By Eric Tymoigne

The last three posts have explained how the operations of banks are constrained by profitability and regulatory concerns, and how banks operate to try to bypass these constraints. It is now time to go into the details of how banks provide credit and payment services to the rest of the economy.

Monetary Creation by Banks: Credit and Payment Services

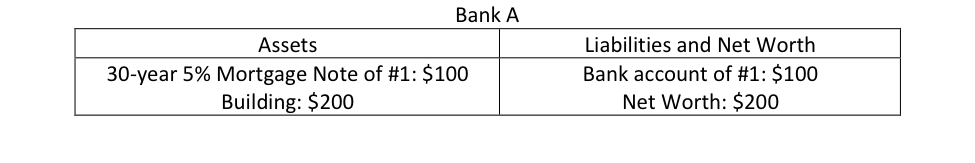

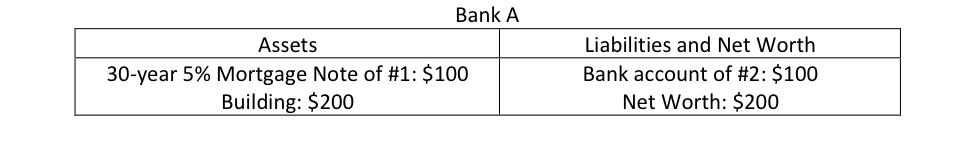

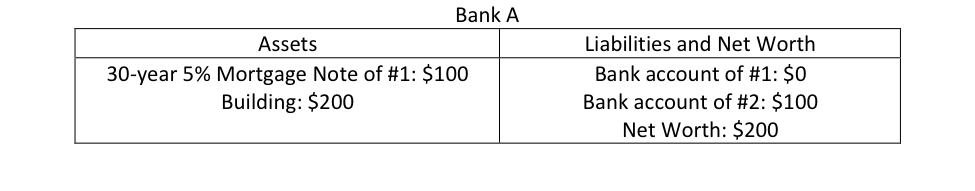

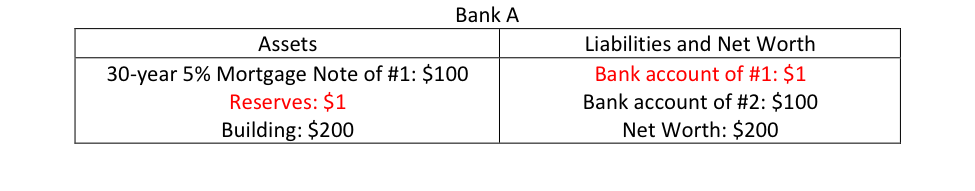

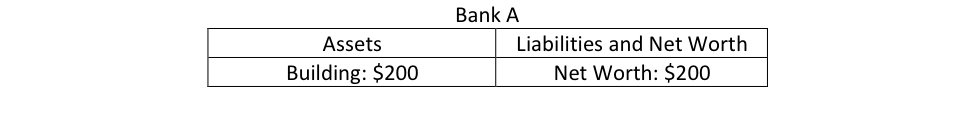

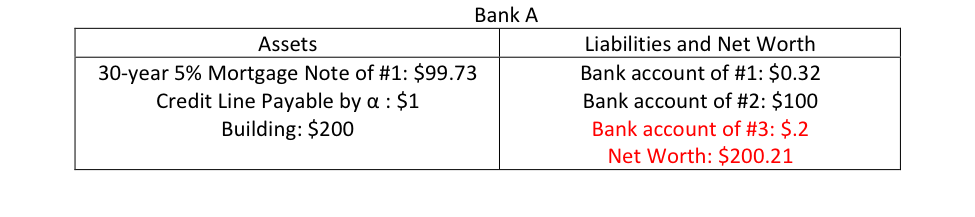

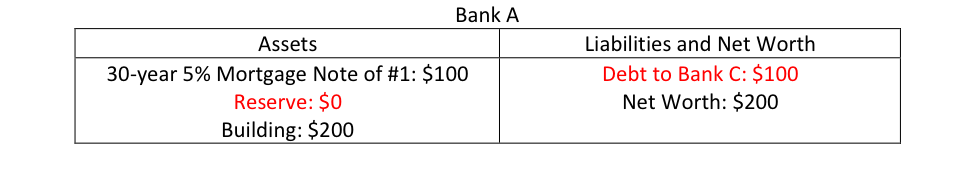

Bank A just opened for business and its balance sheet looks like this:

Now comes household #1 who wants to buy a house worth $100 from household #2. #1 sits down with a banker (a.k.a. loan officer) who asks a few questions regarding annual income, available assets, monetary balances, the downpayment #1 is willing to make, among others. The banker asks for documentations that corroborate the answers provided by #1.

