The public debt is the outstanding U.S. Treasury securities (USTS). It includes both marketable (T-bills, T-notes, T-bonds, TIPSs, and a few others) and non-marketable securities (United States notes, Gold certificates, U.S. savings bonds, Treasury demand deposits issued to States and Local Gov., all sorts of government account series securities held by Deposit Funds). What are the means to reduce the public debt?

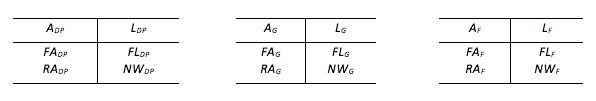

To answer this question it is best to start with the flow of funds accounts. Flow of Funds data are divided in three broad sectors: Domestic Private, Government, and Foreign. They each have a balance sheet:

FA: Financial Assets, FL: Financial Liabilities, RA: Real Assets, NW: Net Worth

It is trivial that every lender there is a borrower so:

(FADP – FLDP) + (FAG – FLG) + (FAF – FLF) ≡ 0

Simplify by assuming a closed economy with no debt in private sector and only the Treasury in the government sector:

Simplify by assuming a closed economy with no debt in private sector and only the Treasury in the government sector:

FADP ≡ FLGT

The financial liabilities of the Treasury (Public Debt) is the financial asset of the domestic private sector. Remember this board in NY city:

Well you could change it to this: (Suddenly I feel $119,027 richer!)

Now let’s assumed that the Treasury wants to eliminate all its financial liabilities: no more public debt! (FLGT = 0). What are the means to do so?

- Let securities mature and do not repay securities holders: 100% tax => FADP = 0 (the U.S. domestic private sector lost a bunch of financial assets!)

- Switch to a Treasury financial instrument not considered a liability (Coins are treated as equity by the Federal Accounting Standards Advisory Board): FADP ≡ FLGT => FADP ≡ NWGT

- (If one adds the monetary authorities, aka Federal Reserve in the government sector) Switch to another liability of the government: repay with Federal Reserve liabilities (Credit the bank accounts of treasuries holders and inject reserves in banks, or pay with FRNs): FADP ≡ FLGT => FADP ≡ FLGFR (Main way today)

What if the Treasury does not want to reduce it public debt but want to bypass a debt ceiling?

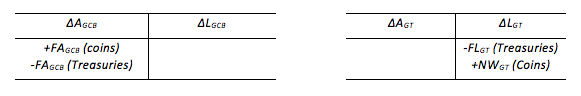

1-First, coin issuance to Fed (∆ refers to change in assets or liabilities):

2-Second: buys back treasuries from Fed with coins: debt-equity conversion (now the Treasury can issue more treasuries)

3-Third: issues a treasury liability not subject to the debt limit. Examples are United States notes, which look exactly like federal reserve note except for the color.

45 responses to “Public Debt, Debt Ceiling and Monetary Sovereignty: Some Accounting Realities”