In thecontext of today’s conventional wisdom about the dangers of budget deficits,Lerner’s views (examined last week) appear somewhat radical. What is surprisingis that they were not all that radical at the time. As everyone knows, MiltonFriedman was a conservative economist and a vocal critic of “big government”and of Keynesian economics. No one has more solid credentials on the topic ofconstraining both fiscal and monetary policy than Friedman. Yet, in 1948 hemade a proposal that was almost identical to Lerner’s functional finance views.On one hand, this demonstrates how far today’s debate has moved away from aclear understanding of the policy space available to a sovereign government,but also that Lerner’s ideas must have been “in the air”, so to speak, widelyshared by economists across the political spectrum. At the end of thissubsection we will also visit Paul Samuelson’s comment on this topic—whichprovides a cogent explanation for today’s confusion about fiscal and monetarypolicy. As Samuelson hints, the confusion was purposely created in order tomystify the subject.

Briefly,Milton Friedman’s 1948 article, “AMonetary and Fiscal Framework for Economic Stability” put forward aproposal according to which the government would run a balanced budget only atfull employment, with deficits in recession and surpluses in economic booms.There is little doubt that most economists in the early postwar period sharedFriedman’s views on that. But Friedman went further, almost all the way toLerner’s functional finance approach: all government spending would be paid forby issuing government money (currency and bank reserves); when taxes were paid,this money would be “destroyed” (just as you tear up your own IOU when it isreturned to you). Thus, budget deficits lead to net money creation. Surpluseswould lead to net reduction of money.

He thusproposed to combine monetary policy and fiscal policy, using the budget tocontrol monetary emission in a countercyclical manner. (He also would haveeliminated private money creation by banks through a 100% reserverequirement–an idea he had picked up from Irving Fisher and Herbert Simons inthe early 1930s–hence, there would be no “net” money creation byprivate banks. They would expand the supply of bank money only as theyaccumulated reserves of government-issued money. We will not address this partof the proposal.) This stands in stark contrast to later conventional views(such as those associated with the ISLM model taught in textbooks) that“dichotomized monetary and fiscal policy. Friedman, too, later argued that thecentral bank ought to control the money supply, delinking in his later work theconnection between fiscal policy and monetary policy. But at least in this 1948paper he clearly tied the two in a manner consistent with Lerner’s approach.

Friedmanbelieved his proposal results in strong counter-cyclical forces to helpstabilize the economy as monetary and fiscal policy operate with combinedforce: deficits and net money creation when unemployment exists; surpluses andnet money destruction when at full employment. Further, his plan forcountercyclical stimulus is rules-based, not based on discretionary policy—itwould operate automatically, quickly, and always at just the right level. As iswell known, he later became famous for his distrust of discretionary policy,arguing for “rules” rather than “authorities”. This 1948 paper provides a neatway of tying policy to rules that automatically stabilize output and employmentnear full employment.

We see thatFriedman’s “proposal” is actually quite close to a description of the waythings work in a sovereign nation. When government spends, it does so bycreating “high powered money” (HPM)–that is, by crediting bankreserves. When it taxes, it destroys HPM, debiting bank reserves. A deficitnecessarily leads to a net injection of reserves, that is, to what Friedmancalled money creation. Most have come to believe that government finances itsspending through taxes, and that deficits force the government to borrow backits own money so that it can spend. However, any close analysis of the balancesheet effects of fiscal operations shows that Friedman (and Lerner) had itabout right.

But if thatis so, why do we fail to maintain full employment? The problem is that theautomatic stabilizers are not sufficiently strong to offset fluctuations ofprivate demand. Below we will examine why that is the case.

