By J.D. Alt

Somehow a great confusion has arisen. It has divided our nation into feuding, bickering camps, caused many to view their own government as a ruthless competitor, and is now seriously threatening us with, among other things, a frightening deluge of collapsing bridges. The confusion is about money—what it is, where it comes from and, most important, whether there is enough of it to pay for all the things we need as a nation.

Somehow a great confusion has arisen. It has divided our nation into feuding, bickering camps, caused many to view their own government as a ruthless competitor, and is now seriously threatening us with, among other things, a frightening deluge of collapsing bridges. The confusion is about money—what it is, where it comes from and, most important, whether there is enough of it to pay for all the things we need as a nation.

Presently, we have convinced ourselves there is not enough money to pay for the things we need. The logic that tells us this seems intuitively obvious: American businesses and households, at any given time, hold a given amount of Dollars (which are exchanged back and forth amongst the businesses and households as the economy churns along) and—obviously—there is a limit as to how much the sovereign government can tax those businesses and households in order to collect some portion of those Dollars for its own spending. Many citizens believe the government is collecting too much in taxes—an excess which reduces the Dollars available to be exchanged back and forth in the private economy. Thus, “out of control” sovereign spending is in competition with the businesses and households for a given pie of Dollars. Even worse, when the sovereign government borrows Dollars from that pie, to make up for what it can’t collect in taxes, it is obligating the citizens to pay even more taxes in the future!

In this narrative, the key to economic growth and prosperity is for the sovereign government to (a) strictly limit its borrowing and (b) collect fewer taxes, leaving more Dollars in the private economy for creating jobs. Limiting or shrinking tax collections, however, reduces the Dollars available for public spending—and we are therefore trapped in a perpetual antagonism between the public spending we think is necessary or desirable and the number of Dollars we believe the sovereign government can, or should, reasonably collect in taxes.

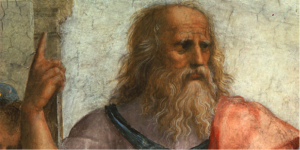

This narrative is built upon an understanding of money that goes back to Aristotle:

“For (the purpose of barter,) the various necessaries of life are not easily carried about, and hence men agreed to employ in their dealings with each other something which was intrinsically useful and easily applicable to the purposes of life, for example, iron, silver, (gold) and the like. Of this the value was at first measured simply by size and weight, but in process of time they put a stamp upon it, to save the trouble of weighing and to mark the value.”

(Politics, Book 1, Part 9, Translated by Benjamin Jowett)

In this story, then, money is originally gold (or silver) coinage which has been stamped or “minted” by some authority attesting to the quantity of metal contained in the coin. Typically, these coins were stamped with the visage of a reigning monarch or sovereign—the implicit assumption being that it was this sovereign authority which established the confidence in the accuracy of the stamp.

The story continues along these lines: As the citizens traded and did business amongst themselves, the gold coins became the currency of exchange. At some point, those who had acquired a great quantity of coins needed a safe place to store them. Banks were created for this purpose, and bank-notes were the paper receipts for the gold coins placed on deposit. Soon the paper bank-notes themselves were used as money, with people accepting them in exchange for goods and services because of the actual gold backing them up in the bank’s vault. Whether paper or metal, however, the only way the sovereign could acquire some portion of this money for its own spending was to impose taxes (or fines and fees) upon the citizens.

It is easy to see how our present narrative is a continuation of this story about gold coinage—in spite of the fact that in the modern world today there is no national currency that is backed by either gold or silver. All sovereign monies today are “fiat” currencies (a term we’ll examine in a moment.) Gold coins, which are still minted for commemorative purposes, are simply decorative chunks of precious metal—a kind of jewelry—which are purchased with fiat money. The U.S. Dollar has had no connection to gold or silver for over four decades. Nevertheless, the implicit story about gold coinage stubbornly persists, leading to the fuzzy reasoning that U.S. Dollars (and other fiat currencies) continue somehow to “operate” in the same way as gold coins: (1) Dollars are “struck” by the government (which officially establishes their value); (2) Dollars are owned by citizens and (3) kept in banks which loan them out to people and businesses. The sovereign government itself—to obtain the Dollars it needs to pay for its public spending programs and expenses—must get those Dollars either by collecting taxes from the citizens, or borrowing Dollars from the bankers.

