Due to the size of this post, it was split in two. You can find Part B here.

The M&B series is back! The goal is to finish the first complete draft of the book by the time I need to teach my Money and Banking course. Over the coming months, the following topics will be covered.

- Overview of the financial system

- Federal Reserve System institutional analysis

- Interest rate and interest rate structure

- Pricing of securities

- Off balance sheet: Securitization

- Off balance sheet: Derivatives

- Monetary policy in action (issues surrounding interest-rate rules, transmission channels, etc.)

- International monetary arrangements and exchange rates

- Modeling (theory of the circuit, including the money supply in models, stock-flow coherency, portfolio constraints, capital gains, using models, etc.)

With these new sections and the seventeen other chapters of the book (which I have already rewritten in part to take into account feedbacks from my students), one should have a solid alternative preliminary text (let me know if I should cover more topics). The incomplete draft was well received by my students and has been downloaded over 8000 times as of May 2017.

Remember that this series (and book) emphasizes the importance of balance sheet mechanics and the upcoming posts will continue to do so whenever balance sheets, and more generally double-entry accounting rules, help to explain the issues at hand.

Like last year, the upcoming posts will be raw with limited editing. The point is to get the ball rolling and to get as many feedbacks as possible from the readers. As previous readers may have noticed, the book that contains previous posts was significantly edited (but still contained many typos). So here we go!

Chapter 1 in the book (post 1 on NEP) explains what a balance sheet is and how it evolves. In doing so, an emphasis is put on the fact that a balance sheet must balance and that double-entry accounting rules cannot be denied. Posts 18 and 19 provide an overview of some elements of the U.S. financial system by focusing on balance sheets. They will be part of chapters 2 and 3 in the upcoming revised book. The U.S. financial system is extremely complicated. Figure 18.1 provides an overview of that system that consists of three main categories; financial markets, financial companies, and regulatory and supervisory institutions. Post 18 emphasizes that that the world of finance is a world of promises and it goes through most of the different sorts of promises that exist. Post 19 overviews the private and public institutions that are involved in the financial industry.

Figure 18.1 The financial system in the US

The Financial Sector: A World of Promises

Anybody can make any kind of promise. “I will pick you up tonight at 8PM,” “I will do my homework tomorrow” “I will provide you a free pizza whenever you want,” “I will service my mortgage every month for the next 30 years.” The hard parts are, first, to convince others of the genuineness of the promise so they are willing to accept it and, second, to fulfill the promise once it has been accepted. If the issuer of a promise is not credible (maybe he has a reputation for being late and lazy, maybe he defaulted on past debts), there is much less chance that the promise will be accepted or it will be accepted only at a high cost to the issuer. Thus, all promises involve the credibility of the issuer, that is, trust in the ability and willingness of the issuer of a promise to fulfill that promise. The world of finance establishes a framework to record the creation and fulfillment of formal promises that are financial in nature, and to measure the credibility of issuers at any point in time. As noted briefly in Post 14 but developed in a later post, finance measures more or less accurately the credibility of these financial promises by pricing promissory notes.

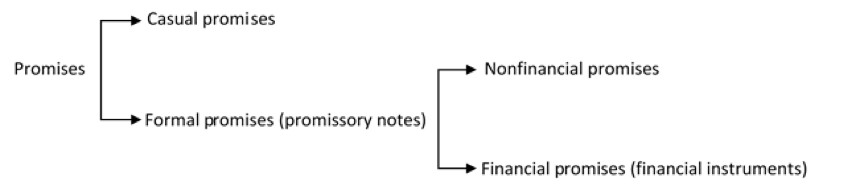

This textbook will use the term “promissory note” for formal promises, that is, promises that carry the weight of the law either through contractual agreements or through legislations. A promissory note may be financial or non-financial depending on the nature of the promise made. A free-pizza coupon is a non-financial promissory note (see Figure 18.3 for other examples) because the reward provided by the issuer is not monetary in nature. On the contrary, a mortgage note or a monetary instrument merely involves future monetary transfers with the issuer (interest payments, tax payments, among others). The textbook studies financial promissory notes (also known as “financial instruments”).

Figure 18.3 shows that a promissory note does not have to take a specific shape or to be made of a specific material. Today the cheapest means to make a promissory note is through an electronic entry, but issuer may choose to do so by stamping gold or leather, or by printing paper, and they may make the object concretizing the promissory note very fancy and big or very small and simple. The shape and material is irrelevant to the existence of a promissory note. As long as key legal elements, described below, are included, there is a promissory note.

Figure 18.2 A categorization of promises

Figure 18.3. Some nonfinancial promissory notes

Creation and destruction of promissory notes

The creation (and destruction) of any promissory note, financial or nonfinancial, involves at least two actors: the issuer, who makes the promise, and the bearer, who accepts the promise and so chooses to trust the issuer. Without a willing bearer, there cannot be issuance and without a willing issuer, there cannot a promissory note. As such, banks cannot created bank accounts if nobody wants to hold them (see Post 10), corporations cannot issue shares if nobody wants to acquire them, etc.

The creation of a promissory note is a complicated matter that involves lots of legalese explaining in detail the promise and what happens if it is not fulfilled. Lots of time is also spent on determining how credible the issuer is—its creditworthiness—and how the willing bearers are to hold. The legal document that records all the details of a promissory note can run for hundreds of pages, and bearers and issuers are supposed to know all the details of the agreement, which is sometimes not the case as illustrated in a later post on securitization.

One may wonder why one may decide to issue a financial instrument and why others are willing to hold it. People, businesses, governments and other entities issue promissory notes for all sorts of reasons. Some want to obtain funds to be able to go to school or to buy a car, others want to buy expensive equipment to expand their productive capacities, another reason maybe to provide meals to poor households or to maintain and develop the infrastructure of the state, and yet another reason is to manage the overall national economy. In general, financial promissory notes are issued because someone, the issuer, does not have enough funds on its balance sheet to pursue the goal it sets for its self; the issuer has a deficit of funds. By issuing financial promissory notes, the issuer asks other economic with a surplus of funds, or with the ability to create those funds, to trust him by giving him funds that he promises to return later on with some rewards. Depending on the nature of the reward and the credibility of the issuer, the demand for a promissory note varies. When the promissory note comes due, the issuer repurchases its promissory note from bearers by giving back to bearers the funds they provided in the first place.

