By A. Clayton Slawson III*

In today’s economic market, people tend to think excessively about money whether to spend on essential or discretionary goods and services, savings or which investment options to choose, or even the current topic du hour in Washington, whether there is too much or too little money floating around! Many “arm chair” economists, lacking the knowledge of our economic history, stop at these basic thoughts however, and thus never fully understand money in terms of its identity, origin, or even how today’s currencies became of value in the first place. Just as these concerns can vary person to person, so too can the very definition of money and how currency adopts value. In order to better understand the “nature of money,” this paper will utilize the frameworks of both the Orthodox school and the Heterodox schools of thought to provide a basic understanding of money in their respective approaches, which will set up a clear argument for why one approach is more advantageous for guiding economies toward full employment. Undoubtedly, any weekend warrior economists will be better prepared for discussions on money at the conclusion of this paper.

When economists discuss “the nature of money,” they are referring to the essential purpose of money in an economy. Now, it may seem unambiguous, money is money, yet depending on the school of thought, money can serve two completely different purposes. The Classical and Keynesian schools have been “duking” it out for decades regarding the nature of money and for the purpose of this paper, they be will referred to as the Orthodox and Heterodox schools respectively. Orthodox economists view money as a way to initiate transactions, meaning money’s sole purpose is to facilitate exchanges of goods and services. Conversely, the Heterodox school of thought views money as the end product from entering an exchange of goods and services. The most clear and precise definition of each, is to say that money acts only as a medium of exchange in the Orthodox framework comparatively to the idea that businesses and individuals offer goods and services in exchange for profit in the Heterodox approach. So, one might ask “which came first, the chicken or the egg?” Unlike this unsolved age old adage, this paper will highlight the correct framework to design policy around.

The Orthodox approach is perhaps the most widely taught and recognized theory amongst introductory economics students and the general public alike for its feasibility and simplicity. In this framework, the story generally begins with the tale of Robinson Crusoe or some other rudimentary story of two individuals meeting for the first time; each interested in the others’ possessions. Imagery of the Pilgrims of Plymouth Colony exchanging goods and services with the Wampanoag tribe of Cape Cod is a typical example of such a scenario (Plymouth Colony, 2013). In this case, both parties demonstrate the economic principle of double coincidence of wants, or the fact that in order for either party to take possession of the goods or services offered by the other, each must want what the other has. To better explain the Pilgrim example, if a Pilgrim wants good “A” from a Native American, the Native American must also want good “B” from a Pilgrim in order for the exchange to occur. If neither party wanted nor had what the other is willing to trade, the exchange fails to occur. This calamity is called the double coincidence of wants , or the rare instance that both parties are wanting and willing to trade for the others’ goods or services. In order to negate the double coincidence of wants, the creation of money was the most effective means within the Orthodox school. Before going into detail about actual money in the Orthodox approach, it is appropriate to understand a little more about the reasoning behind adopting a monetary system.

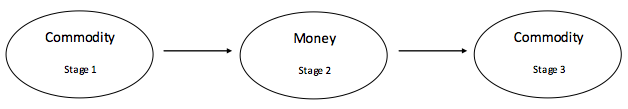

The barter system proves effective only when dealing with the most basic and simple civilizations as the one described in the previous paragraphs, however this type of system fails quickly as the complexity of society increases. One major flaw with the barter system, and perhaps the most important reasons societies graduate to a monetary system is the linked problems of the double coincidence of wants and its logistics. To expand on this idea a little further and frame the argument for money’s maturation in the Orthodox school, it is important to look at an example from Adam Smith. “The butcher seldom carries his beef to the baker or brewer; in order to exchange it for bread or beer (Smith, First Published 1776).” In Smith’s example, one can visualize the double coincidence of wants and the logistical dilemma at work. First, double coincidence of wants raises the predicament that maybe the baker and the brewer have no desire for beef, and in this case, the butcher has no way to acquire bread and beer for a complete dinner. This is to say the butcher is dependent on the other tradesmen’s’ desire for beef. Secondly, is the butcher really going to carry his commodity all over his village in a rare attempt to accomplish the double coincidence of wants? To avoid this mishap, individuals take their commodity to market where they can exchange their goods for money and then with that money purchase the goods and services they desire (Smith, First Published 1776). An example would be a society that converts grains, livestock, and tobacco into gold coins through a market sale, and then proceeds to buy the desired commodities with those same coins. The coins are much more desirable for all market participants because they can be used to buy the goods and services due to the universal acceptance of market participants. Furthermore, the coins are much more efficient than herding a flock of sheep around town! This series of transactions is linear and the diagram below helps to visualize this transgression.

