By L. Randall Wray [via CFEPS]

Social Security is an intergenerational assurance plan. Working generations agree to take care of retirees, dependents, survivors, and persons with disabilities. Currently, spouses, children, or parents of eligible workers make up more than a quarter of beneficiaries on OASDI. A large proportion will always be people without “normal” work histories who could not have made sufficient contributions to entitle them to a decent pension. Still, as a society, we have decided they should receive benefits.

Further, the program is not means tested. One need only meet statutory requirements to receive benefits. Indeed, as the Bush Commission’s Report emphasizes, the Supreme Court has twice ruled Social Security does not make intergenerational promises to the dead, but, rather, only to their survivors. The Bush Commission sees that as a weakness; I see it as a strength.

II. TRUST FUNDS DO NOT INCREASE GOVERNMENT’S ABILITY TO MEET COMMITMENTS (Advance Funding is a Fiction)

The Greenspan Commission tried to change Social Security from paygo to advance funding in 1983. But that is impossible; it just demonstrated a misunderstanding of accounting. The existence of a Trust Fund does not in any way, shape, or form enhance government’s ability to meet Social Security commitments. This point is difficult to get across.

The Social Security Trust Fund is one of Uncle Sam’s cookie jars. He also has a defense cookie jar, a corporate welfare cookie jar, etc. (See Figure 1.) We count taxes as Uncle Sam’s income, and he can pretend he stuffs the various cookie jars with those tax receipts — the payroll tax goes into the Social Security cookie jar, and he pretends it pays for Social Security spending. Maybe he pretends capital gains taxes go into the corporate welfare cookie jar. And so on. That is all internal accounting.

Figure 1: Federal Government Internal Accounts

Say Uncle Sam spends more on corporate welfare than he pretends to have in that cookie jar. But he pretends the Social Security cookie jar is overflowing with tax receipts because he runs a huge surplus there. (See Figure 2.) So Uncle Sam writes some IOUs from the corporate welfare cookie jar to the Social Security cookie jar to remind himself. Over time, the Social Security cookie jar accumulates Trillions of dollars of IOUs from Uncle Sam’s other cookie jars.

That is just the government owing itself, and has no effect on the external accounts. (See Figure 3.) The total spent on Social Security, corporate welfare, transportation and so on equals its total spending for the year. The total it collects from taxes, including payroll taxes, capital gains taxes, gas taxes, and so on, equals its total income for the year. If government spends more than its income, that is called deficit spending. If it spends less, it runs a budget surplus. The cookie jar IOUs cannot change that in any way.

Figure 3: Federal Government External Accounts

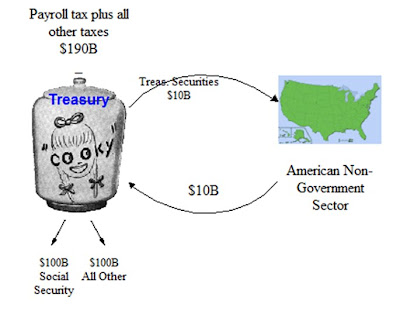

Note I’m not saying there is anything wrong with the Treasury Securities held by the Trust Fund-Social Security can count them as an asset. But they will not in any way change the external accounting in 2017 or 2027 or 2041 — when the government’s overall spending will be less than, equal to, or greater than its overall tax receipts. (See Figure 4.) When Social Security begins to run a deficit, the existence of the Trust Fund will not reduce the amount of Treasury Securities sold to the nongovernment sector.

Indeed, comparison of Figure 4a with 4b demonstrates that the external accounts are not changed by existence of a Trust Fund-the implications for the government are the same.

Figure 4a: Social Security Runs $10 Billion Deficit, With Rest of Federal Government Budget in Balance, WITH TRUST FUND

Figure 4b: Social Security Runs $10 Billion Deficit, With Rest of Federal Government Budget in Balance, WITHOUT TRUST FUND

III. TRUST FUNDS DO NOT PROVIDE POLITICAL PROTECTION (Proof: They Fuel Privatization Scams)

Many economists realize that from the perspective of Uncle Sam, the Trust Fund is just an internal accounting construction. But I’ve had top economic advisors of both Democrats and Unions tell me while that is true, the Trust Fund provides political protection. That is clearly false. It is only because Social Security runs surpluses accumulated in a Trust Fund that we have all these privatizat ion scams. Do you really believe Wall Street fund managers would have any interest in Social Security if it ran deficits?

