By J.D. Alt

Viewed through the ideology of money-scarcity, the major challenges facing society appear to represent “costs” that people must be penalized to pay by taking dollars out of their personal pockets. At one level, politics is the endless and bitter argument of one party proposing to do X, Y, or Z in order to accomplish some collective benefit, and the other party saying: Yes, but how are you going to pay for it?—which is the “gotcha” question because everyone certainly “knows” that in order to actually do X, Y, or Z, the federal government will have to increase taxes or borrow dollars from the Private Sector pot. Understanding modern fiat money (and how to manage it as a collective tool) creates, as we now understand, a remarkably different and more useful perspective. With this new perspective, as we’re about to see, many of the biggest challenges we face as a collective society can be viewed not as a “cost”—a penalty to be paid—but instead as an enormous opportunity to make our lives, both collectively and individually, more effective and prosperous. Confronting these challenges, in other words, will not take dollars out of our personal pockets, it will—in addition to hopefully overcoming the challenge addressed—put dollars into our pockets. This, in essence, is the uniquely empowering perspective that modern fiat money makes possible.

Continue reading →

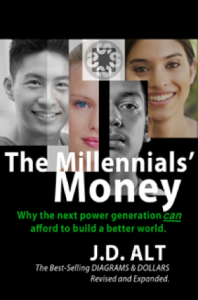

I’m pleased to announce the book

I’m pleased to announce the book