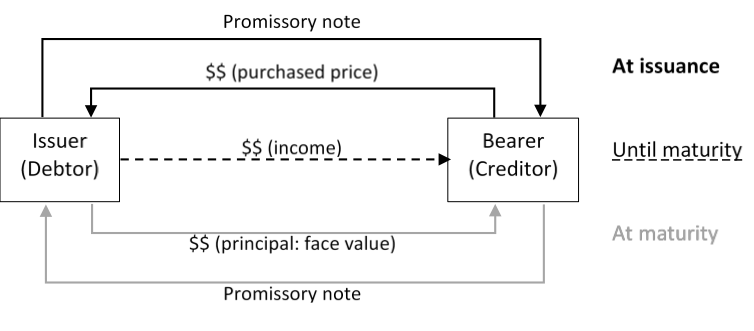

Figure 18.4 shows the general logic behind financial instruments (here denominated in dollars). At issuance, the issuer sells a promissory note to the bearer. The bearer decides to buy the promissory note of the issuer at a certain price, say $100. The issuer then uses the $100 for whatever purpose. Until the promissory note is returned to the issuer, the bearer receives periodically a monetary reward from the issuer (e.g., $10 every month or $20 every six months). When the principal is owed (“at maturity”), the $100 is paid back by the issuer to whomever presents the promissory note. The issuer is effectively buying back its promissory note and he does so at its face value, that is, the monetary sum inscribed on the promissory note. Once it has recovered his promissory note, an issuer destroys it to prevent others from acquiring it and so having a claim on the issuer.

Figure 18.4 Broad logic behind financial instruments.

As illustrated below and explained in a later post on the price of promissory note, Figure 18.4 does not fit exactly the structure of all financial instruments because sometimes the income is not paid until maturity (zero-coupon securities), sometimes the principal is paid bit by bit overtime (fully-amortized promissory note) rather than at once at maturity (unamortized promissory note), sometimes the issuer never promises to buy back his promissory notes and so never has to repay the principal (consols, corporate shares). However, the Figure illustrates the general point that someone issued a promissory note, pays a reward, and then takes back its promissory note at maturity. Post 15 shows that this logic applies to all financial instruments including from monetary instruments.

Characteristics of a promissory note: Term to maturity, liquidity, risks, and other characteristics

Balance sheets contain many types of financial instruments. Some of them are issued by an economic unit to others who have a claim on the issuer (financial liabilities), some of them are held by that same economic unit who has claims on others (financial assets). The way a promissory note is structured varies widely depending on the needs of their issuers and potential bearers, but common questions that a promise must answer are:

- Who is the issuer? That is, who made the promise? The mark of the issuer (name, head, etc.) is present so bearers know who is supposed to fulfill the promise contained in the promissory note.

- What is the unit of account? Promissory notes cannot exist before there is a unit of measurement for transactions and outstanding assets and liabilities.

- When will the issuer take back its promissory note? That is, how long will it take the issuer to fulfill the promise? There is a term to maturity. At maturity, the issuer must take back the promissory note it issued. The term can go from zero (issuer takes back its promissory note at the bearer’s discretion) to infinity (issuer takes back its promissory note at its discretion).

- At what price will the issuer take back its promissory note? A face value specifies the number of units of account the promissory note carries ($100, $10, $1, 25 cents, etc.) and so the monetary value of the principal owed.

- How will the issuer take back its promissory notes? How can bearers redeem the notes? The expected means that will be used by the issuer to fulfill his promises, also called the “reflux mechanisms/channels” or redemption channels (Post 14 shows that the way this question is answered is crucial for financial stability)

- What is (are) the benefit(s)/reward(s) for those willing to trust the issuer? Income, voting rights, settle debts owed to issuer, avoid prison, etc.

- Are there any protections for bearers in case the issuer is unable or unwilling to fulfill the promise? If the issuer defaults on its promises, the bearers get paid by taking ownership of some assets of the issuer (house for mortgages, etc.). The asset(s) of the issuer uses to secure a promissory note are (is) called a collateral. If there is no collateral, the promissory note is said to be unsecured.

- Is it possible to transfer the promissory note to another bearer? Promissory notes may be marketable/transferable/negotiable, that is, the person to whom the promise has to be fulfilled can be changed by transferring ownership of the promissory note. Some promissory notes are not transferable because they name the beneficiary and cannot be endorsed to someone else. Some, like checks, have limited transferability through endorsement.

Depending on how these questions are answered, the name of a promissory note changes in the same way the race of a dog changes depending of its physical characteristics; some are called stocks/shares, bonds, or mortgages, others are called bills, commercial papers and student debt. While they differ in characteristics, they all contain a promise made by someone (the issuer) to someone else (the bearer).

Depending on the previous characteristics, a promissory note is also more or less liquid. Broadly, the liquidity of an asset means the ability to sell it quickly without incurring major capital losses. A house is one of the most illiquid assets. If someone decides to buy a house today for $500,000 and wants to sell it the next day, it will be impossible to sell it for at the same price. The owner will either have to wait—days, weeks, months, or years depending on the popularity of the location of the house and the state of the economy—to find someone willing to buy it for $500,000, or will have to offer a large discount to sell it immediately: there are plenty of people willing to buy a house for $100.

One way to check if a promissory note or any other asset is liquid is to analyze how its nominal price behaves overtime, that is, at what price its circulates overtime among bearers. Figure 18.5 shows how the price of three different promissory notes with the same face value changes overtime. Promissory note #1 is perfectly liquid in the sense that the price at which it passes among economic agents is constant; it is always face value and so there is never any capital loss (or gain). Federal Reserve notes (FRNs) are example of perfectly liquid promissory notes: a $20 FRN is always accepted at $20. Promissory note #3 is highly illiquid because, even though one may be able to record a capital gain by selling at the right time, its nominal price is highly volatile. Promissory note #2 is less liquid than promissory note #1 but more liquid that promissory note #3. Indeed, while the initial bearer will always make a capital loss if he sells, the volatility of the price is low and so later bearers will have less chance to record large capital losses if they want to sell quickly.

Figure 18.5 Liquidity and price volatility

Note that the notion of liquidity is different from the notion purchasing power stability. A $20 Federal Reserve note may circulate at $20 at all times but the amount of goods and services that $20 can purchase varies through time. Post 11 and Post 15 explains that the mechanics at play in the determination of liquidity and purchasing power are quite different.

Why are some promissory notes more liquid than others? Two main factors determine the liquidity of a promissory note. One is its financial characteristics presented above. Another is the existence of a well-organized financial infrastructure that allows for a smooth trading of promissory notes according to their financial characteristics; in this case, the price at which the promissory note circulates reflects well the promise made.

