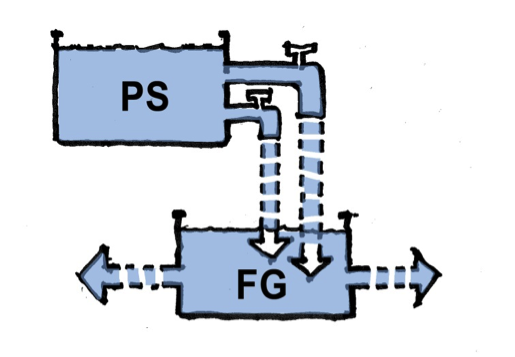

Jesse Myerson created a firestorm over mainstream media with his Rolling Stone piece “Five Economic Reforms Millennials Should Be Fighting For”. I’d like to address the very first of these reforms, the Job Guarantee (JG), as Myerson references my proposal for running the program through the non-profit sector and discussed it in several interviews on Tuesday.

Last month, I did a podcast with him about this program. Let me focus on some questions that keep popping up about the proposal, e.g., Josh Barro’s Business Insider piece.