The graphic above illustrates a market participant who enters the marketplace with a commodity (stage 1) and sells this commodity for a money of account (stage 2). In the most basic sense, this money could have been anything from jewels, metals, animal pelts, or even notched sticks; whatever the markets recognized “money” to be. with his newly acquired money, the consumer is now able to purchase the commodity he was originally wanting in stage 3 (Kelton, 2012). Thus one can see how the introduction of money impacted the evolution of the exchange of goods and services over time, where the exchanges matured from a simple barter to a transaction of buying and selling.

A common question after seeing this diagram is “where does the money come from and what supports its value?” In the Orthodox framework, money is said to be exogenous, or created through the barter system as a solution for the double coincidence of wants (Wray, 2001). The progression begins with the exchange of commodities amongst market participants until bartering transactions become too rare in terms of satisfying the needs and wants or making trades is too cumbersome in divisibility and quantity. When one considers commodities such as livestock or bushels of wheat, the problem of divisibility and quantity are exposed because it becomes difficult to divide quantities of livestock proportionate to a pint of kerosene used for fuel. The examples of obstacles within this scenario are plentiful. In order to solve for so many mismatched goods and services, the market must adopt a single commodity as a converter, generally divisible into small quantities, to make transactions equitable and convenient.

From the idea of equitability, the concept of a “just price” emerged which solidified the use of money in the exchange of goods and services due to its usability and least common denominator characteristics (Fuster, 2002). Revisiting Smith’s example again, the butcher looks to ensure a complete dinner, so too does the baker and the brewer. Since the butcher has a set quantity of money after selling his beef to spend in the market to complete his dinner, the baker and brewer must have their goods priced at a level of affordability. This must be true or else they will have difficulty in acquiring the desired goods for a balanced meal; if the baker and brewer price their goods too expensively for the butcher, an exchange won’t happen resulting in the baker being unable to afford beef and beer and the brewer being unable to afford beef and bread (Smith, First Published 1776). To ensure exchanges occur, the baker and brewer must price their commodities at levels that permit the butcher to buy them. Although this idea seems utopian, the original market place was based around ethics and social relationships, so the idea of market participants making decisions around morals and community are not too unorthodox (Fuster, 2002).

The quantitative question concerning the just price in Adam Smith’s the Wealth of Nations, is answered in the same story about the butcher, baker, and brewer. Smith’s example continues with the scenario that the butcher sells his beef for three or four pence per pound, which should reasonably afford him a pound of bread for three or four pence or a pint of beer for three of four pence (Smith, First Published 1776). This idea of a just or fair price permitted market participants to essentially convert their goods and services into a commodity; usually gold, silver, or any other divisible metallic which would be denominated in pence for Smith’s example. (Fuster, 2002) (Innes, 2004). However, in the Orthodox framework, a new problem may arise because if the butcher only sells one pound of his beef, he may be forced to choose between purchasing bread or beer, as he can only afford one or the other. The quantity of money the butcher has from his sale generally assigns a limit to how much bread and beer he can purchase per unit of beef sold. This makes his purchasing power equal only to the amount of money he acquires through sales; evidently making money in this framework neutral (Wray, Monetary Theory and Policy Lecture, 2013).

