By Rob Parenteau and Marshall Auerback

We have never quite been able to pin down why “maximize shareholder value,” the mantra of the world in which we have both worked for the past three decades, always left us with a bad feeling. But considering the actions of the markets over the past few days, particularly the perverse response to the consolidation of the rentier class’s power grab in Europe (which will consign millions of people to years of poverty and indentured servitude), it is easier to understand a little better why.

There is perverse logic at work here. You’re a fund manager who, at the start of the fourth quarter, was down 25%. Neither hard to do nor a particular sign of incompetence, given the uncharacteristically huge volatility, the hidden role of derivatives, the highly “politicized” nature of the markets themselves, etc. A market that rises 4% in Q4 doesn’t really help you. But if you’re up 15% in Q4 and therefore “only” down 10% for the year or, even better, UP for the year, then you might be able to stay in the game a bit longer. So you have a massive incentive to play in the casino, under the guise of “maximizing shareholder value.”

It’s sort of like managing one of the so-called Too Big To Fail (TBTF) banks now. You know you’re basically insolvent. You know the game is going to end at some point and, if and when rationality returns, your bank will be restructured (maybe via an FDIC forced takeover a la WaMu) and you’ll be out of a job. So you get even more reckless in the meantime, inflating the numbers as much as possible via accounting tricks and taking the huge “performance” bonuses which accrue to you. It is the fund management equivalent of Bill Black’s control fraud writ large.

Of course, as Bill always

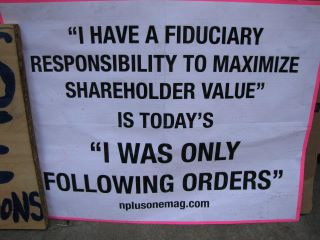

points out, the “F” word (fraud) is never taken seriously in the economics profession. In fund management, there’s another “F” word which is now pervasively ignored – “Fiduciary” as in “fiduciary responsibility.” The same control fraud dynamics at work in both areas. “Cash is trash,” as the system is set up to force the fund manager to play.

The funny thing is, the looters inside the banks used the phrase “shareholder maximization” to con the shareholders into believing they too would be taken along for the ride to mega riches. In the case of Lehman, AIG, etc. the true nature of the con was revealed. The insider managers operating both simple and elaborate control fraud schemes often walked away quite wealthy, the shareholders got little more than an invitation to the back row of the bankruptcy court.

What is truly amazing is that shareholders, fund managers, retail investors, etc. fell for this over and over and over again, perhaps because the Grifters and psychopaths in the corner office were just that good, or perhaps because they wanted to believe and so suspended disbelief, or perhaps because it was the only game left in town and they did see some shareholders get very wealthy by financing what we will one day soon understand were the storm trooper MBAs working their best reptilian angles to plunder and pillage the last spoils of the empire of global, fully deregulated, cowboy/casino capitalism. We speak as market practitioners, who are keen to see capital markets work the way they are supposed to: finance as the handmaiden to industry, and not the other way around. Gresham’s Law is operative here as well: bad money is driving out good. It needn’t be this way.

RIP, shareholder value meme. You were a pretty damn powerful one, almost as powerful as TINA. Arise AWIP (“another world is possible”), new true stakeholder economy, which can trump TINA. Because the old structures are corrupt to the core. And at some level we all have known it, but we haven’t known how we could effectively contest it and change it. Perhaps the Occupy Wall Street protests growing around the world is finally showing us another way.

* TINA = There Is No Alternative (Myth killed

here)