By Glenn Stehle

Texas is the De Civitate Dei, the new holy city of free market fundamentalism, and Ted Cruz, the upstart Tea Party senator from Texas, has been quick to canonize himself as its patron saint. In case you haven’t heard it yet, Texas is now “the light and the way,” and if you don’t believe it, just ask Ted Cruz or Rick Perry, or better yet ALEC:

The Texas growth narrative is well-known by now. Texas’ population grew by 11 million people (79 percent) between 1980 and 2011, more than double the rate of growth of the nation as a whole. With that population growth came job growth. Since the 1990s, the rate of Texas job growth has been a full percentage point or more above the national average most years.

The American Legislative Exchange Council, among others, has suggested that other states should adopt policies that will make them more like Texas in order to grow their economies. One example from the introduction to ALEC’s recent Rich States, Poor States report: “[M]any governors are looking at Texas, which has led the nation in job growth over the past three years, as the state with the best policy to emulate.” In particular, ALEC notes the state’s tax policy as a plus.

But back home in the Lone Star state, how’s that one true faith working out for the state’s less privileged citizens?

Last week Raúl Ilargi Meijer of Automatic Earth wrote an outstanding post on how electric utility companies gouge their residential customers, evade paying taxes and elide pollution controls. His report dealt with the first free market Shangri-la of the “developed” world: Great Britain. So it should probably come as no surprise that when Texas’s free market faithful started casting about for a beau ideal, it was to the enchanted land of Margaret Thatcher — the holiest of holy in the neoliberal pantheon — that their odyssey should carry them:

Texas lawmakers continued studying the issue [of deregulation] during the1998 interim with a seven-member Senate committee going so far as to fly to England to examine that country’s deregulation efforts. During this period, Enron, industrial users and Gov. Bush shored up political support for electric deregulation.

–TEXAS COALIATION FOR AFFORDABLE POWER (TCAP), “Deregulated Electricity in Texas: A History of Retail Competition”

All fired up by their pilgrimage to the neoliberal Mecca, the free market evangels moved quickly upon their return to Texas. With a down-to-earthiness rivaling the populism of an old-fashioned tent revival, they gathered the devoted to declare their holy war on the state’s electrical regulation. As TCAP goes on to explain:

On Jan. 20, 1999, during a packed press conference in a room just outside the Senate chambers, state Sen. David Sibley laid out his plan to deregulate the Texas electric market. The 76th legislative session was just getting under way. Sibley, co-sponsor of Senate Bill 7, would become a leading force behind the legislation that would fundamentally change how electricity is bought and sold in Texas. Sen. Sibley was clear in his intention. “We want this bill to bring down the cost of electricity for all Texans,” he said. Building on that goal, Sen. Sibley later added that “if we don’t get consumers lower rates, then we have been a failure — I’ll be the first to say it.” The Waco Republican also pledged his law “would benefit virtually everyone living within our state’s borders.”

[….]

“Lower electric rates will help Texas companies compete in the international marketplace, make more household money available for spending on non-energy goods and services and bring new investments into Texas,” [Rep. Steve Wolens, champion of deregulation in the Texas House] said.

[….]

Eventually Rep. Wolens and Sen. Sibley merged their ideas into a single piece of legislation, approximately 200 pages long. Enron was a big supporter of the legislation, as were traditional electric companies.

[….]

On March 8 a Senate committee adopted the legislation unanimously. On March 17 the full Senate gave its approval. Wolens’ House committee signed off on the bill on May 12th and then it was adopted by the full House on May 21. Gov. Bush signed Senate Bill 7 on June 18 proclaiming that “competition in the electric industry will benefit Texans by reducing monthly rates.”