In terms of financial characteristics, as explained in a later post and Post 15, the most liquid promissory notes are those that are transferable, of the shortest term to maturity, and with reflux mechanisms that are reliable and compatible with their term to maturity. Federal Reserve notes are due on demand, checking accounts are due on demand and so both are perfectly liquid given that existing reflux mechanisms do allow bearers to redeem on demand.

In terms of financial structure, a well-developed deep market will promote liquidity. A deep market means that the price at which a promissory note trades is not influenced by major swings in its demand or supply. If trading in a market is limited and participation is thin (few buyers and sellers at any price point), the price of a security will be very sensitive to a change in demand or supply of that security. In this case, there is a high chance to record a capital loss if some participants try to sell the security quickly. On the contrary, if trading volume are strong and at any price point there are lots of willing buyers (so the price cannot fall much) and sellers (so the price cannot rise much), a promissory note will be more liquid given its financial characteristics.

Once an economic unit has decided what type of promissory note to issue, and assuming some willing bearers do exist, the difficult part becomes to fulfill what was promised. A bearer may also want to sell the promissory note to another bearer and may have difficulties to do so. As such, the bearer of a promissory note faces several risks, among which are:

- Credit risk: The issuer is not able or unwilling to fulfill what was promised when it was promised. The income due is not paid, or only paid partially, or paid fully but not on time. The issuer is not able or willing to repurchase partially or fully its promissory note—i.e. part or all the principal—when he stated he would. More broadly, credit risk occurs when any other part of a promise is not fulfill in terms of amount and/or timeliness. If credit risk does occur, the issuer is said to have defaulted/to be in default/to be delinquent. This has important implications for the creditworthiness of the issuer and for the price of its promissory note as explained in a later post.

- Prepayment risk: Some clauses in a promissory note may allow the issuer to repay the principal due more quickly than the stated term to maturity. For example, a bearer may buy a promissory note expecting to earn an income over 10 years, but the issuer may suddenly decide to repurchase fully his promissory after 7 years, which leads to a loss of income for the bearer. Households usually tend to repay their mortgages more quickly than the original term to maturity (a 30-year mortgage is repaid in 20 years by making accelerated payment of the principal), some bonds are callable (i.e. the issuer can repurchase them earlier than expected).

- Collateral risk: If the issuer defaults, the value of the collateral may not be high enough to recover all the income, fees, and principal due to the bearer.

- Liquidity risk: If the bearer decides he no longer wants to hold a promissory, he may try to sell it to another bearer (the issuer will not buy it back until maturity). Doing so may, however, be costly if the promissory note is not liquid as explained above.

There are many other risks that exist for bearers that are more or less pronounced depending on the structure of the promissory note, the structure of the balance sheet of the issuer and of the bearer, and the state of the economy. The main point is that accepting to hold a promissory note is not without risks, not only because one must trust the issuer but also because of potential adverse changes in financial market conditions and in the overall economic situations. Given the characteristics presented above, one may classify financial promissory notes into marketable (aka “securities”) and non-marketable (aka “advances” or “loans”). The following uses the Financial Accounts of the United States to present an overview of financial instruments. The Accounts measure how much of each instrument is outstanding, who the issuers are and who the bearers. Since 1945, a lot has changed in terms of these elements.

Marketable promissory notes: An overview

While some securities are not marketable, most of them are because the promises that they contain can be fulfilled to anyone who holds the security rather than to a specific bearer. There are three broad types of securities that are distinguished by their financial characteristics; equity securities, debt securities, and monetary instruments. Monetary instruments are analyzed in Post 15 and Post 16.

Equity securities

There are different types of equity securities such as corporate stocks/shares/equities and mutual fund shares. The main legal aspect of equity securities is that they represent a stake in the business that issued them. As such, while they may not manage the business, holders of equity securities are collective owners of the business and their financial wealth depends on how profitable the business is. The income earned from the equity security—called dividend—is a proportion of the profit so if the business does not make any profit no dividend is paid. Even if there is a profit, dividend payment may not be guaranteed if the board of the company decides that it is best to allocate earnings in a different manner, such as the expansion of the business. Not paying a dividend is, however, a risky strategy because unhappy bearers may decide to dump the security leading to a fall in its price. This could make the business subject to potential hostile takeover bids by competitors who want to take control of the business by acquiring a large quantity of its stocks.

Given that they are the owners of a company, equity security holders make collective decisions about the major issues facing a business. Each share gives a vote and the more share one owns in a business, the more voting power one has. Some holders of equity securities may prefer to give up that right in exchange for a more certain income. This is the main different between common stocks and preferred stocks, with the latter guaranteeing a dividend as long as there is some profit, but also not giving a right to vote.

Equity holders are the first one to take losses in a bankruptcy procedure. For example, assume a business only has $100 worth of assets to make payments to thousands of creditors. The overall dollar amount owed in terms of principal, income, and other claims is $10,000 including $1000 worth of equity securities. The bankruptcy judge is tasked with distributing the $100 among claimants. One way would be to give 1 cent per dollar claimed and to call it a day, but that is not how equity securities are structured. Equity holders take losses first and so the $1000 they are owed is wiped out first from the claims on the business. The judge then moves to the next claimants, holders of debt securities and other claims, to figure out how to allocate losses.

Finally, the term to maturity of an equity security is infinite, which means that the issuer never promises to pay back the principal owed. Issuers of equity security may choose to buy back their equity securities at their convenience, but they do not have to do so. For example, if one buys a corporate share with a face value of $1000 from business X, business X is under no obligation to repay the $1000. If one wishes, one may try to sell the share to someone else at the prevailing market price (that may be above or below $1000).

