By L. Randall Wray

Yet another rescue plan for the EMU is making its waythrough central Europe—with the ECB acting as lender of last resort toEuro-banks. It is trying the tried-and-failed Fed method of rescue. As we nowknow the Fed lent and spent over $29 TRILLION trying to rescue (mostly) USbanks. It did not work. The biggest banks are still insolvent, and havecontinued their massive frauds trying to cover up their insolvencies. Youcannot paper-over insolvency through massive lending by the central bank. Andthe Euroland problems are compounded by the insolvencies of virtually all theirmember states.

To be sure, we also have probable insolvencies of some ofour US states—but we’ve got a sovereign government that will eventually do theright thing (as Mr. Churchill famously said, Americans get around to that,after trying everything else first). But the Euro states do not have anysovereign backing them up. And note that the ECB remains unwilling to do thejob. A disastrous financial collapse and possible Great Depression 2.0 remainsthe most likely scenario.

How Did Euroland Get Into Such A Mess? PartOne: Private Debt

We all knowthe favourite story told: profligate-spending Mediterranean governments blew uptheir budgets, causing the crisis. If only they had followed the example ofGermany—as they were supposed to do once they joined the Euro—the EMU wouldhave worked just fine.

While thestory of fiscal excess is a stretch even in the case of the Greeks, it doesn’teasily apply to Ireland and Iceland—or even to Spain—all of which had lowbudget deficits (or even surpluses) until the crisis hit. In truth, there weretwo problems.

First, likemost Western countries, private sector debts blew up in many Euroland countriesafter the financial system was de-regulated and de-supervised. To label this asovereign debt problem is quite misleading. The dynamics are surely complex butit is clear that there is something that is driving debt growth in thedeveloped world that cannot be reduced to runaway government budget deficits.Nor does it make sense to point fingers at Mediterraneans since it is (largely)the English-speaking world of the US, UK, Canada and Australia that has seensome of the biggest increases of household debt—the total US debt ratio reached500%, of which household debt alone is 100%, and financial institution debt isanother 125% of GDP.

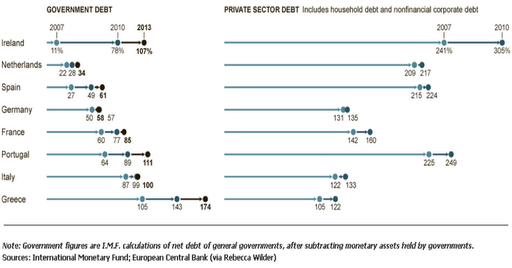

Take a lookat this graph, which shows the debt-to-GDP ratios for the private andgovernment sectors:

Clearly, upto 2007 the really big debt ratios were in the private sector. The story isvery similar to that of the US. But note that the problem tends to be worse in those countries with smallergovernment debts—there is an inverse relation between private debt ratios andgovernment debt ratios. Now why is that?

And as weknow from previous MMP sections, the sectoral balance identity shows thedomestic private balance equals the sum of the domestic government balance lessthe external balance. To put it succinctly, if a nation (say, the US) runs acurrent account deficit, then its domestic private balance (households plusfirms) equals its government balance less that current account deficit. To makethis concrete, when the US runs a current account deficit of 5% of GDP and abudget deficit of 10% of GDP its domestic sector has a surplus of 5%; or if itscurrent account deficit is 8% of GDP and its budget deficit is 3% then theprivate sector must have a deficit of 5%–running up its debt.

{An aside: Abig reason why much of the developed world has had a growth of its outstandingprivate and public sector debts relative to GDP is because we have witnessedthe rise of BRIC (and others—especially in Asia) current account surpluses—matchedby current account deficits in the developed Western nations taken as a whole.Hence, developed country budget deficits have widened even as their privatesector debts have grown. By itself, this is neither good nor bad. But overtime, the debt ratios and hence debt service commitments of Western domesticprivate sectors got too large. This was a major contributing factor to the GFC.}

Our Austerianssee the solution in belt-tightening, especially by Western governments. Butthat tends to slow growth, increase unemployment, and hence increase the burdenof private sector debt. The idea is that this will reduce government debt anddeficit ratios but in practice that does not work due to impacts on thedomestic private sector. Tightening the fiscal stance can occur in conjunctionwith reduction of private sector debts and deficits only if somehow thisreduces current account deficits. Yet many nations around the world rely oncurrent account surpluses to fuel domestic growth and to keep domesticgovernment and private sector balance sheets strong. They therefor react tofiscal tightening by trading partners—either by depreciating their exchangerates or by lowering their costs. In the end, this sets off a sort of modernMercantilist dynamic that leads to race to the bottom policies that few Westernnations can win.

