As anyone who’s followed the discussion has seen, the proposal from the newly-elected leader of the British Labor Party, Jeremy Corbyn, to implement “People’s Quantitative Easing” or PQE, has created a lot of controversy (Richard Murphy’s blog is a good place to see the PQE defense against these arguments). The basics of the proposal are that the government would create a public bank for financing infrastructure (National Investment Bank, or NIB), which the Bank of England (BoE) would then lend to directly in order to fund. The NIB would then carry out infrastructure projects to jumpstart the economy, create public capital, and create jobs.

The proposal obviously counters the austerity mantras going around in British politics (not to mention most other places), though Corbyn himself has paid lip service to balancing the budget, as well. The controversy, beyond the typical concerns with greater government spending of austerians, are fairly predictable for anyone who has taken a standard macroeconomics course (usually with a textbook written by someone who didn’t see the financial crisis coming)—

- first, the often heard QE = “printing money” = massive inflation argument is pervasive here with regard to PQE, as well;

- second, there are substantial concerns being voiced that “forcing” the BoE to finance the NIB will undermine the “independence” of the central bank and monetary policy;

- third, PQE gives the government free reign to spend by eliminating the need to fund its deficits in the financial markets.

So, here I want to look at the accounting and some basic operational realities of this proposal in order to understand how PQE does or does not do what the naysayers say it will.

For PQE, consider a NIB that is essentially an arm of the government carrying out its spending, so we can include it as part of the government simply spending from the government’s account at the central bank, while its purchases of infrastructure show up as government assets.

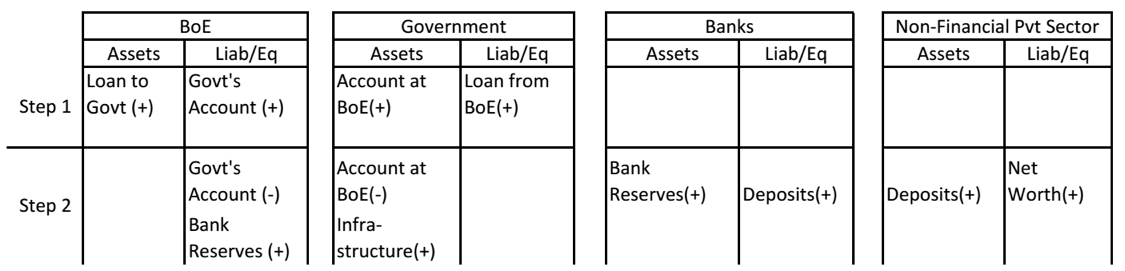

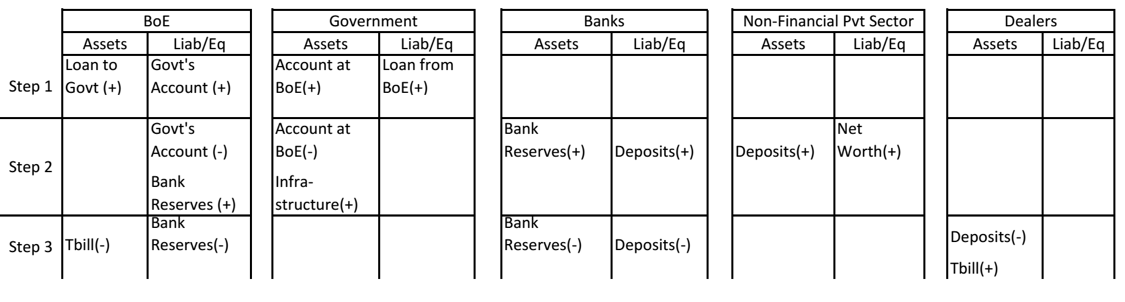

Here’s what it looks like if (Step 1) the BoE gives the government an overdraft, and (Step 2) the government spends (I’ll show below that there’s more to it than this, operationally, but just bear with me for now):

Table 1: Steps 1 and 2 of PQE

In Step 1, the loan from the BoE to the government shows up on both the government’s and the BoE’s balance sheets (obviously). In Step 2, the spending on infrastructure creates reserve balances, injected into the spending recipient’s bank’s reserve account, and a deposit is credited by the bank to the recipient that also raises the recipient’s net worth. (Of course, if the government is purchasing infrastructure, the spending won’t directly raise net worth of the builder itself, but when all is said and done, as a matter of double-entry accounting, the non-government sector’s financial net worth will have increased by the same amount as the government’s deficit increase as a result of the spending (e.g., wage income of employees of the builder, profits of the builder’s suppliers, and so on).)

