General Goals and Decision Criteria for Government Fiscal Policy

In the era of climate change, a worldwide social and economic disaster, the valuation of real resources, especially atmospheric resources and energy resources must change in order for human civilization to survive. Government fiscal policy is a critical element of that change in valuation, both on the spending and the taxation side. In addition, in a planning role, government becoming the architect or co-architect of new energy, transportation and land use realities. As I have written before, making atmospheric resources or the permission to use them, a tradable commodity does not adequately and properly engage our most powerful instrument in addressing climate change and adaptation to climate change, the institutions and fiscal policy of government itself. However, government leaders are human beings with interests and varying ethical commitments to the common good of their people and humanity in general. In order to hold them accountable in their spending and taxation decisions it will help to make a part of public political discourse those criteria by which they make spending and taxation decisions. These public criteria can in turn be modified by political discussion as well as scientific measurement of the results of those policies, which then can either be refined or discarded depending on their outcomes.

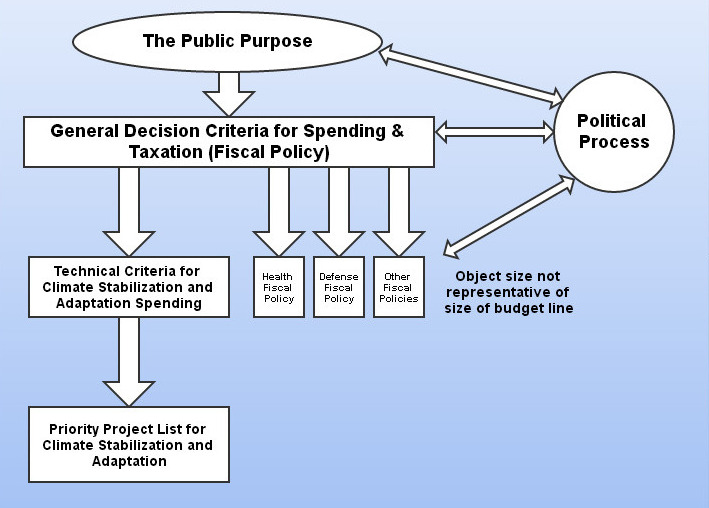

Below would be elements of what some might consider in their list of general priorities for how government should structure fiscal policy. Later from this list, one can derive specific spending priorities to address a particular area of government action, once domain-specific technical criteria have been enumerated. I will attempt to do this for the spending priorities of governments in facing climate change, subsequently. There is obviously overlap between many of the goals or items in this list.

1) Promotion of survival of human species/nation

2) Promotion of survival of human civilization/national culture or cultures

3) Promotion of human health/health of nation

4) Promotion of the health of systems of the earth vital to humanity and co-evolved species

5) Promotion of or provision of useful employment for all who wish to work

6) Promotion of fair distribution of rewards from economic activity via regulation and investment

7) Provision of education for the young and education or work-related training for those of any age who seek it out

8) Promotion of a deeper scientific understanding of the world and of the national territory

9) Protection of citizenry from external military threats

10) Protection of citizenry/residents from domestic or international crime/violence

11) Protection of individual and familial property rights in balance with community and social rights

12) Endeavor to protect citizenry/residents from accidental and natural disasters such as inclement weather, fire, traffic collisions

13) Create, fund, and maintain political institutions, including those that enable the expression of popular will like elections and plebiscites.

14) Maintenance of a fair legal system enabling rule of law and due process of law

15) Supply critical or uniquely valuable goods and services not supplied by private sector actors

16) Supply critical goods and services supplied inefficiently or inequitably by private sector actors

17) Supply via spending and monetary policy and maintain a currency with a stable value to enable transactions between private and public sectors, within the private sector, and between domestic private and public sectors and the rest of the world.

18) Ensure the stability of a financial system that enables investment and savings, including savings and/or pensions for old age.

19) Enable or promote safe transport of people, goods, and communications within the national territory.

20) Enable in agreement with national laws safe transportation/passage of people and goods across national boundaries.

21) Supply government employees with adequate monetary compensation for their efforts to serve the public good, either via union contract or according to a fair, attractive pay scale, reducing the likelihood of corruption and loss to the private sector or distraction from public service of valuable public servants.

22) Supply government employees and legislators with adequate monetary and real resources to achieve their public missions, inclusive of support and research staff.

23) (For currency-issuing monetarily sovereign governments) Maintain via appropriate spending, taxation and monetary policy the level of growth or planned economic degrowth appropriate to the public purpose and demand for monetary savings by the private sector

24) (For currency-issuing monetarily sovereign governments) Design and fairly enforce a taxation regime in such a way as to discourage social “bads” and encourage social “goods”, while maintaining the overall level of taxation that will dampen excess inflationary trends and unwanted depreciation of the currency

25) (For currency-using governments) Design and fairly enforce a taxation regime that discourages social “bads” and encourages social “goods”, while supplying the government with enough tax revenue to fund its operations and spending.