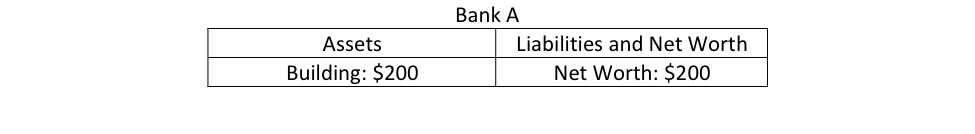

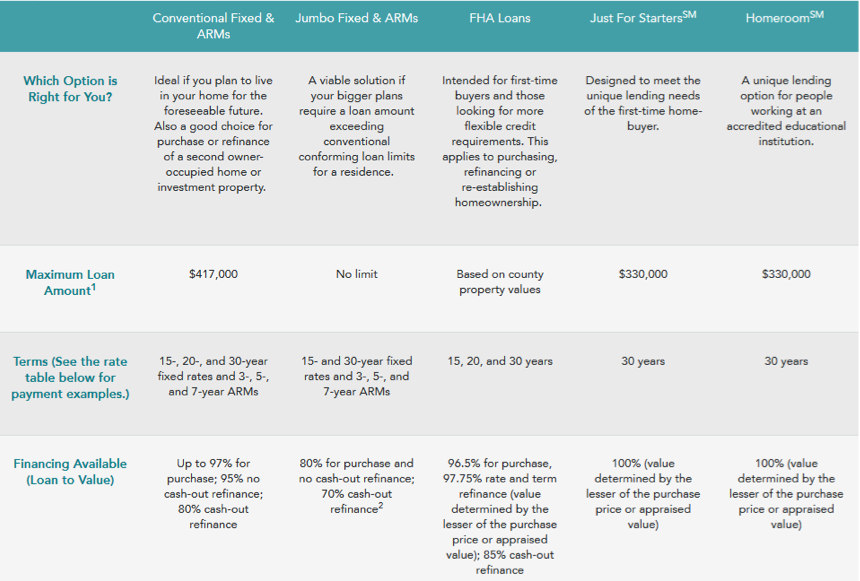

The banker also shows to #1 what financing options are available, that is, the banker shows to #1 what type of mortgage note household #1 has to issue to be accepted by bank A. Figure 1 is taken from an actual website.

- For 100% financing (no downpayment by household), the bank is prepared to provide up to $330,000 and it will only accept a 30-year 5.125% fixed-rate mortgage note. The bank will not accept a 20-year mortgage note, or a 3.875% note for 100% financing.

- For up to 97% financing (household provides at least a 3% downpayment), the types of mortgage note that a household can issue to the bank widen. The bank is willing to accept a 30-year 3.875% fixed-rate note, or a 15-year 3.125% fixed-rate note, among others. The maximum face value of the note that the bank will accept is $417,000 unless the household is able to provide a 20% downpayment.

#1 picks one of the options and fills up a credit application that is attached to the all the documentation provided by #1. The credit application is then sent to the credit department for further analysis (check the 3Cs) and either approved or not.

Figure 1. Example of types of mortgage note a bank will accept

All this is similar to bond issuances by corporations, except that mortgage notes do not have an active market in which they can be traded. In the case of a bond, a corporation may issue a bond with terms that are different than what market participants want. The bond will trade at a discount or a premium in that case. If Ford issues a 10-year 5% corporate bond but the market yield is currently 6% (i.e. market participants want a 6% rate of return), market participants will only buy the bond from Ford at a discount. To simplify, assume a bond with a $1000 face value and a 5% coupon rate (every year the bond pays $50 of interest income), then to get a 6% yield someone should pay $833 (50/833=6%); a 17% discount.

Unfortunately for #1, there is no active market for its promissory notes, so if #1 does not issue a mortgage note with the terms required by A, its note will trade at 100% discount; A will not buy it (#1 could always check what another bank would offer). That is the disadvantage of non-tradable promissory notes over securities, the issuer is completely bound by what potential bearers require in terms of the characteristics of the promissory note (interest rate, term to maturity, etc.).

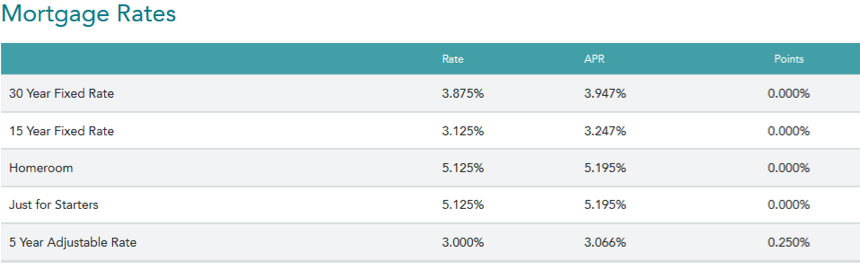

Figure 2 shows what a mortgage note looks like. It is a legal document that formalizes a promise made by a household to a bank. The household issued a 30-year fully-amortized fixed-rate 7.5% note to a bank called “Shelter Mortgage Co.,” which means that, over 30 years, the household promises to pay an annual interest representing 7.5% of the outstanding note value and to repay some of the principal every month. That comes down to a monthly payment of $1896.27. The mortgage note is accompanied by a mortgage deed (and many other documents). The deed is a legal document that establishes the right of the bank to seize the house if the household does not fulfill the terms of the mortgage note.

Figure 2. A mortgage note

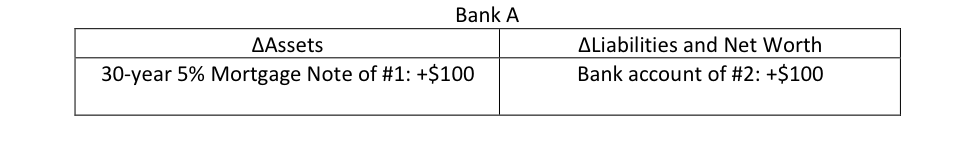

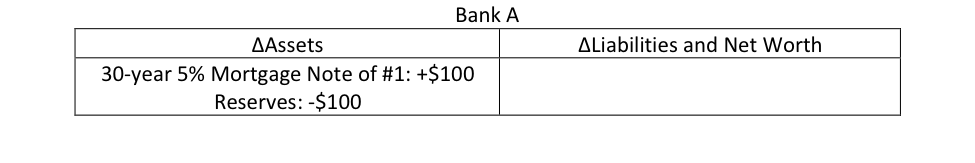

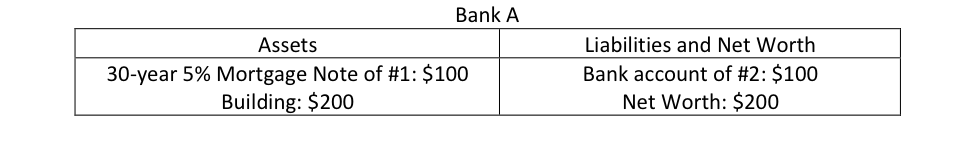

Going back to our household #1 who wants to buy a $100 house, suppose that bank A agrees to acquire from #1 a 30-year 5% mortgage note with a $100 face value. How does A pay for it? Bank A issues its own promissory note, called “bank account,” to #1.