This narrative gives taxes a very specific and narrow meaning: Taxes are how the sovereign government acquires the Dollars it needs for sovereign spending. If it cannot obtain enough Dollars through taxes, then it must borrow Dollars. This is the basic logic of our present political dialog, and it seems to be a logic that is irrefutable.

Fiat Money

There is, however, an alternative history of money with even deeper historical roots: (Philip Grierson, in his book The Origins of Money, traces its source to the early Wergeld fines which prevented blood feuds in early tribal societies.) This alternative story leads to a strikingly different logic about taxes and sovereign spending. This is the story of “fiat” money.

The definition of “fiat” is “an order issued by legal authority.” In Latin, the term means “let it be done.” Unlike gold and silver coins, then, which had value because of the value of the precious metal they contained, fiat money has value because an Emperor or sovereign power declares that it has value. But how does the sovereign establish and enforce this value? What is the declaration that creates “money” people will willingly accept in exchange for real goods and services?

Before answering these questions, it is important to note that many people today—especially those who consciously embrace the gold-based narrative we first described—do not believe that fiat money is “real.” Here is an example of the typical “understanding” about fiat money that is presented by this perspective:

“In a fiat money system, money is not backed by a physical commodity (i.e.: gold). Instead, the only thing that gives the money value is its relative scarcity and the faith placed in it by the people that use it.” (Kwaves.com)

This view sees fiat money as something the sovereign government “prints” to make up for what it needs but doesn’t have. “Printing money,” without anything of “real” value to back it up (even though it is something the sovereign has the authority to do) is thus considered to be deceptive and vaguely criminal, considerations that give rise to indignant recriminations whenever it appears the sovereign government might be stooping in that direction. It has also been demonstrated throughout history, and become a part of economics “101”, that when governments print too much fiat money, the purchasing power of the money declines, robbing the citizens of wealth. Powerful barriers have thus been erected to guard against the sovereign’s potential treachery with regard to its ability to “print” money.

Unfortunately, these perceptions and the barriers erected represent a fundamental misunderstanding of what fiat money actually is and how it functions. Given that we are, in fact, using a fiat money system today, this misunderstanding has much to do with the great confusion in our current monetary dilemma. It is worth some effort, therefore, to try to shed light on the misunderstanding.

Let’s return to our earlier questions: How does the sovereign establish and enforce the value of the fiat currency it issues? What is the declaration that creates “money” people will willingly accept in exchange for real goods and services?

The declaration consists of two parts that work in tandem: First, the sovereign declares that it shall, on some regular basis, collect taxes from its citizens. Second, it declares that the only thing it will accept as payment for taxes due, is the “money” the sovereign—and only the sovereign itself—shall issue. This money becomes the sovereign “fiat” currency: Citizens willingly accept it in exchange for real goods and services because they know:

a) They are going to need some of this sovereign currency to pay their taxes with, and

b) They know they will be able to use the sovereign currency to purchase goods and services from other citizens for exactly the same reason.

The central question that arises from this tandem relationship is: if the government of the United States, for example, issues the fiat U.S. Dollars (prints them, or keystrokes them onto an electronic ledger), how do the citizens get hold of the Dollars so they have them to pay their taxes with? The answer is both obvious and startling: The sovereign government has to spend the Dollars after it issues them. And what does it spend the Dollars on? It buys things from the citizens—goods and services which the citizens willingly provide in exchange for the Dollars because they need the Dollars to pay their taxes with.

In a fiat money system, then, sovereign spending happens before taxes are paid! It is literally, by logic, not possible for it to happen the other way around. Furthermore, the fiat Dollars the sovereign spends are not Dollars it has collected in taxes, but rather Dollars it has issued specifically for the purpose of its spending. Finally, and most important: taxes are collected not to provide the sovereign with Dollars to spend, but rather to ensure the citizens will continue to need the fiat Dollars and, therefore, continue to be willing to sell their goods and services in exchange for them.

