(With apologies to Friedrich Hayek)

The markets are again infree-fall and, once again, a lazy Mediterranean profligate is to blame. This time, it’s an Italian, rather than aGreek. No, not Silvio Berlusconi, buthis fellow countryman, Mario Draghi, the new head of the increasingly spinelessEuropean Central Bank.

At least the Alice inWonderland quality of the markets has finally dissipated. It was extraordinary to observe the euphoricreaction to the formation of the European Financial Stability Forum a few weeksago, along with the “voluntary” 50% haircut on Greek debt (which has turned outto be as ‘voluntary’ as a bank teller opening up a vault and surrendering moneyto someone sticking a gun in his/her face). To anybody with a modicum of understanding of modern money, it wasobvious that the CDO like scam created via the EFSF would never end well andthat the absence of a substantive role for the European Central Bank wouldprove to be its undoing.

As far as the haircuts went,the façade of voluntarism had to be maintained in order to avoid triggering aseries of credit default swaps written on Greek debt, which again highlightsthe feckless quality of our global regulators being hoisted on their own petard,given their reluctance to eliminate these Frankenstein-like financialinnovations in the aftermath of the 2008 disaster.

What is required is a “backto the future” approach to banking: Inthe old days, a banker “hedged” his credit risk by doing (shock!) CREDITANALYSIS. If the customer was deemed tobe a poor credit risk, no loan was made.

It goes back to a point wehave made many times: creditworthinessprecedes credit. You need policiesdesigned to promote job growth, higher incomes and a corresponding ability toservice debt before you can expect a borrower take on a loan or a banker toextend one. And, as Minsky used to pointout, in the old days, banking was a fundamentally optimistic activity, becausethe success of the lender was tied up with the success of the borrower; inother words, we didn’t have the spectacle of vampire-like squids bettingagainst the success of their clients via instruments such as credit defaultswaps.

Credit default swapsthemselves are to “hedging” credit exposure what nuclear weapons are to“hedging” national defence requirements. In theory, they both sound like reasonable deterrents to mitigatedisaster, but use them and everything blows up. At least one decent by-product of the eurocrats’ incompetent handling ofthis national solvency disaster has been the likely discrediting of CDSs as ahedging instrument in the future. Notethat 5 year CDSs on Italian debt have not blown out to new highs today in spiteof bond yields rising over 7%, because the markets are slowly but surely comingto the recognition that they are ineffective hedging instruments – althoughthey have been very useful in terms of lining the pockets of the likes of JPMorgan and Goldman Sachs.

Say what you willabout Silvio Berlusconi (and there’s LOTS one can say about the man as anyreader of the NY Post can attest). But hewas right to oppose to a crude political ploy being foisted on him by the ECB,the French and Germans to accept an irrational and economically counterproductiveprogram fiscal austerity program in exchange for “support” from the likes ofthe IMF. All Berlusconi had to do wascast his eyes to the other side of the Adriatic to see the likely effect ofthat. The markets’ reaction to his resignation was surreal: akin to turkeysvoting for Thanksgiving. The overriding imperative in Euroland(indeed, in the entire global economy) should be to stimulate economic growth to ensure that there are enoughjobs for all who want them.

Private spending is very flatand so they need to replace it with public spending or GDP will declinefurther. The eurocrats seem incapable of understanding that even if the budgetdeficit rises in the short-run, it will always come down again as GDP growsbecause more people pay taxes and less people warrant government welfaresupport.

As for Italy itself, this isa sordid case of the Europe’s mandarins subverting yet another democracy,through crude economic blackmail. Already one government has been destroyed this way: In the words ofFintan O’Toole of the Irish Times:

Firstly, it was madeexplicit that the most reckless, irresponsible and ultimately impermissiblething a government could do was to seek the consent of its own people todecisions that would shape their lives. And, indeed, even if it had gone ahead,the Greek referendum would have been largely meaningless. As one Greek MP putit, the question would have been: do you want to take your own life or to bekilled? Secondly, there was open and shameless intervention by European leaders(Angela Merkel and Nicolas Sarkozy) in the internal affairs of another state.Sarkozy hailed the “courageous and responsible” stance of the main Greekopposition party – in effect a call for the replacement of the elected Greekgovernment.

