Update: Paul Krugman has posted a reply to this post that is a straw man. He and Nick Rowe are viewing this all through the lens of the old Monetarist/Keynesian debates in which there was a choice b/n interest rate targets and monetary aggregate targets; the Monetarist critique assumed the Keynesians were going to keep interest rates at the same level forever and not change them. Once John Taylor came up with his “rule,” everyone agreed an interest rate target could work.

What we are talking about here is operational tactics–the CB can only target an interest rate. It cannot target a reserve balances or the monetary base directly. But that is different from strategy–that is, WHERE the CB puts its target and WHEN it chooses to change the target. There is NOTHING in anything I’ve ever said or anything any PK’er, MMT’er, etc., has ever said that suggests the CB can’t set the target wherever it wants whenever it wants. The point is that whatever the target is, THAT is what its daily operations defend directly, not a monetary aggregate, not the monetary base, not reserve balances. There is nothing in anything I’ve said that would preclude the CB from running a Taylor’s Rule type strategy, for instance, that responds at any point in time endogenously to the state of the economy. That is, the target rate is an exogenous control variable (i.e., it is necessarily set by the CB) that it sets endogenously in response to economic events.

The debate between Paul Krugman and my friend Steve Keen regarding how banks work (see here, here, here, and here) has caused me to revisit an old quote. Back in the 1990s I would use Krugman’s book, Peddling Prosperity (1995), in my intermediate macroeconomics courses since it provides a good overview of what were then contemporary debates in macroeconomic theory as well as Krugman’s criticisms of various popular views on macroeconomic policy issues from that era. One passage near the very end of the book has always remained in the back of my mind; in it, Krugman critiques a popular view that was and still is highly influential regarding productivity and trade policy. He writes: “So, if you hear someone say something along the lines of ‘America needs higher productivity so that it can compete in today’s global economy,’ never mind who he is or how plausible he sounds. He might as well be wearing a flashing neon sign that reads: ‘I DON’T KNOW WHAT I’M TALKING ABOUT.’” (p. 280; emphasis in original)

In his latest post in this debate (which Keen replied to here), Krugman demonstrates that he has a very good grasp of banking as it is presented in a traditional money and banking textbook. Unfortunately for him, though, there’s virtually nothing in that description of banking that is actually correct. Instead of a persuasive defense of his own views on banking, his post is in essence his own flashing neon sign where he provides undisputable evidence that “I don’t know what I’m talking about.”

Moving right into Krugman’s post, he writes: “There are vehement denials of the proposition that banks’ lending is limited by their deposits, or that the monetary base plays any important role; banks, we’re told, hold hardly any reserves (which is true), so the Fed’s creation or destruction of reserves has no effect. This is all wrong, and if you think about how the people in your story are assumed to behave — as opposed to getting bogged down in abstract algebra — it should be obvious that it’s all wrong.”

Yes, I will argue here that banks either individually or in the aggregate are not limited by their deposits and the monetary base doesn’t constrain bank lending, but my argument as well as that of the endogenous money crowd in general (MMT, horizontalists, circuitistes, etc.) has nothing to do with whether or not banks “hold hardly any reserves.”

He continues: “First of all, any individual bank does, in fact, have to lend out the money it receives in deposits. Bank loan officers can’t just issue checks out of thin air; like employees of any financial intermediary, they must buy assets with funds they have on hand. I hope this isn’t controversial, although given what usually happens when we discuss banks, I assume that even this proposition will spur outrage.”

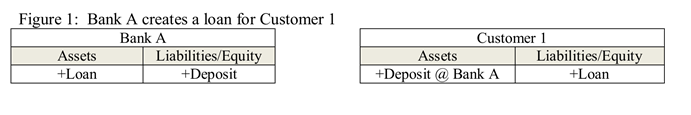

In fact it is wrong, and in fact that is not controversial. Let’s start with a basic bank and its customer and do T-accounts for both. The bank creates a loan and a deposit “out of thin air,” and the customer has now a new liability (the loan) and an asset (the deposit) as shown in Figure 1.

As is well known, and by the logic of double-entry accounting, the bank does make a loan out of thin air—no prior deposits or reserves necessary. But this isn’t really the point Krugman wants to make, so let’s just move on. Krugman continues:

“But the usual claim runs like this: sure, this is true of any individual bank, but the money banks lend just ends up being deposited in other banks, so there is no actual balance-sheet constraint on bank lending, and no reserve constraint worth mentioning either. That sounds more like it — but it’s also all wrong.”

