By Eric Tymoigne

I struggled a few years to get an M&B course together. It lacked coherency and students had difficulty to link the different parts of the course. A good part of the problem comes from the M&B textbooks that, besides having outdated presentations, are a disparate collection of chapters without a coherent core. So I gave up with textbooks and went my own way, and comprehension dramatically increased among my students.

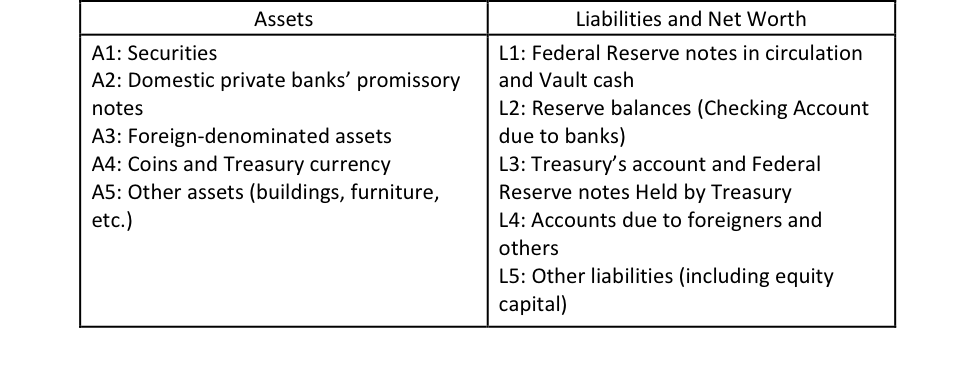

The core of the financial system consists of financial documents and among them are balance sheets. Balance sheets provide the foundation upon which most of an M&B course can be taught: monetary creation by banks and the central bank, nature of money, financial crises, securitization, financial interdependencies, you name it, it has to do with one or several balance sheet(s). As Hyman P. Minsky used to note, if you cannot put your reasoning in terms of a balance sheet there is a problem in your logic.

Continue reading →