*The title of this post was inspired from a post by Mike Sax.

First an admission. I’m not really a blogger. I occasionally write pieces that somehow find their way onto blogs, but I rarely read or respond to blogs. I have no idea who is who in the blogosphere. For example, I do not know someone named Scott Sumner, who is apparently a Very Important Person in blogoland.

I note that he’s associated with the proposal that the Fed target nominal GDP. When I first heard about this, I thought it was a joke. Yeah, right, might as well have the Fed target the Earth’s Wobble. Gee, I’d really like the Fed to stabilize the tilt, to achieve San Diego’s invariantly moderate climate in upstate NY where I spend much of my time!

You see, the Fed has tried and failed to target Bank Reserves, Money Supply, and Inflation. So, what the heck, let’s have the Fed try and fail to hit Nominal GDP. As if the Fed has any tool that would allow it to do that. Anyone who understands central banking knows that central banks have one tool in their tool kit, and it is not a Hammer. It is the overnight interest rate—the rate at which it lends to banks, and at which banks lend to each other against the safest collateral. That target, in turn, impacts other short rates on other very safe lending and on Treasury Bills. Most bets are off once we move beyond that, however. The Fed has been trying for years to get the mortgage rates low enough to stimulate home buying—using ZIRP and QE1, QE2, and QE3 up the ying-yang to very little effect.

So, I still laugh anytime I hear anyone suggest that the Fed target NGDP. Good luck with that.

In any case, Sumner claims to have found MMT’s Achilles’ Heel. He sets up a hypothetical example. Presume GDP is growing at 5%, unemployment is 5%, and the nominal interest rate is 5%.

An Aside: I can recall when I visited the Mayor’s office in Istanbul where it was reported that national inflation was about 29%, the nominal interest rate was about 29%, and the government’s budget deficit was about 29%–whereupon I told the Mayor that Turkey had hit the perfectly sustainable Trifecta! (See below for more discussion.)

But, Sumner interjects: suppose the central bank lowers the nominal rate to a big fat Zero. He predicts that GDP would DOUBLE and the price level would DOUBLE!

And somehow that proves MMT is wrong? Here’s his argument as well as his claim.

“Suppose we pick a fairly “normal” year, when NGDP growth and nominal interest rates and unemployment are all around 5%. It might be 2005, 1995, 1985, whatever. The exact numbers aren’t important. Now the Fed does an OMP and doubles the monetary base by purchasing T-securities. They announce it’s permanent. What happens? One MMT answer is that the Fed can’t do this. It would cause interest rates to change, and they peg interest rates. But the more thoughtful MMTers seem to be willing to let me do this thought experiment, as long as I acknowledge that interest rates would change and that it’s not consistent with actual central bank practices. I’m fine with that. So let’s say they double the base and let rates go where ever they want. I claim this action doubles NGDP and nearly doubles the price level. MMTers seem to disagree, as I haven’t changed the amount of net financial assets (NFA) at all. But here’s the Achilles heel of MMT. Neither banks nor the public particularly wants to hold twice as much base money when interest rates are 5%, as that’s a high opportunity cost. So they claim this action would drive nominal rates to zero, at which level people and/or banks would be willing to hold the extra base money. Fair enough. But then what? You’ve got an economy far outside its Wicksellian equilibrium.” http://www.themoneyillusion.com/?p=10238

Now, my own projection (and what I told the Turks) is that bringing down the interest rate will simultaneously reduce the budget deficit and nominal GDP growth—with falling inflation accounting for most of that. So, lowering Turkey’s interest rate from 29% to 0% would have eliminated most of the budget deficit (since government would spend far less on the Trillions of Turkish Lira debt it had to roll-over every month) and also inflation. So Turkey might have managed to bring interest rates, nominal growth, and budget deficits all down to the sustainable Trifecta of Zero! (By the way, Italy ran that experiment before joining the EMU—her interest rate and budget deficit were double digits, and after Warren Mosler talked to the Treasury to convince them that Italy would not default on Lira debt, rates were reduced, deficits came down, and inflation also fell.)

But let us ignore for a moment the possibility that lowering interest rates actually reduces budget deficits and growth, while raising unemployment. How does Sumner get from a 500 basis point reduction in overnight interest rates to a GDP that DOUBLES? Really?

Let’s give him the benefit of the doubt, and ignore the usual impact of Fed reduction of rates of 300 or 400 bp—which historically has had an impact of just about nil, nada, zip. Sumner argues we must ignore all the previous cases of interest rate reductions, because these occurred outside “normal” times. So let us say we are in a “normal” time, where the economy is humming, in conditions where the Fed would normally begin to think about raise rates because unemployment is already down to 5% and GDP growth is at 5%. So the Fed instead tries Sumner’s experiment, reducing them by 500 bp. Sumner claims GDP will DOUBLE and prices will DOUBLE. Just how plausible is that? What kind of interest rate spending elasticities are required? And what is the time period required?

