By Matthew Berg

A fateful Saturday in January

On Saturday afternoon, the White House ruled out using platinum coin seignorage as a way to defuse the political crisis caused by Congressional Republicans’ unwillingness to raise the debt ceiling. In the words of press secretary Jay Carney:

“There are only two options to deal with the debt limit: Congress can pay its bills or they can fail to act and put the nation into default.”

A common reaction to this dispatch was bewilderment that Obama would (yet again) unilaterally discard his bargaining chips. As Congressman Jerold Nadler put it:

“It’s really a shame that the administration is ruling out one of the very few bargaining chips it has with Republican extremists who are intent, once again, on using the debt ceiling as a means of political blackmail.”

Likewise, a Democratic aide in the Senate told Joe Weisenthal,

“It’s certainly a strange negotiating strategy to go out of your way to decrease your leverage by taking options off the table.”

It is true that we cannot rule out the possibility that Obama is in fact simply bluffing. And that would be in keeping with the president’s previous “negotiation” record.

The political context

However, if we take the Administration’s statement at face value, it makes perfect sense in terms of President Obama’s political incentives (given Obama and his advisers misunderstand what money is and how it works). The White House’s actions also fit with Obama’s other publicly stated issue positions and policy goals.

Like previous second-term presidents, Obama is concerned with establishing what he sees as his “legacy.” According to Bob Woodward, Obama often says “I’m a blue dog. I want fiscal restraint and order.” In 2008, Obama campaigned on what is euphemistically known as “entitlement reform,” and in the first presidential debate of 2012 against Mitt Romney, Obama said,

“I suspect that on Social Security, we’ve [Obama and Romney] got a somewhat similar position. Social Security is structurally sound. It’s going to have to be tweaked the way it was by Ronald Reagan and Speaker — Democratic Speaker Tip O’Neill. But it is — the basic structure is sound.”

From all of this and from much more consistently corroborating evidence, it is beyond clear that Obama would like nothing more than to strike a “grand bargain” that revives the glory days of Reagan-O’Neill, but he has been frustrated by the Tea Party congress’ just-say-no approach to negotiation. Combined with Obamacare, which aims to reduce the government’s budget deficit by “bending” the so-called health care “cost-curve,” Obama believes that a “grand bargain” of this sort would establish the sort of Clintonian legacy of “fiscal responsibility” that he’s always dreamed about.

None of this makes any sense to those who understand sectoral balances and how the monetary system works, but it is nonetheless how President Obama sees the world. The terrible irony is that the austerity of a “grand bargain” would not cement but would rather undermine his legacy by throwing the economy back into recession.

Though this be madness, yet there is method in’t

A “senior administration official” explains that method:

“This now puts all the pressure back where we believe it belongs: on the Republicans. There are no magic coins. There is no way to get out of this. We feel fine about the politics of it. We think we are in a stronger position if Republicans realize there is no out.”

By ruling out the trillion dollar coin, the 14th amendment, and any other work-arounds that might come up, the Obama administration is pursuing (for better or for worse) a deliberate strategy – the strategy known popularly as burning one’s bridges (or boats).

Obama is following in the well-worn footsteps of Cortés, who scuttled his ships upon arrival in Mexico, the ancient Chinese general Xiang Yu, who ordered his troops to destroy their boats and supplies before the battle of Julu (“break the kettles and sink the boats”!), and the ancient Romans, who routinely burned their boats or bridges as a deliberate tactic.

Cortés scuttles his ships off the coast of Vera Cruz. Painting by Miguel Gonzalez on display at the Naval History Museum in Mexico City

By burning ones bridges, ones own “troops” become committed to victory – because they know that with no way out, the only options are victory or death. Just as importantly, the enemy “troops” get the same message – with the effect of making them more likely to flee, since they know they face a determined opponent.