Germany,however has specialized in such dynamics and has played its cards well. It hasheld the line on nominal wages while greatly increasing productivity. As aresult, in spite of reasonably high living standards it has become a low costproducer in Europe. Given productivity advantages it can go toe-to-toe againstnon-Euro countries in spite of what looks like an overvalued currency. ForGermany however, the euro is significantly undervalued—even though most euronations find it overvalued. The result is that Germany has operated with acurrent account surplus that allowed its domestic private sector and governmentto run deficits that were relatively small. Germany’s overall debt ratio is at200% of GDP, approximately 50% of GDP lower than the Euro zone average.

Notsurprisingly, the sectoral balances identity hit the periphery nationsparticularly hard as they suffer from what is for them an overvalued euro, and lowerproductivity than Germany enjoys. With current accounts biased toward deficitsit is not a surprise to find that the Mediterraneans have bigger government andprivate sector debt loads.

Now, if Europe’s center understood balance sheets, it wouldbe obvious that Germany’s relatively “better” balances rely on the periphery’srelatively “worse” balances. If each had separate currencies, the solutionwould be to adjust exchange rates so that our debtors would have depreciationand Germany would have an appreciating currency. Since within the euro this isnot possible, the only price adjustment that can work would be either risingwages and prices in Germany or falling wages and prices on the periphery. But ECB,Bundesbank and EU policy more generally will not allow significant wage andprice inflation in the center. Hence the only solution is persistent deflationarypressures on the periphery. Those dynamics lead to slow growth and hencecompound the debt burden problems.

How Did Euroland Get Into Such A Mess? PartTwo: Government Debt

To be sure, the private debt problem—related to the internalEuropean dynamics of a strong mercantilist Germany in the center—would be veryhard to resolve. But Euroland has an even more fatal problem: the Euro, itself.So let us turn to that second problem.

The fundamentalfault with the set-up of the EMU was the separation of nations from theircurrencies. It was a system designed to fail. It would be like a USA with noWashington—with each state fully responsible not only for state spending, butalso for social security, health care, natural disasters, and bail-outs offinancial institutions within its borders. In the US, all of those responsibilities fall under thepurview of the issuers of the national currency—the Fed and the Treasury. Intruth, the Fed must play a subsidiary role because like the ECB it isprohibited from directly buying Treasury debt. It can only lend to financialinstitutions, and purchase government debt in the open market. It can help tostabilize the financial system, but can only lend, not spend, dollars intoexistence. The Treasury spends them into existence. When Congress is notpreoccupied with Kindergarten-level spats over debt ceilings that arrangement worksalmost tolerably well—a hurricane in the Gulf leads to Treasury spending torelieve the pain. A national economic disaster generates a Federal budgetdeficit of 5 or 10 percent of GDP to relieve pain.

That cannothappen in Euroland, where the Euro Parliament’s budget is less than one percentof GDP. The first serious Euro-wide financial crisis would expose the flaws.And it did.

Member states became much like US states, but with two keydifferences. First, while US states can and do rely on fiscal transfers fromWashington—which controls a budget equal to more than a fifth of US GDP—EMUmember states got an underfunded European Parliament with a total budget ofless than 1% of Europe’s GDP. (To make it even worse, the Parliament’s fundingcomes from the member states!)

This meant that member states were responsible for dealingnot only with the routine expenditures on social welfare (health care,retirement, poverty relief) but also had to rise to the challenge of economicand financial crises.

The second difference is that Maastricht criteria were fartoo lax—permitting outrageously high budget deficits and government debtratios. Most of the critics hadalways (wrongly) argued that the Maastricht criteria were too tight—prohibitingmember states from adding enough aggregate demand to keep their economieshumming along at full employment. It is true that government spending was chronicallytoo low across Europe as evidenced by chronically high unemployment and rottengrowth in most places. But since these states were essentially spending and borrowinga foreign currency—the Euro—the Maastricht criteria permitted deficits anddebts that were inappropriate.

Let us take a look at US states. All but two have balancedbudget requirements—written into state constitutions—and all of them aredisciplined by markets to submit balanced budgets. When a state finishes theyear with a deficit, it faces a credit downgrade by our good friends the creditratings agencies. (Yes, the same folks who thought that bundles of trashmortgages ought to be rated AAA—but that is not the topic today.) That wouldcause interest rates paid by states on their bonds to rise, raising budgetdeficits and fueling a vicious cycle of downgrades, rate hikes and burgeoningdeficits. So a mixture of austerity, default on debt, and Federal governmentfiscal transfers keeps US state budget deficits low.

(Yes, I know that right now many states are facingArmageddon—especially California—as the global crisis has crashed revenues andcaused deficits to explode. This is not an exception but rather demonstrates myargument.)

The following table shows the debt ratios of a selection ofUS states. Note that none of them even reaches 20% of GDP, less than a third ofthe Maastricht criteria.

|

Alaska

|

15.7

|

Montana

|

12.2

|

|

Connecticut

|

12.1

|

New Hampshire

|

13.0

|

|

Hawaii

|

12.2

|

New York

|

10.5

|

|

Maine

|

11.0

|

Rhode Island

|

16.9

|

|

Massachusetts

|

16.5

|

Vermont

|

12.6

|

By contrast, Euro states had much higher debt ratios—withonly Ireland coming close to the low ratios we find among US states (the redline is drawn at the Maastricht criterion of 60%).