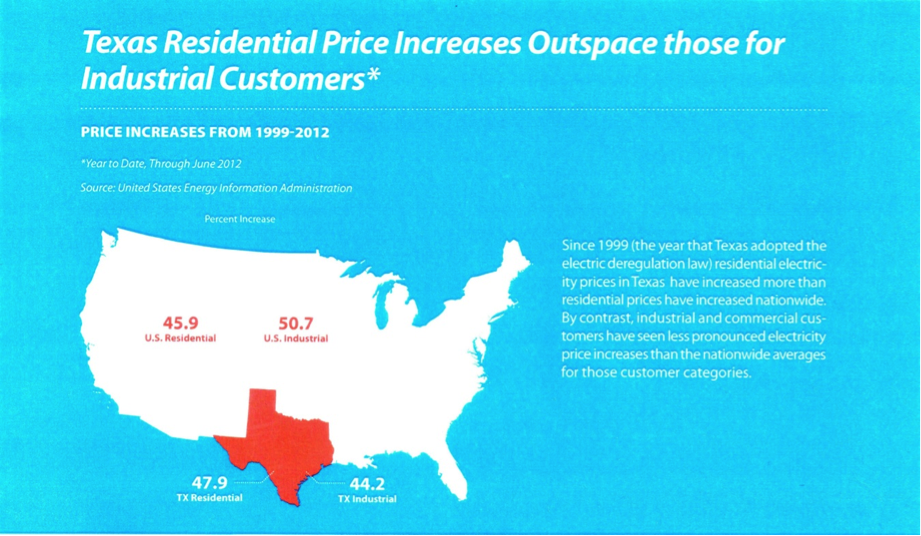

So how has electric deregulation worked out for Texans? The answer is that it’s been a mixed bag. For large industrial users it’s not been too bad. Between 1999 and 2012, their electric power costs have lagged behind those of the rest of the nation. As the graphic below shows, their costs have risen only 44.2%, whereas in the rest of the nation they have risen 50.7%.

But for small residential users who buy electricity at the retail level, they’ve paid a very heavy price. TCAP puts the price tag at $10.4 billion. For the 10 years prior to deregulation, Texas residential users paid average prices 6.4 percent below the national average. In the 10 years after deregulation, Texans residential users paid prices 8.5 percent above the national average.

And high residential prices are not the only problems stalking the Texas grid. Dark clouds are beginning to gather on other fronts. For instance, since deregulation began capital investment in the grid has lagged behind, and the grid is now at risk of being overloaded. In 2012, the North American Reliability Council declared that the Lone Star State had the nation’s least reliable grid.