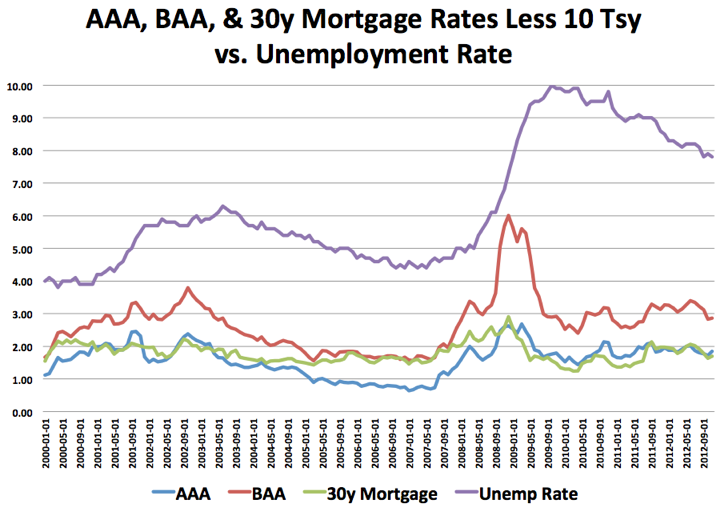

Some time ago my colleague Linwood Tauheed and I surveyed the orthodox literature to obtain estimates of interest rate elasticities. You need to remember that the Fed only directly controls the fed funds (and discount) rate, so lowering that rate by 500 bp is not going to lower the rates that really matter for private spending—longer term rates—by nearly so much. Indeed, operation QE has been relatively impotent—in the Fed’s own reckoning—even as it tried to directly lower longer-term interest rates. As the following graph shows, interest rate spreads over 10 year treasuries (which track the Fed’s policy rate reasonably well) are no where near constant. Indeed they vary by 200 bp to 300 bp–which is as much of the maximum “umph” that we could expect from Sumner’s experiment.

Lowering the fed funds rate also won’t necessarily lower the risk premium—overnight interbank borrowing is collateralized by safe treasuries, so firms and households are not going to get anything like zero rates since their borrowing is riskier. Let us be generous and presume that Sumner’s scenario can lower rates to actual borrowers by 200 or 300 bp—which would be quite a feat, far exceeding QE’s impact on loan rates. How much would private borrowing and spending rise? In Sumner’s view, they would rise sufficiently to DOUBLE GDP—ie from approximately 15 Trillion to 30 Trillion dollars. That is a big impact.

Real world, mainstream, estimates of the interest rate effects on spending are orders of magnitude lower than Sumner’s claim.

However, let us say that Sumner’s own fairly outrageous presumptions turn out to be correct. Would that invalidate MMT? Is a substantial impact of interest rate changes on aggregate spending a refutation of MMT?

I cannot see how. All that MMT claims is that if the Base is doubled, increasing banking system excess reserves, then the overnight rate will fall towards zero or the support rate paid by the central bank on reserves (presumably above zero). While MMT is skeptical that this would simulate spending, no part of MMT stands or falls due to an inverse and substantial interest rate elasticity of spending. If monetary policy is potent in that respect, so be it. Use it if it works, when it works. If it doesn’t work, then use fiscal policy. Our bet is that it won’t work. But that is a projection that can be decided by experiment. So far, it has failed handily—monkeying around with interest rate hikes and cuts have had no discernible stabilizing influence on the economy. But we can pretend the Jury is still out.

Nay, Sumner’s battle is with economics—both mainstream and heterodox. There isn’t any theory or evidence in support of his claim that a 500bp reduction of the overnight rate would lead to a doubling of GDP and the price level. It is the claim of the unschooled or the ideologue.

In short, Sumner’s thought experiment does not expose any weakness of MMT. If anything, it exposes a weakness in his thinking. He invokes Wicksell in his argument that doubling the monetary base would double GDP because neither banks nor the public will want to hold twice the base—hence they lend and spend until the cows come home and NGDP doubles. For those who do not know, Wicksell was a pre-Keynesian economist who had some interesting ideas. But drawing on Wicksell when you’ve got Keynes would be like an astronomer going back to Copernicus when you’ve got Galileo.

He concludes:

“That’s the flaw with MMT; it’s not net financial assets that matters, it’s currency…. It was hard sifting through all the comments, which were often on side issues, but it seems they regard base money as just another financial asset. But it’s not, which is why their view of monetary policy is wrong. Indeed in a sense they don’t even have a theory of monetary policy, they have a fiscal theory that implies open market operations don’t matter.”

