By Eric Tymoigne

Money is the blood of capitalist enterprise and finance is about money now for money later. As such a well-developed financial system is essential for economic activity in a capitalist economy. The broader the range of promissory notes that can be issued, the more accommodative the financial system is to the demands of the productive system. Households cannot fund the purchase of a house with a credit card and there is no point in buying groceries with a 30-year mortgage. While all this may seem obvious, economists have been divided about the relevance of finance for economic activity. This divide ultimately rests on different premises on how to do economics, which John Maynard Keynes characterized as Real Exchange Economy versus Monetary Production Economy.

Before I go further, a word of caution. Economists and national income accounts use the word “investment” in a specific way. Investment means adding to the amount of real assets, i.e. growing productive capacities. One cannot invest in shares, bonds, and other financial assets but merely in machines and raw materials (knowledge is also an area emphasized by economists). Portfolio choice, which is usually what people have in mind when talking about (financial) investment, is not the same thing as (physical) investment.

The Real Exchange Economy (REE)

Money supply is a veil

Money supply is a veil

Until the 1980s, most economists believed that finance is neutral, i.e. irrelevant for economic activity, which is an extension of the quantity theory of money. The study of exchange within a barter economy with small independent producers—think of farmers with their own plot of land—is regarded as a satisfactory proxy to understand the basics of capitalism:

Despite the important role of enterprises and of money in our actual economy, and despite the numerous and complex problems they raise, the central characteristic of the market technique of achieving co-ordination is fully displayed in the simple exchange economy that contains neither enterprises nor money. (Friedman 1962, 13)

The point is to understand how market exchange helps economic units to manage the prevailing natural scarcity of resources by allocating resources according to given sets of initial allocations, preferences and technics of production. Once this is understood, money supply can be added to the analysis but it does not substantially change anything. It merely smooths exchange and is not sought for itself, and so does not influence allocation, production, and distribution. Capitalism is equivalent to a barter economy with money.

Put in terms of the financial industry, one may think of financial markets and banks as institutions used by economic units to borrow and lend current production; finance is a market for intertemporal output:

It may be supposed in theory that the entrepreneur borrows these consumption goods from the capitalists in kind, and then pays them out in kind in the shape of wages and rents. At the end of the period of production he repays the loan out of his own product, either directly or after exchanging it for other commodities. […] If this procedure were adopted by all entrepreneurs who work with borrowed capital, competition would bring about a certain rate of interest that would have to be paid to the capitalists in the form of some commodity or other. […]Now if money is loaned at this same rate of interest, it serves as nothing more than a cloak to cover a procedure which, from the purely formal point of view, could have been carried on equally well without it. (Wicksell 1898, 103-104)

Assume a barter economy in which the only production is potatoes and in which workers and other income earners are paid in potatoes. Some economic units may have too many potatoes for current consumption, so they save potatoes. Potato savers can go in a market in which they lend their potatoes to economic units who plant potatoes—the potato investors. The following year, there will be more potatoes than what was planted as each potato is a seed that can be used to produce more potatoes, the marginal product of potatoes. This marginal product is at the foundation of the interest rate earned by the potato savers, their reward is more potatoes in the future, which means that interest and principal servicing creates an automatic demand for output (as did payment of wages). Monetary considerations can be added to this story, but they do not add anything to the understanding of what goes on in the financial industry. Money supply and other financial claims are just claims on production, i.e. money supply is a mere medium of exchange.

Monetary considerations are irrelevant and “the objectives of agents that determine their actions and plans do not depend on any nominal magnitudes. Agents care only about ‘real’ things, such as goods […] leisure and effort” (Hahn 1982, 34). As such economic units strive to get involved in the most productive economic activities in order to produce as much as possible in relation to their preferences. Markets are there to help them discover the most productive economic activities in the most efficient way. This way of thinking goes back at least to 19th century Austrian economists such as von Bawerk and Menger.

In many current macroeconomic models, this reasoning is simplified even further by getting rid of any market and assuming a farmer who is both a saver and an investor (as well producer/consumer and employer/employee). He saved potatoes today to plant them. The amount he saves (and so invest) depends on the reward received next year. The reward is the marginal product of potatoes.

Finance and the Economy

This understanding of finance is grafted to a specific theory of economic growth. Economic growth is driven by “supply factors”, i.e. the growth rate of inputs: physical capital (“machines”) and labor. Finance helps economic growth because the ability to invest (i.e. grow physical capital: Kt = Kt-1 + It-1) depends on the ability to save and the point of finance is to allocate saving—saving drives investment.