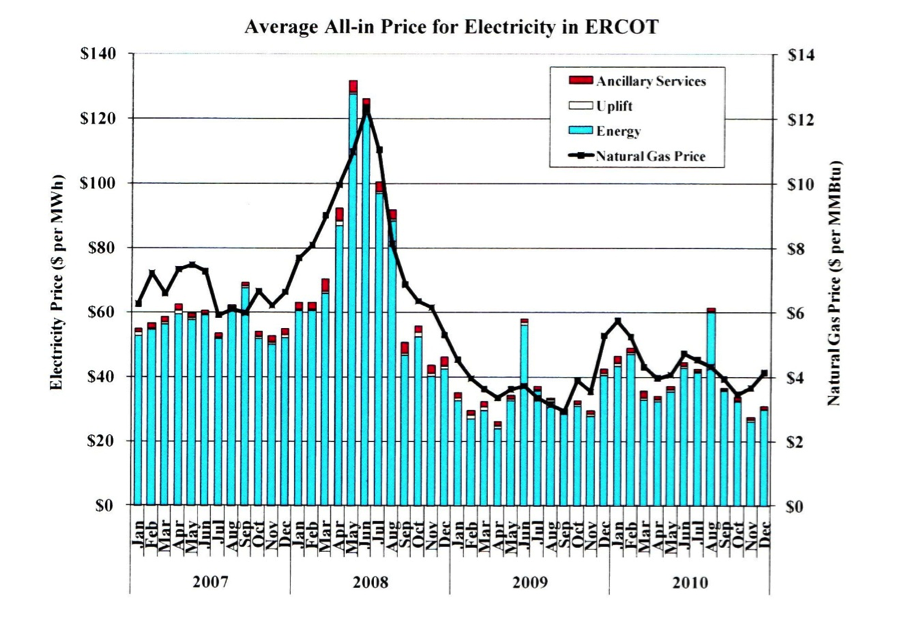

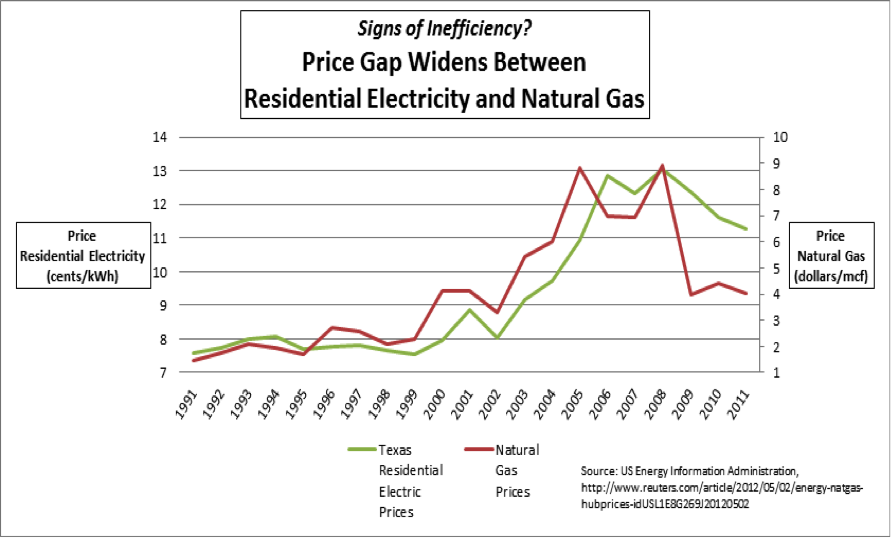

Two graphs tell much of the story. But in order to understand the graphs, it is necessary to understand that a majority of electricity in Texas is produced from natural gas (Susan Combs, “Overview: Non-Renewable Fuels” ) Therefore, when the price of natural gas skyrockets, such as it did in the period between 2000 to 2008, the price of electricity should go up. But when the price of natural gas plummets, as it did after 2008, then the price of electricity should go down.

As the following graph shows, this relationship works extremely well for electrical power sold at the wholesale level, where prices remain regulated and therefore reflect production costs:

However, as the following graph shows, the relationship between natural gas prices (production costs) and electricity prices for small residential customers has broken down:

If we peruse the TCAP Chronicle’s archive of articles, we begin to get a handle on at least some of the reasons why this might be so. We get a window into the methods the retail electricity providers (REPs) use to gouge their residential customers. Under such conditions, a theoretically free market fails, and the REP’s wholesale cost savings are not passed along to retail customers. What we see is a situation not at all unlike what Ilargi describes for the UK, and we discover that it is, after all, a small world, a very small world indeed.

Consumer advocate Carol Biedrzycki has spent the last several years investigating the practices the REPs use to keep their customers ill-informed. As TCAP explains:

Texas electricity companies have an expensive secret: located on your electricity bill are extra fees that may have nothing to do with electricity. According to a new report, many retail electricity providers (REPs) are charging absurd amounts of money for what should be basic customer service — and they’re getting away with it one loophole at a time.

In “Texas Electricity Consumers, Beware of REP Fees” , consumer advocate Carol Biedrzycki examines fees charged by more than 40 retail electric providers between 2011 and 2013. The results are ugly, and Biedrzycki says it’s only getting worse.

[….]

Biedrzycki says that finding fees in the fine print can be like a scavenger hunt, and trying to comprehend the legal jargon can take “hours and days.” Studying a REP’s Terms of Service Agreement and Electricity Facts Label are your best options when attempting to avoid unwanted fees…. But even reviewing these documents won’t protect you when a REP fails to report extra fees in the first place, says Biedrzycki.

One way Biedrzycki says REPs gouge their residential customers is through “minimum usage fees.” The consumer advocate warns that

These are fees added to a bill if the customer’s kilowatt hour use for a month falls below a certain level. Essentially, consumers are being charged for conserving energy.

Biedrzycki saw minimum usage fees on the rise since 2011. Back then, only 36 percent of REPs charged minimum usage fees. Fast forward two years, and that number has increased significantly to 81 percent. Minimum usage fees range from $6.95 at Bounce Energy and Champion Services to $20.00 at 4Charge Energy, according to the report.

“Many elderly and low-income households live in small spaces and intentionally keep their power consumption low to save money and then they are penalized with a minimum usage fee.” Biedrzycki said, “Energy conservation is a goal established by the Texas Legislature. It is contrary to the achievement of the State’s energy efficiency goal to charge consumers a fee for not using enough electricity.”

–TCAP, “Report Part II: Minimum Use Fees”

Another way in which REPs rip off their residential customers is through connection and disconnection fees:

One of the most common and unnecessarily expensive REP fees is the disconnect and reconnect fee, Biedrzycki has found….

But in the age of smart meters, connecting and disconnecting a customer has never been easier — customers are basically paying REPs to do something as easy as sending an email. She said these fees are particularly ironic, given that smart meters were created to save consumers money.

