By Felipe C. Rezende

That is precisely what Post Keynesian economists have been arguing since Keynes’s revolution. Given uncertainty in the Knightian sense, it is the existence of money and the organization of production around money that cause unemployment of labor and productive resources. This is so because money is special in a capitalist economy, it affects economic decisions both in the short-run and in the long-run. According to Keynes (1936), money has special properties such as almost zero elasticity of production, almost zero elasticity of substitution and low carrying costs. See Krugman’s introduction to the new edition of Keynes’s General Theory, Wray (2007) and Davidson (2006) for further details.

As Wray (2007) put it:

In my view, the central proposition of the General Theory can be simply stated as follows: Entrepreneurs produce what they expect to sell, and there is no reason to presume that the sum of these production decisions is consistent with the full-employment level of output, either in the short run or in the long run. Moreover, this proposition holds regardless of market structure—even where competition is perfect and wages are flexible. It holds even if expectations are always fulfilled, and in a stable economic environment. In other words, Keynes did not rely on sticky wages, monopoly power, disappointed expectations, or economic instability to explain unemployment. While each of these conditions could certainly make matters worse, he wanted to explain the possibility of equilibrium with unemployment. (Wray 2007:3)

Krugman also refuted the New Keynesian claim that involuntary unemployment exists due to price and wage stickiness. According to Krugman, “there’s no reason to think that lower wages for all workers — as opposed to lower wages for a particular group of workers — would lead to higher employment.” Keynes explained why flexible wages do not assure full employment and, as Krugman noted, Keynes wrote a whole chapter entitled “changes in money wages” to explain that the cause of unemployment is not due to wages and prices rigidities as New Keynesians wrongly claim. (See for instance here, here, and here)

Wray also pointed out that

“Keynes had addressed stability issues when he argued that if wages were flexible,then market forces set off by unemployment would move the economy further from full employment due to effects on aggregate demand, profits, and expectations. This is why he argued that one condition for stability is a degree of wage stickiness in terms of money. (Incredibly, this argument has been misinterpreted to mean that sticky wages cause unemployment—a point almost directly opposite to Keynes’s conclusion.)” (Wray, 2007:6)

In fact, Krugman observed that flexible wages and prices can make things worse rather than better even if one includes real balance effects. Wage and price flexibility are destabilizing forces which also trigger a Fisher-type debt deflation process.

On Say’s Law, Krugman argued (here and here) that

“If there was one essential element in the work of John Maynard Keynes, it was the demolition of Say’s Law — the assertion that supply necessarily creates demand. Keynes showed that the fact that spending equals income, or equivalently that saving equals investment, does not imply that there’s always enough spending to fully employ the economy’s resources, that there’s always enough investment to make use of the saving the economy would have had it it were at full employment.”

“The understanding that Say’s Law doesn’t work in the short run — that a fall in consumption doesn’t automatically translate into a rise in investment, but can lead to a fall in output and employment instead — is the central insight of Keynes’s General Theory.”

On the Loanable funds model of the interest rate he pointed out (here and here) that:

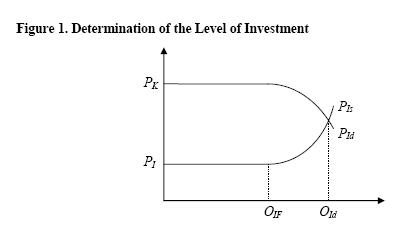

“One of the key insights in Keynes’s General Theory — actually, THE key insight— was that the loanable funds theory of the interest rate was incomplete. Loanable funds says that the interest rate is determined by the supply of and demand for saving; Keynes pointed out that the supply of saving is endogenous, depending on the level of output. He even illustrated the point with a remarkably ugly diagram.”

Krugman also argued that “saving and investment depend on the level of GDP. Suppose GDP rises; some of this increase in income will be saved, pushing the savings schedule to the right. There may also be a rise in investment demand, but ordinarily we’d expect the savings rise to be larger, so that the interest rate falls”

It means that as income expands, for instance due to government spending, there is a downward pressure on the interest rate. This is the crowding in effect. As he noted government spending “does NOT crowd out private spending”

He then pointed out that what is moving interest rates “it is not deficits. It’s the economy.”

