By William K. Black

Peter Wallison dissented from the Commission’s finding that deregulation played a material role in the crisis. Here are the key excerpts.

Deregulation or lax regulation. Explanations that rely on lack of regulation or deregulation as a cause of the financial crisis are also deficient. First, no significant deregulation of financial institutions occurred in the last 30 years [p. 445].

Moreover, the Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA) substantially increased the regulation of banks and savings and loan institutions (S&Ls) after the S&L debacle in the late 1980s and early 1990s, and it is noteworthy that FDICIA—the most stringent bank regulation since the adoption of deposit insurance—failed to prevent the financial crisis [p. 446].

The shadow banking business. The large investment banks—Bear, Lehman, Merrill, Goldman Sachs and Morgan Stanley—all encountered difficulty in the financial crisis, and the Commission majority’s report lays much of the blame for this at the door of the Securities and Exchange Commission (SEC) for failing adequately to supervise them. It is true that the SEC’s supervisory process was weak, but many banks and S&Ls—stringently regulated under FDICIA—also failed. This casts doubt on the claim that if investment banks had been regulated like commercial banks—or had been able to offer insured deposits like commercial banks—they would not have encountered financial difficulties [p. 446].

The Commission report and the dissents do not distinguish between the three “des” – deregulation, desupervision, and de facto decriminalization. Deregulation occurs when one reduces, removes, or blocks rules or laws or authorizes entities to engage in new, unregulated activities. Desupervision occurs when the rules remain in place but they are not enforced or are enforced more ineffectively. De facto decriminalization means that enforcement of the criminal laws becomes uncommon in the relevant industries. These three regulatory concepts are often interrelated. The three “des” can produce intensely criminogenic environments that produce epidemics of accounting control fraud. In finance, the central task of financial regulators is to serve as the regulatory “cops on the beat.” When firms gain a competitive advantage by committing fraud, “private market discipline” becomes perverse and creates a “Gresham’s” dynamic that can cause unethical firms and officials to drive their honest competitors out of the marketplace. The combination of the three “des” was so criminogenic that it generated an unprecedented level of accounting control fraud, which in turn produced unprecedented levels of “echo” fraud epidemics. The combination drove the crisis in the U.S. and several other nations.

Wallison discusses only one example of deregulation – the repeal of the Glass-Steagall Act. I show that his claim that “no significant deregulation of financial institutions occurred in the last 30 years” is false.

I do not discuss here in detail the enormous S&L deregulation and desupervision that occurred at the federal and state level that occurred in 1982-83 and made possible the second phase of the S&L debacle – then the worst financial scandal in U.S. history. The first phase of the debacle was caused by interest rate risk. It, ultimately, cost the taxpayers roughly $25 billion to resolve. The second phase of the debacle was driven by the epidemic of accounting control fraud by S&Ls. Deregulation and desupervision in 1981-1983 created the criminogenic environment that allowed that epidemic of fraud. I have written about it extensively in my staff reports to the National Commission on Financial Institution Reform, Recovery and Enforcement and my book: The Best Way to Rob a Bank is to Own One. Akerlof & Romer (1993) used the second phase of the debacle as an exemplar of the title of their article – “Looting: the Economic Underworld of Bankruptcy for Profit.” The criminologists Calavita, Pontell, and Tillman discuss the fraud epidemic in their book – Big Money Crime. Airbrushing the deregulation and desupervision that permitted the second phase of the S&L debacle out of history is necessary to Wallison’s central task – defending his disastrous lobbying for decades for financial deregulation. We will see that the S&L deregulation and desupervision are not alone in disappearing from Wallison’s rewrite of history.

I will also not discuss in detail the enormous desupervision that occurred at the SEC that permitted the Enron-era frauds. The budget and staffing of the SEC were kept relatively flat while its workload grew enormously. The percentage of fillings it reviewed declined to five percent. Congressional Republicans consistently sought to cut the SEC’s budget and staffing levels in the 1990s. Criminologists refer to the result as a “systems capacity” problem. (see here and here)

As SEC enforcement director Robert Khuzami emphasizes, the SEC must serve as the regulatory “cops on the beat.” The staff and budgetary limits rendered the SEC incapable of performing its primary statutory mission.