According to Biedrzycki’s research, Ambit Energy charges $15 to disconnect and $50 to reconnect, Green Mountain Energy charges $45 to disconnect and $15 to reconnect, and Reach Energy charges $50 to disconnect and up to $75 to reconnect.

–TCAP, “Report Pat 1: Hidden Charges”

Elsewhere in her report, Biedrzycki finds a litany of other extra fees. One REP, for instance, charges customers $5 for copies of billing records, $15 for making over five payments in one month, and $5.95 if the bill is paid with the assistance of a live agent.

“Because the retail energy marketplace was deregulated by the state more than a decade ago,” TCAP concludes, “REPs can set their own prices.” Biedrzycki believes that doesn’t mean they should blatantly rip consumers off. “They’re getting away with this because no one is stopping them,” Biedrzycki said.

Efforts to create standard-offer products for electricity shoppers have been fiercely opposed by the REPs. In the last legislative session of the Texas legislature, four of the top five biggest spenders on lobbying were electric companies. With so much firepower, the electric industry was able to kill legislation which would have brought standardized products to the market. Such standardized products allow customers to shop based on price and service without having to wade through the reams of fine print contained in a bewildering array of Terms of Service Agreements.

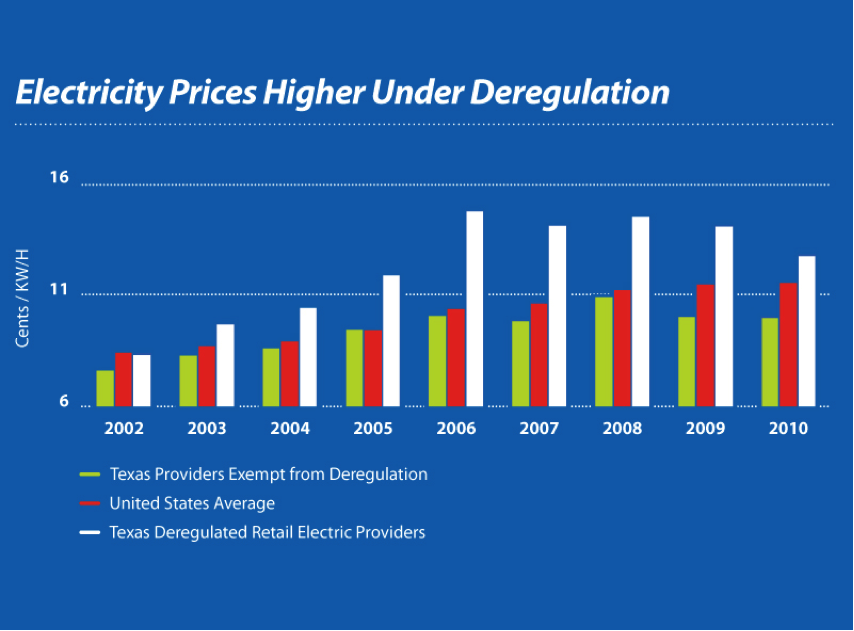

One of the most eye-opening pieces of information TCAP has produced is the following graph. City-owned REPs like Austin Energy and CPS Energy in San Antonio, and rural electric cooperatives and investor-owned utilities, are still regulated. Comparing prices among deregulated REPs to regulated utilities yields the finding that prices rose faster in “competitive,” deregulated markets.