While I have designed this list to be as realistic as possible and to minimize controversy, it contains political and economic assumptions that not everyone will share. However, I believe many of these items are uncontroversial. Most importantly, I believe the public discussion of how we might define “the public purpose” which government fiscal policy is supposed to realize is important to develop further.

Some with allegiance to what I believe to be unrealistic ideas about government’s size or supposedly optimal limited role will claim that many of the above criteria are not the province of government but of the private sector. Also those who have not absorbed the reality of modern currencies will object to the distinctions made about the role of taxation in different types of government in the last three items.

The list above might also be considered to be “unrealistic” by those who number themselves on the “Left” but have decided to compromise with the neoliberal order or what they feel to be current political reality. For instance the commitment to full employment is considered by many self-identified liberals now a “bridge too far”. I would challenge them to edit that bullet point with a lesser goal and see how it comes out as a decision criteria for government fiscal policy. Untertaking such an exercise, I think, would be helpful for political actors coming to terms with their own ideologies and biases

Obviously representative government is contingent upon mostly professional legislators and/or government executives weighing these individual criteria for government fiscal policy. However in order to democratize that process, the publication of the priorities of a given government or legislator in list form might help constituents influence and rearrangement spending priorities. The above list is very long and might be edited down or condensed into “meta-factors” for the purposes of discussion. However, it might also be simplified via ranking or weighting each of the factors in a given budget period or point in time. Even published in list form as is, would give constituents or journalists a point of purchase on a given budgeting decision to initiate or sustain meaningful public discussion. Otherwise, to leave the budgeting process to the unscrutinized efforts of legislators and government executives without recourse to a list of principles, means to lose a way for corruption, inefficiency or ineffectiveness of spending to be minimized.

It can be reasonably argued that the efficiency and inefficiency of government spending cannot be discussed without the government first committing to its own list of priorities against which its own actions would be judged. Touching upon the language of John Kenneth Galbraith and Modern Money theory, these are the tools by which one can define the public purpose. Also, informal corruption of government by Big Money, can not, I believe be effectively combated without contrasting how that money has diverted the governments budgeting process away from the public purpose, as defined.

Technical Criteria for Government Spending on Climate Change Mitigation and Adaptation

While most conventional discussions of climate change policy focus on which method of assigning a price on carbon is the most effective, as I have stated above this overlooks how we can effectively deploy the instrument of government to more quickly create a net-zero carbon infrastructure, dismantle the plutocratic order, and change land-use patterns to combat climate change. A focus on government fiscal policy, in particular spending does not exclude and can complement the necessary ascending carbon price. The above general goals for government fiscal policy are not specific enough to address the technical challenges of transitioning from an economy based on fossil fuels to one based on non-carbon, mostly renewable energy.

A overall set then of technical criteria should be published by governments to guide public discussion of and the direction of government spending regarding climate change mitigation and adaptation. Such a set of criteria will also make the decisions of government in this area comprehensible but also enable public discussion and dissent if such projects do not realize the intended effects. Also making explicit criteria for spending also would reduce the likelihood of corruption and inefficiency in government fiscal policy.

1) Government project/investment enables or lays the groundwork for a net-zero carbon emissions system for transportation, electricity generation, residential energy use, commercial energy use, agricultural energy use or industrial process energy use.

2) Government project/investment enables increase in stable (non-gaseous) atmospheric carbon storage in building materials, solids, soil or vegetation.

3) Government projects/investments that lead to a conservation of energy resources and reductions in energy demand at least for a transition period if not for the foreseeable future.

4) Prioritize investments that reduce demand for fossil fuels with the highest climate damage potential as well as damage to local eco-systems.

5) Prioritize investments that reduce dependence on oil, the most expensive and most supply-limited of fossil fuels.

6) Outside of investments specifically in research and development, the project/investment does not depend on unlikely technological breakthroughs to deliver a net-zero carbon infrastructure/system within two decades

7) Investment priority would be allotted to projects that enable a stabilization or reduction in the overall ecological footprint of human civilization, keeping in mind that the overall footprint cannot, contrary to a romantic “naturalistic” ideal, be zero. Non-carbon areas of concern are:

- Biodiversity Loss

- Overuse of freshwater resources

- Overloading of nitrogen & phosphorus cycles

- Ozone Depletion

- Ocean Acidification/Sterilization

- Reduction in Uncultivated/Unbuilt Land Ecosystems

- Increasing Waste Stream from Human Activity including Toxic and Radioactive Wastes

8) Investment priority will be allotted to projects that enable an increase in social welfare as measured by

- Reducing unemployment

- Increasing the proportion of total income accruing to labor

- Increasing public health via improvement in local air and water quality, increase in health-promoting physical activity, decreases in accidental death

- Increasing access to health care and social insurance

- Increasing skills and knowledge-base related to the building of a net-zero carbon emission civilization via education and job training

- Increasing the affordability of comfortable housing with low environmental impacts

- Decreasing social isolation/increasing social connection and cooperation

- Increasing the availability and affordability of nutrient-rich foods produced with low environmental impacts

- Increasing the degree to which people as citizens, workers and consumers can co-determine the conduct of their work, political and policy decision-making, and consumption decisions.