In sum, Wallison’s history excludes the deregulation and desupervision that permitted the two massive financial crises that preceded the current crisis. We will see that Wallison also ignores the major acts of deregulation, desupervison and de facto decriminalization that made possible the current crisis.

Deregulation

This column addresses the role of deregulation in allowing the current crisis. I break the discussion in to three subsets: deregulation by legislation, deregulation by rule changes, and an odd hybrid – the SEC’s Consolidated Supervised Entities (CSE) program.

Deregulation by Legislation

Gramm-Leach-Bliley (1989) repeals the Glass-Steagall Act and Reduces CRA Examination

The repeal of Glass-Steagall demonstrates the complexity of what deregulation can mean. The banking regulatory agencies were extremely hostile to the Glass-Steagall Act. They eviscerated the Act by adopting rules and interpretations that created so many exceptions to Act’s separation of “banking and commerce” that the separation was rendered ineffective. The federal regulators also did not enforce the remaining provisions of the Act vigorously even before it was repealed in 1999. The combination of deregulation and desupervision by the banking regulators so gutted the Act that its formal repeal by the Gramm-Leach-Bliley Act in 1999 had little practical effect.

Wallison refers to a modest regulatory strengthening of the CRA rules in 1995, but he does not inform the reader that the GLB Act reduced the frequency of examinations of smaller and rural banks under the Community Reinvestment Act (CRA) and sought to discourage alleged extortion by housing activist organizations (e.g., ACORN) by requiring the disclosure of any agreements they made with banks not to challenge mergers. Senators Dodd and Schumer led the group of Democrats that successfully pushed these anti-CRA provisions on a reluctant White House because the Democrats were so eager to repeal Glass-Steagall. (see here)

Wallison does not disclose this deregulatory aspect of the GLB Act because it falsified his claim that the CRA caused the crisis.

If there is doubt that these lessons are important, consider the ongoing efforts to amend the Community Reinvestment Act of 1977 (CRA). Late in the last session of the 111th Congress, a group of Democratic congress members introduced HR 6334. This bill, which was lauded by House Financial Services Committee Chairman Barney Frank as his “top priority” in the lame duck session of that Congress, would have extended the CRA to all “U.S. nonbank financial companies,” and thus would apply, to even more of the national economy, the same government social policy mandates responsible for the mortgage meltdown and the financial crisis [p. 443].

There are many crippling flaws in Wallison’s claim that the CRA was “responsible for the … crisis.” Here, I note only the fact that the timing and direction of regulatory changes falsify his claim that the CRA was responsible for the crisis. The obvious problem is that the CRA had been in effect since 1977 – so one must assume a fictional latency effect of 15 years, a period that included two recessions, before the CRA suddenly became toxic. The recessions should have exposed any toxic aspects of the CRA long before the current crisis. The less obvious problem is that the CRA was weakened, not strengthened, after 1999. This refutes Wallison’s assertion that the CRA was “responsible for the … crisis.” As I will explain, the statutory weakening of the CRA in 1999 was compounded by other forms of deregulation and desupervision during the run-up to the crisis in 2001-2007.

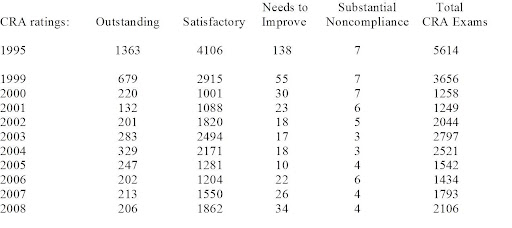

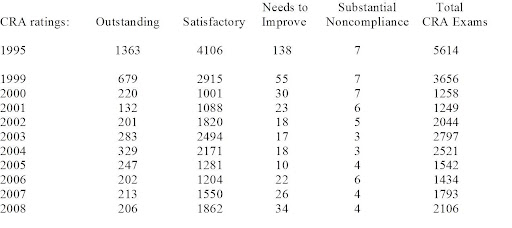

I prepared the chart below by searching the FFIEC data base for CRA rating by date of the CRA examination.(see FFIEC website here)