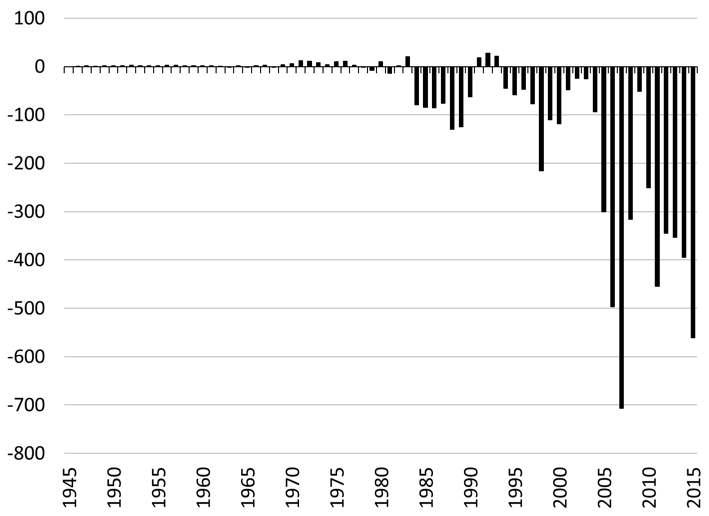

Interestingly, the corporate business sector has never used the stock market as a major source of funds and, since the early 1980s, corporations have used many of their earnings to repurchase the shares they previously issued. While some corporations have issued large quantities of shares to finance their business operations—Facebook and Twitter may come to mind—other corporations have repurchased their shares in quantities that dwarfs new issues. As a consequence, Figure 18.6 shows that the net increase in corporate shares (issuances minus repurchases) has been constantly negative since 1994 and averaged -$231 billion annually from 1994 to 2015.

Figure 18.6 Net issuance in corporate equities, billions of dollars.

Source: Board of Governors of the Federal Reserve System (series Z.1, F.102, line 38)

A central reason behind this trend has been a change in the management strategies of corporations because of the financialization of the economy (see Post 7). For example, business managers have seen a change in their remuneration structure away from salary and toward stocks and bonuses. This has pushed managers to find means to boost up the short-term trend of stock prices, and one means to do so is to make the stock of a company scarcer. Thus, large sums have been used by businesses to repurchase their shares to the detriment of other more productive purposes, like research and development or investment.