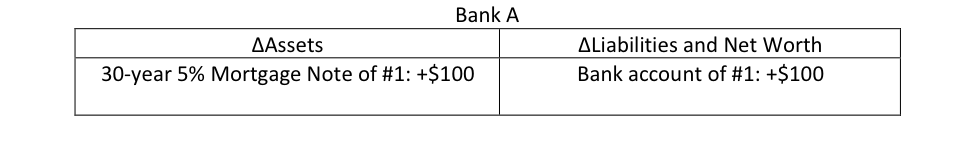

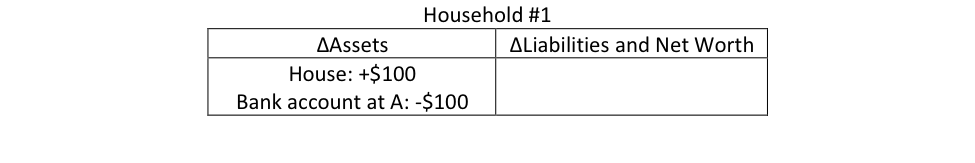

Or, in terms of t-account, we have the following first step:

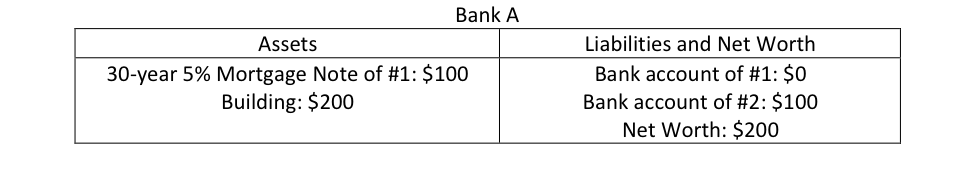

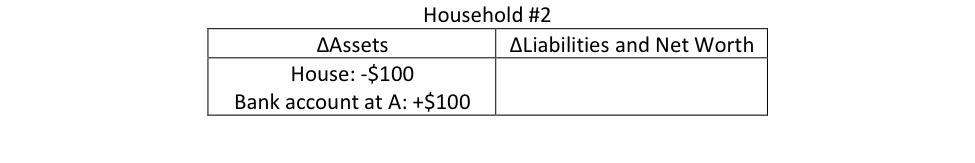

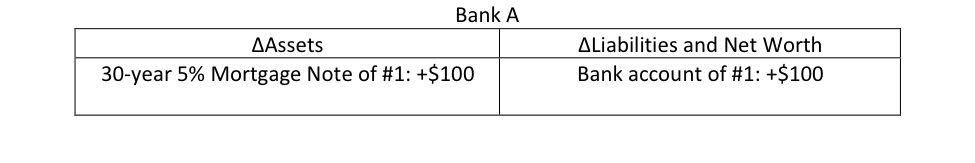

#1 then pays #2 and, for the moment, let us assume #2 opens an account at A (we will see what happens below when #2 has an account at a different bank):

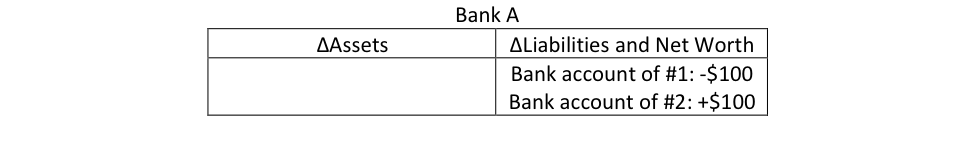

Or in terms of t-accounts, we have the following when the payment occurs:

While the above shows the logic of what goes on when a bank provides credit services, the bank also provides payment services. This means that, in practice, the accounting is simpler because A makes the payment on behalf of #1, it does not let #1 touch any funds. Instead, A directly credits the account of #2 so the first step is actually:

And the final balance sheet is (#1 does not need to have a bank account for the payment to go through, A just credits the account of #2 by typing “100” on the computer)

The promissory note of the bank called “bank account” is one type of monetary instrument as explained in Post 15.

What can we learn from the example above?

1. The bank is not lending anything it has: when providing credit services the bank swaps promissory notes with its clients

The accounting of the previous section is commonly referred to as “bank lending,” i.e. the A is said to lend $100 to #1. As stated in Post 2, when studying central banking, “lending” means giving up temporarily an asset, “I lend you my pen for a minute.” This is clearly NOT what is going on. Banks are not in the business of allowing customers to temporarily use some of the banks’ assets: that is a loan shark business. The bank is not lending anything it owns. Lending would mean this:

Household#1 is borrowing cash from the bank. But what happened is this:

One may ask: Is there not an indirect lending of reserves though? After #1 gets its account credited, it could withdraw reserves and make a cash payment to #2. #1 would then have to get reserves back to A. The answer is no for two reasons:

- We have just seen that in practice the bank makes the payment for #1. That payment does not need to result into any reserve drainage (it did not above).

- As shown below, #1 does not have to give back reserves to A to repay its debt, and #1 rarely, if ever, does so in practice.

So not only is #1 not borrowing reserves from A, but also #1 is not giving back reserves to A. There is no lending or borrowing of reserves going on between A and #1, either directly or indirectly. What a bank does do is to swap promissory notes with economic units and to make payments for them. Reserves may enter the picture at the time of the provision of payment services, never at the time of the provision of credit services.

2. The bank does not need any reserves to provide credit services

While it may need reserves to provide payment services (transferring funds to #2), A does not need any reserves to provide credit services to #1. All it does with household #1 is to exchange promissory notes:

- The household makes the following promise: pay 5% interest on the outstanding mortgage value for 30 years and repay some of the principal every month.

- The bank makes the following two promises:

- To convert bank accounts into Federal Reserve notes at the will of the account holders

- To accept its own promissory note when #1 services the mortgage.

