By L. Randall Wray

In the Primer we discussed the general case of governmentspending, taxing, and bond sales. To briefly summarize, we saw that when agovernment spends, there is a simultaneous credit to someone’s bank deposit andto the bank’s reserve deposit at the central bank; taxes are simply the reverseof that operation: a debit to a bank account and to bank reserves. Bond salesare accomplished by debiting a bank’s reserves. For the purposes of thesimplest explication, it is convenient to consolidate the treasury and centralbank accounts into a “government account”.

To be sure, the real world is more complicated: there is acentral bank and a treasury, and there are specific operational proceduresadopted. In addition there are constraints imposed on those operations. Twocommon and important constraints are a) the treasury keeps a deposit account atthe central bank, and must draw upon that in order to spend, and b) the centralbank is prohibited from buying bonds directly from the treasury and fromlending to the treasury (which would directly increase the treasury’s depositat the central bank). The US is an example of a country that has both of theseconstraints. In this blog we will go through the complex operating proceduresused by the Fed and US Treasury. Scott Fullwiler is perhaps the mostknowledgeable economist on these matters, and this discussion draws veryheavily on his paper. Readers who want even more detail should go to his paper,which uses a stock-flow consistent approach to explicitly show results.

First, however, let us do the simple case, beginning with aconsolidated government (central bank plus treasury) and look at theconsequences of its spending. Then we will look at the real world example ofthe US today. Readers have asked for some balance sheet examples, so I am usingsome simple T-accounts here. It might take some readers a bit of patience towork through this if they have not seen T-accounts before. (Note: these arepartial balance sheets—I am only entering the minimum number of entries to showwhat is going on.)

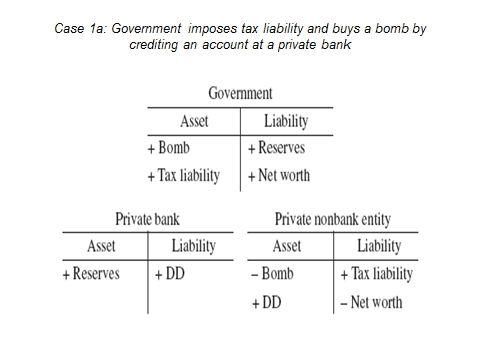

Let us assume government buys a bomb and imposes a taxliability. This is shown as Case 1a:

The government gets the bomb, the private seller gets ademand deposit. Note that the tax liability reduces the seller’s net worth and increasesthe government’s (after all, that is the purpose of taxes—to move resources tothe government). The private bank gets a reserve deposit at the government.

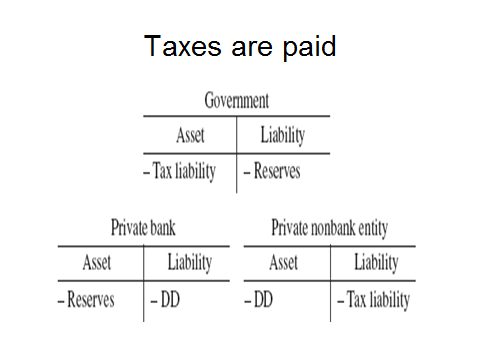

Now the tax is paid by debiting the taxpayer’s deposit andthe bank’s reserves:

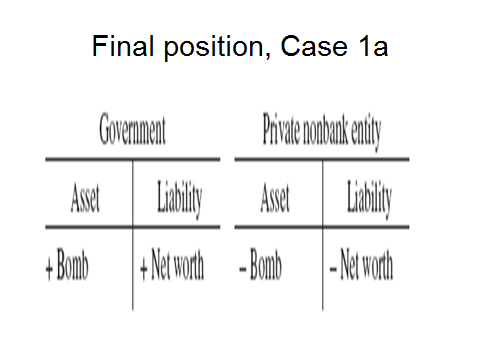

And so the final position is:

The implication of “balanced budget” spending and taxing bythe government is to move the bomb to the government sector—reducing theprivate sector’s net worth. Government uses the monetary system to accomplishthe “public purpose”: to get resources such as bombs.

Now let us see what happens when government deficit spends.(Don’t get confused—we are not arguing that taxes are not needed; remember“taxes drive money” so there is a tax system in place but government decidesthat this week it will buy a bomb without imposing an additional tax).