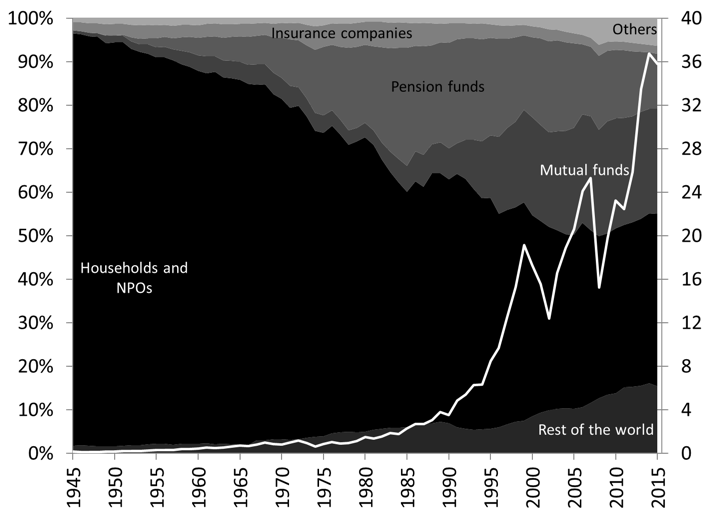

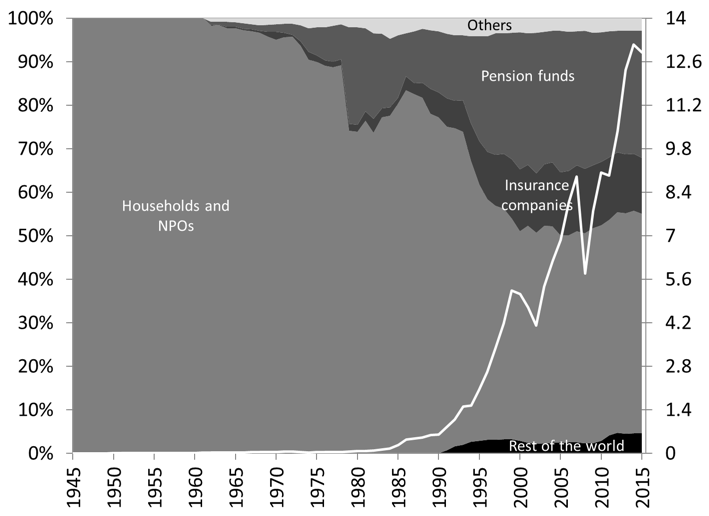

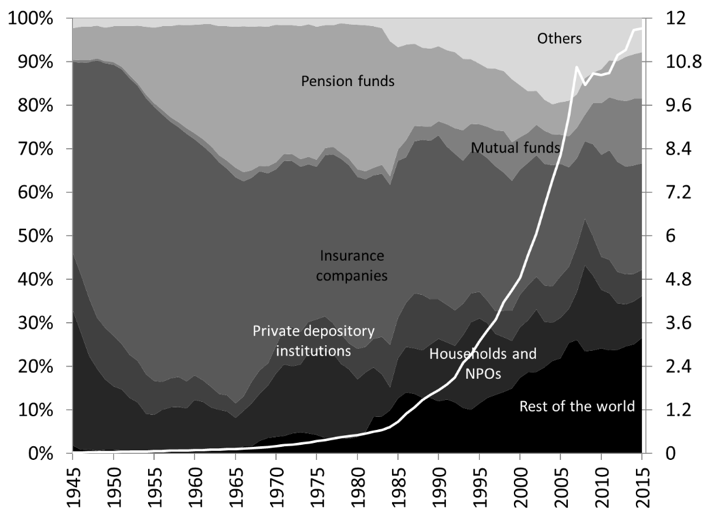

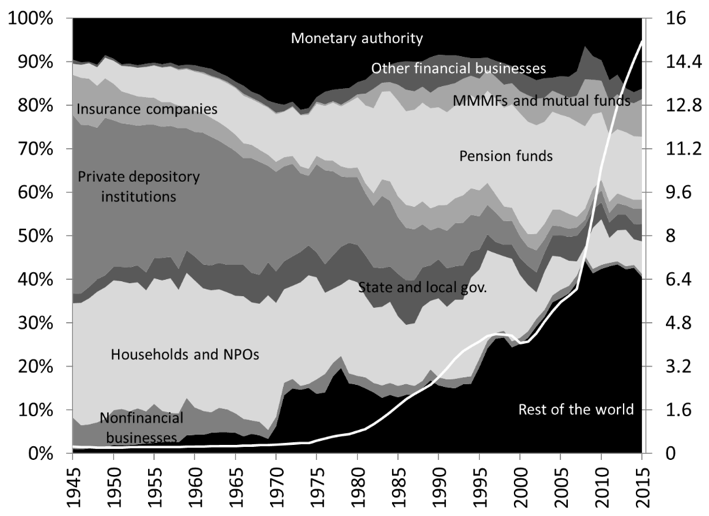

For every issuer of a promissory note there is a bearer, for every creditor there is a debtor. Figure 18.7 and 18.8 illustrate this point by showing the structure of ownership of corporate shares and the structure of issuers. In 2015, the market value of outstanding corporate stocks was about $36 trillion. Households hold most of the stocks, either directly or indirectly via money managers (pension funds, mutual funds and insurance companies). Figure 18.7 shows that two trends in the evolution of the structure of ownership. One is the growing role of money managers—also known as institutional investors—and another is the internationalization of the ownership. Until the late 1950s, over 90 percent of corporate shares were held directly by households and non-profit organization (NPOs). Overtime, money managers—especially pension funds and mutual funds—have owned a great proportion of corporate shares and, by 2015, money managers held about 40 percent of all corporate shares, with another 40 percent held directly by households. The rest of the world has also held a growing proportion of outstanding corporate stocks in the United States and today owns about 15 percent of them.

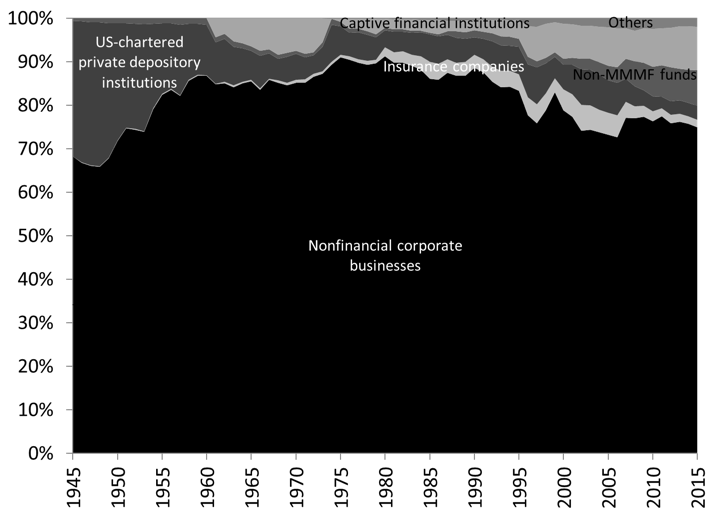

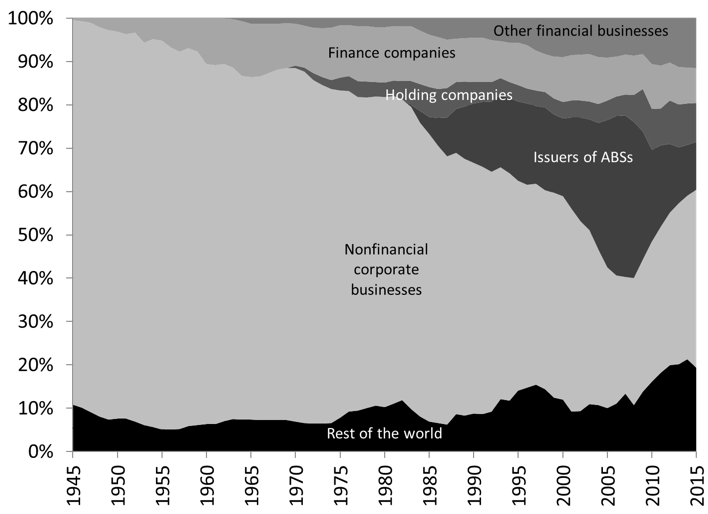

Over 70 percent of corporate shares outstanding are issued by nonfinancial corporations (Figure 18.8). This proportion is even larger if one includes the shares issued by “captive financial institutions.” They are financial affiliates of nonfinancial corporations that provide financial services to the customers of the parent nonfinancial corporations (credit cards issued by retail stores, financing provided by a car dealer to its customers, among others). Banks chartered in the United States, life insurance companies, non-MMMF funds (closed-end funds and exchange-traded funds) are most of the other issuers of corporate shares.

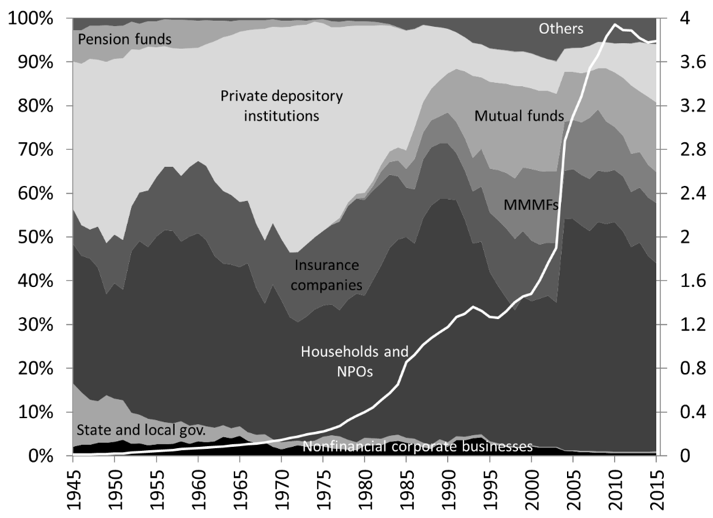

Figure 18.9 shows that another major issuer of equity securities are mutual funds with the market value of their shares equaling $12 trillion. The evolution of the structure of ownership of mutual funds shares follows a similar story to corporate shares with 100% of mutual funds shares held directly by households until the 1960s, followed by a rapid increase of indirect ownership via money managers that today hold about 40 percent of mutual fund shares. Foreign ownership is less pronounced than for corporate shares with only about 5 percent of mutual funds shares held by the rest of the world.

Figure 18.7 Structure of ownership of corporate equities (percent) and market value of outstanding shares (trillions of dollars)

Source: Board of Governors of the Federal Reserve System (series Z.1, L.223)

Note: “Others” includes monetary authority (common stocks of American International Assurance Company Ltd. (AIA) and American Life Insurance Company (ALICO) held between December 2009 and January 2011 via special purpose entities AIA Aurora LLC and ALICO Holdings LLC), the federal government (preferred shares issued by US banks to Treasury to access emergency injection of capital via the Troubled Asset Relief Program), private depository institutions, state and local government, closed-end funds, exchange-traded funds, and security brokers and dealers.