In this orthodox approach, money is said to be neutral because it serves no purpose other than to facilitate exchange (Wray, 2001). By utilizing the diagram and the butcher example, it is evident that the butcher is essentially trading one commodity for another with money as the vehicle to complete the transaction. At the end of stage 3, with the new commodity in hand, the butcher only has an amount of the new commodity equal to that of his old commodity, meaning no wealth was created and no economic growth occurred. The only change that happened in the butcher example is the movement of commodities from one individual to another. This is an important observation because it completes the discussion of money’s origination in the Orthodox approach and shows money’s nature; however, it should be kept in mind during the policy argument as it is a pertinent point in deciphering which approach to utilize.

Since the Orthodox school adopts the idea of exogenous money and its purpose as a medium of exchange during transactions, which has neutral properties as described and exemplified prior, it would make sense that the Heterodox framework has an alternative viewpoint in regards to the nature of money. That is to say, In this approach, economists consider money to be endogenous (Wray, 2001). Quickly defined, endogenous money simply means the economy created the money rather than it being adopted by the economy as seen in the Orthodox school (Wray, Monetary Theory and Policy Lecture, 2013). This will become much more clearly understood after the story of money is told and how it plays a role in the market place is described.

The story of money in the Heterodox approach begins with the state or centralized institutions, rather than some commodity being widely accepted as a medium of exchange to facilitate commerce . Money is used as a money of account established by an authoritarian figure or government and implemented as a unit of measure, such as inches, pounds, or liters. This concept comes to fruition due to a populaces’ obligation to pay a debt as defined by the said government. By placing an obligation on the population in the form of interest, penalties, or taxes, a demand for the respective money is created (Wray, 2001). With a debt obligation looming overhead, the authoritarian has created a demand for the commodity it deems satisfactory for payment. By requiring citizens to use the said commodity, the governing body has inherently given it value. Examples of this system are found throughout history, including Biblical times.

The Heterodox approach is based under a system where authoritarian figures and governments have instituted debts, penalties, and taxes as to create a demand for the created money of account and can find its origins in the penal system, with examples from the Bible, Mesopotamia, and even through our ever evolving modern society. In Numbers of the Old Testament, it is written that “an individual who sins unintentionally shall present a female goat a year old for a sin offering (Many, Numbers, 1989).” Likewise, in Mesopotamia, injury payments were owed to individuals under common law and were paid in cattle (Hudson). Even today, penalty payments assessed for unlawful acts such as adultery resulting in divorce, speeding tickets, and disorderly conduct are all settled in a unit of account determined by the state. By highlighting the penal code’s involvement in the Heterodox approach explains the origin and the natural progression of authoritarian figures or groups levying interest and taxes on the populace becomes evident. It essentially laid the ground work or the acceptance of a reigning body to collect debt obligations (Hudson).

Once again, the Old Testament from the Bible contains several basic examples of this system that provide for a fundamental understanding of the process enacted by ancient and modern civilizations alike.

“When you have come into the land that the Lord your God is giving you as an inheritance to possess, and you possess it, and settle in it, you shall take some of the first of all the fruit of the ground, which you harvest from the land that the Lord your God is giving you, and you shall put it in a basket and go to the place that the Lord your God will choose as a dwelling for his name. You shall go [ and deliver] to the priest who is in office at that time…” -Deuteronomy 26:1-3

This segment from Deuteronomy is one of the earliest written examples of an obligation being bestowed upon society. In this case, God is requiring those who harvest from his land to pay a tax in the form of harvested goods which conclusively makes the fruit a valuable commodity because it is required for payment. This could be construed as prime example of demand driven money and is verified with another passage “when you have finished paying all the tithe of your produce in the third year (which is year of the tithe)… (Many, 1989)” In both excerpts, individuals must take their tithe to an authoritarian to make payment. Despite the controversy surrounding any religious text, the objective theme of demand based money has merit in this context because the same idea is found in other societies too, specifically Mesopotamia.

Silver money was instituted by the Mesopotamian Empire as a means to foll ow the distribution of commodities to the palace’s and temple’s labor force. The inflows of goods and services required a detail record keeping system that was capable of simultaneously logging the debts and interest owed to them (Hudson). However, although not directly relevant to the debt obligations, the fact that the palaces and temples invented a system to track credits and debts is the lineage to the eventual assessing and settling debt. By operating with an accurate and effective accounting system for maintaining a precise system of weights and measures, the temples of Mesopotamia became early corporate prototypes, and possibly the foundation of banks, later seen in Greece, Rome, and modern society (Hudson).

