This is part of a series, following on from the last instalment that asked “Do We Need Taxes?”.

Previously we have argued that “taxes drive money” in the sense that imposition of a tax that is payable in the national government’s own currency will create demand for that currency. Sovereign government does not really need revenue in its own currency in order to spend.

This sounds shocking because we are so accustomed to thinking that “taxes pay for government spending”. This is true for local governments, provinces, and states that do not issue the currency. It is also not too far from the truth for nations that adopt a foreign currency or peg their own to gold or foreign currencies. When a nation pegs, it really does need the gold or foreign currency to which it promises to convert its currency on demand. Taxing removes its currency from circulation making it harder for anyone to present it for redemption in gold or foreign currency. Hence, a prudent practice would be to constrain spending to tax revenue.

But in the case of a government that issues its own sovereign currency without a promise to convert at a fixed value to gold or foreign currency (that is, the government “floats” its currency), we need to think about the role of taxes in an entirely different way. Taxes are not needed to “pay for” government spending. Further, the logic is reversed: government must spend (or lend) the currency into the economy before taxpayers can pay taxes in the form of the currency. Spend first, tax later is the logical sequence.

Some who hear this for the first time jump to the question: “Well, why not just eliminate taxes altogether?” There are several reasons. First—as we said last time–it is the tax that “drives” the currency. If we eliminated the tax, people probably would not immediately abandon use of the currency, but the main driver for its use would be gone.

Further, the second reason to have taxes is to reduce aggregate demand. If we look at the United States today, the federal government spending is somewhat over 20% of GDP, while tax revenue is somewhat less—say 17%. The net injection coming from the federal government is thus about 3% of GDP. If we eliminated taxes (and held all else constant) the net injection might rise toward 20% of GDP. That is a huge increase of aggregate demand, and could cause inflation.

Ideally, it is best if tax revenue moves countercyclically—increasing in expansion and falling in recession. That helps to make the government’s net contribution to the economy countercyclical, which helps to stabilize aggregate demand.

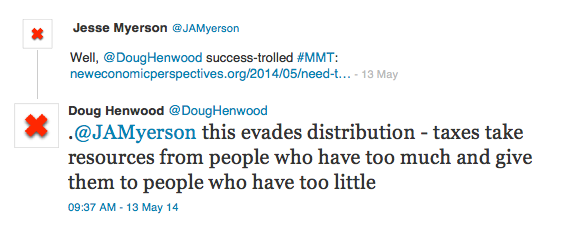

So, we covered those points last time, in part due to a silly twit by Doug Henwood, who likened this to “astrology”. Not one to be bothered with embarrassment he responded to the last blog with this exchange:

Well, no. Taxes on the rich might take “resources” from people who have too much—if he means that their demand deposit account is debited. But taxation does not “give them (the resources) to people who have too little”. Rather government spending directed to those who “have too little” is what gives the poor access to resources (they can use their demand deposit credits to buy food, clothing, shelter, and so on).

These are functionally two entirely separate activities. Government can spend to help the poor without taxing the rich or anyone else. And anyone who can understand balance sheets knows that there is no longer any balance sheet operation in which government “spends” its tax revenues.

Henwood seems to imagine that the rich roll their wheelbarrows full of coins up to the Treasury Department’s steps, where armored trucks load the cash up and take it out to make payments to the poor.

Doesn’t work that way. Tax payments debit the accounts of taxpayers. If you’ve ever gone to a ballgame you know that when the scorekeeper awards a run to Boston, he does not take it away from New York. Rather, he keystrokes runs to Boston. If after review of the video, the umpire has made an error, he “debits the account” of Boston. Where does the run taken away go?

That’s a question for the physicist, not the economist. Where do the taxes payments go? Nowhere—a bank account is debited. I think it has something to do with electrical charges changing from negative to positive, although some commentators told me it is all photons now. All I know is that taxes do not and cannot “pay for” spending.

All of this was recognized by Beardsley Ruml, a New Dealer who chaired the Federal Reserve Bank in the 1940s; he was also the “father” of income tax withholding and wrote two important papers on the role of taxes (“Taxes for Revenue are Obsolete” in 1946, and “Tax Policies for Prosperity” in 1964). Let’s first examine his cogent argument that sovereign government does not need taxes for revenue, and turn to his views on the role of taxes.

In his 1964 article, he emphasizes that “We must recognize that the objective of national fiscal policy is above all to maintain a sound currency and efficient financial institutions; but consistent with the basic purpose, fiscal policy should and can contribute a great deal toward obtaining a high level of productive employment and prosperity.” (1964 pp. 266-67) This view is similar to that propounded in by MMT.

