If we learn the wrong lessons from Greece, our social safety net may wind up in tatters.

That the US has the reserve currency is an irrelevant consideration here. The key distinction remains user vs. creator. The euro zone nations are part of the former; Canada, Australia, the UK, Japan and the US are representatives of the latter.

Using “PIIGS” countries as analogues to the US or the UK, as Rogoff, Ferguson and countless other commentators do, is wrong. Their faulty analysis comes as a result of the deficit critics’ failure to distinguish between the monetary arrangements of sovereign and non-sovereign nations. Any sovereign government (none within the EMU enjoy that status any longer) can deal with a collapse in revenue and an increase in outlays from a financial perspective without invoking the sort of deadlocks that are now crippling the EMU zone. That is why, for example, the Japanese yen is not in freefall against the dollar, despite having a public debt to GDP ratio in excess of 200%, almost 2.5 times that of the US. In fact, over the past few days the yen has actually appreciated against the dollar. Now why would that be, if the lesson we were supposed to learn was the evils of “unsustainable” government deficit spending?

Fiscal sustainability has no relevance in a system where there are no operational constraints on the ability of a government to spend. US Social Security checks will not bounce. Nor will the Canadian or Japanese equivalents. Similarly, their bonds will always be able to pay out interest.

Note that this doesn’t mean that there are no real resource constraints on government spending. Let’s be clear: anyone who advances the use of fiscal policy as an effective counter-stabilization tool is always careful to point out that these interventions can come at a cost. That cost could well be inflation if, as a result of the fiscal expansion, we reach full employment, resource constraints begin to appear, but the government continues to spend. But if the economy recovers, tax revenues will increase and safety net spending will fall. In the US, that means we will likely be back to “normal,” with deficits around 2-4% depending on the state of the economy, which is where we’ve been for the past 30 years aside from 1998-2001.

Why won’t these deficits be inflationary? As Professor Scott Fullwiler noted in a recent email correspondence with me, once the recovery is underway and the economy gets to a significantly higher capacity utilization where price pressures could emerge, the deficit will be declining substantially. It will also be at least a partially offset by a fall in discretionary spending on social welfare. It’s axiomatic that the faster the economy grows, the smaller the deficit becomes, unless the government continues to spend recklessly–which we certainly do not advocate.

And by the time we get to a point where we might have inflation, the deficit is back to 2-3%, which again is where we’ve been for the past 30 years, while average inflation has been about 2%. Note: inflation does not equal default. You and I could well buy credit default swaps on any country in the world, but we are unable to collect if any of the relevant countries register a positive rate of inflation — even a double digit rate of inflation — because inflation is not tantamount to default. Nor do the ratings agencies recognize default in this manner. Default is defined as a failure to perform a task or fulfill an obligation, especially failure to meet a financial obligation. Inflation is not incorporated into the definition when it comes to questions of national insolvency.

By contrast, the talk of Greek default is prevalent across the markets, and that is a reasonable concern in the context of the euro zone. The default option is considered a foregone conclusion, even allowing for the massive 110 billion euro bailout, which was designed to inspire “shock and awe” among investors but instead has simply engendered shock. If Greece costs 110 billion euros to bail out, how much next time for Spain, Italy, or even France?

If the markets have concerns about national solvency, they won’t extend credit. And that is the problem facing all of the euro zone countries. Greece, Portugal, Italy, France, and Germany are all users of the euro-not issuers. In that respect, they are more like any American state or municipality, all of which are users of the US federal government’s dollar.

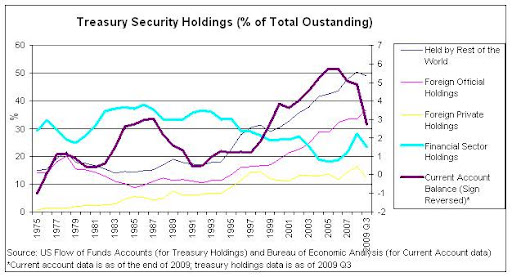

And deficits per se will not create the conditions for default in the US. If the US continues to run net export deficits (all the more likely given the ongoing fall in the value of the euro), and the private domestic sector is to net save, the US government has to net spend–that is, run deficits. That is a basic accounting identity, nothing more, nothing less. If the US government tries under these circumstances to run surpluses, it will first of all force the private domestic sector into deficits (and increasing debt) and ultimately fail because the latter will eventually seek to increase their saving ratio again.

And the same logic applies for Greece. The call is for the IMF/EU package to reduce its budget deficit as a percentage of GDP from the current 13.6% to 8.1% in 2011. How will they achieve that? Trying to engineer a reduction in the deficit via austerity programs (or freezes or whatever else one might like to call them) at a time when private spending is still insufficient to maintain adequate real GDP growth is a recipe for disaster. It will increase the deficit.

Consider Ireland as Exhibit A in this regard. Ireland began cutting back deficit spending in 2008, when its banking crisis began to spread and its budget deficit as a percentage of GDP was 7.3%. The economy promptly contracted by 10% and, surprise, surprise, the deficit exploded to 14.3% of GDP. We would wager heavy odds that a similar fate lies in store for Greece, given the EU’s inability to understand or recognize basic financial balances and the interrelationships among the various sectors of the economy. Neither a government, nor the IMF, can predict with any certainty what the outcome will be–ultimately private saving desires will drive the outcome, as Bill Mitchell has noted repeatedly.

Why do we have huge budget deficits across the globe? It’s not because our officials have all suddenly become Soviet-style apparatchiks. It is largely because the slower global economy has led to lower revenues (less income=less taxes paid, since most tax revenue is based on income, and lower tax brackets) and higher spending on the social safety net. Gutting this social safety net because we extrapolate the wrong lessons from the euro zone’s particular (and self-imposed) predicament constitutes the height of economic ignorance. It also reflects a transparently political agenda, which the US would be ill advised to embrace. The rescue packages, the IMF intervention and all the talk about orderly defaults cannot overcome the EMU’s fundamental design flaw. Let neo-liberalism die with the euro.

*This post originally appeared on ND 2.0