These institutions were creditors who loaned money, most likely silver, to those individuals, merchants, and tradesmen looking to pay in advance for land, boats, and workshops (Hudson). Aside from financing these entrepreneurial endeavors, the palaces and temples of Mesopotamia exchanged their silver for crops, and being the unit of account within the temples and palaces, was accepted as payment for rent, principal payment, or interest owed by these leasees. Essentially this system of payments through debits and credits was the beginning of the Heterodox approach.

One question to ask, would be how did Mesopotamia acquire silver? There isn’t much evidence to support the Orthodox approach that individuals in a market economy unanimously decided upon silver as a medium of exchange causing an individual to mine and refine silver into denominated units; but rather the palaces and temples of Mesopotamia financed the endeavor to mine and process silver. Royal families financially backed the entire process in an attempt to increase their wealth as to move resources from the rural communities to themselves (Hudson). In the process, the families hired laborers to extract the silver, and then compensated them for their work in silver. This exchange for services occured simultaneously while the governing body collected rent and other debts in silver payments for housing, land, or any other financeable object the laborers owed. This cycle should begin to look vastly different from that of the Orthodox school, and with a diagram and further explanation should be clear.

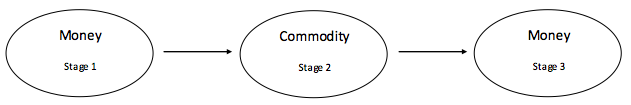

Arranged above is the same linear system as seen in the Orthodox segment, yet notice where money is situated. Stage 1 depicts a market participant bringing money to a transaction and purchases some commodity (stage 2). Upon receiving the commodity, the participant sells the commodity in stage 3 for money. This model assumes the participant engages in this activity to increase their wealth comparatively to stage 1 (Kelton, 2012). What one can conclude from this model, as opposed to the Orthodox system, is in this example wealth is created. This is different from the Orthodox approach because money was neutral as it only facilitated the exchange, and the participant was no better off financially in stage 3 than they had been in stage 1, which is not the case in the Heterodox approach.

To put this idea into context using the Mesopotamia example, stage 1 would be the palace or temple bringing their silver to a transaction. The commodity being purchased could be a number of items including land, labor, or an object such as a ship. In the event the palace purchased a plot of land, they would turn around and rent the land to a willing farmer who pays rent for the opportunity to till the soil (stage 3). In this micro example, the Mesopotamian palace utilized their money to purchase some commodity only to rent it for profit. This example emphasizes the ability for market participants to build wealth under the Heterodox approach. Because money is oriented in stage 1 and 3, and stage 3 enables market participants to acquire more money than when they started money is non neutral, there is an identity that “money matters (Kelton, 2012).”

At his junction in the discussion of the nature of money in terms of both the Orthodox and Heterodox approaches, the difference has been clearly defined and can be summarized as money is neutral and non neutral in the Orthodox and Heterodox frameworks respectively. As the referenced examples show, with money as a neutral, market participants are merely exchanging one good for another without any possibility of increasing wealth. This differs from the Heterodox approach because the model allows for profit, or the growth of wealth. With this point being made, the quantity of money thus becomes a focal point in the discussion if it is the goal of society to increase their wealth, which is commonly agreed upon as a growing economy, or a positive.

With the quantity of money being necessary for guiding the economy toward full employment as it emphasizes the creation of wealth in the Heterodox framework, it can be derived that a growing economy is one where the quantity of money is increasing. Naturally, if market participants are growing their wealth, then the quantity of currency is growing too, but to achieve that goal, money must be demanded. As discussed in the Mesopotamia example, creating demand for currency is as simple as subjecting the populace to a debt obligation denominated in the authoritarians desired currency. By employing workers for wages in silver coins, and then subjecting those same workers to taxes payable in silver coins. Because the royal families were the sole producers of silver coins, and could spend them on more workers and tax the workers, the Mesopotamian palaces had a sovereign currency. This system allowed for them to purchase all goods and services denominated in its own currency, which provi ded the palaces with the ability to directly impact the number of coins in circulation, or wealth obtained by the populace. Despite the fact that the Mesopotamian era was thousands of years ago and its financial operations were based in silver, the Heterodox approach of today is based off of the same principles.

