What has so far prevented a deep depression in 2009? The answer, as Paul Krugman explained yesterday, are automatic stabilizers. Indeed, as Hyman Minsky emphasized more than 20 years ago in his book Stabilizing an Unstable Economy (1986), this feature of the federal government’s budget – i.e. the fact that it moves counter-cyclically in an automatic fashion – imparts a great stabilizing force to aggregate demand.

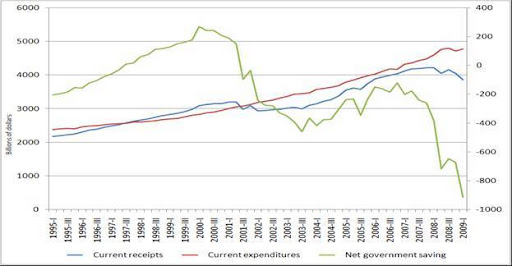

The figure below sheds light on the non-discretionary (i.e. automatic) nature of government deficits. In an economic downturn, tax receipts automatically fall, and government expenditures automatically rise, resulting, automatically, in budget deficits. (net govt saving = right hand scale)

The components of government spending that rise automatically are called ‘transfer payments’, that include unemployment compensation, Medicaid, grants-in-aid to state and local government, etc.

With these forms of payment increasing and tax receipts declining due to falling economic activity, the federal budget moves automatically into deficit.

Source: Bureau of Economic Analysis (BEA)

So far the stimulus package was not what saved the US economy. The budget projections show that 24% of the total cost of the stimulus package will occur in fiscal year 2009 (which means $198 billion) and 47% of it occurring in fiscal year 2010.

“The ARRA is estimated in the budget to cost $825.4 billion over the next 10 years. These costs are split between $600.0 billion in increased outlays and $225.4 billion in reduced receipts. Although the cost of the ARRA is spread over 10 years, the budget projections show 24 percent of the total cost occurring in fiscal year 2009 and 47 percent of the total cost occurring in fiscal year 2010…The budget estimates that receipts will be reduced $77.4 billion in fiscal year 2009 and $152.3 billion in fiscal year 2010 primarily because of the tax provisions of ARRA… The budget estimates that outlays will be increased about $120.2 billion for fiscal year 2009 and $237.8 billion for fiscal year 2010 because of the spending and investment provisions of the ARRA.”

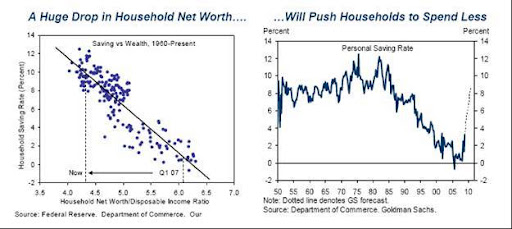

Source: Jan Hatzius, Goldman Sachs

Source: Jan Hatzius, Goldman Sachs

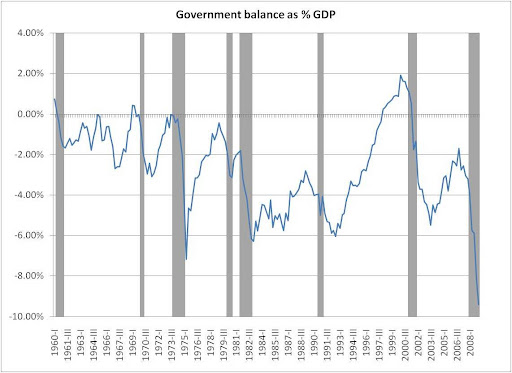

As Minsky emphasized, the problem, during the Great Depression, was that the government sector was too small relative to the rest of the economy; it couldn’t fill the demand gap and allow the private sector to save as much as it desired. In the absence of large enough automatic stabilizers to offset swings in private spending, GDP contracted to the point where desired net nominal saving equaled actual net nominal saving. Note that in second half of the last century, given the private sector’s desire to have positive net nominal saving, the US government normally ran budget deficits.

As Wray pointed out, “Since WWII we have had the longest depression-free period in the nation’s history. However, we have had nine recessions, each of which was preceded by a reduction of deficits relative to GDP.” This directly results from the impact of large swings in the federal government’s budget.

Automatic stabilizers work by putting a floor under aggregate demand, preventing a deflationary spiral, but they also put ceilings in place, as rapid economic growth translates into rising tax revenues which destroy income and temper the expansion. The impact of large automatic stabilizers explains why we can have a deep recession but not a Great Depression. As Wray noted:

“With one brief exception, the federal government has been in debt every year since 1776. In January 1835, for the first and only time in U.S. history, the public debt was retired, and a budget surplus was maintained for the next two years in order to accumulate what Treasury Secretary Levi Woodbury called “a fund to meet future deficits.” In 1837 the economy collapsed into a deep depression that drove the budget into deficit, and the federal government has been in debt ever since. Since 1776 there have been six periods of substantial budget surpluses and significant reduction of the debt. From 1817 to 1821 the national debt fell by 29 percent; from 1823 to 1836 it was eliminated (Jackson’s efforts); from 1852 to 1857 it fell by 59 percent, from 1867 to 1873 by 27 percent, from 1880 to 1893 by more than 50 percent, and from 1920 to 1930 by about a third. (Thayer 1996) The United States has also experienced six periods of depression. The depressions began in 1819, 1837, 1857, 1873, 1893, and 1929. Every significant reduction of the outstanding debt has been followed by a depression, and every depression has been preceded by significant debt reduction. Further, every budget surplus has been followed, usually sooner rather than later, by renewed deficits. However, correlation—even where perfect—never proves causation. Is there any reason to suspect that government surpluses are harmful?”

Pingback: Krugman’s New Cross Confirms It: Job Guarantee Policies Are Needed as Macroeconomic Stabilizers | | New Economic PerspectivesNew Economic Perspectives