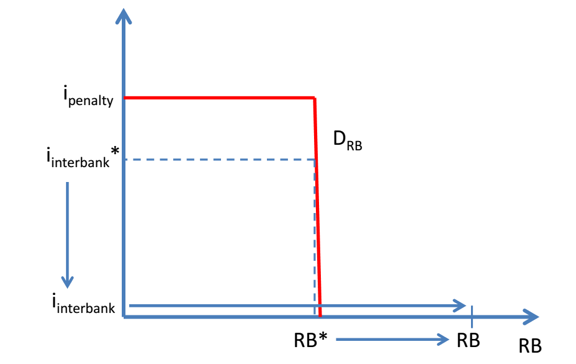

Note, though, that in Step 2, the BoE has created reserve balances that are also assets for banks. In the UK, reserve requirements are 0, so the demand for reserve balances will be very low and also highly inelastic (it’s not much different where reserve requirements are greater than zero, but it is a little different). Thus, if PQE is of any size of macroeconomic significance, it will shift the quantity of reserve balances beyond the demand as in Figure 1 and thus push the interbank rate to zero or near zero. In other words, left on its own, PQE creates a zero overnight rate, or ZIRP (Zero Interest Rate Policy).

Figure 1: PQE, Reserve Balances, and the Interbank Rate

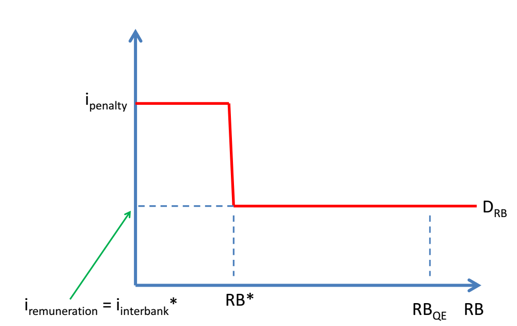

To avoid ZIRP and set a positive interest rate target, the BoE could pay interest on reserve balances (IOR) and set its interest rate target effectively equal to IOR, as shown in Figure 2.

Figure 2: PQE with IOR

This is a basic point of QE, and now PQE, that I have yet to see neoclassical economists acknowledge. It cannot be any other way. Think of any market if you’re not familiar with interbank markets—now, shift the supply curve so far that it is now completely to the right of the entire demand curve. What happens? The price falls to zero, unless you put in a price floor. This is Economics 101. With QE you get ZIRP or IOR = the target rate if you don’t like ZIRP and want the target rate above zero.

This is very significant. As I explained in more detail here, neoclassicals argue that paying IOR at the target rate stops QE from being inflationary, since in their view banks have the opportunity to earn IOR rather than make loans. They also argue that ZIRP stops QE from being inflationary, such as with Krugman’s version of the liquidity trap where “base money” (i.e., reserve balances) and Tbills both earn 0% and thus become perfect substitutes and more “money” is essentially the same thing as more Tbills (which isn’t the same thing as Keynes’s liquidity trap, but that’s a whole separate story).

From Figures 1 and 2, though, IOR = target rate or ZIRP are the ONLY TWO POSSIBLE OUTCOMES OF RISING RESERVE BALANCES AS A RESULT OF QE. Logically, then, neoclassicals own views on QE must conclude that the increase in reserve balances from QE is not inflationary.

So, continuing with the logic of the neoclassical argument, an increase in excess reserve balances that results from PQE must be accompanied by ZIRP or IOR = target rate, and from their own positions on the latter the rise in reserve balances themselves CANNOT BE INFLATIONARY. So, the first of the key arguments against PQE being made by neoclassicals and heard often in the financial press—that PQE will be inflationary because it raises the “money supply”—is inconsistent with the views held by these very same people.

Now, PQE could be inflationary if the additional spending on infrastructure pushes the economy beyond full employment, or creates bottlenecks in some key resource markets. Or, from the neoclassical perspective, ZIRP or even interest rate target = IOR could be inflationary if it results in the interbank rate being less than what they view is consistent with the natural rate of interest. Regardless, from the perspective of the neoclassicals own model the increase in reserve balances that PQE creates is not in and of itself inflationary.

In other words, from a basic consideration of accounting and simple supply and demand in the interbank market, the first objection to PQE—that it is inherently inflationary—is incorrect.

(This isn’t a topic for this post, but from the endogenous money perspective that I hold along with other MMTers, Post Keynesians, and an increasing number of authors in central bank research departments, both arguments by neoclassicals (IOR= target rate and ZIRP stop the rise in reserve balances from QE from being inflationary) are wrong.)