All these are promises and none of the issuers has to have what is needed to fulfill the promise right away when he issue his promissory notes. That is the point of finance; it is about banking on the future.

Think of a pizza shop that issues coupons for a free pizza. The shop does not have to make pizzas first before it issues the coupons, it will make pizzas only if people show up with coupons. Converting the coupons into pizzas is costly for the shop and so affects its profitability, but the issuance of coupons is not constrained by the current availability to pizzas. The shop is just making a promise and anybody can make any kind of promise. The hard parts are, first, to convince someone of the genuineness of this promise and, second, to fulfill the promise once it has been accepted by someone.

In the same way, a bank does not have to any Federal Reserve notes now to be able to issue a bank account that promises Federal Reserve notes on demand. A bank will need reserves only if account holders request cash or make payments to someone who has an account at another bank. The Fed will provide reserves on demand, i.e. at the will of banks, so banks never worry about being unable to get reserves. Reserves will never run out. What banks do need to worry about is the cost of acquiring reserves. In normal times, this cost is predictable and relatively stable but the Volcker experiment shows that a central bank may make reserves prohibitively expensive.

3. The bank is not using “other people’s money”: it is not a financial intermediary between savers and investors

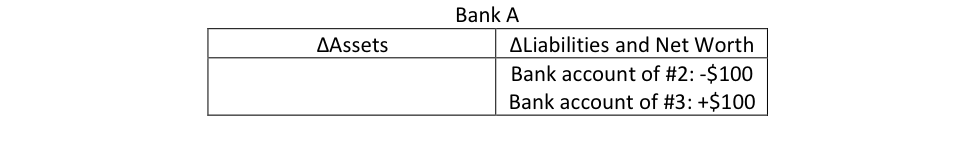

This is a development of the first and second point. A view of banking, from which the word “lending” probably comes from, is that banks are intermediaries between savers and investors. Some people come to deposit cash and then banks lend the cash. It is quite clear that a bank is not lending any funds that some deposited (nobody deposited anything in our example). And, worse offender, a bank is certainly not using others’ bank accounts to grant credit. Assume that household #3 comes to bank A to get a $100 credit, A never does this:

That is, it does not take the funds of #2 and give them to #3. This t-account would be a payment from #2 to #3, not a credit by bank A. To provide a credit is exactly what credit means, it is about crediting account. The crediting is done by typing a number on the computer. Once this number is entered, the bank is liable to the account holder for the two reasons presented above.

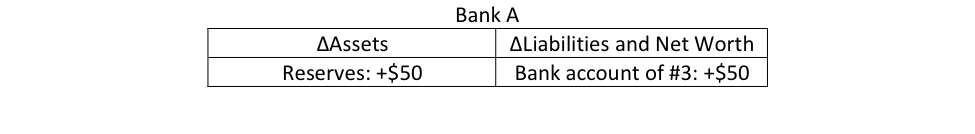

Banks do not wait for depositors before they engage in credit services. Say household #3 comes to open an account by depositing $50 worth of Federal Reserve notes. The following occurs:

This deposit does not enhance the ability to provide credit services because A is not in the business of lending reserves to non-bank economic units. The ability of the bank to acquire non-bank private promissory notes is unrelated to the amount of reserves on its balance sheet because a bank pays for them by issuing its own promissory notes.

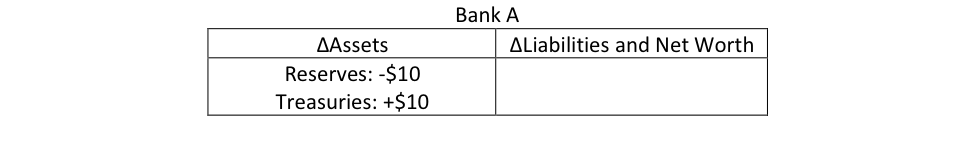

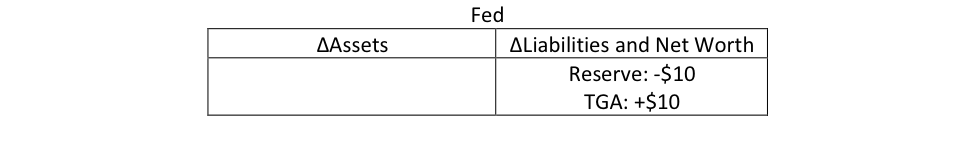

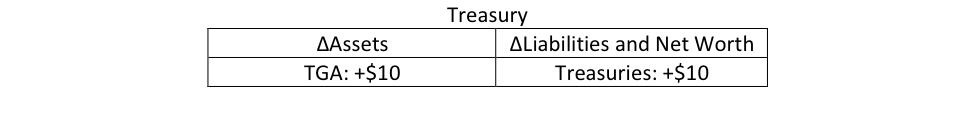

There is one case where a bank does need reserves to acquire a promissory note: if a bank buys the note from an institution with a Federal Reserve account. For example:

- If a bank participates in auction of treasuries, the Treasury only accepts reserves in payment. In the past, the Treasury sometimes allowed banks to pay for the treasuries by crediting the TT&Ls (another cash management method used for monetary-policy purpose), but it no longer does since 1989.

- if it buys promissory notes from another bank

In the first case, the balance sheet changes as follows (says the bank buys $10 worth of treasuries from the Treasury)

And on the balance sheet of the Fed the following occurs

And the Treasury:

The Fed always ensures that banks have enough reserves to make the auction successful, the supply of Federal Reserve notes by savers is irrelevant for the success of treasuries auctions.

4. The bank’s promissory note is in high demand

Why did #1 enter in an agreement with A? Because nobody else would accept #1’s promissory note and a large number of economic units accepts A’s promissory note (if someone does not, A offers conversion into cash that most accept in payments). Post 15 explains why bank monetary instruments are widely accepted.