Going back to the potato economy, in order to have more potatoes next year, one needs to save more today. Say that if one plants a potato at year 0 one gets two potatoes at year 1. To get three potatoes at year 2, one must not consume one and half potatoes at year 1. Of course, saving is painful because one gets less potatoes to eat, so saving must be rewarded (one more potatoes next year). The question becomes: is the reward worth the pain? The graphical way to represent all this is the loanable funds market (Figure 1).

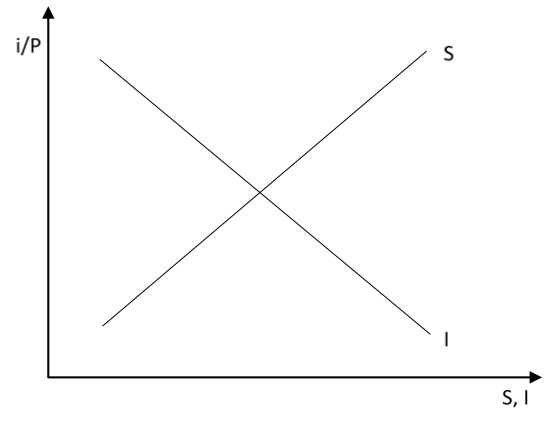

Figure 1. The loanable funds market

Economic units meet in a market to borrow and lend current output, “potatoes.” The higher the interest rate provided to saving, the more saving there is, i.e. the more economic units reduce their current consumption and supply potatoes to economic units who invest. The interest rate needs to rise because the higher the amount of saving, the higher the pain. The interest rate is of course a physical reward, a real interest rate, more potatoes in the future. Savers/lenders are not interested in monetary earning so their credit standards are set in real terms.

The opposite goes on with the planters of potatoes/borrowers. The incentive to invest decreases as the reward to pay out increases. The reason for that is found in the production process. As more potatoes are planted, the nutritive quality of a given amount of soil declines and so a potato seed will produce less potatoes. As such, investors can afford to pay a smaller reward for each additional potato that is invested. In technical terms, the marginal product of capital falls as more capital is used in the production process given other inputs.

The government may come in the market to borrow real resources too:

The government’s fundamental objective is to borrow a given amount of real resources, not a given amount of money. (Friedman 1952, 690)

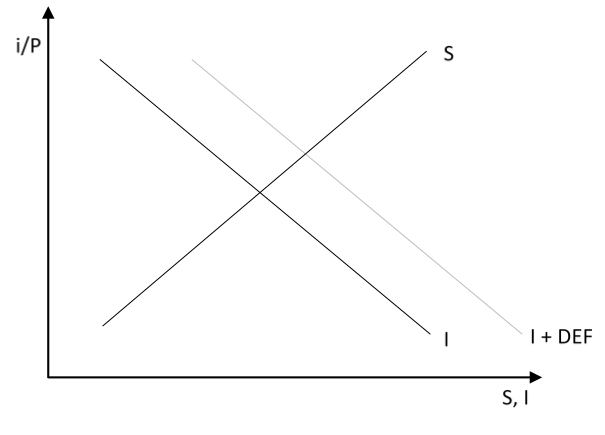

This is leads to the well-known “crowding out” effect (Figure 2). As government enters the loanable funds market, the real interest rate rises and private investment declines. Assume a market without a government that is at equilibrium (Figure 1). As the government comes to borrow potatoes (Figure 2), it competes with the private sector for the current amount of saved potatoes. Like for any other market, a higher demand for something increases the price of that thing. This is the market to borrow potatoes so the interest rate will rise until the market finds a new equilibrium. A higher interest rate reduces the incentive to invest.

Figure 2. Crowding out effect

Conclusions

In the end, finance is a mere intermediary between savers and investors and what finance does is to help barter intertemporal output. There are several conclusions one can draw from this view:

- The amount of current investment is constrained by the amount of current output that has been saved. To encourage more investment today, one must discourage present consumption (i.e promote saving today), and saving allows the transfer of current output through time: saving is just delayed consumption.

- The whole point of finance is to allocate saving to the most deserving investment projects, which are the ones who are involved in the most productive activities (the investment projects with the highest marginal product).

- Banks are just intermediaries between savers and investors: banks lend unconsumed output on behalf of savers.

- When government deficit spends, it discourages investment and so discourages the growth of the economy. Government should avoid deficit spending.

- While the financial system works with money, money is just a veil, a mere medium of exchange to smooth market mechanisms. What is really going on is the borrowing and lending of current output. Monetary payments generated by financial contracts are irrelevant for the course of the economy.

