By Michael Hudson

Financial strategists do not intend to let today’s debt crisis go to waste. Foreclosure time has arrived. That means revolution – or more accurately, a counter-revolution to roll back the 20th century’s gains made by social democracy: pensions and social security, public health care and other infrastructure providing essential services at subsidized prices or for free. The basic model follows the former Soviet Union’s post-1991 neoliberal reforms: privatization of public enterprises, a high flat tax on labor but only nominal taxes on real estate and finance, and deregulation of the economy’s prices, working conditions and credit terms.

What is to be reversed is the “modern” agenda. The aim a century ago was to mobilize the Industrial Revolution’s soaring productivity and technology to raise living standards and use progressive taxation, public regulation, central banking and financial reform to distribute wealth fairly and make societies more equal. Today’s financial aim is the opposite: to concentrate wealth at the top of the economic pyramid and lower labor’s returns. High finance loves low wages.

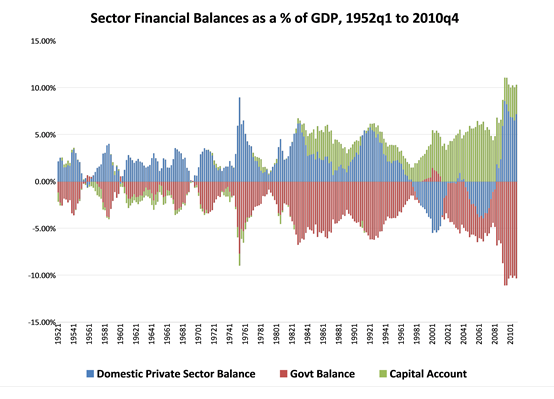

The political lever to achieve this program is financial. The European Union (EU) constitution prevents central banks from financing government deficits, leaving this role to commercial banks, paying interest to them for creating credit that central banks readily monetize for themselves in Britain and the United States. Governments are to go into debt to bail out banks for loans gone bad – as do more and more loans as finance impoverishes the economy, stifling its ability to pay. Yet as long as we live in democracies, voters must agree to pay. Governments are sovereign and debt is ultimately a creature of the law and courts.

But first they need to understand what is happening. From the bankers’ perspective, the economic surplus is what they themselves end up with. Rising consumption standards and even public investment in infrastructure are seen as deadweight. Bankers and bondholders aim to increase the surplus not so much by tangible capital investment increasing the overall surplus, but by more predatory means, headed by rolling back labor’s gains and stiffening working conditions while gaining public subsidy. Banks “create wealth” by providing more credit (that is, debt leverage) to bid up asset prices for real estate and enterprises already in place – assets that either are being foreclosed on or sold off under debt pressure by private owners or governments. One commentator recently characterized the latter strategy of privatization as “tantamount to selling the family silver only to have to rent it back in order to eat dinner.” [1]

Fought in the name of free markets, this counter-revolution rejects the classical ideal of markets free of unearned income paid to special interests. The financial objective is to squeeze out a surplus by maximizing the margin of prices over costs. Opposing government enterprise and infrastructure as the road to serfdom, high finance is seeking to turn public infrastructure into rent-extracting tollbooths to extract economic rent (the “free lunch economy”), while replacing labor unions with non-union labor so as to work it more intensively.

This new road to neoserfdom is an asset grab. But to achieve it, the financial sector needs a political grab to replace democracy with financial technocrats. Their job is to pretend that there is no revolution at all, merely an increase in “efficiency,” “creating wealth” by debt-leveraging the economy to the point where the entire surplus is paid out as interest to the financial managers who are emerging as Western civilization’s new central planners.

Frederick Hayek’s Road to Serfdom portrayed a dystopia of public officials seeking to regulate the economy. In attacking government so one-sidedly, his ideological extremism sought to replace the checks and balances of mixed economies with a private sector “free” of regulation and consumer protection. His vision was of a post-modern economy “free” of the classical reforms to bring market prices into line with cost value. Instead of purifying industrial capitalism from the special rent extraction privileges bequeathed from the feudal epoch, Hayek’s ideology opened the way for unchecked financial power to make a travesty of “free markets.”