Figure 18.8 Structure of issuers of corporate equities (percent)

Source: Board of Governors of the Federal Reserve System (series Z.1, L.223)

Figure 18.9 Structure of ownership of mutual fund shares (percent) and market value of outstanding shares (trillions of dollars)

Source: Board of Governors of the Federal Reserve System (series Z.1, L.223)

Debt securities

Debt securities are distinct from equity securities by the fact that they do not represent a slice of ownership of the company but rather are an acknowledgment of debt by the issuer. This acknowledgement comes with a promise to repay the principal and a guaranteed reward even if the issuer does not earn any income (issuer has to sell assets, use its savings or find other means to pay the income due on debt securities). Debt securities are also provided more protection in case of bankruptcy, the first layer being provided by equity securities. However, not all debt securities are equal in bankruptcy and some may be subordinated to others, that is, may absorb losses before others debt securities. The post on securitization will develop this point.

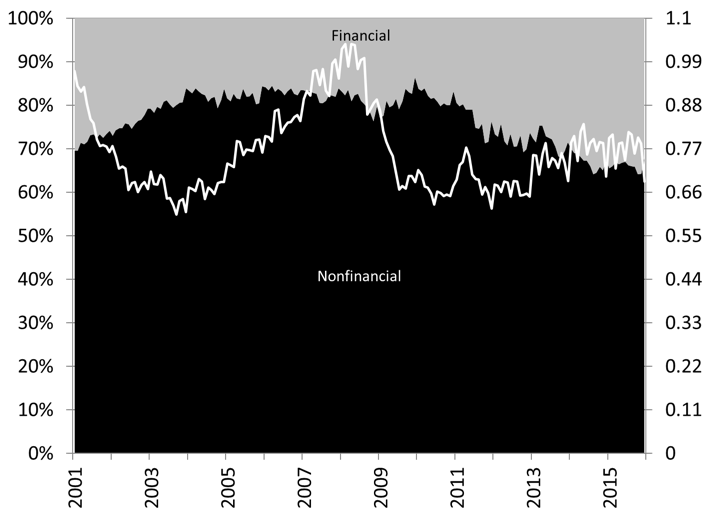

The structure of debt securities varies greatly to fit the needs of the issuer and bearers. Some pay a periodical income—called coupon—but others do not, some are secured while others are not, and the range of the term to maturity varies from one month to decades. A classic example of a short-term debt security is the commercial paper. Some businesses may mostly need extra funds for a short period in order to pay their workers and to buy the raw material needed to start production. Once the production is completed and the output sold, the businesses repay their debts. Commercial papers are short-term promissory notes that fulfill such financial needs. Their term to maturity at issuance is usually less than 270 days and averages 30 days in the United States. Figure 18.10 shows that about 70 percent of commercial papers are issued by nonfinancial corporations either to finance inventories (renting space, paying insurance, etc.) or to finance production (paying wages, electricity, etc.). The rest are issued by financial companies that seek short-term sources of funds.

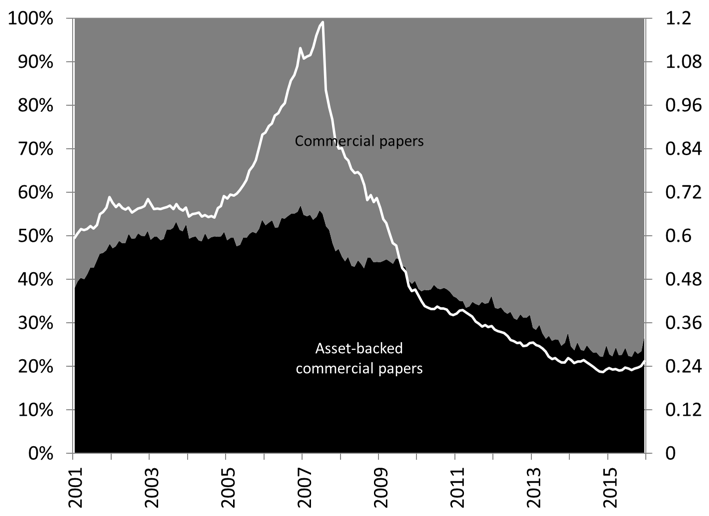

Given that the issuance of commercial papers is tied to economic activity, the outstanding dollar amount of commercial papers fluctuates with the business cycle: it rises in an expansion and falls in a recession. Commercial papers do not pay a coupon but reward their bearer is another fashion explained in a later post. Most commercial papers are unsecured promissory notes but, with the rise of securitization (see a later post), a secured form of commercial papers—called asset-backed commercial papers (ABCPs)—became prominent. Figure 18.11 shows that the outstanding volume of ABCPs peaked at $1.2 trillion in 2007—about 50 percent of all types of commercial paper outstanding—before collapsing to $240 billion by 2015 or about 25 percent of all types of outstanding commercial papers.

Figure 18.10. Structure of issuers (percent) and outstanding dollar amount (trillions of dollars) of commercial papers.

Source: Board of Governors of the Federal Reserve System (series “commercial paper”)

Figure 18.11. Proportion of unsecured and secured commercial papers and outstanding dollar amount of asset-backed commercial papers (trillions of dollars)

Source: Board of Governors of the Federal Reserve System (series “commercial paper”)

Note: There are four categories of commercial papers in the dataset: nonfinancial, financial, ABCPs and others. “Others” represents an insignificant proportion and are included in commercial papers.

