By Stephanie Kelton

Earlier this week, President Obama talked about the weakening state of the economy, telling us that he’s not worried about a double-dip recession and that the nation should “not panic.” It’s hard to imagine a more alarming assessment at this juncture.

The recovery is faltering. Our economy is growing at annual rate of just 1.8 percent. Manufacturing just grew at its slowest pace in 20 months. More than 44 million Americans – one in seven – rely on food stamps. Employers hired only 54,000 new workers in May, the lowest number in eight months. Jobless claims increased to 427,000 in the week ended June 4. The unemployment rate rose to 9.1 percent. Nearly half of all unemployed Americans have been without work for more than 6 months. About 25% of all teenagers who are looking for work are unemployed. Eight-and-a-half million Americans are underemployed – i.e. working part-time because their hours have been cut or because they can’t find full-time work. There are, on average, 4.6 unemployed people for every 1 job opening. And even if all the open positions were filled, there would still be 10.7 million people looking for work.

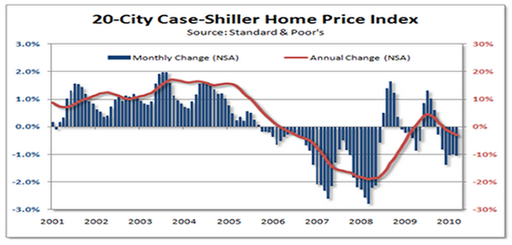

The Case-Shiller index shows that the housing market has already double-dipped.

And, because of the huge shadow inventory of yet-to-be-foreclosed homes, Robert Shiller, a co-creator of the index, thinks home prices could easily fall another 15-25% before bottoming out. If he’s right – and I suspect he is – this spells the end of the recovery. As prices continue to decline they create hidden losses elsewhere in the economy, hurting not just homeowners but the financial institutions that hold their mortgages. The list goes on and on.

These are not, as Obama said, “headwinds” that will slow the pace of our recovery. They are gale force winds that will push millions of families into poverty and thousands of business into bankruptcy.

There is a way out, but it seems unlikely that Congress and the White House will work together to do what’s necessary to turn things around. Why? Because a recent

poll shows that 59 percent of the public disapproves of the president’s handling of the economy. And Republicans smell blood. They know that since WWII no president has been re-elected with unemployment above 7.2 percent, so they see Harry Hard Luck and Sally Sob Story as their best chance at reclaiming the White House in 2012. It’s a victory the Republicans have been masterfully engineering since February 2009, when they succeeded in restricting the size and scope of the American Recovery and Reinvestment Act (ARRA).

Some of us saw this coming. For example, Jamie Galbraith and Robert Reich warned, on a panel I organized in January 2009, that the stimulus package needed to be at least $1.3 trillion in order to create the conditions for a sustainable recovery. Anything shy of that, they worried, would fail to sufficiently improve the economy, making Keynesian economics the subject of ridicule and scorn.

But it’s easy to see why the $787 billion package we ended up with didn’t do the trick. Remember that the stimulus didn’t take effect all at once – it was spread out over a three-year period. And while the left hand of the federal government was trying to rev up the economy with increased spending, the right hand of the private sector (together with state and local governments) was dutifully stomping on the breaks. Just consider the fact that bank lending declined by

$587 billion in 2009 alone – the biggest one-year drop since the 1940s. That’s a $587 billion hole that businesses and households created just as the stimulus was rolling out the first $200 billion or so. ARRA was the right medicine, but it was administered in the wrong dosage, and this became clear within months of its passage.

In July 2009, I wrote a post entitled, “Gift-Wrapping the White House for the GOP.” In it, I said:

“If President Obama wants a second term, he must join the growing chorus of voices calling for another stimulus and press forward with an ambitious program to create jobs and halt the foreclosure crisis.”

Two years later, both crises are still with us, and the election is just around the corner.

Meanwhile, a new Washington Post-ABC News

poll shows former Massachusetts Governor Mitt Romney with a slight edge in a hypothetical race against President Obama, and

Howard Dean is warning that without a marked improvement in the economy, even Sarah Palin could clobber Obama in 2012.

To avoid this, President Obama must get his economics right. Unfortunately, he’s too busy fanning the flames of the phony debt crisis and

complaining that the discouraging data is hampering the recovery because it “affects consumer confidence, and it affects business confidence.” But here’s the thing – the recovery isn’t going to be driven by a change in our mentality. It’s going to be driven by a change in our reality.

So here’s what he needs to do – stop talking about the deficit. It has always been his Achilles’ heel. The US is not broke and cannot go bankrupt. Let go of that myth, and deliver one of those jaw-dropping, awe-inspiring speeches of yesteryear. Tell the American people that he’s calling on the Republicans to help him enact the most sweeping tax relief since Ronald Reagan was in office — a full payroll tax holiday for every employee and every employer in the nation. Tell us that you understand that sales create jobs, and income creates sales. Tell us that families and small businesses don’t have enough income to dig us out of the ditch we’re still in. Tell us that you will not withhold a dime from our paychecks until cash registers across the nation are chiming and unemployment has fallen below 5 percent. Tell us before it’s too late.