Let’s now consider central bank independence and PQE. What does “independence” mean here? I’m going to define it as (1) the central bank’s ability to set the interest rate target where it chooses as a result of its own ability to consult its preferred strategic response to the state of the economy (such as Taylor’s Rule), (2) its ability to manage the quantity of reserve balances circulating as it sees fit, (3) its ability to carry out non-traditional monetary operations (e.g., purchases of longer-term Treasuries or mortgages) in order to manage longer-term interest rates as it sees fit.

Now, as an aside, those that understand central bank operations—as detailed in the literatures on endogenous money and numerous publications by central banks—will know that there are cases in which even the most independent central bank can do (1) but not (2) or (3), such as in the pre-2008 method of central bank operations. But this is the central bank’s own choice of how to carry out its operations. It is now well known that setting IOR = target rate is operationally required for (2) to work (if it desires an excess supply of reserve balances and a target rate above zero). Thus, to simultaneously carry out (1), (2), and (3) as the Fed has done since late 2008, the operational requirement is IOR = target rate. However, even with IOR < target rate—as many central banks normally practice—it is possible to carry out (1) and (3) simultaneously as the operations for (3) would have to be sterilized with offsetting operations as in the US during early to mid-2008 or during Operation Twist.

At any rate, to sum up, under traditional, pre-2008 operations (1) and (3) are possible (assuming (3) is sterilized). If IOR = target rate, then all three are possible. The question is how or whether PQE changes this.

From Figure 2 above, clearly the BoE could set IOR = target rate and thus be able to still carry out (1), (2), and (3). For (1), it can simply adjust IOR up or down in order to move the target rate, since IOR = target rate. For (2), it can target any quantity of reserve balances along the flat portion of the demand curve (if it supplies less than as in normal times it will have to accept a rising interbank rate as given by the demand curve—discussed below). For (3), like the Fed now with IOR = target rate, it can carry out non-traditional operations to reduce longer term interest rates. All of this is possible as long as IOR = target rate, with or without PQE.

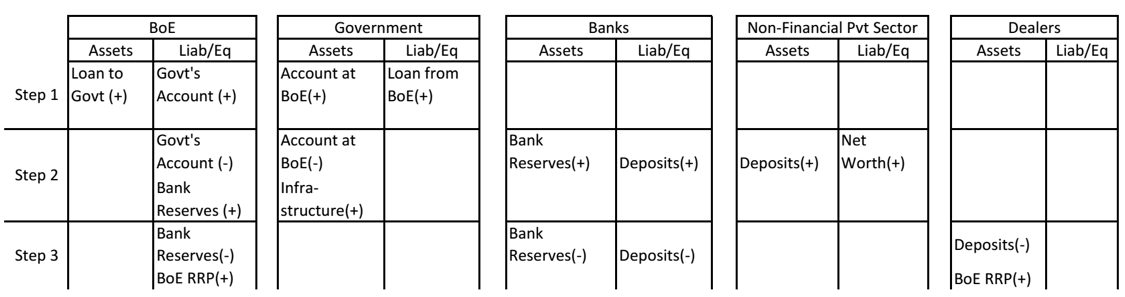

But what about the scenario in which the BoE wants fewer reserve balances to circulate than PQE has created? As Table 1 shows, PQE creates reserve balances, but the BoE might want a smaller balance sheet than PQE effects. In (2) above, the BoE can create more balances if it wants as long as IOR = target rate, but what about if it wants fewer balances circulating?

Consider Table 2, in which now there is a Step 3 showing the BoE carrying out reverse repurchase agreements (RRPs) to non-banks such as dealers as the Fed is now doing. RRPs can drain the reserve balances—all or just some portion, as desired by the BoE—that have been created by PQE. Indeed, if the BoE wants to return to the pre-2008 method of operations, it can actively use RRPs to set its balance sheet size comparable to that period (allowing for growth in the demand for currency since then, of course) provided it is willing to raise the rate it offers on RRPs to coincide with the more inelastic portion of the demand for reserve balances as the quantity circulating is reduced. Just as easily, the BoE could instead allow banks to trade in their reserve balances created by PQE for time deposits instead of RRPs as many other central banks have done for years.