The chart confirms a number of points that anyone who has ever been a financial regulator after the passage of the CRA in1977 knows. CRA ratings have long been like Lake Woebegon’s children: they’re virtually all above average. Fewer than ten banks get rated as a serious problem – and even they get treated with kid gloves. Examine the data for 1999 and 2000. The examiners discover seven serious CRA problems in 1999 – slightly above one-tenth of one percent of the banks examined. That CRA rating “substantial noncompliance” triggered a requirement for annual CRA reexaminations of the non-magnificent seven and should have led to immediate enforcement actions. Clinton was President and had appointed each of the regulatory leaders. By 2000 the regulators appointed by Clinton (who Wallison seeks repeatedly to cast as the villains) acted so aggressively against the seven that the 2000 exams revealed that there were still seven awful banks. It’s not like banks were failing frequently in this period and requiring the regulators’ attention to be paid solely to “safety and soundness.” The claim that banks lived in fear of the CRA and that the CRA drove their lending decisions is pure fiction. Banks routinely got satisfactory or outstanding ratings by making good loans. Banks had to try hard to get poor ratings and even the tiny minority that did so rarely faced any meaningful sanction.

The data in the chart also show that the statutory deregulation, reducing CRA examination frequency, was significant. The number of annual CRA examinations in the 2000s was typically well under one-half of the number of CRA examinations in 1995. Wallison is deliberately disingenuous in stopping his discussion of CRA changes in 1995. Both statutory and regulatory deregulation of the CRA occurred after that date. (My next column will also discuss the desupervision of CRA compliance that occurred during the 2000s.) The CRA, and its enforcement, became weaker as the mortgage fraud epidemic surged. That (further) falsifies Wallison’s claims that the CRA was “responsible for the … crisis.”

Statutory changes that allowed the creation of “private label” MBS

The SEC, Department of the Treasury, and OFHEO (which regulated Fannie and Freddie) created a joint task force, which issued: A Staff Report of the Task Force on Mortgage-Backed Securities Disclosure in January 2003.

The Task Force report explained two key statutory changes that made possible the rise of private label

A number of regulatory and tax constraints initially impeded private entities from expanding into the MBS market created by the GSEs and Ginnie Mae.

1. Secondary Mortgage Market Enhancement Act of 1984

Many of the regulatory constraints affecting private entities were removed in 1984 with the passage of the Secondary Mortgage Market Enhancement Act of 1984 (“SMMEA”). SMMEA was intended to encourage private sector participation in the secondary mortgage market by, among other things, relaxing certain regulatory burdens that affected the ability of private-label issuers to sell their MBS.14 For example, SMMEA allowed state and federally regulated financial institutions to invest in privately issued mortgage related securities.

2. Effect of Tax Laws on MBS Markets

Tax law constraints also affected the types of MBS that could be sold. Until the passage of the Tax Reform Act of 1986 (“1986 Tax Act”), which recognized the Real Estate Mortgage Investment Conduit (“REMIC”) structure with its beneficial tax treatment, most MBS were sold as “pass-through” securities. As discussed below, pass-through securities pay an investor principal and interest received from payments on the mortgage loans that are the assets of the trust. The payments on the mortgage loans are passed through the trust to the investors as they are made.

Before 1986, the effect of the limitation on activity of grantor trusts under the tax laws restricted the use of trusts with multiple classes of securities with differing payment characteristics. In the multi-class structure, the principal and interest payments are not just passed through pro rata as paid to all investors, but rather are divided into varying payment streams to create classes with different expected maturities, different levels of seniority or subordination or other differing characteristics. Prior to 1986, the tax law treated these multi-class trusts as associations taxable as corporations, and distributions would have been taxable at the trust level and also at the trust investor level. This “double taxation” made multi-class structures generally unfeasible.

The 1986 Tax Act eliminated the double taxation for multi-class vehicles structured as REMICs. With the advent of the REMIC, more complex structures with multiple classes were developed which divided up the payment streams on the mortgage loans that were collateral for the securities repayment obligations to investors.

