Eric Cantor weighed in today at Quora on the balanced budget Amendment. This is what he said:

Once created, government programs build constituencies of special interests determined to keep the money flowing, whether or not the particular program is effective. There have been many times when the House has placed wasteful and duplicative programs on the chopping block, only to see pressure from the spending lobby win the day in the Senate.

Near-term spending cuts are necessary to alter the course, but they will not be enough without long-term changes. Likewise, promises of cuts 10 years from now mean little without a way to enforce them. The only way to truly guarantee delivery from future elected officials is for the Constitution to demand it.

To that end, the House has scheduled a vote on a balanced budget amendment that would require supermajorities in both chambers to run a deficit, raise the debt ceiling, raise taxes and spend more than 18% of the GDP. With the balanced budget movement gaining momentum, members of the spending lobby want to argue that Congress and the President already have the ability to control spending. Ability and discipline are not the same. If Washington actually had the discipline to live within its means over the long-term, every American citizen would not owe $46,000 toward the national debt.

In my view, the importance of these upcoming votes cannot be overstated. The adoption of a Balanced Budget Amendment would make reckless borrowing a thing of the past, and will ensure that our children enjoy futures full of opportunity.

Democrats and Republicans should join together to do the right thing, pass this amendment, and make a real difference for the future of our country.

Continue reading →

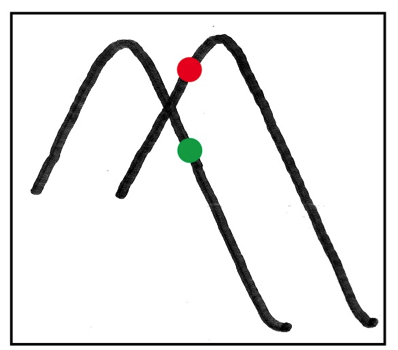

The squiggle illustrated here may look like the Ebola virus, but it isn’t. The resemblance is just an eerie coincidence. It’s actually a graphical snapshot of the classic “Predator-Prey Model.” This mathematical exercise, first developed in the 1920s, serves as the introductory basis for a more recent NASA funded effort which produced—amidst a brief flurry of news and commentary last spring—the startling conclusion that a complete collapse of modern civilization may now be “irreversible.”

The squiggle illustrated here may look like the Ebola virus, but it isn’t. The resemblance is just an eerie coincidence. It’s actually a graphical snapshot of the classic “Predator-Prey Model.” This mathematical exercise, first developed in the 1920s, serves as the introductory basis for a more recent NASA funded effort which produced—amidst a brief flurry of news and commentary last spring—the startling conclusion that a complete collapse of modern civilization may now be “irreversible.”