The United States has a sovereign currency because its money of account, the dollar, is state issued and the federal government is the sole producer of dollars, just as Mesopotamian palaces were sole producers of their silver coins. This fact gives the US a monopoly on dollar production and empowers the government to destroy and spend its currency as necessary.

Destroying currency sounds destructive, however money is removed from circulation when ever citizens pay their debt obligations. For example, billions of dollars are transferred to the United States government’s bank account by April 15, or tax day. These dollars are the units of account the government uses to measure citizens’ indebtedness for public services. This is to say that when one pays their income tax liability, the government erases their accrued debt back to zero (Wray, Monetary Theory and Policy Lecture, 2013). The idea is one dollar of currency paid to the government negates the individual’s debt by one dollar. So technically, the government erases the money from the citizens bank account and simultaneously erases the debt obligation on their balance sheet. Because the United States only accepts tax liability payments in the form of dollars, the demand is created for those dollars. Citizens of the United States must acquire dollars to make their debt obligations right. This should sound reminiscent of the discussion of Mesopotamia, and just as this ancient civilization spent silver into circulation, so too the United States government spend dollars into existence.

With a sovereign currency, the United States government can distribute its money of account as it so desires in the same fashion as ancient civilizations. The government has the ability to purchase all goods and services denominated in its own currency because citizens are willing to accept those dollars because of their looming debt obligation. What this means economically is that in times of the unemployment of resources, the government can spend money into existence to try and “stimulate” economic activity. This parallels ancient times when the palaces and temples of Mesopotamia had the same capabilities. Royal families hired the number of workers and laborers required to extract silver regardless of cost. By paying the laborers in silver, they could then participate in the market place by buying goods and services they needed. The employment of persons by the palace infused money into the economy that otherwise wouldn’t have existed which is to say government can buy goods and services from or lend money to whomever is in the market as a means to stimulate economic growth.

All of the talk about sovereign currency and the state’s ability to tax and spend should be pretty well exhausted, but it is important to understand the concepts as to see how they impact the e conomy. By adopting the Heterodox framework of sovereignty currency and demand for money, the policy prescriptions for achieving full employment become more apparent. With money in demand, individuals in the society will always attempt to acquire more units of account to pay their debt obligation, and in doing so, will search ways to earn money (Wray, Monetary Theory and Policy Lecture, 2013). This is where business enterprise gets its footing, and the linear model depicted earlier comes back into the foreground. If the sovereign state can spend and lend without bound, it has the means to lend to individuals looking to incorporate entrepreneurial endeavors to earn profit. Profit allows for the market participants to engage in activity to earn money as to meet their every day necessities, but also ensure they have the money of account needed to pay their debt obligation when due.

In this framework, the Government is not restricted to its expenses being equal to its revenue because it possesses the inherent quality that all money it spends will eventually be destroyed when all debt obligations are paid off. By having this capability, the Government has an incredible amount of policy space to work with, including increasing government spending during economic down times, and increasing taxes during periods of inflation (Wray, Monetary Theory and Policy Lecture, 2013). Not only can the government directly purchase goods and services to employ all unemployed resources, but it can also lend to those individuals looking to for financial advances. Through the different avenues of stimulus, the government can have a gratifying effect on the status of the economy.

With this amount of discretion in determining the money supply, the authoritarian can act as a steward of the economy, and enact certain policy to ensure the economy stays on a healthy track. The Heterodox approach grants this control to the authority as opposed to the Orthodox approach, where the economic health is determined by market participation without any means to encourage or discourage its trajectory.