Actually, that’s not the argument I would make whatsoever. Neither would any person who understands endogenous money, horizontalism, the circuit, etc. The number of banks involved has nothing to do at all with the argument. Our argument is valid if we consider only 1 or 1 million banks. So, again, let’s keep going.

Krugman: “Yes, a loan normally gets deposited in another bank”

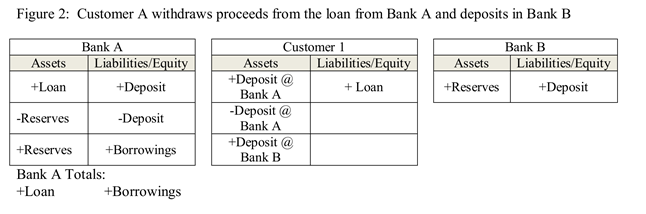

Actually, a loan doesn’t get deposited in another bank—a deposit gets deposited in another bank. The loan is a bank’s asset, and a deposit is a bank’s liability. Here we see the very beginnings of the importance of remaining clear on accounting if one wants to truly understand what “loans create deposits” means. If we assume, as per Krugman’s example, that Customer 1 takes the proceeds of the loan and deposits them in, say, Bank B, then we have Figure 2 below:

This is a bit more complicated than Krugman made it sound, isn’t it? Let’s walk through this slowly.

Customer 1 withdraws the deposit from Bank A, which is the “-Deposit” on Bank A’s liability/equity side, and the “-Deposit @ Bank A” on Customer 1’s asset side. Customer 1 then makes a deposit in Bank B, which is the “+Deposit @ Bank B” on Customer 1’s asset side and the “+Deposit” on Bank B’s liability.

But how does the deposit get from Bank A to Bank B? Let’s assume it’s done by electronic transfer here (that is, Customer 1 instructs Bank A to transfer the funds from the account at Bank A to the account at Bank B) since Krugman wants to discuss currency withdrawals below. Note that as far as the banks are concerned, this is the equivalent to Customer 1 spending the proceeds of the loan and the recipient of the spending being another customer that banks at Bank B—that is, in either case the deposit simply moves from Bank A to Bank B.

Now, let’s also assume that Bank A had no reserve balances on hand when it made the loan. How does it transfer reserve balances to Bank B? As it turns out, the Fed provides an overdraft for any payment sent in which a bank’s account goes below zero—that is, the payment is never rejected when it occurs on the Fed’s books. The Fed does this as part of its legal obligation to promote stability in the payments system (more on this in a minute). The rub is that the Fed requires Bank A to clear this overdraft by the end of the day, which Bank A will most likely do in the money markets (such as the federal funds market, often via pre-established lines of credit). So, on the liability/equity side for Bank A, we end with “+Borrowings” in the money market to clear the overdraft.

Note underneath Bank A’s balance sheet I’ve shown the totals or net changes to its balance sheet overall, which is simply a loan created offset by borrowings in the money markets on the liability/equity side. So, the loan was made without Bank A ever needing to meet reserve requirements, without needing reserve balances before making the loan, and without needing any deposits. Can Bank A just continue to make loans forever this way without ever needing any of these? The key here is to understand the business model of banking—which is to earn more on assets than is paid on liabilities, and to hold as little capital (equity) as possible (since that’s generally more expensive than assets). The most profitable way to do this is to make loans (that are paid back, obviously, so credit analysis is an important part of this) that are offset by deposits, since deposits are the cheapest liability; borrowings in money markets would be more expensive, generally. So, Bank A, if it is not able to acquire deposits is not operationally constrained in making the loan, but it will find that this loan is less profitable than if it could acquire deposits to replace the borrowings.

If Bank A wants a more profitable loan but is not able to acquire deposits, it can raise the rate charged to Customer 1 and thereby preserve its spread, which can result in Customer 1 taking his/her business elsewhere. But it can still make the loan. In other words, it is not deposits or reserve balances that constrain lending, but rather a bank’s own choice to lend given the perceived profitability of a loan—which can be affected by the ability to obtain deposits after the loan is made—and also given a perceived creditworthy borrower (someone has to want to borrow, after all, if a loan is going to be made) and sufficient capital (since regulators will want the bank to hold equity against the loan).

A digression is in order here on the central bank and the payments system. According to the Fed’s data in 2011 payments settled using Fedwire (the Fed’s main settlement system) averaged $2.6 trillion per business day, or about 17% of annual GDP each day. A significant percentage of these payments themselves settled a still larger dollar volume of transactions on private netting payments systems. And the US is not unique in this regard, as I explained here (see Table 1), in other countries payments settled on the central bank’s books each business day routinely average between a low of about 10% and a high of over 30% of annual nominal GDP. As the monopoly supplier of reserve balances (since the aggregate quantity can only change via changes to its balance sheet), it is the central bank’s obligation to ensure the stability of the national payments system. All central bank’s therefore provide reserve balances to their banking systems on demand at a price of the central bank’s central bank’s choosing.

