Treasury and Central Bank Interactions

This post concludes our study of central banking matters (there would be a lot more to cover…maybe another time). The post studies how the Fed is involved in fiscal operations and how the U.S. Treasury is involved in monetary-policy operations. The extensive interaction between these two branches of the U.S. government is necessary for fiscal and monetary policies to work properly.

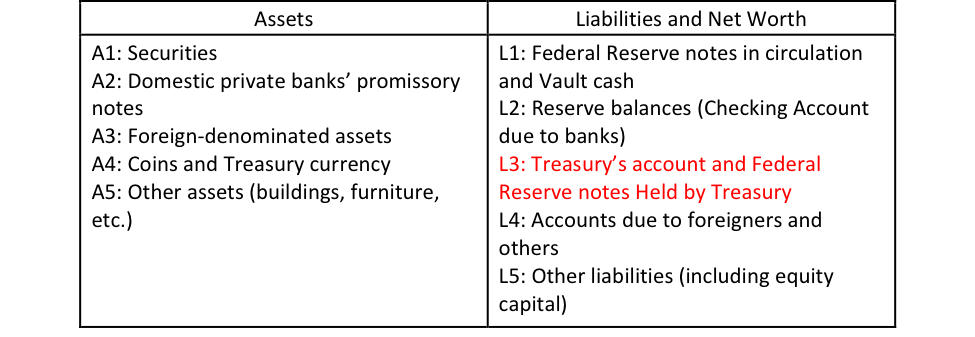

Once again the balance sheet of the Federal Reserve provides a simple starting point. The Treasury holds an account (called Treasury’ General Account, TGA) at the Fed, which is part of L3. To simplify, this post assumes that the Fed still follows the monetary-policy procedures that it followed prior to the 2008 crisis.