By Eric Tymoigne

The last three posts have explained how the operations of banks are constrained by profitability and regulatory concerns, and how banks operate to try to bypass these constraints. It is now time to go into the details of how banks provide credit and payment services to the rest of the economy.

Monetary Creation by Banks: Credit and Payment Services

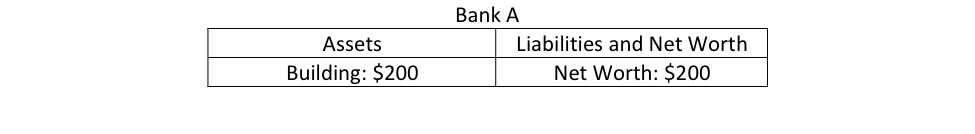

Bank A just opened for business and its balance sheet looks like this:

Now comes household #1 who wants to buy a house worth $100 from household #2. #1 sits down with a banker (a.k.a. loan officer) who asks a few questions regarding annual income, available assets, monetary balances, the downpayment #1 is willing to make, among others. The banker asks for documentations that corroborate the answers provided by #1.

Continue reading