He also has been using a framework that Post Keynesian economists have been using for a long time. See for instance here, here, here, and here. Check also Krugman’s posts here and here.

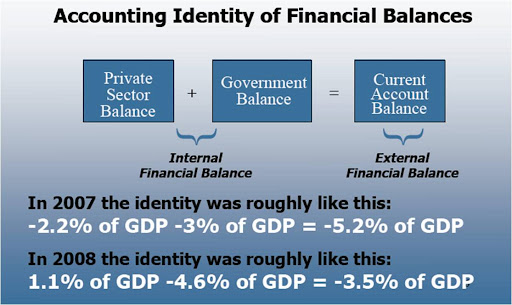

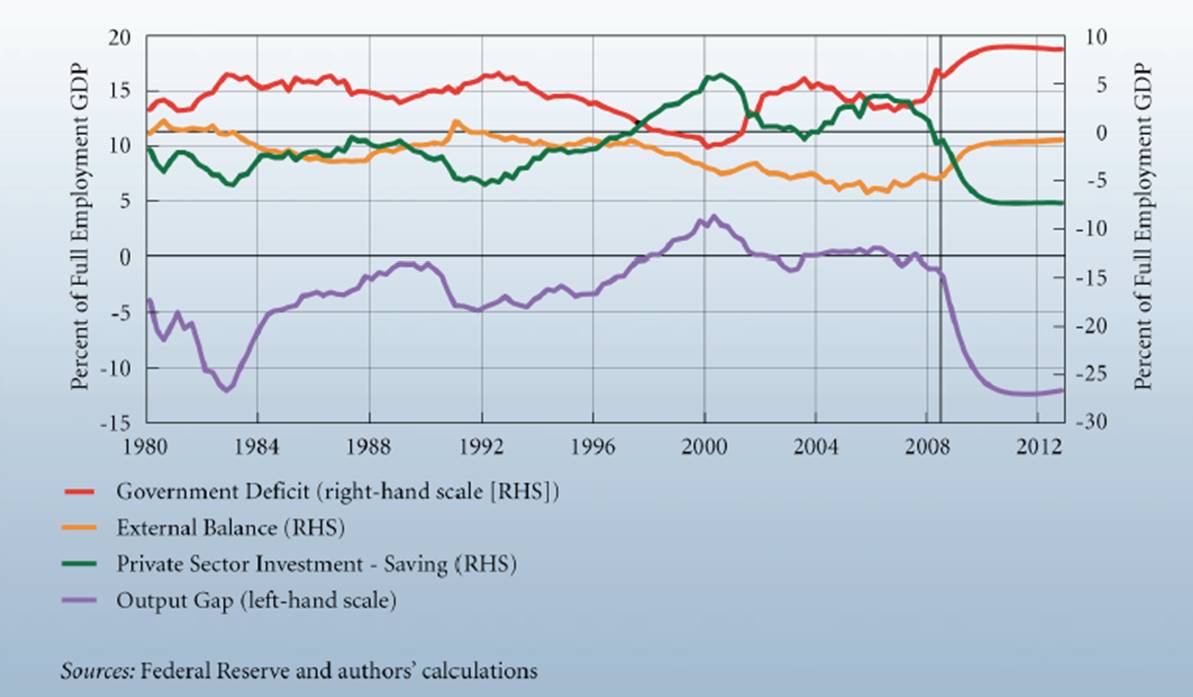

Krugman, clearly following Minsky (1986), concluded that “government deficits, mainly the result of automatic stabilizers rather than discretionary policy, are the only thing that has saved us from a second Great Depression.” This is precisely the point that Minsky made in the first chapters of his book “Stabilizing an Unstable Economy”.

The above statements are precisely what Post Keynesian Economists have been arguing for years. They completely refute the basis of the mainstream economics which guide policy both in the U.S. and in the rest of the world. However, there is definitely a convergence of economic thought between Paul Krugman’s economics, Post Keynesian economists and the specialized media (see here and here). Keynes’s and Minsky‘s economics provide the basis for the next generation of economic models.

Shall they?