The third part of thismoment of clarity was what happened in Ireland: the payment of a billiondollars to unsecured Anglo Irish Bank bondholders. Apart from its obviousobscenity, the most striking aspect of this was that, for the first time, wehad a government performing an action it openly declared to be wrong. MichaelNoonan wasn’t handing over these vast sums of cash from a bankrupt nation tovulture capitalist gamblers because he thought it was a good idea. He was doingit because there was a gun to his head. The threat came from the EuropeanCentral Bank and it was as crude as it was brutal: give the spivs yourtaxpayers’ money or we’ll bring down your banking system.

Of course, this is nothing new for the EU, asany Irishman or Portuguese citizen can attest. Vote the “wrong” way in a national referendum and the result is ignoredby the eurocrats until the silly peasants realize the egregious errors of theirways and re-vote the right way. If ittakes two, or even three, referenda, so be it. Politically, the interpretation of any aspect of the Treaties relatingto European governance have always been largely left in the hands of unelectedbureaucrats, operating out of institutions which are devoid of any kind ofdemocratic legitimacy. This, in turn,has led to an increasing sense of political alienation and a corresponding movetoward extremist parties hostile to any kind of political and monetary union inother parts of Europe. Under politicallycharged circumstances, these extremist parties might become the mainstream.

As for Italy itself, the country runs a primary fiscalsurplus. As George Soros has noted: “Italy is indebted, but it isn’tinsolvent.” Its fiscal deficit to GDP ratio is 60% of the OECD average. It is less than the euro area average. Its ratio of non-financial private debt toGDP is very low relative to other OECD economies.

It is not at all like Greece. It has avibrant tradeable goods sector. It sells things the rest of the worldwants. You introduce austerity at this juncture, and you will cause even slowereconomic growth, higher public debt, thereby creating the very type of Greekstyle national insolvency crisis that Europe is ostensibly seeking toavoid. And then it will move to France,and ultimately to Germany itself. Nopassenger is safe when the Titanic hits the iceberg.

The entire eurozone is already in severe recession (depression, in fact, is not too strong aword), yet the ECB, the Germans, the French and virtually every single policymaker in the core continue to advocate the economic equivalent of mediaevalblood-letting via ongoing fiscal austerity. And, surprise, surprise, the public deficits continue to grow.

Here’s anotherinteresting thing: in the 1990s, a number of countries, including Italy,engaged deliberately in transactions which had no economic justification,other than to mask their public debt levels in order to secure entry into theeuro (see an excellent paper on this by Professor Gustavo Piga, “Derivativesand Public Debt Management”, which documents this practice). Italyactively exploited ambiguity in accounting rules for swap transactions in orderto mislead EU institutions, other EU national governments, and its own publicas to the true size of its budget deficit.

And Eurostatsigned off on these transactions. And who worked at the Italian Treasuryat that time? That’s right: “SuperMario” Draghi, who was director general of the Italian Treasury from 1991-2001 whenall this was going on, and then joined Goldman Sachs (2002-2005), when theprivatisations came up. Interesting that he is now the guy who has todeal with the ultimate fall-out. Karmic justice.

Virtuallyeverybody has lied about their figures (Spain is a notable offender today), solistening to Europe’s high priests of monetary chastity is akin to listening tosomeone coming out of a brothel proclaiming his continued virginity.

Is there a solution? Ofcourse there is. But the eurozone’s chiefpolicy makers continue to avoid utilizing the one institution – the EuropeanCentral Bank – which has the capacity to create unlimited euros, and thereforeprovides the only credible backstop to markets which continue to query thesolvency of individual nation states within the euro zone. They are, as Professor Paul de Grauwesuggests, like generals who refuse to go into combat fully armed (“European Summits in Ivory Towers”):

“Thegenerals… announce that they actually hate the whole thing and that they willlimit the shooting as much as possible. Some of the generals are so upset bythe prospect of going to war that they resign from the army. The remaininggenerals then tell the enemy that the shooting will only be temporary, and thatthe army will go home as soon as possible. What is the likely outcome of thiswar? You guessed it. Utter defeat by the enemy.