The European Union’s financial planners claim that Greece and other debtor countries have a problem that is easy to cure by imposing austerity. Pension savings, Social Security and medical insurance are to be downsized so as to “free” more debt service to be paid to creditors. Insisting that Greece only has a “liquidity problem,” European Central Bank (ECB) extremists deem an economy “solvent” as long as it has assets to privatize. ECB executive board member Lorenzo Bini Smaghi explained the plan in a Financial Times interview:

FT: Otmar Issing, your former colleague, says Greece is insolvent and it “will not be physically possible” for it to repay its debts. Is he right?

LBS: He is wrong because Greece is solvent if it applies the programme. They have assets that they can sell and reduce their debt and they have the instruments to change their tax and expenditure systems to reduce the debt. This is the assessment of the IMF, it is the assessment of the European Commission.

Poor developing countries have no assets, their income is low, and so they become insolvent easily. If you look at the balance sheet of Greece, it is not insolvent.

The key problem is political will on the part of the government and parliament. Privatisation proceeds of €50bn, which is being talked about – some mention more – would reduce the peak debt to GDP ratio from 160 per cent to about 140 per cent or 135 per cent and this could be reduced further. [2]

A week later Mr. Bini Smaghi insisted that the public sector “had marketable assets worth 300 billion euros and was not bankrupt. ‘Greece should be considered solvent and should be asked to service its debts,’ … signaling that the bank remained firmly opposed to any plan to allow Greece to stretch out its debt payments or oblige investors to accept less than full repayment, a so-called haircut.” [3] Speaking from Berlin, he said that Greece “was not insolvent.” It could pay off its bonds owed to German bankers ($22.7 billion), French bankers ($15 billion) and the ECB (reported to be on the hook for $190 billion) by selling off public land and ports, water and sewer rights, ownership of the telephone system and other basic infrastructure. In addition to getting paid in full and receiving high interest rates reflecting “market” expectations of non-payment, the banks would enjoy a new credit market financing privatization buy-outs.

Warning that failure to pay would create windfall gains for speculators who had bet that Greece would default, Mr. Bini Smaghi refused to acknowledge the corollary: to pay the full amount would create windfalls for those who bet that Greece would be forced to pay. He also claimed that: “Restructuring of Greek debt would … discourage Greece from modernizing its economy.” But the less debt service an economy pays, the more revenue it has to invest productively. And to “solve” the problem by throwing public assets on the market would create windfalls for distress buyers. As the Wall Street Journal put matters bluntly: “Greece is for sale – cheap – and Germany is buying. German companies are hunting for bargains in Greece as the debt-stricken government moves to sell state-owned assets to stabilize the country’s finances.” [4]

Rather than raising living standards while creating a more egalitarian and fair society, the ECB’s creditor-oriented “reforms” would roll the time clock back to oligarchy. Not the post-feudal oligarchy of landlords owning land conquered militarily, but a financial oligarchy accumulating banking claims and bonds growing inexorably and exponentially, leaving little over for the rest of the economy to invest or consume.

The distinction between illiquidity and insolvency

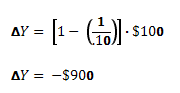

If a homeowner loses his job and cannot pay his mortgage, he must sell the house or see the bank foreclose. Is he insolvent, or merely “illiquid”? If he merely has a liquidity problem, a loan will help him earn the funds to pay down the debt. But if he falls into the negative equity that now plagues a quarter of U.S. real estate, taking on more loans will only deepen his net deficit. Ending this process by losing his home does not mean that he is merely illiquid. He is in distress, and is suffering from insolvency. But to the ECB this is merely a liquidity problem.

