By Fadhel Kaboub

I was recently asked to testify before the Ohio House of Representative’s Tax Reform Legislative Study Committee. I urged the committee to carefully consider the long-term negative consequences of the regressive tax policy for the State of Ohio and its residents. What follows is the gist of my testimony along with some of the data that I presented to the committee.

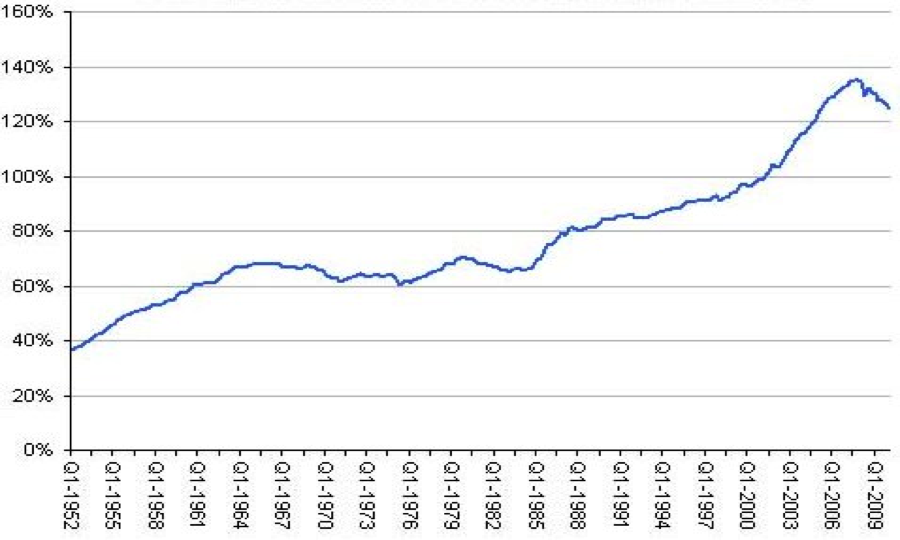

Working class families continue to suffer from real income growth stagnation since the 1980s despite a steady rise in productivity (Figure 1). However, in order to continue supporting the growth of the U.S. economy, household consumption (the engine of GDP growth in the U.S.) became increasingly dependent on access to credit (credit card debt, student loans, car loans, home equity lines of credit, subprime loans, reverse mortgage loans, etc.). That is why household debt as a percent of disposable income has peaked at almost 140% in 2007 (Figure 2). The proper response to this problem is an increase in disposable income rather than easier access to credit.

Economic growth is primarily driven by consumer demand (over 70% of GDP); therefore, relying on household debt to fuel consumption is unsustainable. In the absence of a federally funded Job Guarantee program, state-level progressive tax policy can intervene to lighten the burden on the middle class and on the most economically vulnerable members of society.

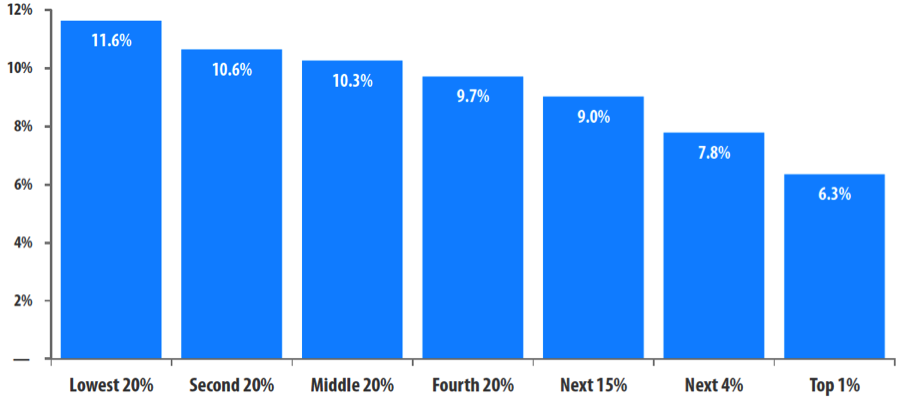

The least economically privileged families in Ohio are contributing a larger share of their income (11.6%) to State and Local taxes than the top 1% income earners who only pay 6.3% (Figure 3). These numbers include the federal deduction offset.

Figure 3: Ohio State and local taxes as a share of personal income (Source: Institute on Taxation and Economic Policy (January 2013).)

