In a previous post, I explained that automatic stabilizers- i.e. the fact that the federal government’s budget moves counter-cyclically and in an automatic fashion – imparts a great stabilizing force to aggregate demand.

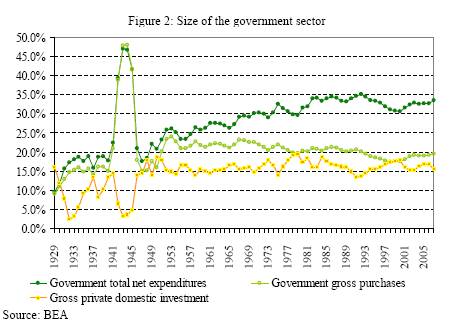

However, the picture below shows that, during the Great Depression the government sector was too small relatively to the rest of the economy.

Source: Tymoigne, 2008: 12

Source: Tymoigne, 2008: 12

The implementation of New Deal policies created automatic stabilizers which work by putting a floor under aggregate demand, preventing a deflationary spiral, but they also put ceilings in place, as rapid economic growth translates into rising tax revenues which destroy income and temper the expansion.

Nowadays, the size of the government and the impact of large automatic stabilizers explain why we can have a deep recession but another Great Depression is unlikely.

But how do automatic stabilizers work? What happens over the cycle? Hyman Minsky sheds light on these issues.

Minsky’s financial instability hypothesis can be described as follows. Let us consider that the whole U.S. economy is in a hedge position, i.e. that cash inflows are greater than outflows for every period, so that debt/payment commitments can be fulfilled while safety margin are kept at some positive level, for instance 20%. As firms and households become more optimistic about future earnings, and as their expectations get validated by economy growth, they change their behavior and reduce their margins of safety, let’s say now to 10%.

As the economy booms, and future earnings turn out to be more than expected, firms and households revise their expectations upwards, they begin to believe they were too pessimistic in the past and, therefore, reduce their cushions of safety, and start to take on more and more riskier projects. They have voluntarily moved into a position Minsky called speculative. A speculative position is one in which cash inflows are enough to meet interest payments, i.e. as they cannot repay the principal they need to refinance the outstanding debt. Borrowers start to discount risk and lenders, now more optimistic about prospective future earnings and profits, increase their willingness to lend.

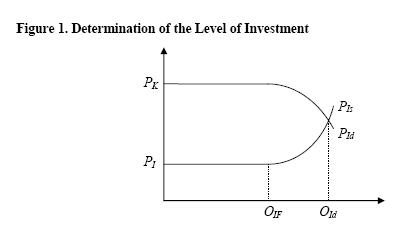

It is now important to introduce how the level of investment is determined according to Minsky’s framework. Firms invest if the demand price of capital exceeds the supply price of current output. “The quantity of investment goods purchased (OId) is determined where PId = PIs” (Tymoigne and Wray 2008, p.9)

The demand price, Pk, is the price that firms are willing to pay for the capital asset. The demand price depends upon the cash flows that ownership is expected to yield and the liquidity of the asset. The curve is horizontal up to the point where firms only commit their internal funds. However, once firms rely on external financing then the subjective borrower’s risk comes into play. This risk is incurred by firms as they may not be able to service their debt. Thus, the price that firms are willing to pay for capital assets decline as the amount they have to borrow to finance it increases.

The supply price, Pi, is the price that firms actually have to pay for the capital good. Firms can use their internal funds up to Oif , and only up to this point, the supply price equals costs + markup. When firms have to borrow to buy capital goods, the supply price of investment is raised by the interest payments on the loan. The curve slopes up after the point Oif because of the lender’s risk. The lender’s risk is the risk the firm will not repay the loan. The more the individual firm borrows, the greater the lender’s risk associated and the higher the interest rate charged on the loan.

When lenders and borrowers become more optimistic about future earnings and profits, they start to discount risks. Firms take on riskier projects and financial institutions riskier loans. Thus, the belief is now that future income will be enough to cover debt commitments. They are in a speculative position.