The public balance sheet includes land and infrastructure as if they are surplus assets that can be forfeited without fundamentally changing the owner’s status or social relations. In reality it is part of the means of survival in today’s world, at least survival as part of the middle class.

For starters, renegotiating his loan won’t help an insolvency situation such as the jobless homeowner above. Lending him the money to pay the bank interest (along with late fees and other financial penalties) or stretching out the loan merely will add to the debt balance, giving the foreclosing bank yet a larger claim on whatever property the debtor may have available to grab.

But the homeowner is in danger of being homeless, living on the street. At issue is whether solvency should be defined in the traditional common-sense way, in terms of the ability of income to carry one’s current obligations, or a purely balance-sheet approach taken by creditors seeking to extract payment by stripping assets. This is Greece’s position. Is it merely a liquidity problem if the government is told to sell off $50 billion in prime tourist sites, ports, water systems and other public assets in order to pay foreign creditors?

At issue is language regarding the legal rights of creditors vis-à-vis debtors. The United States has long had a body of law regarding this issue. A few years ago, for instance, the real estate speculator Sam Zell bought the Chicago Tribune in a debt-leveraged buyout. The newspaper soon went broke, wiping out the employees’ stock ownership plan (ESOP). They sued under the fraudulent conveyance law, which says that if a creditor makes a loan without knowing how the debtor can pay in the normal course of business, the loan is assumed to have been made with the intent of foreclosing on property, and is deemed fraudulent.

This law dates from colonial times, when British speculators eyed rich New York farmland. Their ploy was to extend loans to farmers, and then call in the loans when the farmer’s ability to pay was low, before the crop was harvested. This was indeed a liquidity problem – which financial opportunists turned into an asset grab. Some lenders, to be sure, created a genuine insolvency problem by making loans beyond the ability of the farmers to pay, and then would foreclose on their land. The colonies nullified such loans. Fraudulent conveyance laws have been kept on the books since the United States won its independence from Britain.

Creditors today are using debt leverage to force Greece to sell off its public domain – having extended credit beyond its ability to pay. So the question now being raised is whether the nation should be deemed “solvent” if the only way to carry its public debt (that is, roll it over by replacing bad old loans with newer and more inexorable obligations) is to forfeit its land and basic infrastructure. This would fundamentally alter the relationship between public and private sectors, replacing its mixed economy with a centrally planned one – planned by financial predators with little care that the economy is polarizing between rich and poor, creditors and debtors.

The financial road to serfdom

Financial lobbyists are turning the English language – and economic terminology throughout the world – into a battlefield. Creditors are to be permitted to take the assets of insolvent debtors – from homeowners and companies to entire nations – as if this were a normal working of “the market” and foreclosure was simply a way to restore “liquidity.” As for “solvency,” the ECB would strip Greece clean of its public sector’s assets. Bank officials have spoken of throwing potentially 150 billion euros of property onto the market.

Most people would think of this as a solvency problem. Solvency means the ability to maintain the kind of society one has, with existing public/private checks and balances and living standards. It is incompatible with scaling down pensions, Social Security and medical insurance to save bondholders and bankers from taking a loss. The latter policy is nothing less than a political revolution.

The asset stripping that Europe’s bankers are demanding of Greece looks like a dress rehearsal to prevent the “I won’t pay” movement from spreading to “Indignant Citizens” movements against financial austerity in Spain, Portugal and Italy. Bankers are trying to block governments from writing down debts, stretching out loans and reducing interest rates.

When a nation is directed to replace its mixed economy by transferring ownership of public infrastructure and enterprises to a financial class (mainly foreign), this is not merely “restoring solvency” by using long-term assets to pay short-term debts to maintain its balance-sheet net worth. It is a radical transformation to a centrally planned economy, shifting control out of the hands of elected representatives to those of financial managers whose time frame is short-term and extractive, not long-term and protective of social equity and basic needs.