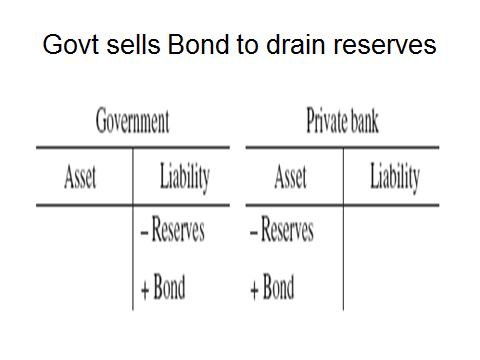

Here, the bomb is moved to the government, but the deficitspending allows net financial assets to be created in the private sector (theseller has a demand deposit equal to the government’s financialliability—reserves). However, the bank is holding more reserves than desired.It would like to earn more interest, so government responds by selling a bond(remember: bonds are sold as part of monetary policy, to allow the governmentto hit its overnight interest rate target):

And the end result is:

The net financial asset remains, but in the form of atreasury rather than reserves. Compared with Case 1a, the private sector ismuch happier! It’s total wealth is not changed, but the wealth was convertedfrom a real asset (bomb) to a financial asset (claim on government).

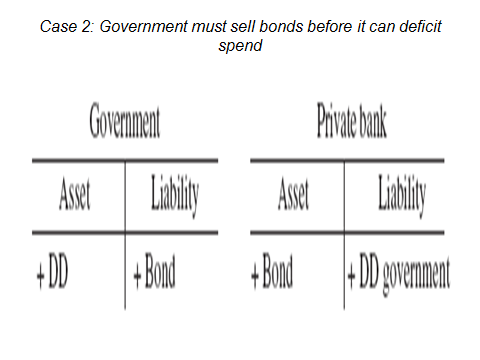

Ah, but that was too easy. Government decides to tie itshands behind its back by requiring it sell the bond before it deficit spends.Here’s the first balance sheet, with the bank buying the bond and crediting thegovernment’s deposit account:

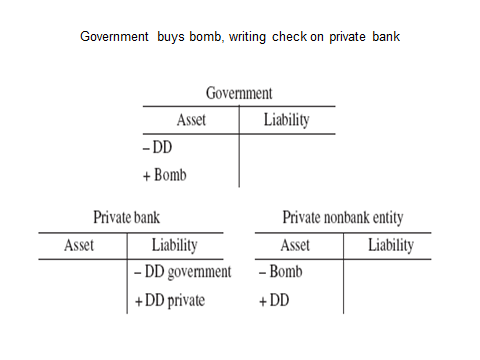

Now government writes a check on its deposit account, to buythe bomb:

The bank debits the government’s deposit and credits theseller’s. The final position is as follows:

Note it is exactly the same as case 1b: selling the bondbefore deficit spending has no impact on the result, so long as the privatebank is able to buy the bond and the government can write a check on itsdeposit account.

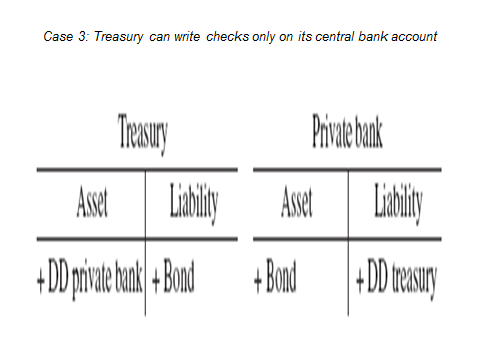

That, too, is too simple. Let’s tie the government’s shoestogether: it can only write checks on its account at the central bank. So inthe first step it sells a bond to get a deposit at a private bank.

Next it will move the deposit to the central bank, so thatit can write a check.

We have assumed the bank had no extra reserves to be debitedwhen the Treasury moved its deposit, hence, the central bank had to lendreserves to the private bank (temporarily, as we will see). Now the treasuryhas its deposit at the central bank, on which it can write a check to buy thebomb.

When the treasury spends, the private bank receives a creditof reserves, allowing it to retire its short term borrowing from the centralbank (looking to the private bank’s balance sheet, we could show a credit ofreserves to its asset side, and then that is debited simultaneously with itsborrowed reserves; I left out the intermediate step to keep the balance sheetsimpler). The private bank credits the bomb seller’s account. The finalposition is as follows:

What do you know, it is exactly the same as Case 2 and Case1b! Even if the government ties its hands behind its back and its shoestogether, it makes no difference.

OK, admittedly these are still overly simple thoughtexperiments. Let’s see how it is really done in the US—where the Treasuryreally does hold accounts in both private banks and the Fed, but can writechecks only on its account at the Fed. Further, the Fed is prohibited frombuying Treasuries directly from the Treasury (and is not supposed to allowoverdrafts on the Treasury’s account). The deposits in private banks come(mostly) from tax receipts, but Treasury cannot write checks on those deposits.So the Treasury needs to move those deposits from private banks and/or sellbonds to obtain deposits when tax receipts are too low. So let us go throughthe actual steps taken. Warning: it gets wonky.