To be clear, none of these debt ratios would be too high fora sovereign government that issues its own currency. Remember that Japan’sgovernment debt ratio is 200%–and its interest rate has been close to zero fortwo decades. But they are too high for nonsovereign nations that use a foreigncurrency.

Those who follow Modern Money Theory believed that market“discipline” would eventually impose debt and deficit limits far belowMaastricht criteria—to ratios closer to those imposed on US states. And with nofiscal authority in the center to match the US Treasury, the first seriouseconomic or financial crisis would expose the flaws of the design of the euro. Becausethe crisis would cause member state deficits and debts to grow. At the sametime markets would begin to realize that these member states are much like USstates but without the backstop of a European Treasury.

And that is precisely what has happened.

To be sure markets have not reacted simultaneously againstall member states. If you think about it, this makes sense. There is a desireto hold euro-denominated debt—the euro is a strong currency and much of theworld wants to buy European exports. So markets run out of Greece and Irelandand now Italy but need to get into other euro debt. Since Germany is thestrongest member and by far the biggest exporter, it benefits the most from arun against the periphery.

Yet as Germany is a net exporter with a relatively smallbudget deficit, it is hard to get German debt. The biggest issuer of debt wasItaly, and there was a strong belief in markets that because Italy’s debt is solarge, it is like a Bank of America—too big to fail. And ditto for France andSpain. So spreads widened for Greece and Ireland and Portugal, but have onlyrecently increased for Spain and Italy.

But after the agreement to accept a “voluntary” haircut of50% on Greek debt, no prudent investor can any longer pretend that Italy, Spainor even France and Germany is a safe bet. Faith based investing in Euro debt isover. And note that if the stronger nations really do bail-out a Spain or anItaly, our friendly credit rating agencies will quickly downgrade the strongnations (they are now threatening France) for contributing funds to rescuetheir neighbors. Even Germany will not be safe if it participates in a bailoutof Italy by committing funds.

There is thus a damned-if-you-do and damned-if-you-don’tdilemma. A bail-out by member states threatens the EMU by burdening andeventually bringing down the strong states; and allowing too-big-to-fail Italyto default would prove to markets that no member state is safe.

And this is why it does not matter how much the ECB lends toEurobanks—the banks would be crazy to buy up government debt. And it is hard tobelieve that any US money managers can make a case that it is still prudent toinvest in euro debt.

Many critics of the EMU have long blamed the ECB forsluggish growth, especially on the periphery. The argument is that it keptinterest rates too high for full employment to be achieved. I have alwaysthought that was wrong—not because I do not agree that lower interest rates aredesirable, but because even with the best-run central bank, the real problem inthe set-up was fiscal policy constraints. Indeed, several years ago, Claudio Sardoniand I demonstrated that the ECB’s policy was not significantly tighter than theFed’s—but US economic performance was consistently better. The difference wasfiscal policy—with Washington commanding a budget that was more than 20% ofGDP, and usually running a budget deficit of several percent of GDP. By contrast,the EU Parliament’s budget could never run deficits like that. Individualnations tried to fill the gap with deficits by their own governments, thesecreated the problems we see today—as the chickens came home to roost, so tospeak.

Is There Any Solution?

Once the EMU weakness is understood, it is not hard to seethe solutions. These include ramping up fiscal policy space of the EUparliament—say, increasing its budget to 15% of GDP with a capacity to issuedebt. Whether the spending decisions should be centralized is a politicalmatter—funds could simply be transferred to individual states on a per capitabasis.

It can also be done by the ECB: change the rules so that theECB can buy, say, an amount equal to 6% of Euroland GDP each year in the formof government debt issued by EMU members. As buyer it can set the interestrate—might be best to mandate that at the ECB’s overnight interest rate targetor some mark-up above that. Again, the allocation would be on a percapita basisacross the members. Note that this is similar to the blue bond, red bondproposal discussed above. Individual members could continue to also issue bondsto markets, so they could exceed the debt issue that is bought by the ECB—muchas US states do issue bonds.

One can conceive of variations on this theme, such ascreation of some EMU-wide funding authority backed by the ECB that issues debtto buy government debt from individual nations—again, along the lines of theblue bond proposal. What is essential, however, is that the backing comes fromthe center—the ECB or the EU stands behind the debt.

No amount of faith in the European integration is going tohide the flaws any longer. A comprehensive rescue by the ECB—which must standready to buy ALL member state debt at a price to ensure debt service costsbelow 3%–plus the creation of a central fiscal mechanism of a size appropriateto the needs of the European Union is the only way out. If these actions arenot taken—and soon—the only option left is to dissolve the Union.

So, finally, returning to the “one nation-one currency” rule would alloweach nation to recapture domestic policy space by returning to its owncurrency. There was never a strong argument for adopting the Euro, and theweaknesses have been exposed. Currency union without fiscal union was amistake.