By William K. Black

Kilkenny, Ireland: November 7, 2014

Kilkenomics, being a festival of economists and comedians, has long reflected the economic consensus that austerity in response to a Great Recession is economic malpractice akin to bleeding a patient to make him healthy. One of the great changes in Europe in the last month is that the number of economic voices willing to make this same point have grown rapidly. Germany’s “there is no alternative” (TINA) to austerity claims were always absurd, but now many more European voices are willing to point out that there are superb alternatives – in Germany. A recent Irish Times article provides a good example.

“Leading economists have criticised Germany on its public investment restraint which, at 18.4 per cent of GDP, is below the EU average of 19.2 per cent. A study by Berlin’s DIW economic think tank suggests a €1 trillion backlog has built up in Germany since 2000.”

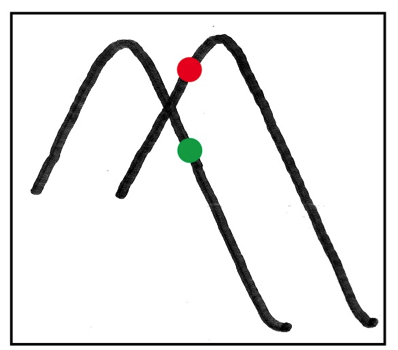

The squiggle illustrated here may look like the Ebola virus, but it isn’t. The resemblance is just an eerie coincidence. It’s actually a graphical snapshot of the classic “Predator-Prey Model.” This mathematical exercise, first developed in the 1920s, serves as the introductory basis for a more recent NASA funded effort which produced—amidst a brief flurry of news and commentary last spring—the startling conclusion that a complete collapse of modern civilization may now be “irreversible.”

The squiggle illustrated here may look like the Ebola virus, but it isn’t. The resemblance is just an eerie coincidence. It’s actually a graphical snapshot of the classic “Predator-Prey Model.” This mathematical exercise, first developed in the 1920s, serves as the introductory basis for a more recent NASA funded effort which produced—amidst a brief flurry of news and commentary last spring—the startling conclusion that a complete collapse of modern civilization may now be “irreversible.”