He goes on to say that the US government gained the ability to pursue these goals after WWII due to two developments. The first was the creation of “a modern central bank” and the second was the sovereign issue of a currency that “is not convertible into gold or into some other commodity.” With those two conditions, “[i]t follows that our federal government has final freedom from the money market in meeting its financial requirements….National states no longer need taxes to get the wherewithal to meet their expenses.” (ibid pp. 267-8)

Why, then, does the national government need taxes? He counts four reasons:

(1) as an instrument of fiscal policy to help stabilize the purchasing power of the dollar; (2) to express public policy in the distribution of wealth and of income as in the case of the progressive income and estate taxes; (3) to express public policy in subsidizing or in penalizing various industries and economic groups; and (4) to isolate and assess directly the costs of certain national benefits, such as highways and social security. (ibid p. 268)

The first of these is related to the inflation issue we discussed above. The second purpose is to use taxes to change the distribution of income and wealth. For example, a progressive tax system would reduce income and wealth at the top, while imposing minimal taxes on the poor.

The third purpose is to discourage bad behavior: pollution of air and water, use of tobacco and alcohol, or to make imports more expensive through tariffs (essentially a tax to raise import costs and thereby encourage purchase of domestic output). These are often called “sin” taxes—whose purpose is to raise the cost of the “sins” of smoking, gambling, purchasing luxury goods, and so on.

The fourth is to allocate the costs of specific public programs to the beneficiaries. For example, it is common to tax gasoline so that those who use the nation’s highways will pay for their use (tolls on throughways are another way to do this).

Note that while many would see these taxes as a means to “pay for” government spending, Rumsl vehemently denies that view in the title to his other piece, “Taxes for Revenue are Obsolete”. Government does not need the gasoline tax to “pay for” highways. That tax is designed to make those who will use highways think twice about their support for building them. Government does not need the revenue from a cigarette tax, but rather wants to raise the cost to those who will commit the “sin” of smoking.

Many would say that it is only fair that those who smoke will “pay for” the costs their smoking imposes on society (in terms of hospitalizations for lung cancer, for example). From Ruml’s perspective this is not far from the truth—the hope is that the high cost of tobacco will convince more people never to smoke, which thereby reduces the cost to society.

However, the point is not the revenue to be generated—government can always “find the money” to pay for hospital construction. Rather, it is to reduce the “waste” of real resources that must be devoted to caring for those who smoke. The ideal cigarette tax would be one that eliminated smoking—not one that maximized revenue to government. He said “The public purpose which is served [by the tax] should never be obscured in a tax program under the mask of raising revenue.” (1964 p. 268)

We can then use this notion of the public purpose to evaluate which taxes make sense. I won’t go through that today, but let me say that Ruml used the corporate income tax as an example of a particularly bad tax. He’s right. My professor Hyman Minsky always argued for abolishing that tax—and I wouldn’t be surprised if he got the idea from Ruml.

Of course, which tax do “liberals” love? Corporate income tax. They all want to increase it to “pay for” all the goodies they want to shower on the poor. In other words, they compound their confusion—not only do they insist on being wrong about the purpose of taxes, but they also embrace one of the worst ones! Maybe a good topic for another blog?

Ruml concluded both of his articles by arguing that once we understand what taxes are for, then we can go about ensuring that the overall tax revenue is at the right level. “Briefly the idea behind our tax policy should be this: that our taxes should be high enough to protect the stability of our currency, and no higher…. Now it follows from this principle that our tax rates can and should be lowered to the point where the federal budget will be balanced at what we would consider a satisfactory level of high employment.” (1964 p. 269)

This principle is also one adopted in MMT, but with one caveat. Ruml was addressing the situation in which the external sector balance could be ignored (which was not unreasonable in the early postwar period). In today’s world, in which some countries have very high current account surpluses and others have high current account deficits, the principle must be modified.

We would restate it as follows: tax rates should be set so that the government’s budgetary outcome (whether in deficit, balanced, or in surplus) is consistent with full employment. A country like the US (with a current account deficit at full employment) will probably have a budget deficit at full employment (equal to the sum of the current account deficit and the domestic private sector surplus). A country like Japan (with a currrent account surplus at full employment) will have a relatively smaller budget deficit at full employment (equal to the domestic private sector surplus less the current account surplus).

I’ll continue this thread.

Pingback: Randy Wray: What are Taxes For? The MMT Approach | naked capitalism