Bank Whistleblowers United

Posts Related to BWU

Recommended Reading

Subscribe

Articles Written By

Categories

Archives

March 2026 M T W T F S S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Blogroll

- 3Spoken

- Angry Bear

- Bill Mitchell – billy blog

- Corrente

- Counterpunch: Tells the Facts, Names the Names

- Credit Writedowns

- Dollar Monopoly

- Econbrowser

- Economix

- Felix Salmon

- heteconomist.com

- interfluidity

- It's the People's Money

- Michael Hudson

- Mike Norman Economics

- Mish's Global Economic Trend Analysis

- MMT Bulgaria

- MMT In Canada

- Modern Money Mechanics

- Naked Capitalism

- Nouriel Roubini's Global EconoMonitor

- Paul Kedrosky's Infectious Greed

- Paul Krugman

- rete mmt

- The Big Picture

- The Center of the Universe

- The Future of Finance

- Un Cafelito a las Once

- Winterspeak

Resources

Useful Links

- Bureau of Economic Analysis

- Center on Budget and Policy Priorities

- Central Bank Research Hub, BIS

- Economic Indicators Calendar

- FedViews

- Financial Market Indices

- Fiscal Sustainability Teach-In

- FRASER

- How Economic Inequality Harms Societies

- International Post Keynesian Conference

- Izabella Kaminska @ FT Alphaville

- NBER Information on Recessions and Recoveries

- NBER: Economic Indicators and Releases

- Recovery.gov

- The Centre of Full Employment and Equity

- The Congressional Budget Office

- The Global Macro Edge

- USA Spending

-

Tag Archives: job guarantee

What’s MMT About Anyway and is the Job Guarantee Crucial to the Project?

This post is primarily addressed to the MMTcommunity and whoever considers himself/herself a follower of Modern MonetaryTheory. It deals with the question ofwhat is in the purview of MMT.

A number of MMT supporters from the blogosphere haveargued that MMT has a descriptive and prescriptive part and, more recently, thatthe Job Guarantee program (JG) falls in the category of prescriptions and that itis not as essential to the MMT project as the description of the operationalrealities of modern economies.

Bill Black: Jobs Now, Stop The Foreclosures, Jail The Banksters

Comments Off on Bill Black: Jobs Now, Stop The Foreclosures, Jail The Banksters

Posted in Uncategorized, William K. Black

Tagged #econ4the99, #occupywallstreet, foreclosures, jail the banksters, job guarantee, the real news, William K. Black

Pavlina Tcherneva on at Issue with Ben Merens

Comments Off on Pavlina Tcherneva on at Issue with Ben Merens

Posted in Pavlina R. Tcherneva

Pavlina Tcherneva on At Issue with Ben Merens

Ben Merens, of Wisconsin Public Radio’s At Issue, hosts Pavlina Tcherneva on how to address unemployment. Listen here.

Comments Off on Pavlina Tcherneva on At Issue with Ben Merens

Posted in Pavlina R. Tcherneva

Obama’s Jobs Plan: How to create millions of new jobs on a shoestring

Expect one thing from President Obama’s speech on Thursday: a mini ARRA, a smaller version of essentially the same stimulus plan as that of 2009. He will probably call for putting the unemployed construction workers to work on infrastructure projects, he will propose tax incentives to firms to hire the unemployed, he will keep pushing for the weatherization of buildings and more funding to teachers and schools.

He will keep advocating a free trade agenda, whatever form that might take. And if informed pundits are correct, he will ask for about a third of the ARRA funds, around $300 billion.

Posted in Pavlina R. Tcherneva

Tagged ARRA, job guarantee, new deal, obamas jobs speech, thursdays jobs speech

After Great Recession: A Bleaker Employment Recovery than after the Great Depression

The last employment numbers provide yet another disappointing bit of news for millions of households all around the country. No net employment gain. However, I am afraid that this is only the very tip of the iceberg because a long-term view shows a much bleaker picture.