Creditors are demanding a political transformation to replace democratic lawmakers with technocrats appointed by foreign bankers. When the economic surplus is pledged to bankers rather than invested at home, we are not merely dealing with “insolvency” but with an aggressive attack. Finance becomes a continuation of war, by economic means that are to be politicized. Acting on behalf of the commercial banks (from which most of its directors are drawn, and to which they intend to “descend from heaven” to take their rewards after serving their financial class), the European Central Bank insists on a political revolution to replace democratic government by a technocratic elite – not of industrial engineers, but of “financial engineers,” a polite name for asset stripping financial warriors. If Greece does not comply, they threaten to wreak domestic financial havoc by “pulling the plug” on Greek banks. This “carrot and stick” approach threatens that if Greece does not sign on, the ECB and IMF will withhold loans needed to keep its banking system solvent. The “carrot” was provided on May 31 they agreed to provide $86 billion in euros if Greece “puts off for the time being a restructuring, hard or soft,” of its public debt. [5]

It is a travesty to present this revolution simply as a financial exercise in solving the “liquidity problem” as if it were compatible with Europe’s past four centuries of political and classical economic reforms. This is why the Syntagma Square protest in front of Parliament has been growing each week, peaking at over 70,000 last Sunday, June 5.

Some protestors drew a parallel with the Wisconsin politicians who left the state to prevent a quorum from voting on the anti-labor program that Governor Walker tried to ram through. The next day, on June 6, thirty backbenchers of Prime Minister George Papandreou’s ruling Panhellenic Socialist party (Pasok) were joined by some of his own cabinet ministers threatening “to resign their parliamentary seats rather than vote through measures to cut thousands of public sector jobs, increase taxes again and dispose of €50bn of state assets, according to party insiders. ‘The biggest issue for the party is stringent cuts in the public sector … these go to the heart of Pasok’s model of social protection by providing jobs in state entities for its supporters,’ said a senior Socialist official.” [6]

Seeing the popular reluctance to commit financial suicide, Conservative Opposition leader Antonis Samaras also opposed paying the European bankers, “demanding a renegotiation of the package agreed last week with the ‘troika’ of the EU, IMF and the European Central Bank.” It was obvious that no party could gain popular support for the ECB’s demand that Greece relinquish popular rule and “appoint experienced technocrats to half a dozen essential ministries to implement the EU-IMF programme.” [7]

ECB President Trichet depicts himself as following Erasmus in bringing Europe beyond its “strict concept of nationhood.” This is to be done by replacing elected officials with a bureaucracy of cosmopolitan banker-friendly planners. The debt problem calls for new “monetary policy measures – we call them ‘non standard’ decisions, strictly separated from the ‘standard’ decisions, and aimed at restoring a better transmission of our monetary policy in these abnormal market conditions.” The task at hand is to make these conditions a new normalcy – and re-defining solvency to reflect a nation’s ability to pay debts by selling the public domain.

The ECB and EU claim that Greece is “solvent” as long as it has assets to sell off. But if populations in today’s mixed economies think of solvency as existing under existing public/private proportions, they will resist the financial sector’s attempt to proceed with buyouts and foreclosures until it possesses all the assets in the world, all the hitherto public and corporate assets and those of individuals and partnerships.

To minimize opposition to this dynamic the financial sector’s pet economists understate the debt burden, pretending that it can be paid without disrupting economic life and, in the Greek case for example, by using “mark to model” junk accounting and derivative swaps to simply conceal its magnitude. Dominique Strauss-Kahn at the IMF claims that the post-2008 debt crisis is merely a short-term “liquidity problem” and one of lack of “confidence,” not insolvency reflecting an underlying inability to pay. Banks promise that everything will be all right when the economy “returns to normal” – as if it can “borrow its way out of debt,” Bernanke-style.