If there is a change in the economic environment firms’ financial positions may be adversely impacted. Let’s consider the following situation where the economy accelerates and inflation becomes a concern to the monetary authority. The turning point would happen when the Fed decides to increase the overnight interest rate. If the interest rate specified on contracts is allowed to fluctuate, firms incur in higher financial costs to service the loan. At the new circumstance, firms can either abandon the project, as it is no longer profitable at higher interest rates, or they can borrow, from willing financial institutions, the funds they need to meet the interest payments on the previous loans. In other words, if interest rates are increased to such a point where firms’ income inflows are no longer sufficient to meet the firms’ outflows, they have involuntarily moved into a new financial position that Minksy called Ponzi. In a Ponzi scheme, firms have to capitalize interest. If financial institutions become worried about the future performance of the economy as a whole or the firm in particular, and decide to no longer extend those Ponzi loans, then firms are no longer capable of meeting their financial commitments and may default on their loans. This situation can be compounded as firms decide to sell their assets at fire sale prices in order to meet their obligations, setting in a Fisher-type debt deflation process which triggers a domino effect on the economy.

Another situation we could consider as a turning point is one in which firms’ expectations about future earnings/profits is not fulfilled. In such an environment, firms will revise their expectations downwards and cut investment. As we know, this will have a multiplier effect in the economy. As income is reduced, so is consumption. Firms cut back production and investment, which depresses incomes further. The economic activity spirals down squeezing incomes even more. As firms’ income inflows were significantly reduced, firms may get to a point where they can no longer meet their liability commitments. Once again, a debt-deflation process may be set in place by the new economic environment when firms decide to sell their assets at fire sale prices trying to meet their obligations.

Now, we may ask ourselves: what is the role of automatic stabilizers in this process?

The answer becomes even clearer. With big government automatic stabilizers are large enough to offset the swings in private spending. As explained in a previous post, when the economy goes into recession, unemployment rises which means that income transfers such as unemployment compensation and welfare are automatically increased.

According to Minsky, there are 3 major effects derived from automatic stabilizers: the income and employment effect, the cash flow effect, and the portfolio effect. Let me briefly explain each one:

The income effect is the traditional Keynesian multiplier. As the economy slows down, the government deficit increases as there is an automatic increase in spending and a reduction of the amount of taxes collected. As noted in previous posts (here and here), a sovereign government spends by crediting bank accounts which means that the banking system, all else equal, now has excess reserves (ERs). The ERs put a downward pressure on the fed funds rate. If the Fed is to hit its overnight nominal interest rate target, it has to intervene and conduct open market sales (OMS) to drain the ERs. As the Fed provides an interest bearing alternative – such as government securities – this is adds to the private sector’s income.

Therefore, transfer payments and interest payments automatically increase when the economy is moving into a recession.

The other one is the cash flow effect. The idea is that government deficits maintain the flow of profits. Following Kalecki (1972) and national accounting identities, in the simplest version, aggregate profits equal investment plus the government’s deficit, Π = Invest. + Gov. Deficit. In the expanded model, gross profits, after corporate tax, equals investment plus government fiscal deficit plus consumption out of profits plus net exports less saving out of wages, i.e. Π = Invest. + Gov. Deficit + CC + NX– SW. This means that government deficits add to profits (private wealth). The flow of profits prevents the collapse of expectations and the deterioration of private sector’s balance sheet.

Finally, the portfolio effect is generated by the increase in the sale of government bonds as a consequence of the (mostly automatic) increased government deficit (as I have just explained). These bonds are safe assets and their holdings on private sector’s balance sheets help to keep expectations from collapsing below a certain level.

The Big Bank (the Fed) act as a lender of last resort, it can prevent or minimize the fall in asset prices. In other words, the Fed can always put a floor to asset prices. This can be done in many ways, such as by calling up banks and say that they need to lend to investors who want to buy assets. The Fed can also decide to buy a wide range of private assets to smooth market transactions. If the Fed decides to buy a wide range of assets to provide liquidity to markets it smoothes liquidity concerns of market participants. It can also regulate markets and discourage bad loans such as subprime real state booms in some regions so that banks will not provide those loans. However, ceilings should also be put in place such as supervision and regulation, as has been emphasized by William K. Black.

In the current recession, the forecast is that the personal saving rate will reach something like 10% in 2009 and that it could jump to 14-16% by 2010. To meet the private sector rising saving desire the government should implement another stimulus package (in the context of the Krugman’s cross described here, this would be equivalent to a shift of the government sector balance -GSB- curve to the right) thus preventing a deflationary spiral and further declines of income due to rising private sector saving desire. At the same time, it becomes important to adopt policies that make the curve steeper by enhancing the role of automatic stabilizers. One possibility is an employer of last resort program in which the federal government provides a job to everyone willing and able to work at a given nominal wage. As argued in previous posts(here and here) such program would reduce both unemployment and poverty and minimize declines in the economic activity by enhancing the ceilings and floors of the system.