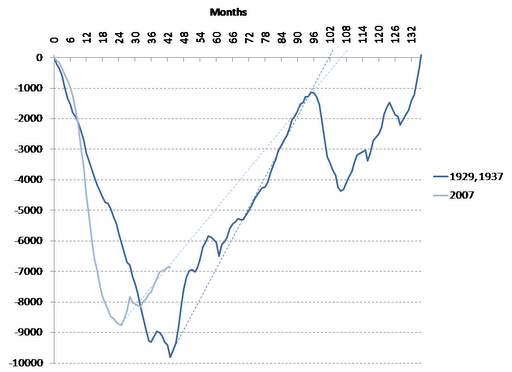

Figure 1 shows how long it took for the employment level to return to its peak level after a recession, and how much job loss occurred relative to that peak. The employment numbers exclude people that were employed in the WPA, NYA and CCC, and focuses on individuals employed in nonfarm activities.

During the Great Depression, the employment level declined for 4 years and almost 10 million jobs were lost compared to the peak employment level that prevailed in August 1929. It took 136 months (over 11 years) to return to this level of employment, but, without the avoidable 1937 recession, the full recovery would have occurred after 102 months (8.5 years) if one takes the trend of recovery that prevailed from 1933.

The Great Recession led to a loss of almost 9 million jobs compared to the peak employment level of January 2008. The loss of jobs occurred at a faster rate than the Great Depression but employment recovered sooner and started to rise after 2 years. However, once the employment recovery started, it occurred at a slower rate than during the Great Depression. If the recovery continues at the same pace, AND assuming that no recession occurs during the recovery phase, it will take about 9 years to return to the employment level of January 2008. Thus, given everything else, it will take longer for employment to fully recover than during the years prior to the 1937 recessions.

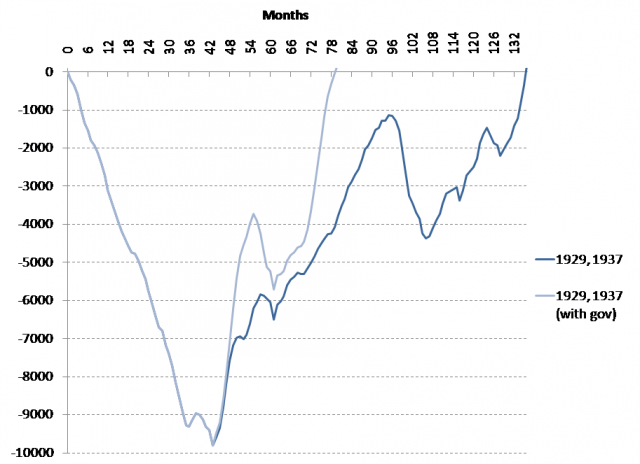

The picture is even bleaker today if one included New Deal employment programs. Figure 2 shows that those programs allowed employment to recover fully after 80 month (less than 7 years) and only three years after the New Deal Programs were implemented. The timid Bush and Obama stimulus have barely made a dent in the employment problem over the past two years.

This, once again, suggest a powerful employment policy to help the economy. Instead of concentrating its efforts on tax rebates and bailing out banks, and waiting for them to lend to businesses, the federal government should directly hire people and involve them in activity that benefited the entire country. We do not need a temporary stimulus; we need a permanent institutionalized and decentralized government program that hires anybody willing to work and unable to find a job in the private sector. By sustaining income and the productivity of workers, a government employment program would tremendously helps to sustain the employability of workers and would improve the confidence of private business, which would in turn improve private employment.

Figure 1. Difference between peak employment level and current employment level. Nonfarm payroll employment, seasonally adjusted, millions of people.

Sources: BLS (Current Employment Survey), Federal Reserve Bulletin (June and September 1941).

Note: People employed in the WPA, NYA and CCC are not included.

Figure 2. Same as Figure 1 with New Deal Federal Employment Programs.

Sources: Federal Reserve Bulletin, Social Security Bulletin.

Posted in Eric Tymoigne, Uncategorized, Unemployment

Tagged Eric Tymoigne, great depression, great recession, job guarantee, unemployment

Matchmaker, Matchmaker Find Me a Job

Good news. Republicans have just unveiled a bold new plan (see below) to create jobs in the private sector. Don’t worry, it isn’t another “wasteful” stimulus package that hires people to repair roads and bridges or helps state and local governments hold onto their teachers and firefighters. This one won’t cost the government a dime! It’s a simple idea, really. A good old-fasioned meet-and-greet, where throngs of unemployed Americans can claw their way through a crowd of equally desperate men and women looking to land the perfect mate. I mean a reasonable match. I mean any job whatsoever.