*The following discussion is adapted from Treasury Debt Operations—An Analysis IntegratingSocial Fabric Matrix and Social Accounting Matrix Methodologies, by ScottT. Fullwiler, September 2010 (edited April 2011),http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1874795

The Federal Reserve Act now specifies that the Fed can onlypurchase Treasury debt in “the open market,” though this has not always beenthe case. This necessitates that theTreasury have a positive balance in its account at the Fed (which, as set inthe Federal Reserve Act, is the fiscal agent for the Treasury and holds theTreasury’s balances as a liability on its balance sheet). Therefore, prior to spending, the Treasurymust replenish its own account at the Fed either via balances collected fromtax (and other) revenues or debt issuance to “the open market”.

Given that the Treasury’s deposit account is a liability forthe Fed, flows to/from this account affect the quantity of reserve balances.For example, Treasury spending will increase bank reserve balances while taxreceipts will lower reserve balances. Normally, increases or decreases to bankingsystem reserves impact overnight interest rates. Consequently, the Treasury’sdebt operations are inseparable from the Fed’s monetary policy operationsrelated to setting and maintaining its target rate. Flows to/from the Treasury’s account must beoffset by other changes to the Fed’s balance sheet if they are not consistentwith the quantity of reserve balances required for the Fed to achieve itstarget rate on a given day. As such, theTreasury uses transfers to and from thousands of private bank deposit (bothdemand and time) accounts—usually called tax and loan accounts—for thispurpose. Prior to fall 2008, theTreasury would attempt to maintain its end-of-day account balance at the Fed at$5 around billion on most days, achieving this through “calls” from tax andloan accounts to its account at the Fed (if the latter’s balance were below $5billion) or “adds” to the tax and loan accounts from the account at the Fed (ifthe latter were above $5 billion). (The global financial crisis and the Fed’sresponse, especially “quantitative easing” has led to some rather abnormalsituations that we will mostly ignore here.)

In other words, timelinessin the Treasury’s debt operations requires consistency with both the Treasury’smanagement of its own spending/revenue time sequences and the time sequencesrelated to the Fed’s management of its interest rate target. As such, under normal, “pre-global financialcrisis” conditions for the Fed’s operations in which its target rate was setabove the rate paid on banks’ reserve balances (which had been set at zeroprior to October 2008, but is now set above zero as the Fed pays interest onreserves), there were six financial transactions required for the Treasury toengage in deficit spending. Since it isclear that current conditions for the Fed’s operations (in which the targetrate is set equal to the remuneration rate) are intended to be temporary and atsome point there is presumably a desire (by Fed policy makers) to return to themore “normal” “pre-crisis” conditions, these six transactions are the base caseanalyzed here (though the “post-crisis” operating procedures do notsignificantly impact conclusions reached).

The six transactions for Treasury debt operations for thepurpose of deficit spending in the base case conditions are the following:

- The Fed undertakes repurchase agreement operations with primary dealers (in which the Fed purchases Treasury securities from primary dealers with a promise to buy them back on a specific date) to ensure sufficient reserve balances are circulating for settlement of the Treasury’s auction (which will debit reserve balances in bank accounts as the Treasury’s account is credited) while also achieving the Fed’s target rate. It is well-known that settlement of Treasury auctions are “high payment flow days” that necessitate a larger quantity of reserve balances circulating than other days, and the Fed accommodates the demand.

- The Treasury’s auction settles as Treasury securities are exchanged for reserve balances, so bank reserve accounts are debited to credit the Treasury’s account, and dealer accounts at banks are debited.

- The Treasury adds balances credited to its account from the auction settlement to tax and loan accounts. This credits the reserve accounts of the banks holding the credited tax and loan accounts.

- (Transactions D and E are interchangeable; that is, in practice, transaction E might occur before transaction D.) The Fed’s repurchase agreement is reversed, as the second leg of the repurchase agreement occurs in which a primary dealer purchases Treasury securities back from the Fed. Transactions in A above are reversed.

- Prior to spending, the Treasury calls in balances from its tax and loan accounts at banks. This reverses the transactions in C.

- The Treasury deficit spends by debiting its account at the Fed, resulting in a credit to bank reserve accounts at the Fed and the bank accounts of spending recipients.

Again, it is important to recall that all of thetransactions listed above settle via Fedwire (T2). Also, the analysis is much the same in thecase of a deficit created by a tax cut instead of an increase in spending. That is, with a tax cut the Treasury’sspending is greater than revenues just as it is with pro-active deficitspending.

Note, also that the end result is exactly as stated aboveusing the example of a consolidated government (treasury and central bank):government deficit spending leads to a credit to someone’s bank account and acredit of reserves to a bank which are then exchanged for a treasury toextinguish the excess reserves. However, with the procedures actually adopted,the transactions are more complex and the sequencing is different. But thefinal balance sheet position is the same: the government has the bomb, and theprivate sector has a treasury.