- The economy is always at full employment because saving is just delayed consumption, and firms know this given that there is a market for intertemporal output (financial markets) that signals future consumption. As such a decline in current consumption does not lead firms to reduce their production. Instead, firms increase their productive capacities to respond to the higher future demand for goods and services induced by the payment of interest income.

- Monetary results are driven by real results: nominal interest rates are driven by the marginal product of capital and expected inflation, economic growth is driven by the growth of inputs

In the end, finance and its monetary dealings do not matter. The real exchange economy perspective has changed slightly since the early 1990s. What makes finance matter are market imperfections. Finance can specialize in circumventing imperfection such as asymmetries of information. In that case, finance can be rationed, which prevents the occurrence of the equilibrium that would prevail under a perfectly competitive (less potatoes are saved and so investment is lower than it would have been). Asymmetry of information can also reinforce negative shocks on the economy and create financial crises (see Post 14).

The Monetary Production Economy (MPE)

Money is everything

Some economists argue that capitalism is not merely a barter economy with money. Capitalism is a monetary economy, that is, an economy in which allocation, production, and distribution are influenced by monetary/nominal incentives. While economic units may adjust nominal rewards to account for inflation and tax, the nominal gains are not driven by underlying physical variables. Instead, it is the other way around, nominal outcomes drive real outcomes.

As such, while the REE view sees limited to no role for the inclusion of monetary considerations in its core theoretical framework, Keynes noted that this is at odd with the way capitalism functions:

The classical theory supposes that […] only an expectation of more product […] will induce [an entrepreneur] to offer more employment. But in an entrepreneur economy this is a wrong analysis of the nature of business calculation. An entrepreneur is interested, not in the amount of product, but in the amount of money which will fall to his share. He will increase his output if by so doing he expects to increase his money profit, even though this profit represents a smaller quantity of product than before. […] Thus the classical theory fails us at both ends, so to speak, if we try to apply it to an entrepreneur economy. For it is not true that the entrepreneur’s demand for labour depends on the share of the product which will fall to the entrepreneur; and it is not true that the supply of labor depends on the share of the product which will fall to labour. (Keynes 1933c (1979): 82–83)

Monetary considerations are crucial at the beginning and at the end of the economic process. Businesses need monetary instruments to start the production process because employees and sellers of raw material demand monetary payments. Businesses judge the relevance of an economic activity—and so employ people in this activity—in relation to its ability to generate a large enough monetary profit. Firms and their employees are not interested in consuming what they produce, they are interested in selling their production for monetary gains. Going back to our potato farmer, his employees do not want to be paid in potatoes and the farmer is not merely interested in producing potatoes. As such, even if an individual is highly motivated and highly experienced in producing potatoes (his marginal product very high), the individual will not be hired if it is expected that the output he will produce cannot be sold at a high enough price.

Thus, monetary incentives have a strong influence on the level and organization of production. Veblen made this point that by making a difference between the engineer’s perspective and the businessman’s perspective. From an engineer’s perspective, the goal is to produce as many potatoes as possible to solve a physiological problem (hunger). As such, the goal is to find the most productive ways to produce an abundance of potatoes. From a businessman’s perspective, the only thing that matters is that a monetary profit be generated. This may entail a sabotage of production (leaving fields idle, let potatoes rot) in order to maintain an artificial scarcity of potatoes. Indeed, capitalist technics of production are so productive that letting them loose would drive the price of potatoes to zero. The supply of potatoes must be constrained. As such scarcity is not a natural state, it is rather a requirement of an economy that is managed by capitalist businesses. While abundance is possible, it is not a viable economic state for capitalism.

Why monetary incentives matter? And what are other implications?

Part of the answer is that banks are in the business of dealing with promissory notes that involve monetary payments not in-kind payments. Another has to do with state’s involvement the monetization of economies via the imposition of monetary dues. If one focuses on the role of banks, the emphasis on monetary incentives is initiated at two stage of credit operations:

- Banks judge ability to pay based on credit standards set in monetary terms: a “normal” nominal debt service to monetary income, or “normal” nominal value of collateral relative to bank advances, a “normal” nominal amount of liquid assets.

- Debtors to a bank must make payments in monetary terms, they cannot pay banks with potatoes.

Beyond the impact on incentives, bank operations have several important macroeconomic implications:

- Banks are not constrained by the level of current saving to grant credit. As noted in Post 10, banks are not in the business of lending anything they own. They do not lend other people’s money, they do not lend reserves, and they do not lend potatoes on behalf of savers; not even “as if.”

- Servicing the debts due to banks does not create an automatic demand for current output: payments to banks destroy monetary gains of non-banks; that is it. Again there are no savers behind banks asking for their potatoes back with interest (in potatoes).