That looks confused to me. By definition, net financial assets in the private sector = government liabilities. These are Treasuries (bills and bonds) plus Base (currency and reserves). Budget deficits, for example, lead to nongovernment surpluses, accumulated as either Treasuries or Base. Open market operations change the composition of NFA held: a purchase of Treasuries by the Fed reduces Treasuries and increases Base held by the nongovernment sector—but does not affect NFA. (A sale has the opposite impact.) Monetary policy is about liquidity—reducing or increasing the liquidity of private portfolios. Rates will adjust to balance portfolio composition with desires. But since the Fed targets the overnight rate, it needs to prevent movement of rates away from target—and does that by accommodating desires.

Fiscal policy is about spending—reducing or increasing NFA. These are statements of fact, not theory. MMT certainly would not say that OMOs “don’t matter”—they affect liquidity, which can be very important when the Fed stops a run on financial institutions by lending reserves or providing them in OMPs. Sumner is just plain wrong if he thinks that simply buying Treasuries in “normal” times causes banks to increase lending, which is transmitted to more spending, more NGDP and more inflation. All it does is to substitute Reserves for Treasuries. Again, Fact, not Theory.

Some years ago I co-authored a paper with my colleague Linwood Tauheed, titled SYSTEM DYNAMICS OF INTEREST RATE EFFECTS ON AGGREGATE DEMAND, that investigated the likely impacts of interest rate changes on aggregate demand. We used conventional estimates of interest rate elasticities for investment spending, as well as for parameters like the marginal propensity to consume. Unlike most conventional studies, however, we included the effect of rate hikes on government spending on interest—hence the interest income channel. As rates rise, the nongovernment sector earns more interest income, of which some is spent on consumption. We tried different government debt ratios and found that with a high enough debt ratio, raising rates would indeed stimulate spending. We can call that a “perverse” effect of monetary policy. Let me provide a few paragraphs from that paper to give you a flavor of the analysis. (Note this is from around the year 2000.) In particular, pay attention to the discussion of conventional estimates of interest rate elasticities—which are surprisingly small, and far too small for Sumner to get the results he wants.

However, note that validity of MMT does not hang on these results—even if monetary policy is as powerful as he believes, and the interest rate elasticities are much higher than those found in the literature, this is not inconsistent with MMT.

Heterodox economics has always been skeptical of the Fed’s ability to “fine-tune” the economy, in spite of the long-running Monetarist claims about the efficacy of monetary policy (even if orthodox wisdom used to disdain discretion). The canonization of Chairman Greenspan over the past decade and a half has eliminated most orthodox squeamishness about a discretionary Fed, while currently fashionable theory based on the “new monetary consensus” has pushed monetary policy front and center. As John Kenneth Galbraith argues, lack of empirical support for such beliefs has not dampened enthusiasm. Like Galbraith, the followers of Keynes have always insisted that “[b]usiness firms borrow when they can make money and not because interest rates are low”. Even orthodox estimates of the interest rate elasticity of investment are so low that the typical rate adjustments used by the Fed cannot have much effect.

Conventional belief can still point to interest rate effects on consumption, with two main channels. Consumer durables consumption, and increasingly even consumption of services and nondurables rely on credit and, thus, might be interest-sensitive. Second, falling mortgage rates lead to refinancing, freeing up disposable income for additional consumption. Ultimately, however, whether falling interest rates might stimulate consumption must depend on different marginal propensities to consume between creditors and debtors. In reality, many consumers are simultaneously debtors and creditors, making analysis difficult because a reduction of rates lowers both debt payments and interest income. If we can assume that these do not have asymmetric effects (a highly implausible assumption), we can focus only on net debtors and creditors. The conventional wisdom has always been that net creditors have lower MPCs than do net debtors, so we can assume that lower rates stimulate consumption by redistributing after interest income to debtors.

Still, the consumer lives in the same business climate as firms, and if the central bank lowers rates in recession, the beneficial impacts can be overwhelmed by employment and wage and profit income effects. Further, as society ages and net financial wealth becomes increasingly concentrated in the hands of the elderly whose consumption is largely financed out of interest income, it becomes less reasonable to assume a low MPC for net creditors. Perhaps the MPC of creditors is not much different from that of debtors—which makes the impact of rising rates on consumption all the more ambiguous. This does not mean that lowering rates in recession (or raising them in expansion) is bad policy, but it could account for the observation made by Galbraith and others before him that monetary policy is ineffectual.

Most conventional and even unconventional explorations of interest rate effects have focused on demand-side effects. It is also possible that raising interest rates can have a perverse impact on prices coming from the supply side. Interest is a business cost much like energy costs that will be passed along if competitive pressures permit. The impact on aggregate demand arising from this might be minimal or ambiguous, but it is conceivable that tight monetary policy might add to cost-push inflationary pressures while easy policy would reduce them. For monetary policy to work in the conventional manner on constraining inflation, interest rate effects on aggregate demand would have to dominate such supply-side impacts. This seems ambiguous at best, given the uncertain impacts of interest rates on demand.