When considering the details of the origination of money and its use under both the Orthodox and Heterodox approaches, it should be remembered that the Orthodox approach is based in the barter system, with lineage to primitive societies who exchanged one good for another. Due to the acknowledgement of problems with the barter system, commodities were more or less converted into a widely accepted divisible form of money to facilitate exchange. However, this system only proves affective in moving commodities from one individual to another, without any other inherent benefits such as the creation of wealth due to the neutrality of money in this framework. This is a completely different model from the Heterodox approach which looks to create wealth within the economy and is accomplished through a system where money matters. For money to be an important component of the system, the state must initiate a debt obligation that is payable with only the sovereign currency of the state. The debt obligation causes citizens to demand the money because they must acquire it to pay off the debt obligation and to acquire this money in the first place, the state must be willing to employ citizens to help move resources to the state and compensate their labor with the state currency. With the state paying and accepting debt payments in the form of its own sovereign currency, the question of affordability is irrelevant, that is to say the government can afford all things denominated in its own currency. The policy implications for this fact allows the government to increase its spending to afford all unemployed resources during periods of poor economic growth and conversely increase the debt obligation to slow down the economy. Conclusively, the Heterodox approach allows for the economy to be much more efficiently managed so full employment or prosperity can be achieved.

*A Note:

For the next few weeks we will be running a series of articles on monetary theory and policy. These are final essays written by MA students in my class this past Fall semester. I was very happy with the results—students indicated that they had a firm grasp of both the orthodox approach as well as the heterodox approach to the subject. Most of them also included some Modern Money Theory in their answers. I asked about half of the students in the class if they would like to contribute their essay to this series. Sometimes students are the best teachers because they see things with a fresh eye and cut to what is important. They are usually less concerned with esoteric academic debates than are their professors. Note that these contributions are voluntary and are written by Masters students. I told students they could choose to use their own names, or they could choose an alias. Comments are welcome, but please be nice—remember these are students.

For your reference, here were the topics for the paper. The paper had a maximum limit of 6000 words.

Choose one of the following. You must consider and address both the orthodox approach and the heterodox approach in your essay. Where relevant, include various strands of each.

A) What is the nature of money? Given the nature of money, what approach should be taken to policy-making?

B) What is the nature of banking? Given the nature of banking, what approach should be taken to policy-making?

C) According to John Smithin there are several main themes throughout controversies of monetary economics, each typically addressed by each of the various approaches to monetary theory and policy. In your essay, discuss how each of the approaches we covered this semester tackles these themes enumerated by Smithin.

L. Randall Wray

Sources

Fuster, D. R. (2002). Economics and the Market Economy. In D. R. Fuster, The Age of the Economist (pp. 7-12). Boston: Pearson Education, Inc.

Hudson, M. (n.d.). The Arcaeology of Money; Debt. Vs. Barter Theories of Mone y’s Origins. Credit and State Theories of Money , 99-125.

Innes, A. M. (2004). What is Money? In L. R. Wray, Credit and State Theory of Money, 2004. Northampton, MA: Edward Elgar Publishing Limited.

Kelton, S. (2012, September). Orthodox Money vs. Heterodox Money Lecture. Advanced Macroeconomics . Kansas City, MO, USA.

Many. (1989). Numbers. In Many, Holy Bible: New Revised Standard Version (p. 133). New York: American Bible Society.

Many. (1989). The Old Testament: Deuteronomy. In Many, Holy Bible: New Revised Standard Version (p. 180). New York: American Bible Society.

Plymouth Colony. (n.d.). Retrieved November 2013, from U-S-History.com: http://www.u-s- history.com/pages/h522.html

Smith, A. (First Published 1776). The Wealth of Nations; Book 1-3.

Wray, L. R. (2012). Modern Money Theory. Palgrave MacMillan.

Wray, L. R. (2013, October). Monetary Theory and Policy Lecture. Kansas City, MO, USA.

Wray, L. R. (2001, August). The Endogenous Money Approach; Working Paper No. 17. Retrieved December 2013, from CFEPS.org: http://www.cfeps.org/pubs/wp/wp17.html

19 responses to “Essays in Monetary Theory and Policy: On the Nature of Money (10)”