If #2 had been willing to accept #1’s promissory note then none of the previous agreement would have been needed. The problem with #1’s promissory note are two folds:

- There is a credit risk: #2 is not sure that it will get paid the interest due AND that it will be able to make payments to #1 by giving back to #1 its promissory note. If #2 knew that it would become heavily indebted ($100 is a lot in our example) to #1 in the future, then assuming that #1 is creditworthy, #2 may be willing to accept #1’s promissory note for the payment of the house. Later #2 could use #1’s promissory note to pay debts owed to #1.

- There is a liquidity risk: the promissory note only comes due in 30-year so household #1 does not have to take it back before that time (though it could because mortgage notes usually allow accelerated repayment of principal). In the meantime, #2 is stuck with this promissory note that nobody else will accept.

Bank A’s promissory note is due at any time the bearer wants (conversion into cash on demand and it can be used to pay the bank at any time) and the creditworthiness of a bank is strong. This is all the more so that the government guarantees that A’s promissory note can always be converted into Federal Reserve notes at par, and that the (nominal) value of A’s promissory note will not fall even if A goes bankrupt. All this makes the A’s promissory note free of credit risk and perfectly liquid.

How does a bank make a profit? Monetary Destruction

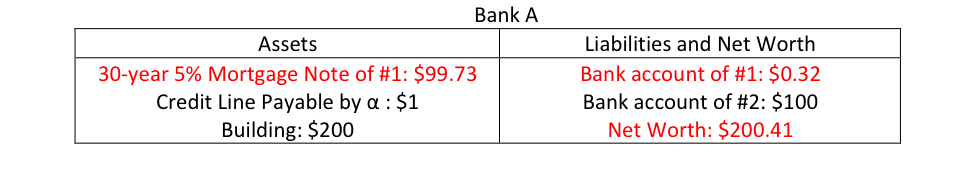

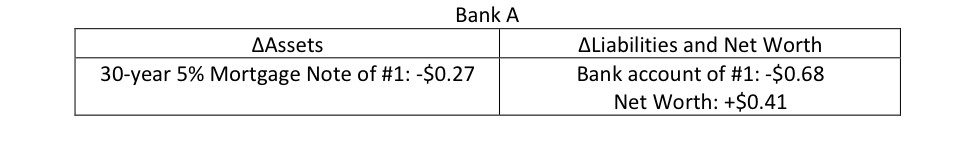

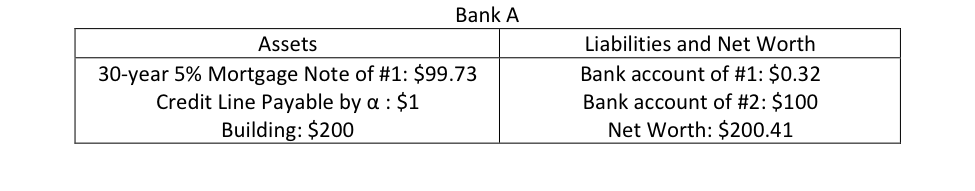

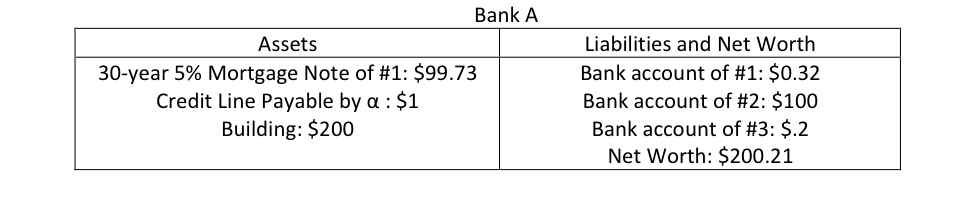

Banks are dealers of promissory notes: banks take non-bank non-federal promissory notes and in exchange give their own promissory note. Banks make a profit by taking back their own promissory notes. At the beginning of the second month, #1 starts to honor its promise made to A by servicing the mortgage note. The monthly principal due is 27 cents ($100/(30*12), assuming linear repayment of principal) and the first interest payment is 41 cents (the annual interest rate is 5% so on a monthly basis the rate is 0.407% = (1.05)1/12 – 1) making the total debt service for the first month $0.68. How does #1 pay this?

There are two ways this amount can be paid, one is by giving $0.68 in cash to the bank. Another more common solution is to follow up on the promise embedded in the bank’s promissory note: Bank A promised to take back its promissory note as means of payment of debts owed to Bank A. Thus, another means to pay the mortgage is to debit $0.68 from the account of #1. Let us assume that #1 has an account at A, that account first needs to be credited:

How can household #1 get funds credited to its account?

- Case 1: #1 receives a $1 payment from the federal government either by selling something to the government or by receiving a transfer payment. The balance sheet of the bank would look like this (Post 6 shows that transactions with the federal government lead to reserve crediting and debiting)

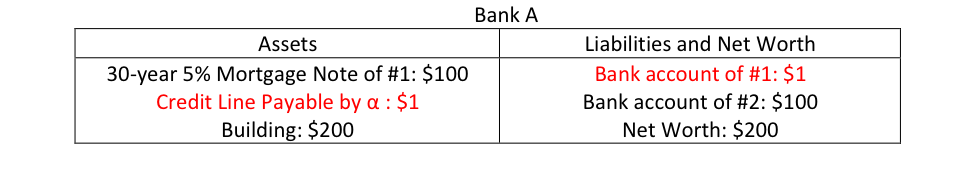

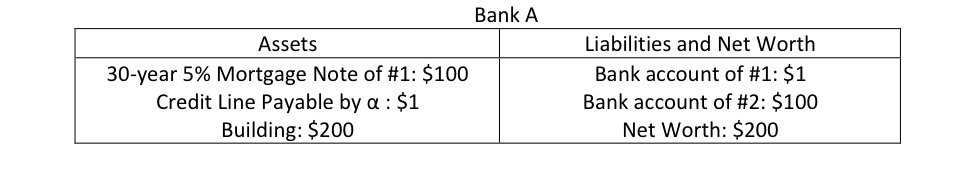

- Case 2: #1 works for business α that produces widgets. Business α just started. It has not sold anything yet but must purchase raw materials and pay #1 (the only employee) to be able to produce widgets. In order to do that, α asked for a $10 operating line of credit from A (an operating line of credit is an off-balance sheet item unless it is used). When α pays #1 the following happens:

Business α has gone into debt by $1 to be able to pay the monthly wage of household #1. Note how similar case 2 is to the first section: business gets credit, banks makes payment, business does not touch any funds.