Note that it cannot be any other way. If the central bank attempted to constrain directly the quantity of reserve balances, this would cause banks to bid up interbank market rates above the central bank’s target until the central bank intervened. That is, central banks accommodate banks’ demand for reserve balances at the given target rate because that’s what it means to set an interest rate target. More fundamentally, given the obligation to the payments system, it can do no other but set an interest rate target, at least in terms of a direct operating target.

What does this mean for our present context? It means simply that there is no quantity constraint on the quantity of reserve balances the central bank will supply, and thus there is no reserve constraint on a bank or on the banking system’s ability to create loans. Central banks stand ready to provide reserve balances at some price always. They can adjust this price up or down if they are concerned about the expansion of credit or monetary aggregates, and this increase in price can be passed onto borrowers who may then not want to borrow. But this means that the manner in which a central bank can exert control over credit expansion is indirectly through its interest rate target, not through direct control over the quantity of reserve balances.

Returning to Krugman, he then writes:

“— but the recipient of the loan can and sometimes does quickly withdraw the funds, not as a check, but in currency.”

Actually, withdrawing funds—spending them, in other words—via check or electronic transfer is far and away more common than withdrawing via currency. When I took out a mortgage to buy a house, I didn’t withdraw the funds in cash (duh!), and neither does anyone else. When I buy a plane ticket with my credit card (which is a loan, by the way, that creates a deposit—do you think Citibank has to look to see if it has sufficient reserve balances before approving your loan to buy those clothes at Nordstrom?), the funds are disbursed via reserve balances, not currency. Again, these absolutely dwarf any currency withdrawals of funds created by a loan—it’s not even close.

And currency is in limited supply — with the limit set by Fed decisions.

This statement is simply mindboggling. It’s so wrong I don’t know where to begin. The Fed NEVER limits the supply of currency. Never. Ever. To do otherwise would be to violate its mandate in the Federal Reserve Act to provide for an elastic currency and maintain stability of the payments system.

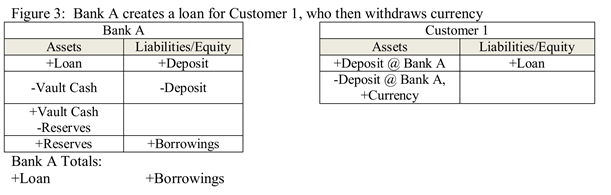

To play along, withdrawing the funds created by the loan as currency would look like this:

Here, instead of the transfer to Bank B, Customer 1 withdraws in the form of currency, which depletes Bank A’s vault cash. Let’s assume that this leaves Bank A holding less vault cash than it desires to hold. In that case, Bank A purchases more vault cash from the Fed. If we further assume that Bank A did not have the reserve balances to settle this transaction with the Fed, as in the previous example, it receives an overdraft from the Fed that it clears in the money markets. The net change to Bank A’s balance sheet is then the same as in Figure 2—a loan offset by borrowings. Again, no prior reserve balances required, whereas the Fed also supplied currency to replenish vault cash on demand. (Yes, a bank does need to have sufficient vault cash on hand to meet the withdrawal in the first place, but it is common for them to place restrictions on withdrawals to avoid running out—such as when your ATM only allows you to withdraw $200/day.) As in Figure 2, the bank’s decision to make this loan would be based on the profitability of the loan, not any quantity constraints related to the monetary base.

And the same goes for the aggregate—there is no constraint on banks’ abilities to obtain currency from the Fed. For instance, consider what a director of the Fed’s payments system operations said about currency in Congressional Testimony in 2006:

One of our key responsibilities is to ensure that enough currency and coin is available to meet the public’s needs. In that role, the twelve regional Federal Reserve Banks provide wholesale currency and coin services to more than 9,500 of the nearly 18,000 banks, savings and loans, and credit unions in the United States. The depository institutions that choose not to receive cash services directly from the Reserve Banks obtain them through correspondent banks. The depository institutions, in turn, provide cash services to the general public. Each year, the Federal Reserve Board determines the need for new currency, which it purchases from the Department of the Treasury’s Bureau of Engraving and Printing (BEP) at approximately the cost of production.

Note that she did not say anything about limiting the supply, or the Fed setting the supply. Two times she specifically said—as I emphasized via italics—that currency in circulation is based on the public’s needs, not any target set by the Fed. Consider also what the New York Fed says about how the quantity of currency in circulation is determined:

Depository institutions buy currency from Federal Reserve Banks when they need it to meet customer demand, and they deposit cash at the Fed when they have more than they need to meet customer demand.

