By reviewing the annual reports (2005-2007) of President Bush’s Council of Economic Advisors (CEA) I learned that the Council had some interest in fraud, but no understanding of elite fraud and its implications for the economy. The reports make sad reading. They deny the developing crisis entirely and they do so for reasons that reflect badly on economics and economists.

The CEA’s reports’ analysis of the developing fraud epidemics and crisis reveal critical weaknesses in theory, methodology, empiricism, candor, objectivity, and multi-disciplinarity. Overwhelmingly, the reports ignored the developing crises and their causes. Worse, as late as 2007, they denied – even after the bubble had popped – that there was a housing bubble. When the nation and the President vitally needed a warning from its Council of Economic Advisors the CEA did not simply fail to warn, but actually advised that those who warned of a coming crisis were wrong.

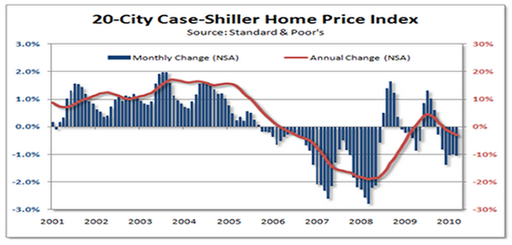

This column does not focus on the CEA’s claims that there was no housing bubble. Like the National Association of Realtors’ top economist who became known to the trade press as “Baghdad Bob” (the mocking nickname journalists gave Saddam Hussein’s press flack after he denied U.S. troops were in Baghdad), the CEA’s specious bubble denial is an obvious embarrassment. Their Japanese counterparts did far better in warning of the developing real estate bubble in the 1980s. The collapse of the twin Japanese bubbles in 1990 and the resultant “lost decade” should have caused the CEA to recognize the gravity of the risk bubbles pose and importance of identifying them promptly. Instead, the CEA gave in to the temptation to claim that the President’s brilliant policies had produced a wonderful economy. The reality was that the economy was headed over the precipice.

The focus of this column is on the portion of the CEA’s annual report for 2006 that discussed the theory of financial intermediation and financial regulation. Indeed, the column focuses on a small subset of the defects in those portions of the report. I write to emphasize how a theory (“control fraud”) developed two decades ago by regulators, criminologists, and economists could have saved the CEA from analytical and policy errors with regard to financial crises and regulation and led it to identify the crisis and recommend effective measures to contain it. The tragedy is that the CEA discussion of the theory of financial regulation embraces three of the most useful theoretical insights – adverse selection, lemon’s markets, and the centrality and criticality of sound underwriting to the survival of lending institutions. These theories are interrelated and they are essential components of control fraud theory.

Had the CEA understood the true import of these three economic theories it could have gotten the crisis right instead of making things worse. White-collar criminologists and economists share these three theories (among others) and employ a (limited) “rational actor” model. (Criminologists never made the mistake of assuming purely rational behavior. Even neoclassical economists now generally acknowledge that behavioral economics research demonstrates that economic behavior can be irrational in important settings.) In the 1980s and early 1990s, the efforts of a small group of criminologists, economists, and regulators to understand the causes of the developing S&L debacle led them to develop a synthetic theory that criminologists refer to as “control fraud theory.” Unfortunately, the typical theoclassical economic treatment of these three theories, exemplified by the CEA’s 2006 report, ignores control fraud. The result is that the 2006 CEA report misstated the predictions of each of the three theories that it discussed and concluded “no problem here.” In reality, the three theories predicted that there were epidemics of accounting control fraud

that were leading inevitably to a catastrophic crisis.

The context of the 2006 CEA report’s discussion of the three theories is a treatise on the theory of financial intermediation and its implications for financial regulation. The treatise is over the top in its praise of the U.S. financial industry. The CEA claimed that the U.S. financial deregulation gave its financial sector a “comparative advantage” over other nations. The CEA cited the financial sector’s rapid growth in size and profits as proof of this comparative advantage and asserted that the financial sector’s rapid growth led to more rapid U.S. economic growth and increased financial stability. The CEA’s theory of financial intermediation posited that banks exist to minimize the informational difficulties that beset lending and investment. The CEA concluded that U.S. banks were growing rapidly because deregulation made them ever more efficient in minimizing these informational defects.

Adverse Selection

The CEA addressed three forms of informational defects that banks helped reduce. The CEA began by discussing “adverse selection.” Adverse selection was the key to understanding and preventing the developing crisis. In the lending context, adverse selection arises when a lender’s policies selectively encourage lending to borrowers who pose greater credit risks that are unknown or underestimated by the lender. Adverse selection can be one of the consequences of “asymmetrical information.” (Adverse selection also poses a serious risk to honest insurance companies.)