- Case 3: #1 receives a $1 from #2. Why? I let you decide.

One may note that, any payment made to #1 that does not come from the government (or an institution that has a federal reserve account) (case 1), or from funds that got created previously by #1 going into debt (case 3), requires that the someone else than #1 goes into debt toward a bank (Case 2). Otherwise #1 can get access to the payment services offered by A.

Let assume that case 2 prevailed so now #1 has enough funds to pay A the first monthly service of $0.68. How is that recorded? It is exactly the same procedure as debt-service payments by banks to the central bank.

Or in terms of t-accounts:

Again, like in the case of a central bank, the bank is not gaining any cash flow from the transaction. Its profit does not increase the amount of reserves on the asset side. What profit does is to raise the net worth of the bank. As noted in the first post, profit is just an addition to net worth, the monetary gain that profit represents may not translate into any cash flow gains. What the servicing of debts owed to banks does is to destroy bank monetary instruments.

While there is no cash flow gains for A, profit is extremely important for the viability of its business. Indeed, the bank needs to meet its capital ratio and making a profit improve net worth. In addition, capital is extremely important to allow any bank to further develop its credit service because it can now create more promissory notes given that it has more capital to protect its creditors.

Let us look at how the capital position of A evolved through time (to simplify the unweighted capital ratio is calculated):

1. After it opened:

Capital ratio = net worth/assets = $200/$200 = 100%

2. After it granted credit to #1:

Capital ratio = $200/$300 = 66.7%

3. After it granted credit to α and made the payment to #1:

Capital ratio = $200/$301 = 66.4%

4. After it received the mortgage service payment from #1:

Capital ratio = $200.41/$300.73 = 66.64%

Until A receives the mortgage service payment, its capital position worsens as A grants more credit. Profit allows a bank to restore its capital position and to further pursue credit activity. It also allows a bank to pay its own employees without further lowering its capital position. So if A has one employee (household #3) who receives a monthly salary of 20 cents then the following is recorded:

Bank A pays #3 by typing a number on the computer. The capital ratio is 66.57%, still better than the 66.4% that prevailed after A granted credit to α.

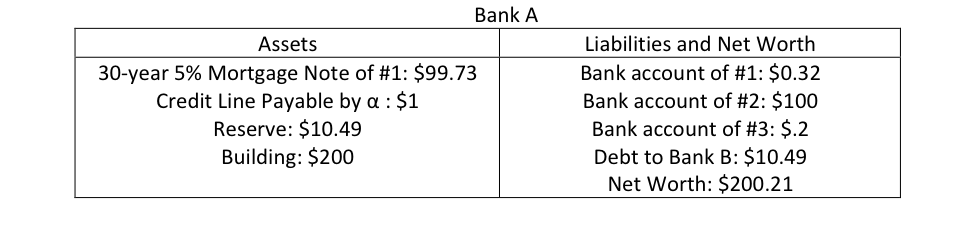

Interbank payments, withdrawals, reserve requirements, and federal government operations: the role of reserves

Reserves are conspicuously absent from the previous discussions but banks do need reserves as explained in Post 3. Reserves enter the picture with payment services (interbank payments), retail portfolio services (withdrawals and deposits), the law (reserve requirements) and federal government operations (taxes, government spending, and auctions of treasuries), as well as transactions with other Fed account holders (we will leave that aside).

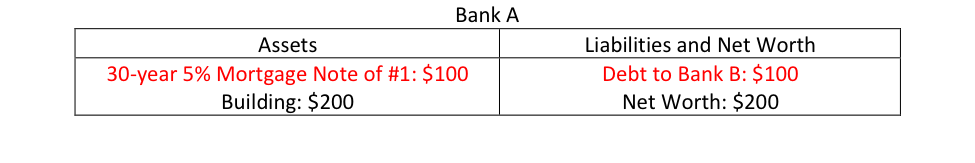

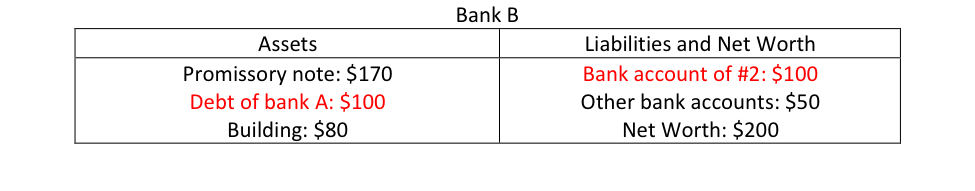

Let us go back to the point where #1 pays #2 and now let us say that #2 has an account at bank B instead of bank A. In that case, A instructs B to credit the account of #2 on behalf of A and A acknowledges it is indebted to B:

Interbank debts are settled with reserves but there is a small problem: bank A does not have any reserves! How could A get them right now? There are several possibilities:

- Selling non-strategic tradable assets to another bank or the Fed, say treasuries: bank A does not have any (the building is a strategic assets because A cannot operate without it, the mortgage note of #1 is not tradable).

- Getting reserves in the interbank market: borrow from a fed funds market participant with excess funds.

- Getting reserves from the Fed: swap promissory note with Fed via the Discount Window

- Recording an overnight overdraft on its reserve balance.

Overtime there will be other means for A to get reserves because:

- Other banks will ask A to make payments on their behalf to economic units with accounts at A.