TheECB has been behaving like the generals. When it announced its programme ofgovernment bond buying it made it known to the financial markets (the enemy)that it thoroughly dislikes it and that it will discontinue it as soon aspossible. Some members of the Governing Council of the ECB resigned in disgustat the prospect of having to buy bad bonds. Like the army, the ECB hasoverwhelming (in fact unlimited) firepower but it made it clear that it is notprepared to use the full strength of its money-creating capacity. What is thelikely outcome of such a programme? You guessed it. Defeat by the financialmarkets.”

The ECB should, as De Grauwesuggests, be using the ecoomic equivalent of the Powell Doctrine: when a nationis engaging in war, every resource and tool should be used to achieve decisiveforce against the enemy, minimizing casualties and ending the conflict quicklyby forcing the weaker force to capitulate.

The ECB is themonopoly supplier of currency. They can set the price on the rates,(obviously not the supply) so if they set a level (say, Italy at 5%) why shouldthere be a default? Capitulating to the markets, or entering the battlehalf-heartedly not only ensures more economic collateral damage, buteffectively emboldens the speculators by granting them a free put option onevery nation in the euro zone. They’llline them up, one by one, starting with Greece and ending with Germany.

The ECB continuesto hide behind legalisms to justify its inaction, ironic, considering theextent to which national accounting fraud has long been tolerated in the eurozone since its inception. The notionthat it cannot act as lender of last resort is disingenuous: The ECB does have the legal mandate under its”financial stability” mandate which was provided under the Treaty ofMaastricht.

True it is fairto say that the whole Treaty of Maastricht is full of ambiguity. Theinstitutional policy framework within which the euro has been introduced andoperates (Article 11 of Protocol on the Statute of the European System ofCentral Banks (ESCB) and of the European Central Bank) has severalkey elements.

One notable feature of the operation of the ESCB is the apparent absence of the lender of last resort facility, which is an issue raised by the WSJ today, and which Draghi uses to justify his inaction. But it’s not as clear-cut as suggested: The Protocols under which the ECB is established enables, but does not require, the ECB to act as a lender of last resort.

Proof that theECB exploits these ambiguities when it suits them is evident in its bond buyingprogram. The ECB articles say it cannotbuy government bonds in the primary market. And this rule was once used as anexcuse not to backstop national government bonds at all. But this changed in early 2010, when it beganto buy them in the secondary market.

The ECB also hasa mandate to maintain financial stability. It is buying government bondsin the secondary market under the financial stability mandate. And itcould continue to do so, or so one might argue that it could. True thereis now great disagreement about this within the ECB. It has been turnedover to the legal department, which itself is in disagreement, which ultimatelysuggests that this is a political judgement, and politics is what is drivingItaly (and soon France) toward the brink.

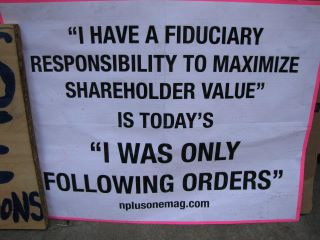

In fact, giventhe 50% “voluntary” haircut imposed on holders of Greek debt, arguably the ECBis the only entity that can buy these national government bonds today. As Warren Mosler has noted,it is hard to see how anyone with fiduciary responsibility can buyItalian debt or any other member nation debt after EU officials announcedthe plan for 50% haircuts on Greek bonds held by the private sector:

Yes,all governments have the authority, one way or another, to confiscate aninvestors funds. But they don’t, and work to establish credibility that theywon’t.

Butnow that the EU has actually announced they are going to do it, as a fiduciaryyou’d have to be a darn fool to support investing any client funds in anymember nation debt.

Thelast buyer standing is and was always to be the ECB, which will now be buyingmost all new member nation debt as there is no alternative that includessurvival of the union.

Andwhen this happens there will be a massive relief response, as the solvencyissue will be behind them, with the euro firming as well.

Of course, wewill still have to deal with the reality of a major recession in Europe so longas the faith based cult of Austerians continues to dominate policy making. Sadly, that’s unlikely to change until peopleare shot on the streets of Madrid or Rome. But at the very least, let’s get this silly national solvency problemaddressed once and for all in the only credible way possible. Mario Draghi, you have the chance to redeemyourself and your country. Don’t wastethe opportunity.