Note thatFriedman would have had government deficits and, thus, net money emission solong as the economy operated below full employment. Again, that is quite closeto Lerner’s functional finance view, and as discussed above it was a commonview of economists in the early postwar period. But almost no respectableeconomist or politician will today go along with that on the belief it would beinflationary and/or would bust the budget. Such is the sorry state of economicseducation today. How did we get to this point? In last week’s blog, Samuelsonexplained that the belief that the government must balance its budget over sometimeframe a “religion”, a “superstition” that is necessary to scare thepopulation into behaving in a desired manner. Otherwise, voters might demandthat their elected officials spend too much, causing inflation. Thus, the viewthat balanced budgets are desirable has nothing to do with “affordability” andthe analogies between a household budget and a government budget are notcorrect. Rather, it is necessary to constrain government spending with the“myth” precisely because it does not really face a budget constraint.

A Budget Stance for Economic Stability. In Friedman’s proposal, the sizeof government would be determined by what the population wanted government toprovide. Tax rates would then be set in such a way so as to balance the budgetonly at full employment. Obviously that is consistent with Lerner’s approach—ifunemployment exists, government needs to spend more, without worrying aboutwhether that generates a budget deficit. Essentially, Friedman’s proposal is tohave the budget move countercyclically so that it will operate as an automaticstabilizer. And, indeed, that is how modern government budgets do operate:deficits increase in recessions and shrink in expansions. In robust expansions,budgets even move to surpluses (this happened in the US during theadministration of President Clinton). Yet, we usually observe that these swingsto deficits are not sufficiently large to keep the economy at full employment.The recommendations of Friedman and Lerner to operate the budget in a mannerthat maintains full employment are not followed. Why not? Because the automaticstabilizers are not sufficiently strong.

To build in sufficient countercyclical swingsto move the economy back to full employment requires two conditions. First,government spending and tax revenues must be strongly cyclical–spending needsto be countercyclical (increasing in a downturn), and taxes pro-cyclical(falling in a downturn). One way to make spending automatically countercyclicalis to have a generous social safety net so that transfer spending (onunemployment compensation and social assistance) increases sharply in adownturn. Alternatively, or additionally, tax revenues also need to be tied toeconomic performance–progressive income or sales taxes that movecountercyclically.

Second,government needs to be relatively large. Hyman Minsky (1986) used to say thatgovernment needs to be about the same size as overall investment spending–orat least, swings of the government’s budget have got to be as big as investmentswings, moving in the opposite direction. (This is based on the belief thatinvestment is the most volatile component of GDP. This includes residentialreal estate investment, which is an important driver of the business cycle inthe US. The idea is that government spending needs to swing sufficiently and inthe opposite direction to investment in order to keep national income andoutput relatively stable; that, in turn will keep consumption relativelystable.) According to Minsky, government was far too small in the 1930s tostabilize the economy–even during the height of the New Deal, the federalgovernment was only 10% of GDP. Today, all major OECD nations probably have agovernment that is big enough, although some developing countries probably havea government that is too small by this measure. Based on current realities, itlooks like the national government should range from the US low of less than20% of GDP to a high of 50% in France. The countries at the low end of therange need more automatic fluctuation built into the budget than those with abigger government.

Looking tothe decade of the 1960s in the US, one sees that it was more-or-less consistentwith Friedman’s proposal and with Lerner’s functional finance approach. Federalgovernment spending averaged around 18-20% of GDP, and deficits averaged $4 or$5 billion a year, except for 1968 when they temporarily increased to $25billion–but for the decade, deficits ran well under 1% of GDP on average. Wecould quibble about whether the US was at full employment in the 1960s, but itwas certainly closer to full employment during that decade than it was afterthe early 1970s. From the early 1970s until the boom of the 1990s during thepresidency of Bill Clinton, the budget was too tight relative to therecommendations of Friedman and Lerner. How do we know? Because unemploymentwas chronically too high—even in expansions it never got down to 1960s levels.

Note thatthis was not because government spending fell much, or because taxes wereraised. Indeed, the deficit tended to be much higher after the early 1970s (thehigh unemployment period) than it was during the 1960s (the low unemploymentperiod).