- Expected demand/sales for goods and services becomes key to economic activity. Firms employ workers and use existing productive capacities only if they believe they will be able to sell their product to make a high enough monetary gains.

- In this type of economy, purchasing power concerns, even though relevant, are usually outweighed by liquidity and solvency concerns. Economic agents are happier if their buying power increases but, usually, economic agents pay a lot more attention to balance sheet risks: “Liquidity is a fundamental recurring problem whenever people organize most of their income receipt and payment activities on a forward money contractual basis. For real world enterprises and households, the balancing of their checkbook inflows against outflows to maintain liquidity is the most serious economic problem they face everyday of their life.” (Davidson 2002: 78). Say that workers labor for one hour and earn a wage rate of w = $5, and that they have to pay a debt commitment of CC = $2 each month to service their debts, and assume that the general price level is P = $1. The real wage earned by workers is w/P = 5 and the net wage of workers is w – CC = $3. Assume that workers get a raise that doubles their wage so that w = $10, and that the general price level is also doubled P = $2. The real wage is unchanged but the capacity of workers to meet their debt commitments is much improved, w – CC = $8.

- “Neutrality is […] restricted to the realm of ‘helicopter economics’” (Gale 1982: 15). In capitalism, money supply is not helicopter dropped, its creation is endogenous to the economic process and comes with a simultaneous creation of a debt that requires monetary payments. These monetary payments force economic units to focus their attention on monetary considerations in their decision-making process.

- Eliminating a market surplus by lowering output prices may not be a viable solution. Firms must make sure that they can sell their output at a high enough price to generate a monetary gain that allow them to pay their creditors and to realize a monetary profit. If prices fall too much, a debt-deflation occurs and market mechanisms promote financial instability (falling prices lead to higher surplus of output) (see Post 14).

- Current saving does not incentivize current investment, saving discourages investment: Firm will not invest if current spending (and so sales) is falling. Saving is not delayed consumption because savers are not paid in kind. This is all the more so that a fall in sales leads to layoffs and so loss of salaries.

Thus, economic growth is driven by demand conditions because of monetary considerations. As such, expected sales are usually too low to justify employing everybody willing to work, so there is a chronic underemployment of resources. In addition, there is no given state of the economy out there (a “natural” growth rate) that is independent of current demand conditions. If productive capacities become too heavily used, firms invest.

Finance and the Economy

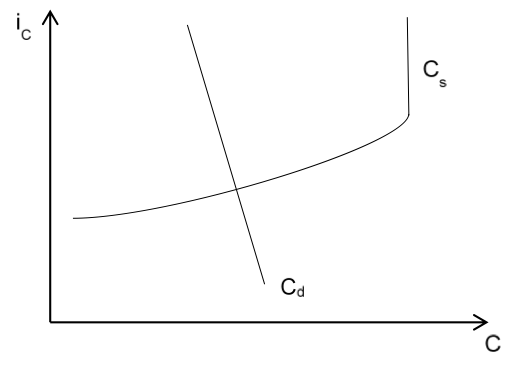

The first phase of the economic process is to ask for credit at banks (the financing phase). The role of banks is to judge if the expectations of firms are reasonable. Banks provide credit to anybody who shows up and is deemed creditworthy. The standards of creditworthiness accommodate a range of economic units (think economic units with different credit scores). Banks charge more to less creditworthy economic units and ration credit (Figure 3).

Figure 3. The market for bank credit

Once they have been granted credit, businesses can buy the resources needed to start the production required to meet the expected demand. Will that that raise inflation? Post 11 notes that if the growth of credit raises the output gap or pushes up the growth rate of unit cost of labor then yes; however, usually the economy operates below full employment and can adjust to an increase in the wage bill and spending.

The next step (the funding phase) is to actually sell what was produced. If expectations are correct or are too pessimist, then all output is sold; otherwise there are some inventories. Once they have sold their product, firms repay their debts to banks. Once debts and expenses have been paid, firms realize a profit, that is, their net worth rises. If monetary gains are not realized or are too small, a business may ultimately close. Households also save some of the incomes they received, which increases their net worth but reduces firms’ potential profits. Firms may try to capture some of the income saved by households by issuing securities to fund the acquisition of assets and/or to refinance their debts.

Thus, saving is the end result of the economic process not the beginning. It matters during the funding phase but not the financing phase. At that time, like at any other times, interest rates are driven by monetary conditions. One of these monetary conditions is the policy rate of the Fed, which has a strong influence on all other nominal rates through cost and portfolio channels (and of course, economic units do care about nominal interest rates because of their impact on liquidity and solvency). As such, government deficit and investment may not have much of an impact on interest rates.