The statutory changes that allowed the creation of an extensive private label MBS system were major contributors to the crisis. Wallison has particularly compelling reasons for seeking to blot the deregulation that led to the rise of private label MBS out of existence. As I explained in a

prior column, Wallison praised the role of private label MBS, praised its provision of subprime loans, and derided Fannie and Freddie for failing to make as many loans to less wealthy Americans as their private label competitors did.

The existence and business practices of the private label competitors refute Wallison’s claims. The private label competitors were not subject to affordable housing goals. If they securitized toxic CDOs (and they did), and if they did so before Fannie and Freddie became the dominant purchaser of toxic CDOs (and they did), then Wallison’s claim that Fannie and Freddie’s affordable housing goals caused the crisis fails yet again.

As late as October 2006, the view from the mortgage industry was that the private label MBS issuers were dominant and likely to remain dominant over Fannie and Freddie precisely because the private label issuers were far more aggressive than Fannie and Freddie in making far riskier loans to less wealthy Americans. Here’s how the Mortgage Bankers Association’s (MBA) trade magazine explained the role of Fannie and Freddie vis-a-vis Fannie and Freddie.

The rise of private label: innovative mortgage products, enthusiastic investor support and consumer demand for new affordable loans have all come together to give extraordinary new power to the private mortgage-backed securities market. This has left the private sector setting the rules once largely dictated by Fannie Mae, Freddie Mac and FHA.

A change in the mortgage-backed securities (MBS) market that began more than two years ago appears to have completely reshuffled the industry’s deck of cards. Now, issuers of private-label residential MBS are holding the aces that were once held by the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac. Once a junior–but powerful–player in the market, private-label residential mortgage-backed securities (RMBS) are now the leading force driving product innovation and the net overall volume of mortgage origination. Further, it appears that the new dominant role for private-label RMBS may be here to stay.

Product innovation has resulted from two developments, the first is mortgage consumers looking for new low-payment mortgages to help them afford rising home prices. The other is the growing willingness of investors to fund the new types of mortgage products that lenders have developed to meet this need.

Mortgages that offer low monthly payment options often do not amortize the principal balance on the loan, and may even negatively amortize. These products–interest-only (IO) mortgages and option adjustable-rate mortgages (option ARMs)–are the primary generators of gains in market share for private-label issuers.

There are also new nontraditional mortgage products that amortize, but extend the amortization term from the current 30 years to 40 and even 50 years in an effort to bring down the monthly payment.

The expectation that private-label issuers are likely to retain their dominant position was the consensus view of the [MBA’s] Council to Shape Change, a blue-ribbon mortgage industry panel of 19 experts that published its findings in August.

The council, echoing what other market observers have said, cited the lag in product innovation as “the most important factor” holding the agencies back. “Most of the business now considered alt-A used to be prime business and would have fallen in the GSEs’ sweet spot,” the report states.

Another factor in the market shift has been the ability of mortgage originators to increasingly securitize their own production. With this new capability, originators have been able to “adversely select the GSEs, feeding only product that lenders cannot advantageously securitize themselves,” the council’s report notes.

Also, due to sharply rising home prices and the limits on the size of loans they can purchase, Fannie Mae and Freddie Mac are a minimal presence in states such as California, the nation’s largest mortgage market.

To get a sense of the dramatic nature of the shift in market share, a few numbers help tell the story. As recently as 2003, the agencies issued 76 percent or $2.13 trillion of the year’s $2.72 trillion in mortgage-backed securities, according to data compiled by Inside Mortgage Finance (see Figure 1). These numbers include Fannie Mae, Freddie Mac and Ginnie Mae securitizations.

In 2003, the non-agency or private-label RMBS was only 24 percent or $586 billion. Most of these were jumbo prime mortgages. The ground began to shift in the second half of 2004 as the refi boom subsided and interest rates began to rise, and home-price appreciation raced ahead at double-digit rates–prompting the introduction of a flurry of new affordability products.