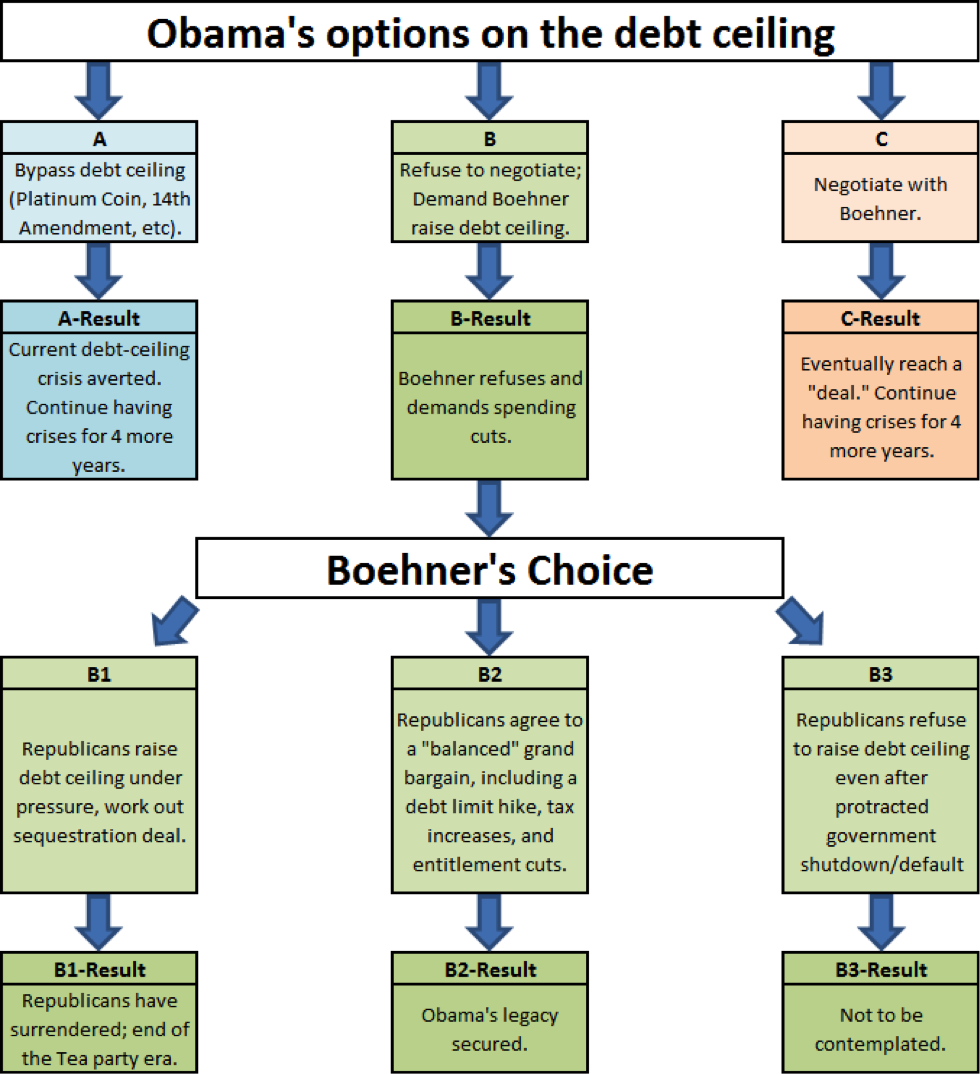

Here’s how Obama and his advisers may see the situation:

Obama has 3 choices. He can either:

- Bypass the debt ceiling.

- Refuse to negotiate with Boehner.

- Negotiate with Boehner.

There are multiple different ways to execute option A, including the 14th Amendment and Platinum coin seignorage, both of which the White House has ruled out. The question is, why did the White House rule those out? One argument in the case of the coin is that it was ruled out because its captivating shiny allure raised new and uncomfortable questions about the nature of money and threatened the interests of established institutions such as Wall Street banks and the Fed.

While there is probably some truth to that theory, it does not explain why the 14th Amendment option was also ruled out, and it does not explain why they are also implicitly ruling out any other possibility (such as issuing scrip) and insisting that “There are only two options to deal with the debt limit: Congress can pay its bills or they can fail to act and put the nation into default.”

Platinum coin seignorage is an ingenious idea that would have solved the technical problem of the debt ceiling, but the White House is not interested in solving a technical problem. The real explanation for why Obama ruled out the platinum coin (as well as all other possible alternatives) lies less in the economics and more in the politics.

The administration realizes at this point that these self-induced crises are going to keep recurring unless something is actively done to cause them to stop re-occuring. If they do not happen in the form of confrontations over the debt ceiling, that merely means that the crises will be diverted into crises over the budget process and continuing resolutions (and crises in those forms would be less politically favorable for Obama, since it would not be so easy to tar the Republicans with gross irresponsibility). So it is immaterial whether the crises are realized through the specific institutional forms of the debt ceiling, the annual budget process, or custom-made rube-goldberg traps like sequestration.

The Obama administration also realizes that, as long as these crises continue to occur, Obama will have no opportunity to accomplish anything at all in his second term other than ward off repeated crises.

Obama could also take option C, and commence negotiations with Congressional Republicans now. If he were to do this, some sort of deal raising the debt ceiling and dealing with sequestration would eventually be struck. If he were to take option C, Congressional Republicans might also be willing to strike a “grand bargain” of a sort. But although Obama wants a “grand bargain,” he doesn’t just want any old grand bargain, but rather wants one on his own terms. Continuing to take Obama at face value, he wants a “balanced” grand bargain that does not merely cut entitlements, but also raises taxes. But under scenario C, with sequestration cuts to defense as Obama’s only real leverage, Congressional Republicans would not be inclined to agree to any further tax increases. Furthermore, like option A, option C also rewards Tea Party intransigence and assures future repeated crises throughout the rest of Obama’s presidency.

Therefore, Obama has a political imperative that demands a final confrontation. And that is why Obama is choosing option B – to refuse to negotiate, and insist that the Republicans must raise the debt ceiling, or the consequences are their fault.