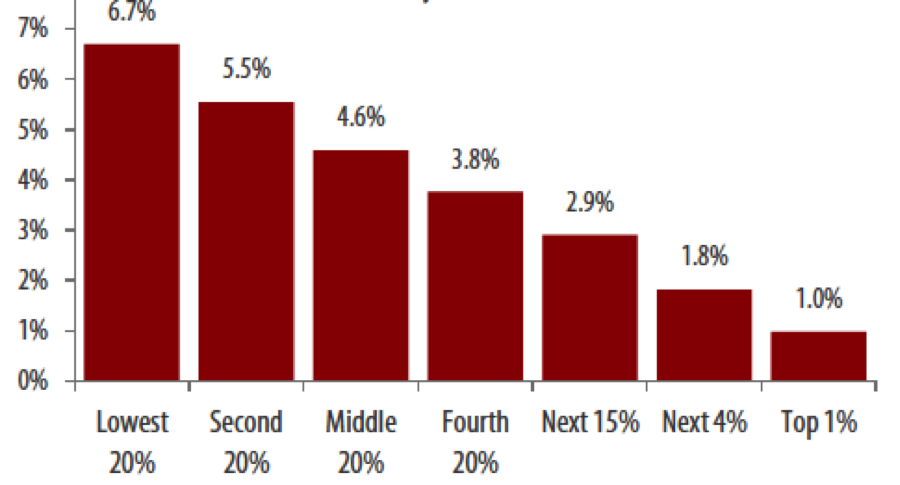

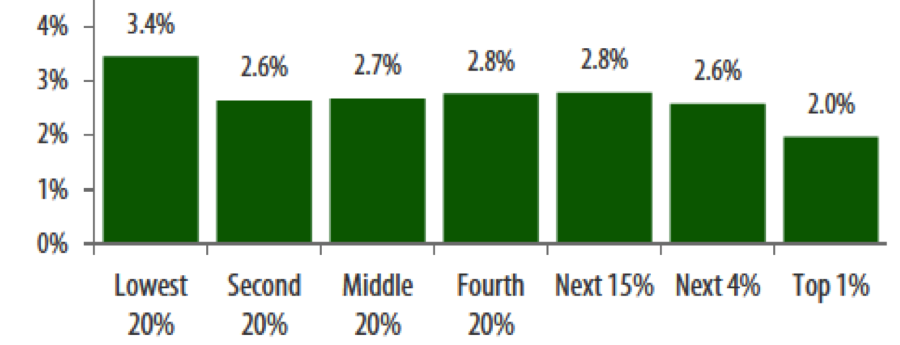

More specifically, if we breakdown the overall State and Local tax structure, we find that this regressive tax burden is prevalent in the cases of Sales and Excise tax as well as Property tax (Figures 4 and 5). The only progressive component is the State and Local personal income tax (Figure 6).

Figure 4: Sales & excise sax share of family income in Ohio (Source: Institute on Taxation and Economic Policy (January 2013))

Figure 5: Property tax share of family income in Ohio (Source: Institute on Taxation and Economic Policy (January 2013).)

Figure 6: Personal income tax (State & Local) share of family income in Ohio (Source: Institute on Taxation and Economic Policy (January 2013).)

I urged the State legislators to preserve Ohio’s Earned Income Tax Credit policy, and also to enhance its effectiveness by making income tax credits refundable for families earning less than $30,000 a year (the current income tax credits are nonrefundable for families earning less than $10,000).

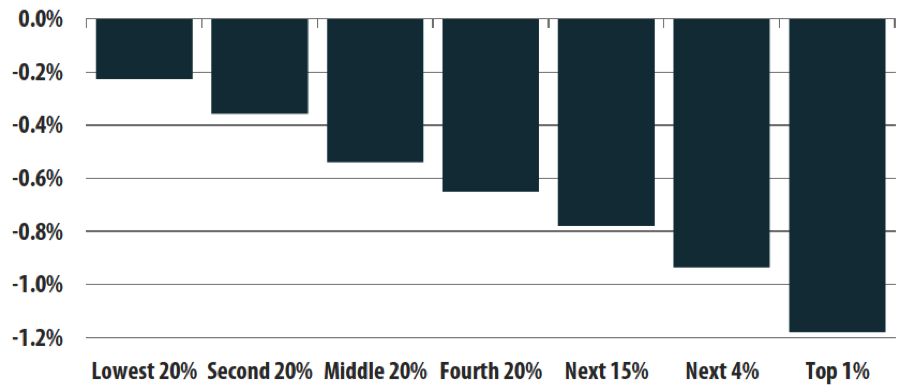

Recent tax cuts in Ohio have been excessively more generous to the rich than to the poor (Figure 7). This is not simply bad social policy, but most importantly a very misguided economic policy.

Figure 7: Tax cut as a share of income in Ohio (Source: Institute on Taxation and Economic Policy (January 2013).)

Businesses will not create new jobs simply because they receive a tax break. They will only hire new employees when sales and revenues increase. In other words, new jobs are created when demand for goods and services increases. This is especially true during periods of sluggish economic growth. No businessperson will tell you that he or she is going to hire more workers to produce more stuff that nobody is going to buy. No business will want to accumulate unsold inventory just because there is a tax incentive.

Tax cuts not only fail to create jobs, but they are also likely to undermine the long-term fundamental basis for economic growth. The decline in tax revenues has meant spending cuts in the most important investment areas of the State’s economy: education, health, public infrastructure, transportation, etc.

For the sake of economic prosperity and the wellbeing of all Ohioans, I urged the committee to reverse the regressive nature of the tax structure and to empower the State of Ohio to invest in education, vocational training, public health, public infrastructure, public transportation, and sustainable energy policies. These are the most important assets that will create jobs and bring business to Ohio in the long-term.

Unfortunately, Ohio is not unique in terms of its regressive tax policy. The study that I cite here shows that this is essentially the norm across all 50 states. This ought to be a wake-up call to all the grassroots activists to double our efforts to address one of the root causes of economic inequality in the United States.

* Dr. Fadhel Kaboub is an Assistant Professor of Economics at Denison University (OH) and a Research Associate at the Levy Economics Institute (NY) and the Center for Full Employment and Price Stability (MO). His research focuses on job creation programs, monetary theory and policy, and the political economy of the Middle East. For more on his work, visit www.kaboub.com

12 responses to “Against Regressive Taxation”