Are these people delusional? (rhetorical) What, exactly, is it that prevents them from understanding the root of the problem? Econ 101. Sales Create Jobs. Income Creates Sales. So easy a caveman can do it.

We don’t need to introduce employers to the unemployed — they can throw a rock and hit one every 10 feet. We need to introduce employers to new customers. Sales create jobs. The problem, as Cullen Roche points out again today, is that too many households are still struggling with high debt levels. As Cullen said, “spenders have become savers,” and this is hurting the economy. Until households finish de-leveraging (restoring balance sheets by paying down debt), there will be no new source of demand — i.e. customers — to support private businesses.

The government could provide that demand — directly, through a job guarantee program modeled on the WPA, or indirectly, through a full payroll tax holiday and another round of revenue sharing for the states. But it looks like the deficit owls are the only ones prepared to support those kinds of bold initiatives. Until then, Congresswomen like Lynn Jenkins (my own “representative,” by the way) will settle for a pathetic event that promises to pair hundreds of potential employers with thousands of job seekers.

Dear Ms. Kelton,

It is my pleasure to announce the 2nd Annual Kansas 2nd District Jobs Fair. If you are a job seeker looking for employment or an employer looking for employees, I invite you to join us on Thursday, September 1st at the Topeka Expocentre Agriculture Hall.

As a CPA, I know the key to turning the economy around is not more government spending, but working with the private sector to create jobs. In order to get our economy back on track, we must first get America and Kansas back to work.

This Jobs Fair will provide an unique opportunity to meet with some of the leading job creators in the state of Kansas. There are retailers and manufacturers, service industry representatives, members from healthcare and not-for-profit companies, cities and universities, as well as financial services providers all gathered to help you find employment. There will be over 60 companies looking to fill hundreds of jobs!

Unlike many Jobs Fairs, participation is free of charge for both businesses and job seekers. I am hopeful that this event will prove an invaluable resource for you, your friends, and family. Please bring your resume and come explore job opportunities.

Congresswoman Lynn Jenkins’ 2011 Jobs Fair

Thursday, September 1st

10am – 1pm

Topeka Expocentre Agricultural Hall

One Expocentre Drive

17th & Topeka Blvd

Topeka, KS

Over 1,000 job-seekers came out to last year’s Jobs Fair– providing a great opportunity for employers and job-seekers to meet. Whether you are looking for a full-time, part-time, or temporary position, do not miss this great opportunity to connect with local employers who are hiring.

I hope to see you there!

Sincerely,

Lynn Jenkins, CPA

Member of Congress

Lynn Jenkins, CPA

Member of Congress

Posted in Stephanie Kelton, Uncategorized

Tagged job guarantee, Lynn Jenkins, payroll tax, Stephanie Kelton

Poverty, Joblessness, and the Job Guarantee

By Pavlina R. Tcherneva

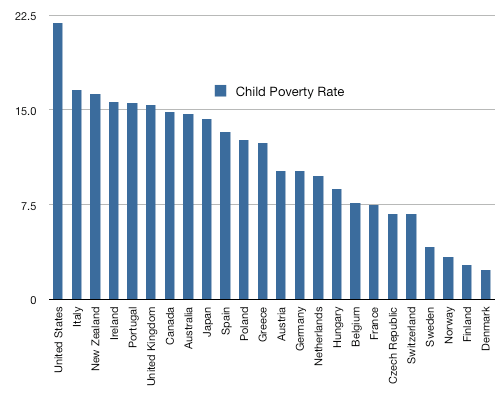

A recent report on the State of America’s Children revealed distressing statistics. More than 1 in 5 children live in poverty in the U.S., by far the most impoverished age group in the nation. Between 2008 and 2009 child poverty jumped 10%, the single largest annual jump in the data’s history. While the U.S. is the wealthiest nation in the world in terms of GDP (and # of billionaires), it ranks last in relative child poverty among all industrialized nations.

|

|

source: http://yglesias.thinkprogress.org/

|

Overall we have 46.3 million people in poverty in the U.S. (the largest number in the postwar era), which is 14.3% of the total population—a percentage that has been trending up since 2000.

Posted in Pavlina R. Tcherneva

Tagged #poverty, Fiscal Policy, job guarantee, joblessness