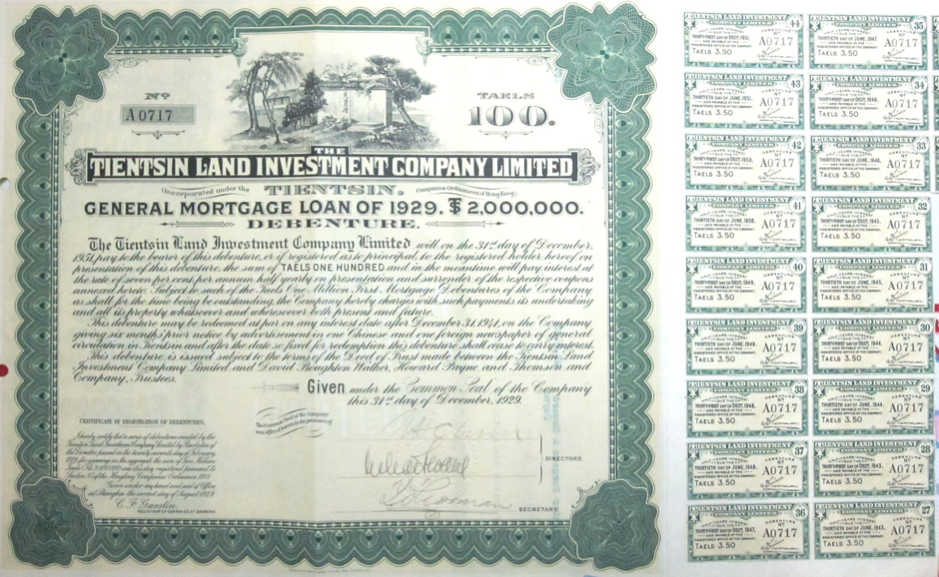

While commercial papers deal with the short-term needs for funds of businesses, corporate bonds deal with their medium to long-term needs. Bonds pays an interest income. The interest income is called “coupon” because bonds were formerly made of paper and small coupons were attached to the bond, and had to be cut and hand over to the issuer in order to receive the interest payment. At maturity, the issuing corporation buys back the bonds from whomever holds it and pays the face value of the bond. Figure 18.12 shows an old-fashion bond with the bond on the left stating a face value of 100 taels (a unit of account that prevailed in China) and 18 coupons on the right. An interest income worth 3.5 taels was due every six months so this bond, issued by Tientsin Land Investment Company, had an initial term to maturity of 9 years: interest income is paid twice a year for 9 years whenever a coupon is handed and, after 9 years have passed, the bond is returned to Tientsin to get $1000. Today, all financial instruments, except for cash, take an electronic form because this form is cheaper to create (it is just a matter of keystroking numbers and letters on a computer; no need for fancy illustrations and calligraphy and cumbersome printing) and to track (centralized accounting of amount due and owners, quick crediting and debit of amount by keystroking on the computer).

Figure 18.12. An old fashion bond

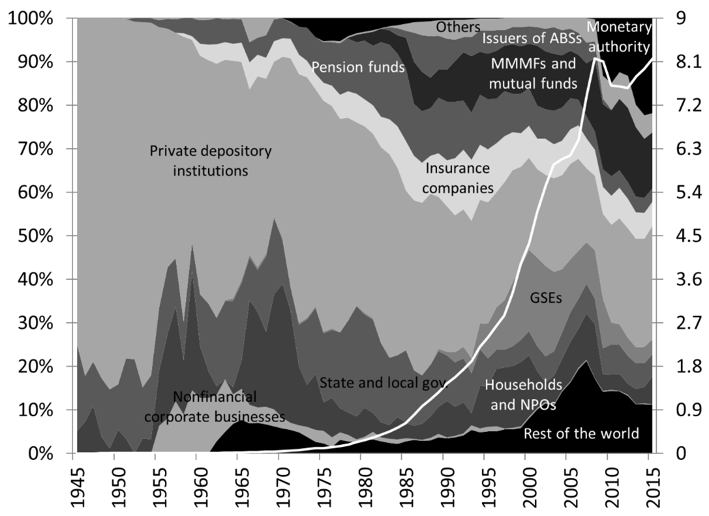

Figure 18.13 shows that a wide variety of economic entities are interested in buying such promissory notes with an outstanding value of a little less than $12 trillion in 2015. Insurance companies, pension funds, and more recently mutual funds have been major purchasers of corporate bonds and in 2015 held about 50 percent of all corporate bonds, down from 85 percent in the 1960s. Today, other financial institutions, such as exchange-traded funds, and the rest of the world have become major holders of corporate bonds, with rest of the world owning about 25 percent of outstanding corporate bonds in 2015.

Figure 18.14 shows that issuers of corporate bonds have also diversified considerably since 1945. Nonfinancial businesses have been major issuers and so have been finance companies, but with the growth of securitization in the 1980s, special purpose entities (“issuers of asset-backed securities” or ABS issuers) have become major issuers and, by 2007, 40 percent of outstanding corporate and foreign bonds were issued by them. Since the Great Recession, however, the volume of corporate bonds issued by ABS issuers has diminished considerably and, in 2015, only 10 percent of outstanding corporate and foreign bonds were issued by ABS issuers.

Figure 18.13 Structure of ownership of corporate and foreign bonds (percent) and dollar amount outstanding (trillions of dollars)

Source: Board of Governors of the Federal Reserve System (series Z.1, L.213)

Note: “Others” includes money market mutual funds, exchange traded funds, security brokers and dealers, and federal, state and local governments, among others.

Figure 18.14 Structure of issuers of corporate and foreign bonds, percent

Source: Board of Governors of the Federal Reserve System (series Z.1, L.213)

A type of corporate bond that was at the center of the 2008 financial and that a later post will study in detail is the private-label mortgage-backed security (PL MBS). Figure 18.15 shows that in six years the dollar amount of PL MBS rose tenfold from $200 billion in 2001 to over $2 trillion in 2007. In the Financial Accounts, the sector that issues them is called “issuers of asset-backed securities,” which are special purpose entities created by private depository institutions to hold mortgages and other promissory notes (see post on securitization). While most of PL MBSs were initial held by depository institutions (they bought the securities issued by the special purpose entities they created), for reasons explained in the post on securitization, government-sponsored enterprises, insurance companies and the rest of the world came to hold 90 percent of them by 2000. The latter were especially eager to buy them when the issuance of PL MBSs boomed in the early 2000s.

Figure 18.15 Structure of ownership of private-label mortgage backed securities and other asset-backed bonds (percent) and dollar amount outstanding (trillions of dollars)

Source: Board of Governors of the Federal Reserve System (series Z.1, L.213)

Commercial papers and corporate bonds are two debt securities that satisfy widely different needs of corporate businesses but private companies are not the only issuer. The United States Department of the Treasury (“Treasury”) is a major issuer of debt securities—called Treasuries—with terms to maturity ranging from 1 month to 30 years. The name of Treasuries changes depending on their initial term to maturity. Treasury bills (T-bills) are Treasuries with a term to maturity of one year or less, Treasury notes (T-notes) have a term to maturity between 2 and 10 years, and Treasury bonds (T-bonds) have terms to maturity over 10 years. Also contrary to T-notes and T-bonds, T-bills do not pay a coupon and so the reward to holders comes in a different form presented in a later post. As explain in Post 6 and through this book, Treasuries are a corner stone of the financial system and the Treasury actively manages the level and structure (that is, proportions) of outstanding Treasuries to meet the needs of other participants of the financial system and to help promote financial stability.