What went wrong? Briefly, the problem could be attributed tothe evolution of the international position of the US that led to a chroniccurrent account deficit. The US emerged from WWII in a dominant position—notonly was the dollar in high demand, but so were US exports—needed bywar-ravaged Europe and Japan. The US had a trade surplus, and lent Dollars tothe rest of the world to buy its output. That added to US demand and—from ouraccounting identities—kept our budget deficits small and let our private sectorrun surpluses (save).

Recall thatthe international monetary system (Bretton Woods) was based on a dollar-goldstandard, with exchange rates fixed to the Dollar and the Dollar convertible togold. By the early 1970s, the US was running a trade deficit and foreignholders were exchanging excess dollars for gold. To make a long story short,the US abandoned gold, the Bretton Woods system collapsed, and most developedcountries floated. The dollar fell in value (helping to generate inflationpressures in the US as imports, especially oil, got more expensive), and the USfound it harder to compete in international markets (Japan and Europe hadlargely recovered and were producing for their own markets—and even for the USconsumer). The current account deficit turned negative—more or lesspermanently–during the administration of President Reagan. As we know from ourmacro identities, that deficit would have to be offset by a growing budgetdeficit—which had to be large enough to offset both the current account as wellas the US domestic sector surplus (saving of households and firms). By the endof the 1980s, Congress and the new president (George Bush) agreed to try toreign-in deficit spending. Hence, an already too-small budget deficit (giventhe current account deficit and the desire of the domestic private sector torun surpluses, demand was too low to eliminate unemployment) was constrainedfurther by the Gramm-Rudman Amendment that promised to work toward a budgetbalance.

The economysuffered from weak growth and relatively high unemployment over most of thisperiod. Then, suddenly, economic growth picked up speed during the Clintonadministration; indeed it grew so fast that it produced a budget surplus (astax revenues boomed) that lasted for nearly three years (the first sustainedsurplus since 1929!). President Clinton actually predicted at the time that thebudget surplus would continue for at least 15 more years, and that alloutstanding Federal government debt would be retired (for the first time since1837).

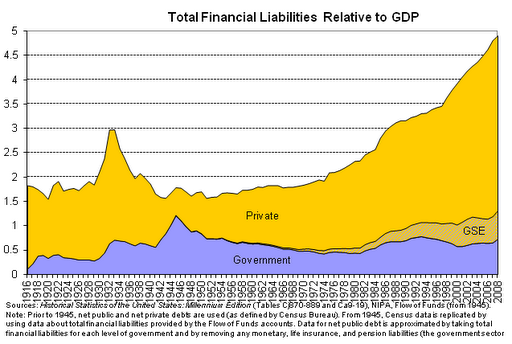

Note thatthis was not accomplished by reversing the current account deficit—whichactually grew. How could the US run a current account deficit and a government budget surplus? Only byrunning a sustained private sector deficit. Indeed, from 1996 until 2007 the USprivate sector ran a budget deficit every year except during the recession ofthe early 2000s. At times, the domestic private sector deficit reached 6% ofGDP (meaning that for every Dollar of US national income, the private sectorspent $1.06. With such a large “flow” deficit, the stock of private sector debt grewrapidly—both in nominal terms and as a ratio to GDP. By 2007, total US debtreached five times GDP (versus three times GDP in 1929 on the verge of theGreat Depression). This huge debt implied a big debt burden—the portion ofincome that had to be devoted to servicing debt. When the economy collapsed in2007, a private sector surplus finally returned (the turn-around from private deficitsto private surpluses amounted to 8% of GDP—a huge reversal that removedapproximately $1 trillion of spending from the economy)—and the governmentbudget deficit grew rapidly to 10% of GDP. Even as the private sector cut downits spending, it was forced to default on debts run up since the Clintonperiod. A wave of bankruptcies and home foreclosures resulted that drove theeconomy into a deep recession and financial crisis that spread around theworld.

Next week: a budget stance to promote growth.