Why sovereign spending isn’t “printing money”

Let’s dig a little deeper and try to see why sovereign spending, as described above, is not the same as “printing money”.

Let’s ask this question: what exactly is a fiat Dollar? What does it represent? We know clearly what it does not represent: it doesn’t represent some quantity of gold or silver stashed away in a vault. When the sovereign prints a fiat Dollar it is not printing a “fake” Dollar that is pretending to have some value it really doesn’t. The fiat Dollar also does not represent an authoritarian command by the sovereign that citizens will use it as legal tender to exchange goods and services. Citizens, in fact, are allowed to use any money they please—as evidenced by the recent popularity of “bitcoin” transactions on the internet. What, then, is the fiat Dollar representing, and how does that representation give it value?

What a fiat Dollar represents, in fact, is a debt of the sovereign government. It is an I.O.U. What does the sovereign owe to the bearer of a fiat Dollar? It owes one Dollar’s worth of tax credit. A fiat Dollar, then, is nothing more—and nothing other than—a promise by the sovereign government to accept that I.O.U. as a payment for taxes the citizen owes the sovereign. It is because of this promise—made in tandem with the declaration that citizens must pay taxes on some regular basis—that the sovereign’s I.O.U. becomes something the citizens desire to have. When sovereign spending occurs, then, the citizens provide the sovereign with real goods and services, and the sovereign pays the citizens with its I.O.U.s.

There are several important things to see here:

First, what the sovereign desires to have is not the return of its I.O.U. when tax time comes—what the sovereign desires are the real goods and services it obtains from the citizens in exchange for its I.O.U.s. These could be many things: roads and bridges, jet planes and battleships, medical and air-traffic-control services, weather and GPS satellites…. (The complete list is quite long, and might add up to many, many trillions of Dollars worth of stuff!)

Second, what the sovereign is committing itself to owe by printing its I.O.U. is something it has an infinite supply of: tax credits. Further, the sovereign itself—by imposing regular taxes on the citizens—creates the demand for the thing that its I.O.U. promises to owe. Sovereign spending, then, is not constrained by the number of I.O.U.s the sovereign is able to issue—it is constrained only by the real goods and services that the citizens are willing and capable of providing in exchange for the I.O.U.s.

Third, when the sovereign receives back its I.O.U.s as the citizens pay their taxes, the transaction is simply the cancellation of an I.O.U. on one side of the ledger, and the extinguishing of a tax obligation on the other: a line is drawn through the tax obligation, and the I.O.U. is torn up. The next time the sovereign needs to buy goods and services from the citizens, it simply issues a new I.O.U. and the process starts over again.

Fiat Dollars, then, function similarly to the electrons in a DC electrical circuit: they flow from a positive source (the sovereign government) to a negative ground (tax collections)—and, along the way, they cause some kind of work to be done. Unlike the battery in a flashlight, however, which will eventually run out of electrons, the sovereign government is capable of continuously producing fiat Dollars—as long as there continues to be citizens willing and capable of providing real goods and services in exchange for the fiat Dollars it produces.

Fourth, the sovereign government has to spend more fiat Dollars than it collects back in taxes. If this were not the case, the citizens, by logic, would be flat broke each time they paid their taxes. Instead, the sovereign spends more than it collects, with the result that the citizens build up a store of the Dollars which they then use in exchanging goods and services amongst themselves (the private sector economy). Most of these excess Dollars are kept in banks, which leverage them with loans that create “bank money”, a leveraging that greatly increases the flow of “money-energy” and work done in the private sector.

Finally, depending on how the bookkeeping that tracks this flow of energy is structured, it could appear as if sovereign spending under a fiat money system is driving the sovereign government gravely into debt. It is easy to see this appearance arising if we insist on measuring sovereign spending with the belief that the spending is paid for with tax Dollars: From this perspective, any Dollar the sovereign spends over and above what it collects in taxes creates a “deficit”. But if, instead, we measure sovereign spending with a correct understanding of fiat money, we can see this “deficit” actually represents something quite different than government debt: it represents the difference between the number of fiat Dollars the sovereign has paid in its spending, and the number of fiat Dollars it has collected back in taxes. In other words, it represents the financial wealth the citizens have retained from the sovereign spending after extinguishing their tax obligations.