- Some economic units will come to deposit Federal Reserve notes at A

- The government will make payments to economic units with accounts at bank A (see case 1 above).

But right now bank A does not have the reserves so it needs to use sources 1 through 4. Recording an overnight overdraft is the costliest solution because it requires the payment of a very high interest rate and penalties. Going at the window is possible but, in normal times, there is a large stigma in the US and it is costly. Borrowing reserves in the federal funds market is usually the preferred means to get reserves. Assume that, first, Bank A uses the overdraft facility to pay Bank B:

As long as the balance is negative only during the day, bank A does not have to pay any interest on it. Before the end of the day, bank A borrows reserves in the interbank market from bank C:

This debt is due the next morning and, at the end of the next day, bank A will need to borrow again from bank C or another bank until it receives enough reserves from sources 5, 6, or 7. While it borrows from other banks, it must pay the interest rate that prevails on the interbank market, which, to simplify, is the Federal Funds rate target. Say bank A has to borrow every day for a month, then its profit for the first month is, assuming a FFR of 2% on an annual basis.

Profit = Interest received – interest paid = 0.41%*100 – 0.083%*100 = $0.327

As long as the FFR stays below the interest rate on the mortgage note the bank is profitable. It is not as profitable as it would have been had it not borrowed reserves, but it is profitable.

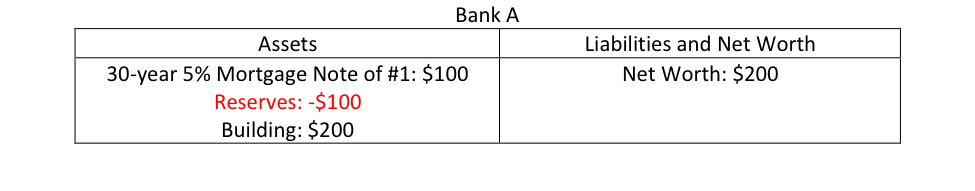

Beyond the need to make interbank payments, in some countries banks are also required to meet some reserve requirements. Bank A has the following balance sheet if we continue from the last balance sheet of the previous section:

The total amount of bank account is $104.93 so A now needs to get $10.49 of reserves on its balance sheet if the reserve requirement ratio is 10%. Again the sources of reserves are 1 through 7 but if A needs them right away only sources 1-3 are available for reserve requirement purpose (A cannot have an overdraft in that case). The accounting implications and profit implications are the same as just presented. For example if it borrows from bank B:

Beyond reserves needed for interbank debt settlements and reserve requirements, Post 6 also looks at the need to get reserves to settle auctions of treasuries and to pay taxes.

In all these cases (and the case of withdrawals of cash by account holders), the central bank always accommodates the needs of the banking system to ensure that the payment system works properly (economic units get paid and debts are settled), to ensure that banks follow the law (only the Fed can provide the reserves that banks need to meet reserve requirements), and to ensure that non-bank economic units can get the cash they need. Banks are never constrained by the quantity of reserves available as long as a central bank merely targets an interest rate.

While the quantity of reserves does not constrain bank A in anyway, the Fed does set a price on the supply of reserves and this price impacts the profitability of bank A. As such banks try to find the cheapest sources of reserves, which usually means attracting and keeping depositors. Banks also try to economize on reserve needs by net clearing interbank debts before settling them, among other means.

Finally, banks do not try to hold more reserves than what they need. As shown in a Post 3, in normal times, most reserves are held because banks are required to do so. Demand for excess reserves is very small and virtually zero. Banks have almost no incentive to keep excess reserves because they can get any amount of reserves they want at any time, because they cannot do much with reserves, and because keeping excess reserves lowers ROA. Banks do not proactively try to get reserves ahead of credit activities and, if credit activity slows, they slow their demand for reserves and may want to avoid attracting new depositors to avoiding building excess reserves. They may keep a slight amount of excess reserves to avoid having to record an overnight overdraft.

What limits the ability of a bank to provide credit services?

Say that a bank really wants to increase aggressively its market share, this will tend to draw the attention of regulators for several reasons:

- In order to grow fast, the best strategy is to provide credit to economic units that other banks do not want to qualify; for short non-prime economic units. This can be done by loosening credit standards faster than other banks and/or, as shown in a Post 8, by offering to accept promissory notes with initial low monthly payments but upcoming large payment shocks (hopefully refinancing will be possible down the road). Both cases lead to a higher chance of default and so a higher probability of loss of net worth for a bank. The decline in the quality of assets may attract the attention of regulators.

- The proportion of liquid assets relative to illiquid assets declines faster than its peers.

- Its interbank debt will balloon rapidly as payments made on behalf the bank grow quickly, which pushes down its profitability and so its ability to build its capital base.

- The quality of its earnings declines. If a bank grants a lot of pay-option mortgages to non-prime economic units, these units will usually only pay part of the interest due. However, accrual accounting allows a bank to record the whole debt service due as received and to record “phantom profits.” This may again attract the attention of regulators if accrual interest income grows out of proportion (accrual accounting is not a problem per se and is a convenient means to smooth business operations if used properly).

Basically, if a bank grows faster than the rest of the industry, its CAMELS rating tends to increase relative to others and its interbank debt becomes unsustainable. Ultimately regulators will issue a cease and desist order. Note that if a bank grows fast by providing credit too non-prime clients at a premium interest rate, then, given interbank debt, its short-run profitability rises as leverage and ROA rise. However, such a bank will then experience massive losses in the near future that will lower rapidly profit and capital. As such, there are two limits to the monetary creation process induced by the swapping of promissory notes:

- The credit standards: if A considers that #1 does not meet the 3Cs of credit analysis, A will not accept #1 promissory note and so will not credit #1’s bank account (or #2’s).

- Regulation, but not through reserve requirements given that the Fed will provide all the reserves needed to fulfill the requirements, but rather through regulatory elements that impact CAMELS rating, that constrain the loosening of credit standards, and that limit to the types of assets banks can hold.