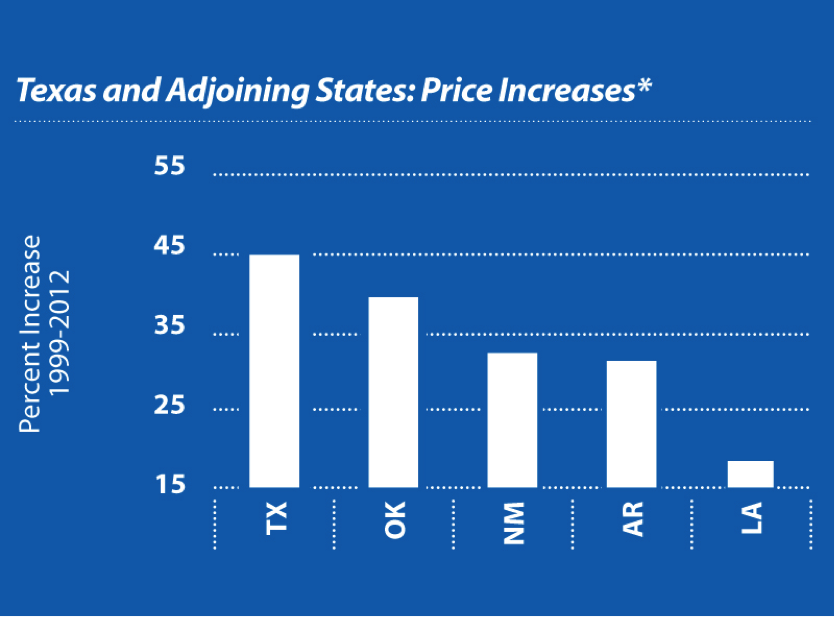

For Texas residential customers, 2012 marked the second consecutive year of prices below the national average. This downward trend was largely driven by changes in the commodity price of natural gas, which fuels many of the state’s power plants. But despite the good news, the Texas market by many important measures continued to underperform. As of June 2012, for instance, average overall electricity prices in Texas were higher than average prices in adjoining states.

In addition to price, reliability questions began to stalk Texas’ electric grid with the occurrence of rolling blackouts in 2011. According to TCAP,

new power plant construction was just barely keeping up with demand, and some policy experts were diagnosing serious “structural” problems with the Texas market. In 2012, the North American Reliability Council declared that the Lone Star State had the nation’s least reliable grid. This was in contrast to big generation reserves prior to the adoption of the Texas electric deregulation law.

And these reliability problems do not bode well for customers, who are being asked to ante up big money to pay for future capital investment:

Major generation companies like NRG and Luminant continued to clamor for regulatory intervention, complaining that the market was not producing sufficiently high prices to support new investment. This was in contrast to the industry’s earlier warnings against market intervention, back when prices were sky high. ERCOT officials released projections showing the state’s reserve margins for generation capacity falling below safe levels within only a few years.

The PUC took action in June [2012] by increasing the offer price cap on wholesale electricity by 50 percent. This decision allowed generators to offer their power into the spot market at prices of up to $4,500 per megawatt hour, up from the previous cap of $3,000. The Commission reasoned that this change would deliver more revenues to generators and therefore spur new investment…. Moreover, some retail electric providers claimed the right to break fixed-rate deals with customers as a result of the change, and at least one company apparently did so.

Even before the increase, Texas had the highest wholesale offer cap in the nation by far…. In November [2012], the PUC agreed to phase in even more increases — to $5,000 in 2013, $7,000 in 2014 and finally to $9,000 in 2015.

A coalition of industrial customers found that a $9,000 cap could cost the state an additional $14 billion annually. For its analysis, the industrial coalition assumed the extreme weather conditions of 2011. A separate analysis, using the same assumptions, calculated bill increases of $48 to $50 per month. “These are staggering numbers and the impact of the Commission’s decision … should not be trivialized or viewed as a purely academic exercise,” wrote an attorney for the Texas Industrial Energy Consumers in a June 15th regulatory filing.

Deregulated Electricity in Texas: A History of Retail Competition

The electric companies are also clamoring for what are known as “capacity payments,” another customer charge levied ostensibly to pay for future investment in power generation. These payments, which would ultimately be paid for by the REP’s customers, have been estimated as high as $4.7 billion per year. As Randy Moraveck explains:

Grocers make money selling groceries. Bakers make money selling bread. But big electric companies want to make money simply for existing. And if they get their way, electricity costs to Texas residents and businesses would increase, maybe by a lot.

Under proposals now before the Public Utility Commission of Texas, owners of power plants would receive subsidies based on the number and size of plants they own. The more they own, the more they receive. The subsidies would be added to wholesale power costs, but they’d trickle down into home energy bills.

[….]

Ostensibly…the money raised would promote new generation investment.

But generation owners offer no guarantees that they’ll build anything. Other states that have set up capacity-payment systems have found them to be complicated, subject to litigation and fraught with controversy. Most of the money doesn’t end up supporting new-generation investment but rather the profits of generation companies.

A couple of weeks ago, the Texas Public Utility Commission took the first step towards making capacity payments the law of the land.

So it looks like there are major price increases in the pipeline for Texas’s electricity users. Given the state’s track record, who do you reckon will pay for these? The electric companies’ industrial customers? Or their residential customers?

4 responses to “Texas is the New Jerusalem of Free Market Fundamentalism, but how’s that working out for the Lone Star State’s great unwashed?”