The GOP’s move

With Obama taking option B, that leaves the ball in the Republican’s court – and by all accounts Republicans are in no mood to simply give in:

“GOP officials said more than half of their members are prepared to allow default unless Obama agrees to dramatic cuts he has repeatedly said he opposes. Many more members, including some party leaders, are prepared to shut down the government to make their point. House Speaker John Boehner ‘may need a shutdown just to get it out of their system,’ said a top GOP leadership adviser. ‘We might need to do that for member-management purposes — so they have an endgame and can show their constituents they’re fighting.’”

With both sides intransigent and the Department of Treasury already running up to the debt limit, that takes us towards a government shutdown of one sort or another. Here, prognostications necessarily become hazier, but the shutdown will probably be a gradual process, not a single event. Treasury will get (and has already begun to get) creative to limit the damage as best as it can and to avoid a technical default (prioritizing interest payments on bonds).

As the shutdown begins, as the stock market begins to decline, and as the economic impact of reduced government spending begins to be felt by the American people, Boehner and the Republicans have 3 choices. They can either:

B1. Cave to Obama’s demand and unilaterally raise the debt ceiling.

B2. Agree to a “balanced grand bargain” and raise (or eliminate) the debt ceiling.

B3. Refuse to raise the debt ceiling.

In the immediate term, as the shutdown begins, Republicans will simply refuse to raise the debt ceiling in the hope that Obama caves. During this time, there will be negotiations of a sort – but the negotiations will primarily consist of each side trying to appear reasonable for public relations purposes, rather than trying to actually reach an agreement. Obama will repeat his willingness to negotiate on sequestration (in isolation of a debt ceiling increase), and Congressional Republicans will demand spending cuts in exchange for a debt ceiling increase.

For Obama, the calculation is that the Republicans will be the ones to take the blame for any government shutdown or default, and that the political pressure will build to the point where they have to give in. Everything in his calculations depends upon that assessment being correct. Depending upon when exactly the government shutdown begins, the sequestration cuts will begin to come into effect, which will only heightens the political pressure (on both the Republicans and Obama).

And so a period of time will elapse… A day? A few days? A week? Two weeks? A month? Two months? More?

Social security recipients stop receiving their checks in the mail. National parks close. The stock market plunges. Consumer confidence plunges, businesses pull back on their already limited investment plans. According to one rough estimate, about 600,000 jobs are lost per month. Congress and the white house are both flooded with phone calls and e-mails from irate constituents.

When this parade of economic horrors has gone on long enough, Boehner & Co. are confronted with the same 3 choices.

If they choose option B1 and unilaterally raise the debt ceiling, then they have surrendered and Democrats have won. A deal will then be made on sequestration. In Obama’s eyes, this is a victory, although it may come at substantial economic costs. Austerity from the sequestration deal, even in the absence of a disastrous “grand bargain” will cause further economic pain. Obama will have routed the Tea Party Republicans, and they will be unable to continue upon the same universally obstructionist course that they have followed since 2010, which makes it possible for Obama to possibly pass a “grand bargain” a bit later, along with the possibility of other legislation on issues such as immigration. Admittedly, the causal sequence between is not strong between the Republicans caving and the Republicans. All that is for sure is that if the Republicans outright cave, then something will have to change. Obama’s assumption is that any sort of change from the current state of government-by-crisis and 100% obstructionism is an improvement.

Secondly, the Republicans could choose option B2, which is probably the most palatable to them and therefore the most likely. Under this scenario, Republicans do not outright surrender as in option B1, but instead are able to save face. The price for this is that they have to agree to a “balanced grand bargain” on Obama’s terms – including not just the spending cuts that they want, but also tax increases in one form or another. We cannot predict the precise form that this deal would take, but it might be something like a debt limit increase through the, chained CPI Social Security cuts, and the abolition of tax deductions used by the wealthy. If the government shutdown lasted only a short amount of time and if the austerity measures in the “bargain” were limited just to items such as chained CPI that come into effect slowly, then the economy could escape an outright double-dip. But in addition to the economic damage from the government shutdown itself, the Economic recovery would be unnecessarily slowed for absolutely no reason at all.

Finally, there is the unthinkable and MAD option B3, in which the Republicans simply do not agree to raise the debt ceiling, and are simply unwilling to either unilaterally raise the debt ceiling or agree to a “grand bargain” that contains further tax increases. Obama must have some breaking point, and at some point would give in, after the economic damage became sufficiently great. If this happens, then Obama’s presidency is over, he might as well not have been re-elected, the economy is dead, and it might even be the end of the Republican Party. But again, this scenario is simply unthinkable. This is the sort of unmitigated disaster that we like to think only happens in history books.

Millions of ordinary Americans are the pawns in all of this, and they are the ones who will suffer. Much like the 2009 mistake of passing a much too small American Recovery and Reinvestment Act, it all makes absolutely fantastic political sense. And absolutely no economic sense.

21 responses to “The Political Economy of the Coin and the Debt Ceiling”