Table 2: PQE with RRPs by the BoE to Drain Excess Reserve Balances

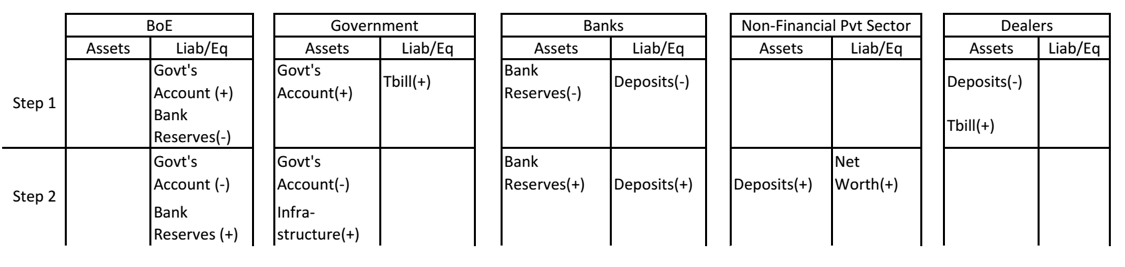

Another essentially equivalent option for the BoE would be to sell assets off of its balance sheet. Table 3 shows, for example, the BoE selling Tbills to dealers in Step 3 instead of RRPs.

Table 3: PQE with Tbill Sales to Drain Excess Reserve Balances

There is one additional aspect of central bank independence that I have left out that could be potentially affected by PQE. Note that as a result of PQE the BoE will have to either pay IOR on the additional reserve balances created or pay interest on its RRPs or time deposits to drain them—in other words, there is no such thing as PQE creating “money” unaccompanied by ZIRP, IOR = target rate, or the BoE draining the reserve balances via RRP or something similar.

The payment of IOR reduces the BoE’s profits, and potentially its equity if the BoE ends up with negative profits, which could have political repercussions even though it shouldn’t (as the monopoly creator of reserve balances, the BoE can never be “bankrupt,” though politicians don’t always allow for this reality). In this case, what should happen is that the BoE be allowed to charge at least about as much interest on the loan it provides to the Treasury as it pays on its reserve balances, RRPs, or time deposits. This has no effect on the government’s budget if—as is common practice—the central bank returns its profits to the government, but can eliminate political concerns with the BoE’s equity position that might affect its independence.

So, aside from the matter of charging interest on the loan from the BoE to the government to avoid a fall in the BoE’s equity, the second objection to PQE is also incorrect.

Now, for the third objection, the question is whether PQE is reducing or even eliminating the ability of markets or even central banks to provide “oversight” over the actions of the government. I’ll leave aside the counter argument here that it is at the very least questionable whether we want markets or central banks to do that in the first place since I am only addressing the objections to PQE in this post. As Bill Mitchell explained, this is quite different from QE as central banks have been doing it the past several years. Traditional QE is not actually a helicopter drop. Rather, helicopter drops are fiscal operations, since government deficits raise the net worth of the non-government sector. Traditional QE is an asset swap that, like all other monetary policy operations, does not alter the net worth of the private sector.

As Bill explains, though, because PQE involves government deficit spending, PQE is in fact, as Stephanie Kelton termed it, Overt Monetary Financing of Government (OMFG). Some refer to this as “public control of the money supply,” but that’s not really true (depending on how one defines the “money supply”) as the BoE can still control the quantity of reserve balances outstanding as discussed above and shown in Tables 2 and 3. On the other hand, if the BoE does this, it nonetheless doesn’t stop the fact that with PQE the government has spent without having to go to markets or the central bank itself.

But does this matter in the sense of being much different from “plain vanilla deficits” (PVD) the government might run in the absence of PQE?

Instead of PQE, Table 4 shows a standard PVD run by the government to finance infrastructure spending. In this case, the government will issue Tbills to replenish its account at the central bank before it undertakes the infrastructure spending. In Step 1, the government sells a Tbill to a bond dealer. In Step 2, there is spending on infrastructure.

Table 4: Plain Vanilla Deficit to “Finance” Infrastructure Spending

(Of course, from the MMT perspective, there is nothing “plain vanilla” about this, since it is the government that is requiring itself to sell the Tbills before it spends. This is nothing more than a self-imposed constraint—OMFG would be more in line with “plain vanilla” if this were better understood. A currency-issuing government never needs to finance its spending in financial markets, and as discussed above OMFGs like PQE do not raise additional risks of inflation. Nonetheless, this post is written to address critics of PQE, so I will stick with the more common definitions.)

There are two important things to understand from Table 4 relative to the previous tables. First, all four tables show that PQE or PVDs raises the net worth of the non-financial private sector. From the neoclassical perspective, none of these scenarios are more inflationary than any other assuming the central bank’s target rate is the same in all four—there is IOR = target rate in Table 1 and sterilization of the spending in Tables 2, 3, and 4 via Tbill sales or RRPs. The impact in all four on aggregate demand is thus simply the infrastructure spending itself.