Beyond incentives: the role of macroeconomic forces

While monetary incentives are central to the dynamics at play in a capitalist economy, the MPE approach also argues that one cannot use microeconomic analysis to draw conclusions about the economy as a whole. By relying on conclusions drawn from studying how economic units make decisions in isolation (microeconomy), one misses the financial interdependences that exist among economic units. When these financial interdependences are taken into account, they lead to counterintuitive conclusions relative to personal experiences.

For example, at the individual level, income is independent from spending (a household does not earn more if it goes to shop more); however national income is NOT independent from spending. The more is spent, the more is earned: GDP = C + I + G + NX. To simplify, the more people shop, the more people are employed and so the greater the number of people who draw an income, and so the higher national income. When someone spends that creates incomes for others.

As such, saving cannot be the beginning of the economic process for an economy. Income allows saving, but, at the macroeconomic level, spending creates income and so spending creates saving. The Kalecki equation of profit is a neat way to show that for business saving:

UnD = CU – SH + I + DEF + NX

With UnD the macroeconomic profit (saving by firms), C the consumption level, I the level of investment, DEF is the deficit, NX net exports, SH is saving by households, CU is consumption out of profit.

Saving is clearly differentiated from investment contrary to the REE approach. Saving is an increase in net worth; it is financial accumulation. It is different from physical accumulation, which is investment. In the REE approach saving and investment are the same thing—physical accumulation. For the MPE approach, this is not appropriate because capitalist economies are monetary economies so income is earned in monetary form and saving is done in monetary form.

More importantly, at the macroeconomic level, it is not possible to transfer income through time by saving it. Indeed, given that national income is driven by spending, as thriftiness goes up national income falls. The only way to transfer income through time is by investing it, i.e. by buying goods and services for the purpose of maintaining or increasing productive capacities; however, not consuming (saving) depresses investment. If people consume less potatoes, there is no incentive to plant the resulting excess inventory of potatoes to produce more potatoes.

Conclusions

Money supply is never neutral in a monetary production economy. The money supply is not only used as a medium of exchange but also as a means of payment, so it must be present at every steps of the economic process for that process to work smoothly. Several conclusions can be drawn from this view:

- There is no saving constraint on the economic system. At the macroeconomic level, saving is created by spending.

- The financial system exists to provide financial resources to the most profitable economic activities. These activities may or may not be productive, may or may not be efficient, may or may not be useful; these criteria are not relevant to the decision to provide funds. The financialization of the economy has pushed businesses away from the production of goods and services.

- Banks are not intermediaries: they do not lend on behalf of savers. A bank does not lend anything, it is a dealer in promissory notes that require monetary payments.

- When government increases deficit spending, it boosts sales and creates more monetary income, which promotes economic activity unless the economy is at full employment (in which case prices go up). There is no crowding out effect from government deficit because finance is not a limited resource (it is not based on saving) and production is demand driven (if government demands more output, more is produced).

- Monetary incentives are crucial because debts owed to banks and government create a need to have reliable stream of future monetary incomes.

- The economy is usually below full employment because it usually goes against monetary incentives to be at full employment (it is not profitable, or as profitable, in money terms). Promoting thriftiness discourages economic activity because profit declines as sales decline. A market for intertemporal output does not exist.

- Real results are driven by monetary results: Anything that is monetary profitable and meet standards of creditworthiness will be financed. The financing stage allows the creation of output, and the output is used potentially to increase productive capacities during the funding stage.

Beyond all these implications, Post 13 shows that economic activity requires that at least one economic sector goes into debt for economic activity to proceed.

Conclusion

The way one should include finance into economic analysis is subject to sharp divisions among economists. These divisions ultimately rest of very different premises used to do economics. This division is old and can be found in debates between Malthus and Ricardo: “I cannot agree with Adam Smith, or with Mr. Malthus, that it is the nominal value of goods, or their prices only, which enter into the consideration of the merchant” (Ricardo 1820 (1951): 26). These different premises lead to very different policy prescriptions that rest on a very different understanding of how the financial system works with the rest of the economy. Post 15 shows that many of these differences can be boiled down to a different understanding of the nature of monetary instruments: For the REE, monetary instruments are a mere commodity and so demanding money is also demanding output; for MPE, monetary instruments are financial instruments.

Done for today! Next post returns to balance sheet issues by studying balance-sheet interdependences.

[Revised 8/6/2016]

7 responses to “Money and Banking Part 12: Economic Growth and the Financial System”