It never ceases to amaze me that those who offer budget plans and projections never take into account the reality that their projections must be consistent with implications of trends in sector financial balances for their projections. This is a simple lesson that those playing the fiscal responsibility game never seem to learn. Certainly this is true of the Republican House Budget Committee, as we’ll see.

The Sector Financial Balances (SFB) model is an accounting identity, and these are always true by definition alone. The SFB model says:

Domestic Private Balance + Domestic Government Balance + Foreign Balance = 0.

The terms refer to balances of flows of financial assets among the three sectors of the economy in any specified period of time. Why must there be flows? Because the three sectors trade financial assets with one another. So, the equation says that the sum of all the balances of flows for the three sectors of the economy is zero, because, since there’s only so much in assets traded in any time period, the positive balance(s) of one or more sectors relative to the others must be matched by the negative balance(s) of the other two sectors.

So, for example, when the annual domestic private sector balance is positive, more financial assets are flowing to that sector, taken as a whole, than it is sending to the other two sectors.

Similarly, when the annual foreign sector balance is positive, more financial assets are being sent to that sector than it is sending to the other two sectors.

And when the annual government sector balance is positive, then it is getting more in financial assets from the other two sectors combined than it is sending to them.

Conversely, when the private sector balance is negative, the private sector is sending more to the other two sectors than it is getting from them, and so on for each of the other two sectors.

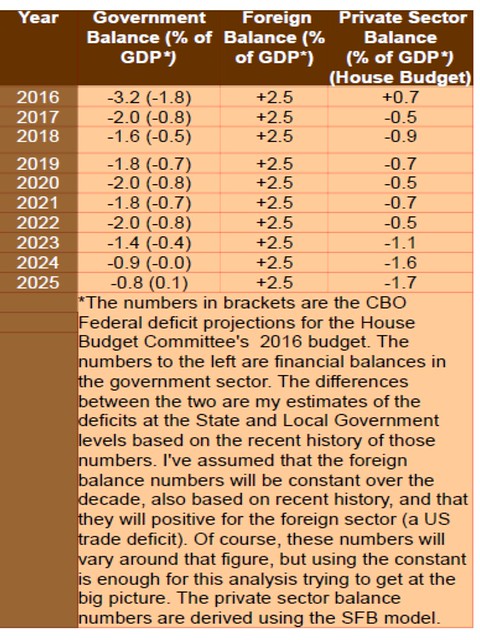

Now let’s apply this to the House Republicans’ Federal budget projections from 2016 – 2025, as in Table One, just below.

Table One: Sector Financial Balance Projections 2016 – 2025

But we know that they won’t be. We know that our nation’s economy is structured so that some parts of the foreign sector and some parts of the private sector have sufficient economic and political power to direct financial flows from outside and inside their sectors disproportionately into their coffers. So, this means that the sub-sectors with lesser economic and political power will suffer the burden of the losses.

Which ones? We know from various studies of inequality (see here and here), that over the past 35-40 years, the American economy has delivered its financial growth disproportionately to large corporations, especially in the FIRE, energy, information technology, defense, and health care sub-sectors of the economy, and also to households either already wealthy, or deriving their income from large companies in these sub-sectors. The vast majority of households have been either barely holding their own or are losing ground economically. These trends have accelerated since the crash of 2008, since most of the gains from the “recovery” have gone to the already wealthy, the bailed out FIRE sub-sector, and the other sub-sectors and types of households just listed.

The implications of this are that the remainder of the private sector, small and large companies not in the sub-sectors just listed and households in the 99% will get poorer and poorer year after year if the Republican projections should be realized. Eventually, unless there’s a credit bubble providing money and corresponding debt liabilities to these sub-sectors, consumer demand will gradually decrease until it finally collapses because net financial assets cannot be drawn upon to maintain it.

In other words, the implications of the Republican budget projections are another economic crash during the coming decade probably sooner rather than later.

What can delay this process leading to collapse. Well, paradoxically, it will be the failure of the Republican deficit projections. This will certainly occur because the projections based on this budget plan don’t accurately project the effects of the automatic stabilizers resulting from those parts of the safety net, their budget plan hasn’t completely eviscerated. The automatic increases in automatic stabilizer spending caused by rising unemployment insurance payments, food stamp spending, early retirements and disability spending will create larger deficits than the Republicans plan.

Like the Tories and Liberals in the UK before them, the political pressures will be too great for them to follow through on their deficit projection plans. The more they try, the more likely it is that they will lose control of all or part of Congress, and not be in a position to implement their austerity plans. But whether or not they lose control, deficit spending will be greater than they plan and it will ease the pressure on the private sector because government deficits in the realm of automatic stabilizer spending mean private sector surpluses and gains in consumer demand that will boost the economy.

Of course there are “good deficits” and ‘bad deficits.” As Bill Mitchell says “bad deficits” are those “. . . which arise from a government not taking responsibility for filling the spending gap. . . .” “Good deficits” are those “. . . designed to support the saving desires of the non-government sector.” The Republican “accidental” deficits will be “bad deficits” because they won’t provide much basis for creating full employment on a continuing basis, and because they will support only economic stagnation. But, nevertheless, they will still alleviate suffering enough to “boil the frog” more slowly.

In upcoming posts, I’ll look at the White House Budget, and the CPC budget and perhaps others and see if anyone else offering budget projections has learned the lesson, to put it kindly, that projections that don’t take sectoral financial balances into account must always be way off the mark.

Pingback: When Will the White House and OMB Ever Learn About Sector Financial Balances? - New Economic PerspectivesNew Economic Perspectives