By year-end 2004, agency RMBS issuance represented $1.02 trillion, while the non-agency piece had risen to $864 billion out of a total of $1.88 trillion, according to Inside Mortgage Finance (see Figure 2).

In 2005, the private-label RMBS surged into the dominant position, with $1.19 trillion or 55 percent of the $2.16 trillion in securities issued, while the agencies issued $966 billion (see Figure 3).

By the first half of 2006, the private-label share has strengthened still more to 57 percent or $577 billion, according to Inside Mortgage Finance. Agency issues totaled $439 billion of the $1.12 trillion market.

Note the comprehensive refutation of Wallison’s thesis provided by the findings of the MBA study. The MBA was an opponent of Fannie and Freddie because it believed that they acted to reduce yields on home loans. The MBA was overjoyed that Fannie and Freddie were losing market share. The MBA attributed Fannie and Freddie’s loss of market dominance to the private label issuers’ far greater willingness to make extreme risk loans to less wealthy Americans. The MBA explained that it was investors’ growing willingness to purchase toxic MBS issued by private label firms that was driving the rapid growth of the private label firms. The MBA study did not find that Fannie and Freddie were the investors purchasing the private label issuers’ toxic MBS. Douglas Holtz-Eakin, later appointed by the Republican Congressional leadership as an FCIC Commissioner, was one of the consultants to the MBA’s Council to Shape Change.

Wallison ignores the passage of the Commodities Futures Modernization Act of 2000

The Commodities Futures Modernization Act of 2000 created two regulatory black holes. Enron exploited one to help create the California energy crisis of 2001. The Act also created a massive regulatory black hole with regard to credit default swaps (CDS). Wallison does not mention the passage of the CFMA. He concedes that AIG took crippling losses from its CDS exposure but dismisses it as an “outlier” (p. 447).

Deregulation by Rule

Wallison fails to mention the major acts of deregulation by rule or interpretation that made substantial contributions to the crisis. I discuss four examples of this form of deregulation.

Rules Reducing Underwriting and Recordkeeping Requirements

On December 31, 1992, the Office of Thrift Supervision (OTS), and its sister federal banking agencies, adopted the Real Estate Lending Standards Rule (RELS), 12 CFR § 560.100-101. The OTS’ prior standard required minimum underwriting demonstrating that the borrower could repay the loan and that the collateral value was adequate to repay the loan in the event that the borrower did not pay. The OTS’ rule was of tremendous value in allowing the OTS to take effective supervisory and enforcement actions and the Justice Department’s fraud prosecutions. The OTS rules also required contemporaneous documentation of that the borrower had conducted the required underwriting. The joint agency standards, however, allowed the lender to establish its underwriting standards and its documentation standards. The result was a very substantial deregulation and impaired ability to supervise, take enforcement actions, and prosecute frauds.

Basel II Reduces Capital Requirements

Wallison mentions the Basel II deregulation only once in passing, without seeming to realize that it refutes his claim that there was no important deregulation in 30 years.

Beginning in 2002, for example, the Basel regulations provided that mortgages held in the form of MBS—presumably because of their superior liquidity compared to whole mortgages—required a bank to hold only 1.6 percent risk-based capital, while whole mortgages required risk-based capital backing of four percent [p. 476].

As weak as U.S. banking regulators were during the crisis, they had great concerns about Basel II’s deregulation and limited it. The Shadow Financial Regulatory Committee expressed similar concerns. Europe, unfortunately, bought into Basel II’s deregulation whole hog, which explains why their banks’ reported leverage was far higher than U.S. banks. (One must always remember that banks’ actual leverage is often dramatically greater than reported leverage.)

Rules and Interpretations Preempting State Laws and Rules

Wallison ignores deregulation via preemption even though it was a major aspect of deregulation in the current crisis. It is particularly understandable that Wallison does not acknowledge preemption because he favored federal regulators’ preemption of state efforts against predatory lending in his capacity as a member of the anti-regulatory and self-selected “Shadow Financial Regulatory Committee.” Statement No. 195 of the Shadow Financial Regulatory Committee on Predatory Lending and Federal Preemption of State Laws (September 22, 2003); Statement No. 186 of the Shadow Financial Regulatory Committee on State and Federal Securities Market Regulation (calling for federal preemption of then NY Attorney General Spitzer’s actions against securities firms) (February 24, 2003).

