Marshall Auerback’s appearance on BNN’s Business Day, November 15, 2012. Topics of discussion include impacts of a Grand Bargain. Click the image or here to watch on BNN’s site.

Marshall Auerback’s appearance on BNN’s Business Day, November 15, 2012. Topics of discussion include impacts of a Grand Bargain. Click the image or here to watch on BNN’s site.

The real weak link now in the Eurozone is Spain, where the data is a disaster. It is Greece writ large. And this is before Madrid, under Prime Minister Mariano Rajoy, has submitted to a new ECB program of agreed austerity in exchange for the ECB backstopping the nation’s bonds via a renewed Securities Market Program (SMP).

Posted in Marshall Auerback

Tagged banking crisis, Catalonia, debt crisis, Mariano Rajoy, spain

Germany’s Constitutional Court gave a green light on Wednesday for the country to ratify Europe’s new bailout fund, boosting hopes that the single currency bloc is finally putting in place the tools to resolve its three-year old debt crisis.

Marshall Auerback appeared on the September 6th episode of BNN’s Business Day discussing the ECB’s bond purchase plan. You can view it here.

This memorable scene in Misery is a perfect metaphor for the ECB’s much vaunted bond buying program.

In essence you have two distinct, but related problems: the solvency issue and the problem of deficient aggregate demand.

There appears to be an emerging consensus that the euro will survive, especially now that Mario Draghi has apparently grasped the nettle and persuaded his colleagues that the ECB is prepared to initiate unlimited purchases of national government bonds in order to underwrite their solvency. Of course, as usual

There appears to be an emerging consensus that the euro will survive, especially now that Mario Draghi has apparently grasped the nettle and persuaded his colleagues that the ECB is prepared to initiate unlimited purchases of national government bonds in order to underwrite their solvency. Of course, as usual

with the ECB, there’s a sting in the tail, the sting being additional “conditionality” (for which one can read more fiscal austerity) as a quid pro quo. It’s like dealing with Hannibal Lecter.

Re-reading Mr Draghi’s market-moving remarks last Thursday, one gains a sense that the European Central Bank chief recognizes that the ECB has a banking run on their hand. Most market participants have understandably focused on Mr Draghi’s pledge that the ECB was “ready to do whatever it takes” to preserve the single currency. “Believe me, it will be enough,” he told a conference in London.

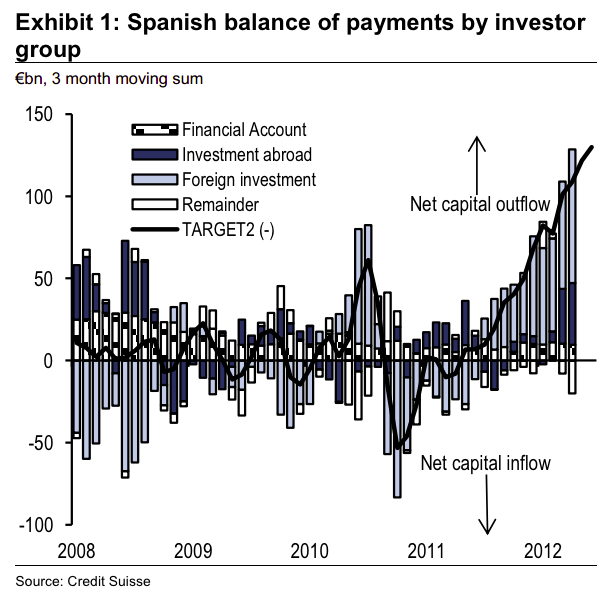

Just when you think that things can get no worse in Spain, they do. Take a look at this chart, courtesy of Credit Suisse via FT’s Alphaville

http://ftalphaville.ft.com/blog/2012/07/11/1080121/just-another-scary-spanish-capital-flight-chart/#comments

Yiagos Alexopoulos at Credit Suisse estimates that Spanish capital outflows are currently running at an annualised rate of 50 per cent of GDP. No question, the bank run is clearly accelerating, and one can easily understand why. The country is turning into a Little House of Economic Horrors. The alleged “rescue” of Madrid’s banks is a non-starter. 100 billion euros won’t begin to cover the scale of the problem on any honest accounting or “stress test” (and that’s before we get to the next phase of announced austerity measures). Continue reading

So for the short term, it appears we won’t have a “Grexit”, which has led many commentators to suggest (laughably) that a crisis has been averted. Typical of this sentiment is a headline in Bloomberg today “Greece avoids chaos; Big Hurdles Loom”. To paraphrase Pete Townsend, meet the new chaos, same as the old chaos. It is worth pondering how acceptance of the Troika’s program (even if cosmetic adjustments are made) will help hospitals get access to essential medical supplies (see here), whilst the government persists in enforcing a program which is killing its private sector by cutting spending and not paying legitimate bills, and an unemployment rate creeps towards 25 per cent and 50 per cent for youth. Continue reading