You have to wonder if the president ever hears from his commerce secretary these days. Friday’s GDP revisions by the Bureau of Economic Analysis should send a pretty strong signal that the economy is far from recovering, making clear that job killing spending cuts should be last thing on his mind:

You have to wonder if the president ever hears from his commerce secretary these days. Friday’s GDP revisions by the Bureau of Economic Analysis should send a pretty strong signal that the economy is far from recovering, making clear that job killing spending cuts should be last thing on his mind:

“While the headline number was well below expectations of 1.8%, what must be noted are the major revisions. Q1 2011 is now reported as +0.4%. That’s a major downward revision which demonstrates that QE2 was in fact doing nothing for growth and that the US is already at stall speed even without the negative impact of the European sovereign debt crisis and the debt ceiling fiasco. The double dip scare is real.” Ed Harrison, Credit Writedowns

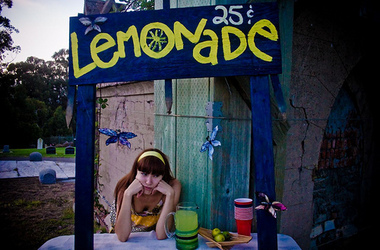

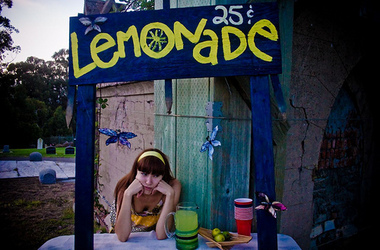

Unfortunately, the president doesn’t demonstrate any evidence that he’s heard this news. For all we know, he might have tasked Secretary Locke to go out and “truck, barter and trade” with the American people in an effort to win the future. So maybe instead of leveling with the president, Locke is out setting up lemon-aid stands across the country. Who knows?

Judging by the evidence available to me, I have to assume that Obama is either willfully ignorant of the dire situation or patently insane enough to believe that we are in the midst of a recovery. Or perhaps he is fully aware that we are on the verge of a fresh contraction, but thinks the best way to increase business activity is to drive up unemployment.

No, I’m sure Gary Locke is hard at work doing the sort of thing you would expect a cabinet level official to do, not off trying to inspire confidence in the business community through conspicuous acts of commerce. The president has heard the news alright. The problem lies in his commitment to, above all else, selling us a phony crisis:

“Now, every family knows that a little credit card debt is manageable. But if we stay on the current path, our growing debt could cost us jobs and do serious damage to the economy. More of our tax dollars will go toward paying off the interest on our loans. Businesses will be less likely to open up shop and hire workers in a country that can’t balance its books. Interest rates could climb for everyone who borrows money – the homeowner with a mortgage, the student with a college loan, the corner store that wants to expand. And we won’t have enough money to make job-creating investments in things like education and infrastructure, or pay for vital programs like Medicare and Medicaid.” President Obama, July 25, 2011

Here he appeals to our fear of the unknown, leading us to conclude that if we don’t reduce the deficit now we will pay dearly tomorrow. This passage is especially troubling given its blatant disregard for the truth. The federal government is not a household – he has yet again committed the classic fallacy of composition. The public debt is not analogous to Joe the Plumber’s Visa card. Not even close. In fact, they are pretty much opposite each other: public debt is private savings, while credit cards are tools for private sector deficit spending. From there, he tries to convince us that as deficits increase more of the spending pie will go towards debt service. Sure, if the economy does not grow with the deficit that might be the case.

So what? Well, the connection he is hoping we’ll make is that this will eventually leading to exploding deficits and increasing interest rates. He seems to forget that we have a sovereign currency, and we spend by crediting bank accounts regardless of the sentiment of the bond market. We decide how much to pay in interest, not bond vigilantes. And he finishes the argument by asserting that we will not “have enough” money to pay for Medicare and Medicaid, which is patently false. To pay for those programs you simply credit the bank accounts of recipients. The money does not exist before that transaction, so it is nonsense to suggest you can ever lack the funds to make the payments. Of course, you can fail to make the keystrokes necessary to initiate the transaction, but that is not insolvency only political failure.

Up until now, I’ve been inclined to give Obama the benefit of the doubt. I figured that while he does not seem to understand how the modern economy functions, at least he is in earnest over his deficit fears. After all, he has surrounded himself with advisers that lack the insight to make effective policy recommendations so why should he know any better? But, as Dean Baker points out he is apparently unaware of the actual size of the deficit, a matter which he has chosen to make the central pillar of his four years in the Oval Office. In a gaffe, the president claimed that he inherited a deficit that was approaching $1 trillion for his inaugural year, while the CBO’s projections placed it at the much lower figure of $198 billion.

That’s a little too wide of the goalposts for my comfort, and it leads me to speculate whether or not he really believes his own rhetoric. After all, if you desperately want to convince Americans that hacking away at the social safety net is a good idea, you would think you’d have your facts straight. If he really believes the deficit is too large, then you wouldn’t you think he would know just how large it is?

Unless, of course, you let slip those kind of statements on purpose. Inheriting a trillion dollar budget deficit from your predecessor sounds a lot more urgent than a couple billion. And if you want to convince your constituency to roll over and accept cuts in the very programs that have been core to the Democratic party for the better part of a century, you had better be sure to make them believe those cuts to be absolutely necessary.