The federal agencies actually competed to be the most aggressive preemptors. The competition in laxity added greatly to the desupervision that will be the subject of my next column, but it also produced deregulation at the state level. The Commission report makes this plain.

The Comptroller of the Currency took the same line [as the OTS] on the national banks that it regulated, offering preemption as an inducement to use a national bank charter. In a speech, before the final OCC rules were passed, Comptroller John D. Hawke Jr. pointed to “national banks’ immunity from many state laws” as “a significant benefit of the national charter—a benefit that the OCC has fought hard over the years to preserve.” In an interview that year, Hawke explained that the potential loss of regulatory market share for the OCC “was a matter of concern” [p. 112].

Note that the strident efforts that federally insured banks and S&Ls made to preempt state efforts to prevent predatory loans by non-insured affiliates further demonstrates that banks and S&Ls made nonprime loans for the purpose of maximizing short-term reported income – not because of the CRA. They were eager to expand their fraudulent liar’s loans and feared State enforcement efforts against such lending.

Rules Further Reducing the Scope of the CRA

In addition to the statutory deregulation of CRA provisions wrought by adoption of the Gramm-Leach-Bliley Act in 1999, the federal regulatory agencies further reduced enforcement of the CRA by rule in 2004 and 2005 by expanding the definition of small banks from $250 million in assets to those with assets up to $1 billion. The rule changes reduced substantially the amount of information on loans the banks now considered small would have to provide and make public and reduced CRA examination frequency for many banks.

A Hybrid: the SEC’s Consolidated Supervised Entity (CSE) Program

There are regulatory actions that do not fall neatly into any category. The SEC, for example, created a regulatory structure for the purpose of blocking regulation. The context was that the European Union (EU) issued its Financial Conglomerates Directive was going to regulate the largest U.S. investment banks – unless they were regulated by the U.S. on a “consolidated supervision” basis. The SEC rushed to create a regulatory structure that the investment banks could voluntarily opt into – the Consolidated Supervised Entities (CSEs). The SEC’s CSE program was a sham. The SEC was supposed to act in an unprecedented capacity as a safety and soundness regulator (in addition to its role as a regulator of disclosures) over five of the largest, most complex financial institutions in the world. The SEC had no expertise and no systems that would allow it to succeed. But the Sec didn’t even try, its CSE program was a sham designed to block EU regulation of the largest investment banks. Each of the largest U.S. investment banks promptly volunteered to be regulated by the SEC’s CSE program. (The OTS, the weakest of the weak banking regulators, entered the competition in laxity with the SEC – and lost decisively. Each of the large investment banks voluntarily joined the CSE program. When an agency makes it clear that it will be a clearly weaker regulator than the OTS during the 2000s one knows that the agency has attained the status of flagrantly farcical.) The CSE program was so understaffed that it had three employees assigned to supervising Lehman. The CSE program was faux regulation. It created a de facto regulatory black hole for the largest investment banks that effectively reduced the investment banks’ capital requirements. The Commission report discusses the CSE program (pp. 150-155), the Republican dissents do not.

Conclusion

The three “des” – deregulation, desupervision and de facto decriminalization are the defining regulatory characteristics that, along with the perverse incentives of modern executive compensation and the ability of accounting control frauds to suborn purported “controls” (credit rating agencies, auditors, and appraisers) created the criminogenic environment that produced the epidemics of fraud that drove the current crisis. Wallison is correct that federal banking regulation law was made tougher in 1989 and 1991. On the SEC front, Sarbanes-Oxley attempted to toughen the securities laws. Each of those attempted positive statutory actions was overwhelmed by the rampant desupervision. Wallison is incorrect in claiming that there has been no significant financial deregulation in the last 30 years. There has been very little desirable financial deregulation in the last 30 years, but there has been extensive, destructive deregulation. Deregulation played a major role in the S&L debacle and the current crisis.