By Stephanie Kelton

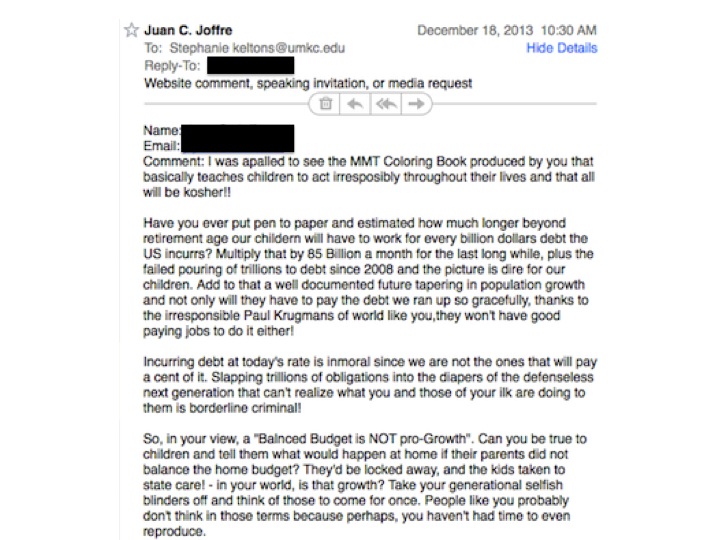

I get a huge volume of e-mail, but I don’t get the kind of hostile stuff that guys like Joe Weisenthal and Paul Krugman sometimes joke about. I got one today, though, and boy is this guy steaming over my MMT coloring book! Here’s the message:

It’s hard not to sympathize with a guy like this. He apparently has kids, and he’s scared to death that his children and grandchildren will suffer real harm because Washington won’t get its fiscal house in order. And why wouldn‘t he think that? I mean, really. Politicians on both sides of the aisle have spent decades labeling the government’s finances a “fiscal train wreck” that will leave future generations with a “crushing burden of debt.” The mainstream media hypes these fears on a daily basis, and even NPR appears to be shilling for the debt scolds.

So it’s no wonder a guy like this is blasting me. He had probably never before encountered anything that rejects, so forcefully, the entire compilation of debt and deficit tropes.

He doesn’t strike me as a particularly open-minded guy, but I think I’ll send him this list of suggested readings anyhow. Maybe he hasn’t finished his holiday shopping.

Recommended Inoculation

Freedom From Debt by Frank Newman

7 Deadly Innocent Frauds of Economic Policy by Warren Mosler

Understanding Modern Money by L. Randall Wray

Also these short articles:

Does Debt Matter? by Robert Skidelsky

Balanced Budgets and Depressions by Frederick Thayer

* I did bother to reproduce, by the way. These are my little burdens of joy. Both will find copies of the coloring book in their stockings on Christmas morning.

Follow me on Twitter: www.twitter.com/stephaniekelton