IV. SOCIAL SECURITY CANNOT FACE A FINANCIAL CONSTRAINT (Except One Imposed By Congress)

Social Security is unusual because unlike most other government programs, we pretend a specific tax finances it. That makes it easy to mentally match payroll tax revenues and benefit payments, and to calculate whether the 75 year actuarial balance is positive or negative. No one knows or car es whether the defense program runs actuarial deficits — because we don’t pretend that a particular tax pays for defense. In reality, Social Security benefits are paid in exactly the same way that the government spends on anything else-by crediting somebody’s bank account. Social Security cannot be any more financially constrained than any other government program. Only Congress can establish a financial constraint.

V. SOCIAL SECURITY DOES NOT APPEAR TO FACE REAL CONSTRAINTS, (America Can Afford 7% of GDP for Social Security)

Today OASDI benefits equal 4.5% of GDP; that grows to 7% over the next 75 years. Does anyone doubt that we will be able to afford to devote 7% of our nation’s output to provide a social safety net for retirees, survivors, and disabled persons? That leaves 93% of GDP for everything else. We have easily achieved larger shifts of GDP in the past without lowering living standards of the working generations. I cannot imagine a future so horrible that we won’t be able support OASDI in real terms.

VI. PRIVATIZATION IS NOT NEEDED, NOR CAN IT HELP TO PROVIDE FOR FUTURE BENEFICIARIES (Any Future Problems Are Not Financial; Financial Fixes Cannot Help)

Future beneficiaries cannot eat stocks or bonds, and we can’t dig holes today to bury Winnebagos for future retirees. Whatever beneficiaries consume in 2050 will have to be produced for the most part in 2050. Financial Fixes cannot change that. Whether the stock market outperforms Treasury bonds is irrelevant. Whether future retirees have amassed $100,000 in personal accounts is irrelevant. All that matters is future productive capacity plus a method of distributing a portion of output to the elderly in 2050.

To accomplish that, all we have to do is credit the bank accounts of the elderly in 2050, and then let the market work its wonders. I am frankly shocked that the Cato Institute refuses to trust the market, backing what amounts to tax credits for playing in equity markets.

VII. PERSONAL ACCOUNTS ARE FINE, BUT ARE NOT RELEVANT TO DISCUSSION OF SOCIAL SECURITY (A Targeted $40 Billion Give-Away is Probably a Good Idea!)

I also find it ironic that the Bush Commission wants to increase government spending by $40 billion a year to give money away to encourage the poor to save. Hey, let’s give them $80 billion a year. I’d prefer that the poor spend it, but if they want to sock it away in personal accounts, that’s fine by me. But, please, let’s provide Big Brotherly advice that they keep it out of Telecom stocks. And leave Social Security out of it!

VIII. SOCIAL SECURITY IS, ALWAYS HAS BEEN, ALWAYS WILL BE, SUBJECT TO CONGRESSIONAL GOODWILL (Maintained At the Ballot Box)

Only Congress can decide who deserves support, and what level of support. Only Congress can decide how much of GDP ought to be devoted to support of the elderly. That’s Democracy and I’m willing to live with it. The Bush Commission says this generates insecurity, but I expect the elderly will continue to use the ballot box to hold the feet of Politicians to the fire of Social Security.

IX. HONESTY IS THE BEST POLICY (Convenient Fictions About Finances Cannot Help)

In spite of all the complex financial fictions, the truth is simple. In 2041, Social Security’s beneficiaries will have to rely on the working population, just as they do today. No financial scams can change that. Trust funds, actuarial balances, privatization, and relative rates of return don’t change it. There ain’t no crisis; there ain’t no urgency. We’ve got two generations to increase our capacity to produce.

X. TOWARD A PROGRESSIVE REFORM (Stop Taxing Work!)

In 1960 it might have made some kind of twisted logic to levy a tax on payrolls and to pretend this paid for Social Security benefits. There were few benefits to be paid, but lots of payrolls to tax, so the tax rate was low. Today, and increasingly in the future, there are more benefits to pay relative to taxable payrolls. In just a few years, only 1/3 of National Income will be subject to the payroll tax- hence ever-higher payroll tax rates will be required to maintain the delusion.

Let’s stop pretending. Payroll taxes simply discourage work-which is as perverse as policy can get. We need people to work to provide all the goods and services the elderly need. Abolish the payroll tax, abolish the Trust Fund, abolish actuarial gaps, and let’s recognize that Social Security is an intergenerational assurance program.