The misunderstanding about fiat money, then, derives from the fact that fiat money fundamentally changes—and, in fact, reverses—the relationship between taxes and sovereign spending which existed in a gold-based monetary system.

It is easy to imagine, of course, a sovereign government that grossly misuses the power of its fiat currency. For much of human history, in fact, the goods and services that sovereigns purchased from their citizens did not create or provide a collective benefit for the citizens themselves, but rather served directly to enhance the personal power and aggrandizement of the head of state. To one degree or another, this problem still exists even in well-developed and strong democracies, like the United States. It is a problem that reinforces the “gold-based” money narrative by inviting the notion that authoritarian misrule can be controlled by (a) insisting on the appearance of a “gold-based” currency, and then (b) starving the sovereign authority of its tax income. A moment’s reflection, however, reveals this strategy to be exactly analogous to sawing off the tree-limb one is sitting on. Fiat currency, in itself, is not the problem. It is, in fact, potentially the solution—but to implement that solution requires a functioning political democracy.

Two Narratives to choose

In truth, then, there are two different narratives about money—and about taxes and sovereign spending—we can choose between. The first, which seems to be the preference of today’s political leaders and economic commentators alike, tells us that for all practical purposes we are broke: It is mathematically impossible for the sovereign government to collect enough taxes to pay for all the things we can document that we are going to need for our collective benefit—and the government appears to already have borrowed more Dollars than it can ever pay back. The things we need—like new bridges, more efficient electrical grids, the next generation of air-traffic control technology—will have to wait. It isn’t clear, though, how long the wait will be, or what, exactly, is going to change to enable the government to ever collect enough taxes to pay for these things in the future. We’re just stuck, and all we have to look forward to is the endless bickering between conservatives and progressives about who’s to blame.

The second narrative paints a dramatically different picture. In a pure fiat money system, the sovereign government doesn’t need to collect taxes in order to spend—it only needs to collect taxes to ensure that the citizens continue their willingness to provide real goods and services in exchange for fiat Dollars. This means two overwhelmingly positive things:

First, it means taxes can become “smart”. Since they are not collected for the purpose of financing sovereign spending, they can be thought about and defined with a completely different set of goals. They can be structured to create positive incentives to encourage all manner of collective, and even personal, benefits. They can be structured to penalize and discourage all manner of actions which bring us collective harm. In addition to maintaining the “value” of the nation’s fiat money, then, taxes can become an implementation of national policy goals across a broad range of social and environmental issues.

Second, choosing to correctly understand and manage a pure fiat money system means the sovereign government can begin immediately to pay citizens to create the public goods and services we deem necessary and desirable as a nation—the only constraint being whether the real resources (labor, materials and technology) are actually available to achieve them.

For example, let’s take those 18,000 “fracture critical” bridges CBS News now tells us exist throughout our national highway system—bridges that could collapse catastrophically if a single rusted bolt or strut gives way (like the one north of Seattle that recently sent three cars and their passengers into the Skagit River.) Are the civil engineers available to immediately begin evaluating and designing the necessary repairs or replacements for each of these 18,000 bridges? I believe quite a few of those engineers, at the moment, are only working part-time. Is the steel and concrete available for the construction to actually be implemented? (The Total Industry Capacity Utilization in America is currently only 76%) Are the cranes required to lift the steel available for lease? (I see them lined up by the thousands, mutely reaching for the clouds, in contractor rental lots across the country.) Are the drivers and welders and concrete finishers available for hire? A lot of them, I believe, are currently collecting unemployment checks.

Under our alternative narrative, then, there is no need to sit around wringing hands and bickering over where the tax Dollars are going to come from: Each of the defective American bridges that we play Russian Roulette with every day could be redesigned, rebuilt, and painted blue—for “new”—within, say, 24 months. It’s literally just a matter of saying, “Let it be done.”

Next time you drive over a bridge, think about which narrative you think America should be using.

54 responses to ““Let it be Done” An Alternative Narrative for Building what America Needs”