Figure 18.16 shows a similar trend to corporate equities with an internationalization of ownership and a growing importance of money managers, especially pension funds. In 2015, about 40 percent of the $15 trillion of outstanding Treasuries held by the public were held by foreigners (foreign central banks, foreign Departments of the Treasury, foreign businesses and households, and other foreign entities), and about 25 percent were held by money managers. A major difference with corporate equities is that the Federal Reserve (“Fed”) has been a major holder of Treasuries. Since 1945, the Fed has usually held at least 10 percent of outstanding Treasuries. Post 4, Post 5 and Post 6 explain why Treasuries are central to the operations of the Fed.

While the federal government is a major issuer of debt securities, states and localities also issue them—municipals or “munis”—and the issuance of new bonds to fund specific projects is often put on the ballot. Municipals can be structured in two different ways: revenue bonds are issued to finance a specific project (a toll bridge, etc.) which revenues will serve to pay the coupon and principal, while general obligation bonds are issued to finance any project and are paid back with tax revenues. The outstanding dollar amount of munis reached a little less than $4 trillion in 2015 and ownership has been highly diversify and mostly domestic since 1945 (Figure 18.17).

Figure 18.16 Structure of ownership of Treasuries (percent) and dollar amount outstanding (trillions of dollars)

Source: Board of Governors of the Federal Reserve System (series Z.1, L.210)

Note: Treasuries held by intra-federal agencies are not included. For example, the United States Social Security Administration holds a substantial amount of Treasuries in its trust fund.

Figure 18.17. Structure of ownership of Municipals (percent) and dollar amount outstanding (trillions of dollars)

Source: Board of Governors of the Federal Reserve System (series Z.1, L.212)

Note: Others include the rest of the world, closed-end funds, exchange-traded funds, security brokers and dealers, among others.

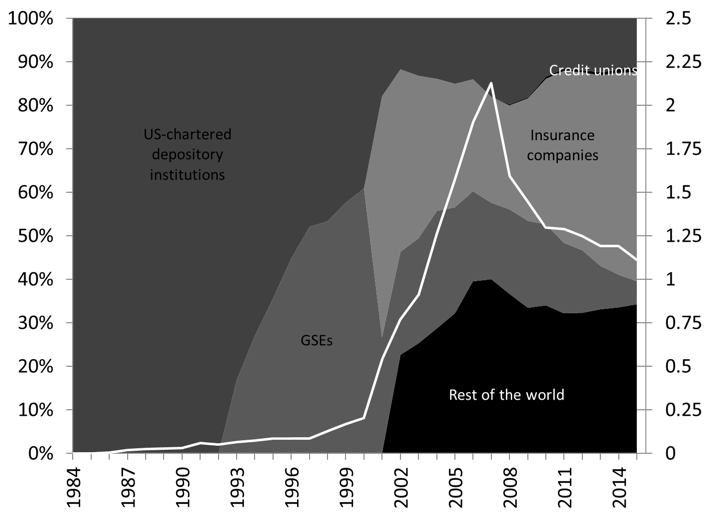

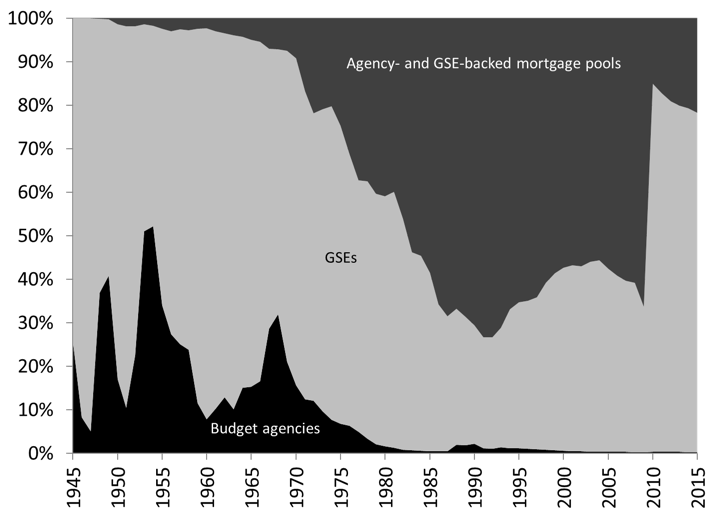

Other major issuers of debt securities are federal agencies, government-sponsored enterprises (GSEs) and the special purpose entities they backed, which altogether issue securities called agency securities. Two prominent GSEs are the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“Freddie Mac”). Their purpose is to promote homeownership and they finance their operations by issuing mortgage-backed securities. A federal agency called Government National Mortgage Association (“Ginnie Mae”) helps further promote homeownership among veterans and low-income households by guaranteeing payments on their mortgages in case of default and by issuing securities backed by these mortgages. While not explicit, financial-market participants believe that, in case of financial difficulties, the federal government will help GSEs—a belief that turned out to be correct as the 2008 financial crisis showed—, so securities issued by GSEs are considered very safe, which leads to a very high demand for them. Federal agencies are part of the federal government and so their securities are considered by be without credit risk, like Treasuries.

In 2015, there was about $8 trillion worth of agency securities (“Agency- and GSE-backed securities”), outstanding and the ownership was highly diversified (Figure 18.18). While private depository institutions were at first the main holders of agency securities, once again money managers and the rest of the world have become major holders. Recently, the Federal Reserve has also become a main bearer of agency securities by holding 20 percent of them following its massive purchases of financial instruments to help contain the effects of the 2008 financial crisis (see Post 4 and Post 5). As Figure 18.19 suggests, GSEs also had to intervene to help their special purpose entities (“mortgage pools”) by buying their securities and exchanging them for GSE securities.

Figure 18.18 Structure of ownership of Agency- and GSE-backed securities (percent) and dollar amount outstanding (trillions of dollars).

Source: Board of Governors of the Federal Reserve System (series Z.1, L.211)

Note: Agency- and GSE-backed securities include securities guaranteed or issued by US federal agencies (Tennessee Valley Authority, Ginnie Mae, among others), securities issued by government-sponsored enterprises (Fannie Mae, Federal Home Loan Bank, among others), and securities issued by special purposed entities created by Ginnie Mae, Fannie Mae, Freddie Mac, and the Farmers Home Administration to pool mortgages and mortgage-related securities.

Figure 18.19 Structure of issuer of Agency- and GSE-backed securities (percent).

Source: Board of Governors of the Federal Reserve System (series Z.1, L.211)

View Part B here

3 responses to “Money and Banking—Part 18 (A): Overview of the Financial System: A World of Promises”