Because the lender does not know (and therefore is not compensated for) the full extent of the risk of default adverse selection produces a “negative expected value” for lenders. In plain English, they lose money. For a residential mortgage lender, adverse selection is fatal because the loans are so large and the loan proceeds are fully disbursed at closing. It is essential to understand that adverse selection is not equivalent to credit risk. A mortgage lender makes money by taking prudent credit risks. Banks “underwrite” prospective borrowers and collateral in order to identify, understand, quantify, and price credit risk. Prudent underwriting minimizes adverse selection. Mortgage lenders that fail to underwrite create severe adverse selection and fail. Honest home lenders would never gut their underwriting standards and create adverse selection.

The existence of a secondary market does not change an honest home lender’s incentive to engage in prudent underwriting. Neoclassical theory predicts that the ultra sophisticated investment banks that ran the secondary market would only purchase loans they had prudently underwritten. A lender that failed to underwrite effectively would be unable to sell its loans in the secondary market. Neoclassical theory also predicts that the secondary market would only purchase loans sold with guarantees against fraud. The first prediction, of course, proved false but the second prediction was typically true. All of the mortgage lenders that specialized in making large numbers of loans under conditions that maximized adverse selection failed even before the cost of the guarantees would have destroyed them because their “pipeline” losses exceeded their trivial (fictional) capital.

The most severe form of adverse selection is fraud. The ultimate form of adverse selection is accounting control fraud. Any experienced banker or insurer knows that adverse selection can lead to fraud. Fraud maximizes the asymmetry of information because the information provided to the victim contains data that are false and material. The fraud makes the loan look far less risky than it really is.

In 2006, MARI, the anti-fraud group of the Mortgage Bankers Association (MBA), reported to MBA members that “stated income” loans were an “open invitation to fraudsters” and that they deserved the term used behind closed doors in the industry, “liar’s loans,” because the incidence of fraud in liar’s loans was 90 percent. The defining element of liar’s loans was the failure to conduct essential underwriting. Moreover, fraudulent nonprime lenders typically simultaneously maximized adverse selection and created deniability by creating large networks of loan brokers to prepare the fraudulent loan applications.

The percentage of nonprime loans made without prudent underwriting is not known with precision because there were no official definitions of stated income, alt-a, or liar’s loans. Subprime and liar’s loans were not mutually exclusive. By the time the CEA wrote its 2006 report roughly half of the loans lenders termed “subprime” were also liar’s loans. Credit Suisse’s March 12, 2007 study (“Mortgage Liquidity du Jour: Underestimated No More”) presented data estimates that roughly 30% of all mortgage loans made in 2006 were liar’s loans. That frequency produces an annual mortgage fraud incidence of well over one million. The FBI had put the entire nation on alert about the developing “epidemic” of mortgage fraud in its September 2004 House testimony. The FBI predicted that the fraud epidemic would cause a financial “crisis” unless the epidemic was contained. In 2006, no one believed that the epidemic was being contained.

What everyone, including the CEA, knew in 2006 was that mortgage underwriting standards for nonprime loans were in freefall while other “layered risk” characteristics were multiplying. This meant that nonprime lenders were dramatically increasing adverse selection while making loans that were ever more vulnerable to losses from adverse selection. Everyone, including the CEA, knew that the only reason this could occur was the rapid growth of the three “de’s” – deregulation, desupervision, and de facto decriminalization. Everyone, including the CEA, knew that no one was forcing the nonprime lenders to make liar’s loans. That should have led the CEA to ask why the senior officers controlling nonprime lenders were deliberately causing the lenders to make loans that created intense adverse selection, endemic fraud, massive (longer-term) losses, and the failure of the lender. That behavior makes no sense under the theory of financial intermediation advanced by the CEA. No honest lender CEO would engage in that pattern of behavior. The nonprime lender CEOs’ behavior only makes sense if they are engaged in accounting control fraud. The recipe for maximizing fictional accounting income has four ingredients and adverse selection optimizes the first two (rapid growth through making very poor quality loans at premium yields).

Unfortunately, the CEA’s 2006 report was devoid of any real analytics or facts related to adverse selection. Indeed, the report’s entire discussion of financial institutions is bizarre because it is not simply removed from any factual context but based on factual assumptions that were contrary to reality and becoming ever more contrary to reality in 2006. The discussion is a surreal theoretical exercise based on unstated factual assumptions that are the opposite of reality. The (inevitable) result of its unstated assumptions is the worst possible financial regulatory policy advice that the CEA could give in 2006 – everything is wonderful because our financial intermediaries prevent adverse selection. The CEA wrote to warn us of the dangers of excessive financial regulation at a time when financial regulation had been eviscerated.

The CEA’s discussion of adverse selection ignored the risk of fraud during what the FBI had aptly termed a fraud “epidemic.” Instead, it premised its concern on managers of high quality projects being unwilling to seek commercial loans from banks because banks charged excessive interest rates for even high quality projects because of their inability to differentiate bad and high quality business projects. In reality, interest rates on commercial loans were exceptionally low – even for poor quality business projects. The CEA’s discussion of adverse selection was premised on an alternate universe.