This is what today’s financial warfare is about. At issue is the financial sector’s relationship to the “real” economy. From the latter’s perspective the proper role of credit – that is, debt – is to fund productive capital investment and spending, because it is out of the economic surplus that debts are paid. This requires a financial regulatory system and tax system to maximize growth. But that is precisely the fiscal policy that today’s financial sector is fighting against. It demands preferential tax-deductibility for interest to encourage debt financing rather than equity. It has disabled truth-in-lending laws and regulations to keeping interest rates and fees in line with costs of production. And it blocks governments from having central banks to freely finance their own operations and provide economies with money. And to cap matters it now demands that democratic society yield to centralized authoritarian financial rule.

Finance and democracy: from mutual reinforcement to antagonism

The relationship between banking and democracy has taken many twists over the centuries. Earlier this year, democratic opposition to the ECB and IMF attempt to impose austerity and privatization selloffs succeeded when Iceland’s President Grímsson insisted on a national referendum on the Icesave debt payment that Althing leaders had negotiated with Britain and the Netherlands (if one can characterize abject capitulation as a real negotiation). To their credit, a heavy 3-to-2 majority of Icelanders voted “No,” saving their economy from being driven into the debt peonage.

Democratic action historically has been needed to enforce debt collection. Until four centuries ago royal treasuries typically were kept in the royal bedroom, and loans to rulers were in the character of personal debts. Bankers repeatedly found themselves burned, especially by Habsburg and Bourbon despots on the thrones of Spain, Austria and France. Loans to such rulers were liable to expire upon their death, unless their successors remained dependent on these same financiers rather than turning to their rivals. The numerous bankruptcies of Spain’s autocratic Habsburg ruler Charles V exhausted his credit, preventing the nation from raising funds to defeat the rebellious Low Countries to the north.

The problem facing bankers was how to make loans permanent national obligations. Solving this problem gave an advantage to parliamentary democracies. It was a major factor enabling the Low Countries to win their independence from Habsburg Spain in the 16th century. The Dutch Republic committed the entire nation to pay its public debts, binding the people themselves, through their elected representatives who earmarked taxes to their creditors. Bankers saw parliamentary democracy as a precondition for making sound loans to governments. This security for bankers could be achieved only from electorates having at least a nominal voice in government. And raising war loans was a key element in military rivalry in an epoch when the maxim for survival was “Money is the sinews of war.”

As long as governments remained despotic, they found that their ability to incur more debt was limited. At this time “the legal position of the King qua borrower was obscure, and it was still doubtful whether his creditors had any remedy against him in case of default.” [8] Earlier Dutch-English financing had not satisfied creditors on this count. When Charles I borrowed 650,000 guilders from the Dutch States-General in 1625, the two countries’ military alliance against Spain helped defer the implicit constitutional struggle over who ultimately was liable for British debts.

The key financial achievement of parliamentary government was thus to establish nations as political bodies whose debts were not merely the personal obligations of rulers, but truly public and binding regardless of who occupied the throne. This is why the first two democratic nations, the Netherlands and Britain after its 1688 dynastic linkage between Holland and Britain in the person of William I, and the emergence of Parliamentary authority over public financing. They developed the most active capital markets and became Europe’s leading military powers. “A funded debt could not be formed so long as the King and Parliament were fighting for the mastery,” concludes the financial historian Richard Ehrenberg. “It was only after the [1688] revolution that the English State became what the Dutch Republic had long been – a real corporation of individuals firmly associated together, a permanent organism.” [9]

In sum, nations emerged in their modern form by adopting the financial characteristics of democratic city states. The financial imperatives of 17th-century warfare helped make these democracies victorious, for the new national financial systems facilitated military spending on a vastly extended scale. Conversely, the more despotic Spain, Austria and France became, the greater the difficulty they found in financing their military adventures. Austria was left “without credit, and consequently without much debt” by the end of the 18th century, the least credit-worthy and worst armed country in Europe, as Sir James Steuart noted in 1767 [10]. It became fully dependent on British subsidies and loan guarantees by the time of the Napoleonic Wars.

