By Yeva Nersisyan

A small tax credit based policy similar to the current proposal will not work; it never has. On the other hand, we know what works from past experiences. Direct job creation by the government, similar to the Works Progress Administration (WPA) of the New Deal, will have immediate and direct effects on incomes and jobs. Instead of paying unemployment benefits and tax credits, the federal government should offer to hire anyone who wants to work at the federal minimum wage. A universal jobs program will get the economy going.

The benefit of a government jobs program is that the government doesn’t need to be profitable, unlike businesses. Profitability is the criteria for judging the success of a private firm; an unprofitable business cannot last long. The Federal government, however, doesn’t need to make profit off of its employment projects. This doesn’t mean to say that it should be wasteful. Rather, government programs should be evaluated under different standards and criteria, not profitability. One of the purposes of a democratic government is to supply public services to its citizens, and if a job guarantee program can succeed in doing that, then we could rightly argue that it is effective and “profitable”.

So what services could the government provide? The most obvious one that comes to mind is to improve the infrastructure. A study done by the American Society of Civil Engineers, gave the American Infrastructure a D grade point average. None of the 15 infrastructure categories evaluated had a grade above C+. We will need to make 2.2 Trillions of Investment over five years to improve the conditions of our bridges, dams, roads, schools, drinking water, etc. So why not start from there? Why not hire everyone who wants to work to improve the American infrastructure? This will give people earned income (not handouts by the government that have a shelf life of a banana), will help stop foreclosures and bankruptcies and will get the economy going. Without a direct job creation program, it looks like the economy will continue in this recessionary environment for a long period of time. Even most optimistic commentators predict to see another jobless recovery.

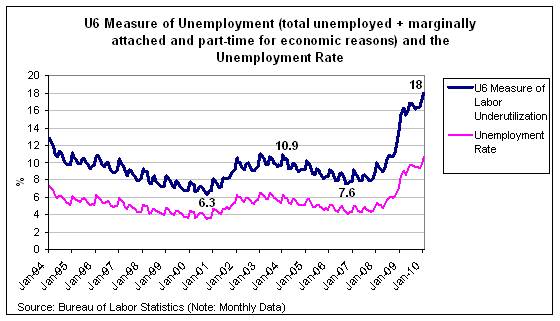

I would go even further and argue that the U.S. economy needs such a Job Guarantee program during the “good” times as well. You might say that usually the economy fares pretty well in providing employment; the US has one of the lowest unemployment rates among developed countries, even reaching lows of 3.7% once in a while. But if you look at the U6 measure of unemployment which is by far a more accurate measure of labor underutilization, the lowest it has been since 1994 (the period of the so-called Great Moderation) was 6.3% at the peak of the NASDAQ boom. Hence even in booms, the private sector doesn’t produce enough jobs to employ everyone who wants to work (and I’m not even talking about the quality of jobs).

We won’t see another bubble of the same magnitude as the housing bubble, the US won’t become a major exporter, consumers are deleveraging, people’s incomes aren’t growing to support income induced consumption. So what will take the U.S. economy out of this recession? Construction, banking and manufacturing, traditional job creating industries don’t offer much hope this time. If we want to have a fast recovery that will also provide jobs, why not start with a federal Job Guarantee program?

President Obama said in an interview that he was hoping that the American people would understand him if he just focused on the right policies. Well, if he really did, maybe Americans would understand him, especially those who would finally be able to get jobs and a source of income. Let’s try a Job Guarantee Program and see what all the jobless Americans have to say.

4 responses to “A Progressive and Tested Policy for Job Creation”