Lemon Markets

The CEA discussed lemon markets in conjunction with its discussion of adverse selection. A lemon market reaches its nadir when bad quality products drive good quality products out of the marketplace. Control fraud theory agrees that lemon market and adverse selection are interrelated theories and provide the keys to understanding why control frauds cause such devastating injury. George Akerlof was awarded the Nobel Prize in Economics in 2001 for his 1970 article on markets for lemons, which was a pioneering article on fraud and asymmetrical information. As I have explained, fraud produces the epitome of adverse selection and control fraud is the ultimate form of fraud. The examples Akerlof provided of sales of goods that posed lemon problems were anti-customer control frauds.

The CEA does not mention Akerlof in its discussion of lemon markets. This was deeply unfortunate, for it reinforced the CEA’s failure to discuss the epidemic of control fraud by nonprime lenders. The CEA also failed to explain one of Akerlof’s most important theoretical contributions in his 1970 article, the “Gresham’s” dynamic. Akerlof used Gresham’s law (bad money drives good money out of circulation in hyperinflation) as a metaphor to explain why market forces became perverse in the presence of asymmetrical information. The anti-customer control fraud that sells an inferior good through the claim that it is a high quality good gains a large cost advantage over its honest competitors. If they are driven into bankruptcy or emulate the fraudulent practices good quality goods – and honest sellers – will be driven from the marketplaces by competition. This happened recently in the Chinese infant formula market, where honest manufacturers were driven out of the market, six infants were killed, and over 300,000 were hospitalized. The perverse effects of extreme executive compensation largely driven by short-term reported earnings have now created a perverse Gresham’s dynamic in many firms, particularly in the finance industry. The CEA did not mention the perverse incentives produced by control fraud and modern executive compensation and why markets make the environment even more criminogenic rather than restraining fraud. Implicitly, however, the CEA recognized that there was some perverse market dynamic that could drive lemon markets to their nadir where “only the worst-quality” good would be sold.

The CEA compounded its error of not discussing Akerlof’s 1970 analysis of control fraud and the Gresham’s dynamic by failing to address George Akerlof and Paul Romer’s 1993 article (“Looting: the Economic Underworld of Bankruptcy for Profit”). Their 1993 article analyzed accounting control frauds. The CEA’s discussion of financial intermediaries also included a discussion of “moral hazard.” As with its discussion of adverse selection, the CEA’s discussion of moral hazard implicitly excluded all fraud. There is no theoretical basis for this exclusion. Economics (and reality) has long recognized that moral hazard can lead to excessive risk or fraud. Fraud is often a superior strategy (in terms of expected value – not morality). As Akerlof & Romer stressed, accounting control fraud is a “sure thing” (1993: 5). “Gambling for resurrection” is a near sure thing, but in the opposite direction. The economic theory of how the insolvent or failing bank’s owners maximize the value of their “option” predicts that they will engage in such extraordinary risk that their gamble will nearly always fail.

But Akerlof & Romer endorsed another point that S&L regulators and criminologists stressed – the manner in which S&Ls purportedly engaged in honest gambling due to moral hazard made no sense for a rational (honest) actor. Please read their explanation with particular care for its obvious application to our ongoing crisis should be glaring.

“The problem with [economists’ conventional description of moral hazard as an] explanation for events of the 1980s is that someone who is gambling that his thrift might actually make a profit would never operate the way many thrifts did, with total disregard for even the most basic principles of lending: maintaining reasonable documentation about loans, protecting against external fraud and abuse, verifying information on loan applications, even bothering to have borrowers fill out loan applications.* Examinations of the operation of many such thrifts show that the owners acted as if future losses were somebody else’s problem. They were right (1993: 4).”

Akerlof & Romer went on to explain that accounting control frauds optimize fictional income by making loans with a negative expected value and by deliberately seeking out borrowers with poor reputations (1993: 17). Their logic relies implicitly on the deliberate creation of adverse selection by the lender and the creation of a Gresham’s dynamic both among borrowers and those that aid and abet the CEO’s frauds, e.g., the appraisers when they inflate appraisals.