As with reserve balances, the Fed could attempt to target the quantity of currency in circulation indirectly—that is, changes in the federal funds rate target might be able to influence how much currency the public wants to hold. But (a) there is strong evidence that currency demand is almost completely unrelated to the Fed’s target rate, and (b) this would mean that it was the fed funds rate target constraining bank lending, not currency or any sort of quantity constraint.

(As an aside, not also the the New York Fed made clear that because the quantity of currency in circulation is based on the public’s demand, the Fed also does not have the ability to oversupply currency. In that case, banks just sell the currency back to the Fed in exchange for reserve balances—which as above don’t enable more/less lending than otherwise. Similarly, if the public were somehow holding more currency than it desired, it could simply deposit these in a bank as a deposit, savings account, CD, money market fund, etc—which banks would then return to the Fed. In other words, because there are (in fact, numerous) opportunities to convert currency into highly liquid (in some cases just as liquid as currency) stores of value that also take the currency out of circulation, there is no such thing as a “hot potato effect” for currency (or deposits either, since they too can be converted into savings, money market funds, CDs, etc.) The Fed can’t supply any more or any less currency than the public wants to hold. Helicopter drops are fiscal operations, not monetary operations.)

Krugman summarizes: “So there is in fact no automatic process by which an increase in bank loans produces a sufficient rise in deposits to back those loans, and a key limiting factor in the size of bank balance sheets is the amount of monetary base the Fed creates — even if banks hold no reserves.”

As above, the quantity of reserve balances the bank is holding has nothing to do with it. Krugman is correct that there is no automatic process that will enable a bank or the banking system overall to keep deposits equal to the amounts of their loans created, but as I’ve explained that represents a potential reduction in the profitability of the loan, not a quantity constraint on a bank’s or the banking system’s abilities to create loans out of thin air. The only relevant quantity constraint on creating a loan is capital—assuming capital requirements are strictly enforced—not reserve balances, not reserve requirements, not deposits, not the monetary base, etc. The latter can only affect the loan decision by influencing the profitability of the loan—a price effect of monetary policy, at best—and similarly the borrower’s decision can be affected by the fed funds rate set by the Fed (and the rate the bank charges as a markup over this), which is another price effect. The reason for this is that a central bank defends the payments system every day, every hour, every minute, at some price. This is the essence or fundamental truth of central banking, and anyone who fails to grasp it doesn’t understand central bank operations.

So how much currency does the public choose to hold, as opposed to stashing funds in bank deposits? Well, that’s an economic decision, which responds to things like income, prices, interest rates, etc.. In other words, we’re firmly back in the domain of ordinary economics, in which decisions get made at the margin and all that. Banks are important, but they don’t take us into an alternative economic universe.

Strange that he would say “stashing funds in deposits” since deposits settle a greater dollar volume of spending than currency does. At any rate, Krugman wants to argue that banks aren’t important since they can’t “do” anything more than occurs in a model without banks. Again, that’s not even close to true. As above, banks create loans without regard to the quantity of reserve balances they are holding; they obtain any reserve balances needed at the federal funds rate or roughly equal to it. Their ability to replace withdrawals with other deposits merely affects the profitability of lending, not the ability to do so. Consider, for instance Canada, which has no reserve requirements and where the central bank is so good at forecasting banks’ demand for reserve balances (due to how the interbank market functions there) that banks actually desire to hold no reserve balances overnight—reserve balances only exist on an intraday basis. What if the Canadian public decided also to stop using currency? (There was in fact a good deal of research on this possibility related to the so-called e-money revolution back in the late 1990s and early 2000s.) This would mean the monetary base was zero. Would this stop banks from lending? No. Now, add reserve requirements to this—which we’ve already shown above do not constrain banks—and a desire to hold currency by the public—which we’ve explained is met on demand by the central bank. Nothing’s changed. The size of the monetary base is a result or an outcome, not a cause.

Instead, Krugman argues that these at least in the aggregate do constrain banks’ abilities to lend, as in the traditional money multiplier model or the loanable funds view. But in fact a world with banks is quite different if the size of the monetary base doesn’t matter, ever. On the way up, this is particularly so in a world in which the largest banks can exist on ever smaller margins between their lending rates and rates paid on liabilities (given scale and also increasing revenues from non-interest sources), while also providing the revolving fund of financing for institutions investing in the money markets. As such, banks can provide the financing for an asset price bubble while the monetary base responds in kind, rather than vice versa; on the way down, as the desire for bank credit relative to income slows, increasing reserve balances or currency don’t necessitate spending. And those paying back debt simply destroy bank deposits (since the repayment results in a debit to the payor’s deposits and a debit to the bank’s loan); there is no transfer from those repaying debt to lenders (and it wouldn’t work that way anyway—debt repayment is out of income for the debtor, but the transfer is a portfolio shift for the owner of the debt, not income aside from the interest payment).

