrawn? No, because there’s no economically significant difference between issuing debt at the Fed’s target rate and issuing debt at roughly the Fed’s target rate. So, the “constraint” is a self-imposed one—and thus not applicable to household, business, or state/local government debt—and even at that its ultimate effect on the Treasury’s debt operations is not macroeconomically significant.

Anyone—MMTers or not—recognizing that interest on the national debt is a policy variable correctly predicted that large deficits would not bring higher interest rates in the US, Japan, and other currency issuing nations operating under flexible exchange rates. Similarly, this same paradigm—again, whether MMTers or not—correctly predicted the opposite in Greece, Italy, and Spain until the ECB stepped in (since it stands above national governments in the hierarchy of money in the EMU somewhat similar to how states do the same in the US with regard to the Fed). As long as a government issues debt in the currency it creates and also has a flexible exchange rate, the interest rate always is or at the very worst can be if desired (as in the “weak form,” which in the case of the EMU is the only “form” available to EMU nations, and even that at the ECB’s pleasure) a policy variable.

In part III, we will consider historical data on US interest rates in the context of the discussion in parts I and II.

Pingback: Qui détermine le taux d'intérêt sur la dette publique ?