There is no good explanation for why the CEA would cite the Akerlof’s famous theory on lemon markets yet ignore the FBI’s 2004 warning, the experience of the S&L debacle (and the public administration literature on the successful regulatory fight against the control frauds), the Enron era accounting control frauds, Akerlof & Romer’s theory of accounting control fraud, and criminology’s theory of control fraud. The basic fraud mechanisms had so many parallels that one is forced to the conclusion that the CEA and its staff never read the most important modern economic article on bank failures. Akerlof & Romer explicitly noted that accounting fraud created perverse “lemon” projects (1993: 29). It is bizarre that the CEA wrote in 2006 for the express purpose of opposing essential financial regulation and thought that the best way to make its case was to cite theories most closely associated with George Akerlof while ignoring his application of those theories to financial regulation and his research findings on the reality of accounting control fraud. Note that Akerlof & Romer were writing about precisely the point the CEA was discussing – the role of banks with respect to information asymmetries. Worse, Akerlof & Romer’s point was that one could not assume that banks acted to reduce information asymmetries because banks engaged in accounting control fraud did the opposite. Akerlof & Romer also explained how accounting control frauds caused Texas real estate bubbles to hyper-inflate. If there was one economics article the CEA needed to read carefully it was Akerlof & Romer. Akerlof was a Nobel Prize winner well before the CEA wrote its 2006 annual report.

But the CEA could have learned the same vital facts about fraud and financial crises had it read the criminology literature, the regulatory literature on the S&L debacle, or the public administration literature. The CEA had experienced recently the Enron-era accounting control frauds and the S&L debacle was relatively recent. The CEA’s failure to even consider the role of fraud in financial crises, particularly after the FBI’s stark warning in 2004, was unconscionable. Akerlof & Romer went out of their way to warn economists of the dangers of control fraud.

“Neither the public nor economists foresaw that the [S&L] regulations of the 1980s were bound to produce looting. Nor, unaware of the concept, could they have known how serious it would be. Thus the regulators in the field who understood what was happening from the beginning found lukewarm support, at best, for their cause. Now we know better. If we learn from experience, history need not repeat itself (1993: 60).”

My criminology colleagues and I sent the same warnings, as did the S&L regulators and public administration scholars. The FBI sent an explicit warning. None of us were able to get through to the Clinton, Bush, or Obama administrations. They have all ignored the epidemic of accounting control fraud that hyper-inflated the real estate bubbles and drove the financial crisis.

The Necessity and Centrality of Effective Underwriting

The CEA report continues its triumphal “just so” story approach to financial services by explaining how banks develop expertise in evaluating credit risk and use collateral as a means of inducing borrowers to “truthfully” rather than “strategically” release information on the true value of the real estate to the lender. By 2006, the nonprime industry was notorious for deliberately inflating appraisal values so that it could make more and larger fraudulent loans. Surveys of appraisers showed widespread efforts by lenders and their agents to coerce appraisers to inflate valuations. No honest lender would ever coerce an appraiser to inflate a collateral valuation. Only lenders and their agents can engage in widespread appraisal fraud. Appraisal fraud is a “marker” of accounting control fraud. The “strategic” behavior with regard to appraisers was by fraudulent lenders and their agents. It relied on endemic, deliberate deceit. Appraisal fraud is particularly egregious in residential home lending because it can lead borrowers to overpay for their home and to fail to understand the risks of purchasing a home.

The greatest analytical defect in this section of the CEA report, however, is its false dichotomy between economic efficiency and financial regulation. The CEA was on to something important. A well run banking system does reduce adverse selection and make markets less inefficient. A well run banking system does so by engaging in expert underwriting of significant loans such as home loans. A bank that does not engage in expert underwriting poses a grave danger. At best, it is incompetent. Far more dangerously, it is often engaged in accounting control fraud. A regulation that requires a lender to engage in prudent underwriting imposes no costs on honest banks and it saves society from vast amounts of damage. When the regulatory agencies gutted the underwriting rules by turning them into guidelines they set us on the road to the Great Recession. Effective financial regulation begins with mandating prudent underwriting. Rules mandating prudent underwriting make financial markets far more efficient and stable by blocking the perverse Gresham’s dynamic that otherwise can create a criminogenic environment.

The CEA was correct in explaining that the raison d’être of financial intermediaries is the provision of exemplary underwriting. It is, of course, significantly insane that the CEA would implicitly assume in 2006, contrary to known facts, that nonprime lenders, the investment banks packaging CDOs, and the rating agencies were prospering because they were engaged in exemplary underwriting. The CEA, in the two most important reports it issued in modern times (2005 and 2006), got the developing financial crisis and regulatory policy as wrong as it is possible to get something wrong.

Conclusion

No economist should be allowed to graduate from a doctoral program without reading Akerlof & Romer. It would also be salutary to expose any doctoral candidate interested in finance or regulation to the relevant work of criminologists and public administration scholars. Collectively, our work on control fraud has shown great predictive strength while neoclassical economic work (both macro and micro) and “modern finance” have suffered repeated, abject predictive failures.

Every financial regulatory agency should have a “chief criminologist.” The financial regulatory agencies are civil law enforcement entities whose primary responsibility is to limit control fraud, but they virtually never have anyone in authority with expertise in identifying, investigating, and sanctioning control frauds.