As financial regulators we have been warning since 1984 that accounting control fraud is optimized by modern executive compensation. Modern executive compensation is so perverse that it creates overwhelming incentives to engage in fraud and the means of committing the fraud that makes it far more difficult to prosecute. The CEO is able to convert the firm’s assets to his own benefit through seemingly normal corporate mechanisms. CEOs also use executive and professional compensation to generate “Gresham’s” dynamics and incentivize fraud by employees, officers, and professionals.

George Akerlof and Paul Romer added their voice to this point in1993 in their article “Looting: The Economic Underworld of Bankruptcy for Profit.” Among the points they emphasized were that accounting control fraud was a “sure thing” and that the way for the CEO controlling a lender to optimize to optimize his looting was to cause the lender to make very bad loans at a premium nominal yield. White-collar criminologists and the National Commission on Financial Institution Reform, Recovery and Enforcement (NCFIRRE) reached similar conclusions beginning in 1993.

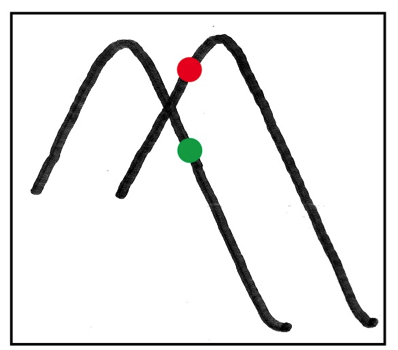

The squiggle illustrated here may look like the Ebola virus, but it isn’t. The resemblance is just an eerie coincidence. It’s actually a graphical snapshot of the classic “Predator-Prey Model.” This mathematical exercise, first developed in the 1920s, serves as the introductory basis for a more recent NASA funded effort which produced—amidst a brief flurry of news and commentary last spring—the startling conclusion that a complete collapse of modern civilization may now be “irreversible.”

The squiggle illustrated here may look like the Ebola virus, but it isn’t. The resemblance is just an eerie coincidence. It’s actually a graphical snapshot of the classic “Predator-Prey Model.” This mathematical exercise, first developed in the 1920s, serves as the introductory basis for a more recent NASA funded effort which produced—amidst a brief flurry of news and commentary last spring—the startling conclusion that a complete collapse of modern civilization may now be “irreversible.”