The modern epoch of war financing therefore went hand in hand with the spread of parliamentary democracy. The situation was similar to that enjoyed by plebeian tribunes in Rome in the early centuries of its Republic. They were able to veto all military funding until the patricians made political concessions. The lesson was not lost on 18th-century Protestant parliaments. For war debts and other national obligations to become binding, the people’s elected representatives had to pledge taxes. This could be achieved only by giving the electorate a voice in government.

It thus was the desire to be repaid that turned the preference of creditors away from autocracies toward democracies. In the end it was only from democracies that they were able to collect. This of course did not necessarily reflect liberal political convictions on the part of creditors. They simply wanted to be paid.

Europe’s sovereign commercial cities developed the best credit ratings, and hence were best able to employ mercenaries. Access to credit was “their most powerful weapon in the struggle for their freedom,” notes Ehrenberg, in an age whose “growth in the use of fire arms had forced them to surround themselves with stronger fortifications.” [11] The problem was that “Anyone who gave credit to a prince knew that the repayment of the debt depended only on his debtor’s capacity and will to pay. The case was very different for the cities, who had power as overlords, but were also corporations, associations of individuals held in common bond. According to the generally accepted law each individual burgher was liable for the debts of the city both with his person and his property.”

But the tables are now turning, from Icelandic voters to the large crowds gathering in Syntagma Square and elsewhere throughout Greece to oppose the terms on which Prime Minister Papandreou has been negotiating an EU bailout loan for the government – to bail out German and French banks. Now that nations are not raising money for war but to subsidize reckless predatory bankers, Jean-Claude Trichet of the ECB recently suggested taking financial policy out of the hands of democracy.

But if a country is still not delivering, I think all would agree that the second stage has to be different. Would it go too far if we envisaged, at this second stage, giving euro area authorities a much deeper and authoritative say in the formation of the country’s economic policies if these go harmfully astray? A direct influence, well over and above the reinforced surveillance that is presently envisaged? …

At issue is sovereignty itself, when it comes to government responsibility for debts. And in this respect the war being waged against Greece by the European Central Bank (ECB) may best be seen as a dress rehearsal not only for the rest of Europe, but for what financial lobbyists would like to bring about in the United States.

[1] Yves Smith, “Wisconsin’s Walker Joins Government Asset Giveaway Club (and is Rahm Soon to Follow?)” Naked Capitalism, February 22, 2011.

[2] Ralph Atkins, “Transcript: Lorenzo Bini Smaghi,” Financial Times, May 30, 2011.

[3] Jack Ewing, “In Asset Sale, Greece to Give Up 10% Stake in Telecom Company,” The New York Times, June 7, 2011.

[4] Christopher Lawton and Laura Stevens, “Deutsche Telekom, Others Look to Grab State-Owned Assets at Fire-Sale Prices,” Wall Street Journal, June 7, 2011.

[5] Landon Thomas Jr., “New Rescue Package for Greece Takes Shape,” The New York Times, June 1, 2011.

[6] Kerin Hope, “Rift widens on Greek reform plan,” Financial Times, June 7, 2011.

[7] Ibid. See also Kerin Hope, “Thousands protest against Greek austerity,” Financial Times, June 6, 2011: “‘Thieves, thieves … Where did our money go?’ the protesters shouted, blowing whistles and waving Greek flags as riot police thickened ranks around the parliament building on Syntagma square in the centre of the capital. … Banners draped nearby read ‘Take back the new measures’ and ‘Greece is not for sale’ – a reference to the government’s plans to include state property and real estate for tourist development in the privatisation scheme.”

[8] Charles Wilson, England’s Apprenticeship: 1603-1763 (London: 1965), p. 89.

[9] Richard Ehrenberg, Capital and Finance in the Age of the Renaissance (1928), p. 354.

[10] James Steuart, Principles of Political Oeconomy (1767), p. 353.

[11] Ehrenberg, op. cit., pp. 44f., 33.