We first encountered the financial balance approach[1] in the work of Wynne Godley at the Levy Institute for Economics over a decade ago, but this framework also informed the contributions of Hy Minsky and Dr. Kurt Richebacher in anticipating the conditions that give rise to financial instability at the level of the economy as a whole. It is not a difficult approach to follow, but it has proven very useful in thinking through the implications of recent credit bubbles and episodes of financial instability.

We can enter this approach from the standard macro observation that in any accounting period, total income in an economy must equal total outlays, and total saving out of income flows must equal total investment expenditures on tangible assets. The financial balance of any sector in the economy is simply income minus outlays, or its equivalent, saving minus investment. A sector may net save or run a financial surplus by spending less than it earns, or it may net deficit spend as it runs a financing deficit by earning less than it spends.

Furthermore, a net saving sector can cover its own outlays and accumulate financial liabilities issued by other sectors, while a deficit spending sector requires external financing to complete its spending plans. At the end of any accounting period, the sum of the sectoral financial balances must net to zero. Sectors in the economy that are net issuing new financial liabilities are matched by sectors willingly owning new financial assets. In macro, fortunately, it all has to add up. This is not only true of the income and expenditure sides of the equation, but also the financing side, which is rarely well integrated into macro analysis.

If households attempt to net save by spending less than they are earning, and businesses attempt to net save (reinvesting less than their retained earnings), then nominal incomes and real output will be likely to fall. Money incomes and economic activity will tend to contract until private savings preferences are reduced (with essential goods and services taking up a larger share of household income as incomes fall), or until depreciation leaves businesses and households inclined to invest once again in durable assets. Common sense suggests that a drop in private income flows while private debt loads are high is an invitation to debt defaults and widespread insolvencies – that is, unless creditors are generously willing to renegotiate existing debt contracts en masse.

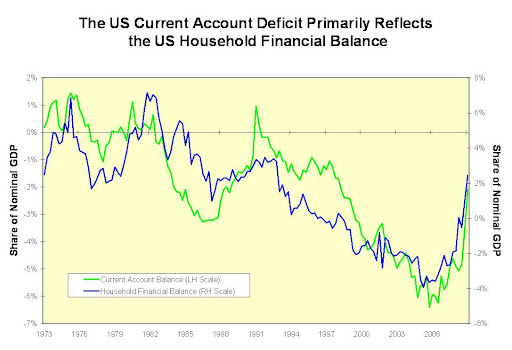

In other words, such a configuration is an invitation to Irving Fisher’s cumulative debt deflation spiral which has been discussed on this website and in prior Richebacher letters. So unless some other sector is willing to reduce its net saving (as with the foreign sector recently, via a reduction in the US current account deficit as US imports have fallen faster than US exports) or increase its deficit spending (as with the federal budget balance of late) then the mere attempt by the domestic private sector to net save out of income flows, given the existing private debt overhang, can prove very disruptive.

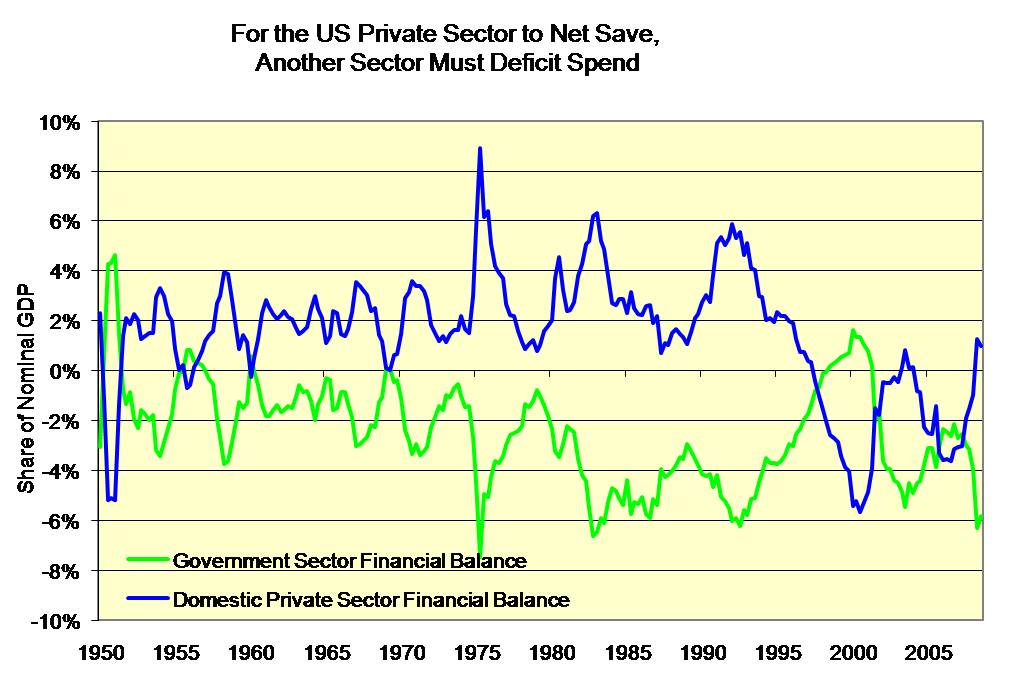

In fact, the US economy has dipped into a mild version of Fisher’s debt deflation process as nominal GDP has fallen, wage and salary income flows have fallen, the CPI and other inflation measures have dropped into deflation, and private debt delinquencies and defaults are still spreading. Following the shocks to tangible and financial asset prices, credit availability, and the labor market, the US private sector, by our calculations, has swung from a 4.5% of GDP deficit spending position three and a half years ago to a 4% net saving position as of Q1 2009. This exceeds the 8% of GDP swing in the private sector financial balance witnessed as the tail end of the 1973-5 recession – it is an enormous adjustment, to put it mildly.