Concluding his post, Krugman writes, “Now, under current conditions — that is, in a liquidity trap — the monetary base is indeed irrelevant at the margin, because people are indifferent between zero interest public liabilities of all kinds. That’s why there are no immediate policy differences between some of the monetary heterodoxies and what IS-LMists like me are saying. But that’s not the way things normally are.”

Krugman wants to reiterate that the size of the monetary base matters, unless we are in a so-called liquidity trap, as he thinks we are in now. His own definition of the liquidity trap is when reserve balances earn the same as t-bills, as they generally do now (within a few basis points). Under those conditions he wants to argue that the monetary base can be as large as the Fed wants it to be and it won’t be inflationary and it won’t encourage more lending. What he fails to understand is that it is only when the Fed sets its target rate equal to the rate paid on reserve balances (which will mean t-bills earn roughly the same as reserve balances—Krugman’s liquidity trap) that the Fed can actually target the quantity of reserve balances and by extension the monetary base. And even then, it must be sure to provide at least as many reserve balances as banks desire at the target rate to achieve its target rate in the first place. The key point here is that “under normal circumstances” the monetary base’s size would be determined endogenously based on the public’s demand for currency and banks’ demand for reserve balances at the Fed’s target rate; the Fed or any other central bank can only control the size of the monetary base directly by creating “liquidity trap” conditions that set interest on reserve balances equal to interest on t-bills.

In short (!), the money multiplier model is wrong because it has the causation backwards—banks create loans based on the demand by borrowers, perceived profitability, and capital they are holding. The quantity of currency held or in circulation and quantity of reserve balances held or in circulation at the time of the decision to create the loan have nothing to do with it. If there are reserve requirements, then the quantity of reserve balances may increase as lending may increase reserve requirements and the central bank will have to raise the quantity of reserve balances circulating to achieve its target. Similarly, if credit creation raises the public’s demand for currency, then the central bank will have to increase currency in circulation, as well. It also means that the loanable funds model is wrong. Banks are not constrained by deposits whatsoever, but the quantity of deposits they can raise after making a loan to replace a withdrawal will affect the profitability of the loan. Again, the constraint is a price constraint, not a quantity constraint.

And, for Krugman and others like him that want to defend the money multiplier, loanable funds, or any other perspective that suggests banks individually or in the aggregate are constrained by currency, deposits, or reserves in lending, well . . . . here’s your (flashing neon) sign.

Pingback: The theory and reality of modern money and banking (chart) « Real-World Economics Review Blog

Pingback: Things I Should Not Be Wasting Time On - NYTimes.com

Pingback: Une analyse limpide

Pingback: More on why Minsky Matters | Credit Writedowns

Pingback: Krugman vs Minsky: Who Should You Bank On When It Comes to Banking? « Multiplier Effect

Pingback: Markets … | Economic Undertow

Pingback: Krugman and loans without parents « Economy View

Pingback: Bring Back Fiscal Policy | | New Economic PerspectivesNew Economic Perspectives

Pingback: Deus Ex Macchiato » Fair value gains as monetary base – even better than the real thing

Pingback: Dan Kervick: Beware of Rule by Central Banks « naked capitalism

Pingback: The Political Path to Full Employment | | New Economic PerspectivesNew Economic Perspectives

Pingback: TheMoneyIllusion » More reasons to stop talking about inflation

Pingback: Krugman contra Minsky: ¿a quién deberíamos creer en cuestiones bancarias? | Vamos a Cambiar el Mundo

Pingback: Krugman | Pearltrees

Pingback: The ultimate vindication of Republican supply-side economics - Page 40 - US Message Board - Political Discussion Forum

Pingback: Debunking another cornerstone of the Austrian-Keynesian dialectic: do Central Banks really control the Money Supply? « Real Currencies

Pingback: Debunking another cornerstone of the Austrian-Keynesian dialectic: do central banks really control the money supply? « The Daily Knell

Pingback: Eurokrise und kein Ende – Spanien im freien Fall | NachDenkSeiten – Die kritische Website

Pingback: Understanding the Permanent Floor—An Important Inconsistency in Neoclassical Monetary Economics - New Economic Perspectives