Moving in step

As noted in a Post 8, there is safety in numbers. As long as banks grow in step, that is, as long as they create bank accounts at about the same speed (and so grow their assets at the about same speed), they may not attract the attention of regulators:

- Interbank debt for a bank will not balloon out of control: requests to make payments on a bank’s behalf are offset by requests to make payments of behalf of others banks.

- Leverage may rise, at least until debt servicing starts, and liquidity may fall but all this occurs at the industry level so no bank is singled out.

As long as underwriting is done properly, ultimately, banks will make a profit and capital will be gained and so leverage will decline overtime. However, as explained in a Post 8, things may get out of hand if most banks aggressively pursue growth in market shares and search for yield.

A Side Note on Alternative Views of Banking: the Money Multiplier Theory and Financial Intermediation.

A now discredited view of monetary creation by banks argues that banks actively seek excess reserves to be able to provide credit. The logic goes as follows with a 10% reserve requirement ratio:

- The central bank injects excess reserves by buying $100 worth treasuries from bank A

- Reserves do not earn any interest so Bank A provides a credit of $100 to household #1 who makes a $100 payment to households #2 at bank B. Bank B now has $100 of extra bank account and $100 of extra reserves. Bank B has $90 of excess reserves. It grants a credit of $90 to household #3 who pays $90 to household #4 at bank C. Bank C has now $90 of extra reserves and $90 of extra bank account so excess reserves is $81, upon which Bank C provides $81 credit to household #5, etc. This continues until there are no excess reserves left in the banking system.

- The sum of bank accounts created is $100 by bank A, $90 by bank B, $81 by bank C, $72.9 by bank D, etc., which amounts to $1000: With $100 of excess reserves banks could create $1000 of bank accounts.

- Conclusion: bank credit is constrained by the quantity of excess reserves and the reserve requirement ratio. Both can be used by the central bank to target the money supply and ultimately inflation.

There are several issues with this view of how banks provide credit and so create monetary instruments:

- Step 1 never happens under normal monetary policy set up: any unwanted excess reserves is drained out of the banking system to prevent a fall of FFR to zero. Post 3 notes that banks have very little need for reserves. The Volker experiment tried to move toward reserve targeting with the goal of targeting money supply, but this was a failure.

- It is just not how banks operate (step 2): Banks are profit-seeking institutions, they do not wait for reserves to grant credit. They grant credit first and look for reserves after, in the same way a pizza shop prints coupons first and then make the pizzas as needed. Forcing banks to hold reserves just reduces their ROA, it is like a tax.

- Banks cannot force economic units to go into debt. Bank credit is demand driven so even if banks have a lot of reserves that does not improve their ability to provide credit. Bank A had to wait for #1 to show up before anything could happened. And while bank A could have tried to entice #1 to come to the bank for financing, ultimately it is #1 who decides to take a credit.

- Milton Friedman himself recognized the problem with this approach: “Given the monetary policy of supporting a nearly fixed pattern of rates on government securities [during WWII], the Federal Reserve System had no effective control over the quantity of high-powered money. It had to create whatever quantity was necessary to keep rates at that level. Though it is convenient to describe the process as running from an increase in high-powered money to an increase in the stock of money through deposit-currency and deposit-reserve ratio, the chain of influence in fact ran in the opposite direction—from the increase in the stock of money consistent with the specified pattern of rates and other economic conditions to the increment in high-powered money required to produce that increase.” (Friedman and Schwartz 1963, 566). There are two main problems with his view:

- He seems to view the WWII experience as a special case instead of the general case: central bank always targets interest rates, at least the FFR and at least within a band.

- His theoretical position is untenable: if causality is known with certainty to be reversed (money supply to reserves instead of reserves to money supply), then one cannot proceed as if the opposite was true because “it is convenient.”

Another view of banking is that banks lend “other people’s money.” People save and deposit money in the bank, and the bank proceeds to lend the money deposited. The post touched on this above but here are the problems:

- Banks do not lend the savings of households: bank do not temporarily take Paul’s funds and given them to Pierre.

- Banks do not lend reserves to non-banks: They do not look if Paul deposited enough cash before granting credit to Pierre.

- Banks are not in the business of lending anything they have: Pierre does not temporarily take cash from the bank, and, usually, does not give back cash to a bank when he services his debt.

- Savers can deposit cash, but savers are not the source of cash, cash comes from the Fed. And the Fed creates cash at the demand of banks so saving does not constraint credit.

Limits to monetary creation by the central bank and private banks

Finance is not a scarce resource as long as the government operates with an inconvertible currency. Banks and the central bank, can create an unlimited amount of monetary instruments whenever they want. While they can create an unlimited amount of monetary instruments, they will not for the following reasons:

- For central bank: under normal circumstances, the main limit to the reserve creation process is the need to maintain the overnight interbank rate positive, which basically implies that the central bank must supply whatever banks demand; no more, no less.

- For banks: core limits to the monetary creation process are profitability and regulatory concerns.

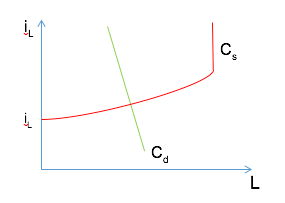

I will finish this post with a Figure that illustrates the points made above. The supply of credit is slightly upward sloping and then becomes vertical as banks ration credit given a set of credit standards. The supply slopes upward to reflect the fact that, at a point in time, as credit grows the creditworthiness of the remaining pool of acceptable economic units falls. A given set of credit standards defines what a minimum level of creditworthiness is and anybody below that level will not be granted credit (hence the vertical supply of credit). The demand for credit is downward sloping but not very elastic. As explained in Post 5, demand for credit by businesses is very insensitive to interest-rate conditions.

Figure 4. The market for bank credit

Done for Today! Next is inflation.

[Revised 8/6/2016]