What has been largely ignored is the impact that interest rate changes have on government spending, and hence on aggregate demand through the “multiplier” channel. In a somewhat different context to the issue to be pursued here, some Post Keynesian authors have recognized that rising rates tend to increase the size of government budget deficits. Indeed, in the late 1980s, a number of countries with large budget deficits would have had balanced budgets if not for interest payments on outstanding debt—Italy was a prime example, with government interest payments amounting to more than 10% of GDP (Brazil was another). It was recognized at the time by a few analysts that lowering rates was probably the only way to reduce the government’s deficit—a path later successfully followed. However, conventional wisdom holds that high deficits cause high interest rates, hence, government can quickly find itself in an “unsustainable” situation (rising rates increase deficits that cause markets to raise rates even higher) that can be remedied only through “austerity”—raising taxes and cutting non-interest spending. In truth, for countries on a floating exchange rate, the overnight interbank lending rate (fed funds rate in the US) is set by the central bank, and government “borrowing” rates are determined relative to this by arbitragers mostly in anticipation of future overnight rate targets.

The heterodox literature on rate-setting by the central bank is large and the arguments need not be repeated here. What is important is to recognize the government’s ability to reduce its deficit spending by lowering interest rates.

What we want to investigate is the nearly ignored possibility that lowering/raising interest rates will lower/raise aggregate demand in a manner opposite to normal expectations. This would occur if lowering rates lowered government deficits by reducing interest payments—which are essentially the same as any other transfer payments from government to the private sector. Assume an economy in which private debt is small relative to GDP, and in which the interest elasticity of private investment (and other private spending) is small. By contrast, government debt is assumed to be large with holdings distributed across “widows and orphans” with high spending propensities. Raising interest rates will have little direct effect on the private sector, which carries a low debt load and whose spending is not interest sensitive, in any case. However, rising interest rates increase government interest payments; to the extent that the debt is short-term or at variable interest rates, the simulative impact on private sector incomes and spending is hastened.

This is, of course, the most favorable case. However, on not implausible assumptions about private and public debt ratios and interest rate elasticities, it is possible for the government interest payment channel to overcome the negative impact that rising rates have on private demand. We will proceed as follows. First, we will briefly introduce the methodology to be used, System Dynamics modeling. We then set out the model and explain the variables and parameters. For the first part of our analysis, we will use historical US data to set most parameters. We will determine given those parameters (debt ratios and interest elasticities), at what level of interest rates can we begin to obtain “perverse” results—where further increases actually stimulate demand. For the final part of the analysis, we will determine values for government debt ratios at which “perverse” results can be obtained, for different levels of interest rates.

Throughout we will assume uniform MPCs, and so leave for further research the questions about distribution effects. Further, we will not include interest rate effects on consumer borrowing—this is equivalent to assuming that consumer borrowing is not interest sensitive, or that any interest rate effects on net (private) debtors is exactly offset by effects on net (private) creditors. Finally, as we will briefly mention below, further research will be needed to explore implications arising from international debtor/creditor relations (Americans hold foreign liabilities, while foreigners hold American liabilities—both private and public—and even if domestic MPCs are the same across debtors and creditors, the MPCs of foreigner creditors and debtors could be different).

A cursory review of the literature on interest rate elasticity found a fairly wide range of estimates, with most below -0.25, although a few were substantially larger. We also found that setting ε = -.25, the investment function approximates the 2000 value for Gross Private Domestic Investment (Ig = 1,832.7) when α = 1 and rIg =.09 — (Ig = 1.8257). Hence, we use -0.25 as the interest rate elasticity of investment for this analysis.

For plausible “real world” prime rates in the range of 10% to 12%, and for a “real world” GDP of just under $10 trillion, government debt ratios well under 50% of GDP are sufficient to obtain perverse monetary policy results. Results for ‘Equilibrium’ Public Debt (Dp) for mpc = .9, ε = -.25, and Investment interest rates of 3% to 20% are shown in Table 5 and Figure 11. With an interest rate of 10%, if the public debt is $4.94 trillion—or about 50% of GDP, interest rate hikes can stimulate aggregate demand.

This exercise has demonstrated that under not-too-implausible conditions, raising interest rates could actually stimulate aggregate demand through debt service payments made by government on its outstanding debt. This is more likely if private sector indebtedness is small, if private spending is not interest-rate elastic, if interest rates are high, and if government debt is large (above 50%) relative to GDP. In addition, the reset period of the government’s debt affects the rapidity with which interest rate changes are transmitted to spending. Our analysis used fairly simple models and hence represents a first attempt at modeling these impacts.

63 responses to “DID SCOTT SUMNER FIND MMT’S ACHILLES’ HEEL?*”