Had the current account deficit (which, remember, is the trade balance plus net income flows related to asset holdings, equals foreign net saving) not shrunk from 6% to 2% of GDP over the same period, while the combined government fiscal deficit increased from 1.5% to 6% of GDP, then the attempt by the private sector to complete such a dramatic swing in its financial balance position would have ended in a very sharp and severe debt deflation.

From an Austrian School perspective, nothing less than that is required to wipe the slate clean of excess private debt and to free up productive resources misallocated during the credit boom years. However, the political appetite for an Austrian solution appears to have all but disappeared following the global repercussions of the Lehman derailment. Investors and policy makers looked into the abyss, and they could not stomach what they saw. Even Germany Chancellor Merkel, who appears to have the most Austrian orientation among G7 policymakers, has chosen to introduce some degree of fiscal stimulus and financial sector intervention in the German economy.

To further illustrate the current situation, we can use the 1973-5 recession as a rough guide – after all, as mentioned above, that is when domestic private net saving jumped to its highest share of GDP in the post WWII period. Currently, we appear to have an even deeper recession, and we know the drop in the ratio of household net worth to disposable income is over four times that experienced in the 1973-5 episode. What happens if private net saving preferences run all the way up to 10% of GDP, with say an additional 4% of GDP increase from the household side, and another 2% from the business side?

If the combined government deficit aims for 12-13% of GDP while the domestic private sector is shooting for 10% and net foreign saving is zero, then the odds improve that an economic recovery can take root alongside a larger private sector deleveraging than we witnessed in Q1 2009. Household and business incomes will be buttressed by tax cuts and government spending, which will allow higher private spending for any given private saving target. In other words, in a worst case scenario, it does appear debt deflation dynamics can be contained and reversed, but at the price of a rather large fiscal deficit that in essence validates higher domestic private sector net saving. The linkages between rising private sector net saving and deflation, and between fiscal deficits and private net saving, are currently poorly understood, but the financial balance approach helps bring some clarity to these questions.

Normally, the business sector tends toward a deficit spending position as profitable investment opportunities exceed retained earnings. This makes a certain amount of sense: debt imposes future cash flow commitments on borrowers, and using debt to expand productive capacity allows the borrower to have a decent shot at generating sufficient cash flow to service debt. Notice this is not usually the case with consumer debt, except perhaps with the case of mortgages used to purchase rental properties, or credit cards used to finance new small businesses. Households do not directly increase their income earning capacity, and hence their debt servicing capacity, by purchasing a flat screen TV or a larger house on credit. Of course, businesses that use credit to buy back shares or complete a merger or acquisition similarly are not directly enhancing their ability to service debt with new productive capacity, so the intended use of new debt is relevant in either sector.

Richard Koo makes the related point in his book, “The Holy Grail of Macroeconomics”, that following the bursting of an asset bubble, businesses often move into a debt reduction mode that takes over their usual search for profitable opportunities. For the current post bubble period, reeling fiscal deficit spending back in before the business sector is headed back toward its more “natural” deficit spending position, or before the rest of the world has found its way to a faster pace of recovery than the US (thereby aiding US export growth), could prove disruptive.

Ideally then, fiscal deficit spending would be designed to encourage businesses to reinvest in more efficient technology or in new product innovation, both of which could help improve US export competitiveness. Alternatively, public/private cooperation in R&D projects like Sematech could be explored with various emerging energy technologies, for example, in order to reduce US energy dependence. Such moves would speed the transition away from deep fiscal deficit spending which began riling investors in longer dated Treasury debt back in March. Nevertheless, such a shift in the fiscal deficit was required for the domestic private sector to return to a net saving position and begin reducing its debt load without setting off a full blown debt deflation.

At best, favorable effects on business investment will arise be secondary or peripheral results of some of the infrastructure and green tech investments in the current fiscal stimulus package, generally due to ramp up in 2010 and 2011. Unfortunately, since few economists work with the financial balance approach we shared with you above, policy makers are not yet emphasizing this type of policy design. Nevertheless, the financial balance approach does offer a more coherent way of thinking about the macroeconomic dynamics currently underway, and the plausible paths ahead. From this framework, we can see the situation is indeed difficult, but not insurmountable, as some of the necessary adjustments in US sector financial imbalances are already in motion. Deflation in the US does look like it can be contained and reversed, but the quest for a new growth model – one that does not rely on serial asset bubbles, household deficit spending and debt accumulation, and imported consumer goods leading to a perpetually rising current account deficit – remains ahead. No doubt it will test the ingenuity and adaptability of an entire generation – a generation that through the abundance of credit, may have forgotten that in order to consume, one must first produce.

[1] Very simply, if income (Y) equals expenditures (E) at the level of the whole economy, and we split the economy into three sectors, domestic private (dp), government (g), and foreign (f) then the following holds true:

Y = E

Ydp + Yg + Yf = Edp + Eg + Ef

(Ydp-Edp) + (Yg-Eg) + (Yf – Ef) = 0

The first term in parentheses is the domestic private financial balance, the second is the combined government financial balance, and the third term is the inverse of the current account balance, since US imports are income to foreign producers, and US exports are expenditures of foreign economic agents. The sum of the domestic private financial balance and the combined government financial balance minus the current account balance must net to zero.

This is an ex post accounting identity that must hold true. It could equally be derived using the saving equals investment identity for the economy as a whole. Values for these concepts can be derived from the Fed’s Flow of Funds quarterly report. In general, nominal income adjusts to reconcile divergences in planned investment relative to intended saving.

Pingback: A note on Automatic Stabilizers | | New Economic PerspectivesNew Economic Perspectives