Second, for a currency-issuing government like the UK’s operating under flexible exchange rates, the debt service in all four scenarios is essentially the same. In Table 4, the debt service on PVD is the Tbill rate, which will arbitrage quite closely with the BoE’s target rate. In Table 1, the government’s debt service is a bit more complicated—recall that in most cases central banks transfer their profits to the national government. This means that paying IOR = target rate on the OMFG that results from PQE (are you keeping up with all the acronyms?) reduces the BoE’s profits returned to the government by the total IOR paid on the OMFG. But this reduction in profits sent to the government in Table 1 will be about the same as the amount of debt service paid by the government in Table 4, so the effect on the government’s budget from debt service (either by the government or by the BoE on IOR) either way is essentially the same.

In Tables 2 and 3, the effect is basically the same again—in Table 2, the RRPs earn a money market rate similar to the BoE’s target rate, while in Table 3 the Tbill now circulating is just like the Tbill issued in Table 4.

So, the fact that the government has to issue Tbills in financial markets in the case of PVD is not materially different from OMFG in PQE, because it is not operationally possible to do OMFG without IOR = target rate, RRPs at roughly the target rate, or sterilizing OMFG by selling financial assets like Tbills held by the BoE. The government’s Tbill rate will arbitrage with these rates since it is just as risk-free to the private sector as is the central bank’s liability earning IOR = target rate (note that the central bank is a legal agency for sovereign currency issuing governments, so the government’s debt can’t be any more risky than one of its agencies’). The BoE’s interest rate policy effectively sets the interest rate on the national debt; it doesn’t control whether or not the government can issue the debt and it does not decide whether or not or how much overall the government can spend. And this is all true whether or not there is PQE, OMFG, or PVD.

The issuance of Tbills in PVD doesn’t “crowd out” financing in financial markets. Yes, there is a dealer that has spent a deposit to purchase the Tbill in Table 3, but dealers are backstopped in repo markets by the BoE and also by banks (themselves backstopped by the BoE). So, the funds for purchasing Tbills is created out of thin air at the margin, not prior savings. All of this is not even to mention that the reserve balances required by the banking system to settle the dealers’ purchases of Tbills with the government are created by a sale of previously issued government debt (either outright or in a repo) from the BoE. In short, those that argue that PVD somehow constrains the government or the financial system overall more than OMFG does are wrong.

So, in the end, all three arguments against PQE are incorrect.

- Is PQE inherently inflationary? PQE is only as inflationary as the spending itself.

- Does PQE limit central bank “independence? The BoE’s ability to set rates is not affected, and if it sets IOR = target rate, it can target the quantity of reserve balances and/or carry out non-traditional operations like QE, etc., just as without PQE.

- Does PQE encourage profligate government spending? A monetarily sovereign government spends and taxes as it chooses through the political process (i.e., Parliament/Congress, Prime Minister/President) laid out in the nation’s laws, and this is so whether it deficit spends via PVDs or OMFGs via PQE. The central bank for such a government sets an interest rate policy that effectively determines the interest rate on the national debt; again, this is so whether government deficits are of the PVD or OMFG variety.

In other words, PQE via OMFG changes very little, if anything, operationally. That is, PQE is not significantly different from PVD once we consider accounting and operational realities. The key is thus not that PQE or OMFG creates “money” directly relative to PVD, but that PVD, PQE, and OMFG all directly create spending and net worth for the private sector—this is what fiscal policy in any of these forms brings to macroeconomic policy that monetary policy alone via interest rate changes or QE operations cannot.

While PQE does not change the nature of fiscal policy, it does change the framing of the debate about fiscal policy, or attempts to do so, to show that the government doesn’t have to finance itself, ever. If it works, it would be a tremendous improvement on the more standard discussions we see regarding fiscal policy. Unfortunately, the economics establishment’s understanding of monetary operations is so poor that we are inundated by objections to PQE based on the more standard framing shown here to be incorrect

There are two final things worth pointing out regarding the MMT view on PQE. First, MMTer Randy Wray wrote a paper in 2001 calling for essentially a PQE-like program in the US. Second, Warren Mosler has noted that simply having the government guarantee debt issued by the NIB would perhaps be a more politically palatable solution that would be essentially identical—the national government would decide how much the NIB could borrow/spend and the NIB would then be able to borrow at effectively the same rate the government issues its debt, itself based on the central bank’s target rate. As such, government guaranteed debt of the NIB would be effectively the same thing as PVD, which as shown above is not different in a macroeconomically significant way from OMFG via PQE.

29 responses to “Corbynomics 101—It’s the Deficit, Stupid!”