9) Investment in emergency geoengineering technologies can proceed after they have been shown, after extensive independent testing, to have negligible unintended negative effects on ecosystem and climate system functioning, while having much greater positive effects on climate stability than risks.

10) Investments in adapting to climate change will not divert substantial real resources from the fight to mitigate climate change and reducing positive climate forcings (i.e. warming potential).

11) Investment in lines of technological and scientific research with a likelihood of increasing human understanding of the basics of natural systems as well as likely paths to achieving climate stability

The above list is open, of course, to discussion and dispute, as is the intention of this exercise. Nevertheless, the public discussion of such technical “meta” criteria for government investment are an important intermediate step between the general priority list of the overall public purpose and the specifics of individual government-funded projects. The above list should provide general, generally-agreed upon terms from which specific investments would then be realized. With such discussion then a list

Priority List of US Federal, State & Local Government Investments for Climate Stability

From the above definitions of the general public purpose from which climate action might emerge and the general technical criteria for government investments to address climate change, I will develop a proposed list of those government investments that are most likely to promote climate stability. Those that appear first will have met more of the technical criteria, which I will list in abbreviated form behind the named investment. The effort is to reduce the degree to which “tastes” either my own or, more importantly, if implemented, that of the politicians involved, will influence the government fiscal priorities. The relative use of fiat-spending by monetarily sovereign governments versus tax-funded spending by regional or local governments is not specifically addressed but is an additional, important area of discussion.

Priority Investments:

1) Interconnected Systems of Protected Bikeways and Bike Parking/Shared Streets – Reproduce success of Danish/Dutch/Paris systems of promoting biking or e-biking (electrical assist) throughout urban, suburban and rural areas where appropriate. May not be appropriate in areas with widely dispersed residences. E-biking expands usefulness to hilly areas, those who cannot/wish not to exert themselves. (Criteria: energy conservation; zero net-emissions infrastructure; reduce demand for oil; present-day technology; increase public health via physical activity; reduce unemployment; reduce local pollution; increase socialization; decrease concentrated automobile clutter; public good)

2) Local Electric Public Transportation (Bus or Rail) with Wide Coverage, Frequent Schedule, 24 hour Service, Wifi Capability – Enable routine trips in areas with higher population density or arrayed along arterial routes to be achieved via electric buses (with on-board high capacity battery storage, fast charge, inductive charge, or trolleybus capabilities) or on some routes, over time, by electric rail. (Criteria: energy conservation, zero net-emissions infrastructure; reduce oil dependence, increase public health via physical activity; present day technology; reduce unemployment; reduce local pollution; increase socialization; decrease concentrated automobile clutter; public/common good)

3) National Renewable Energy Transmission Network – Federally funded to build and administer electrical transmission for renewable energy between high renewable energy areas (US Great Plains, Southwest, Offshore) to all regional electrical grids charging use fees (modeled on Western Area Power Administration) to encourage local development of renewable energy resources, which would otherwise be disadvantaged by lower cost generation in high renewable energy areas. (Criteria: zero net-emissions infrastructure; present-day technology; reduce unemployment; public/common good)

4) National High Speed Rail Network – Build the US High Speed Rail Association’s 2030 high speed rail system or equivalent along separate alignments from existing rail network, enable coast to-coast travel with, in future, net zero emissions in 24 hours. (Criteria: zero net-emissions infrastructure; present-day technology; reduce unemployment; reduce oil dependence; public/common good)

5) Electrified Double Track Freight Rail Network – Public buy-out of freight rail right of way. Double track railway and electrify, offering freight rail companies option of running freight operations while right of way operated as national public-benefit corporation. Grade separate where appropriate. (Criteria: zero net-emissions infrastructure; energy conservation; present-day technology; reduce oil dependence; reduce unemployment; public/common good)

6) Food Production & Transport Energy Electrification Program – Fund development of a fossil fuel independent food system via research, development and grants to farm equipment manufacturers. (Criteria: zero net-emissions infrastructure; reduce oil dependence; reduce impacts of food production & distribution)

7) Subsidize Installation of High Water-Efficiency Irrigation Equipment – Critical droughts will continue in the era of climate change. Farmers will not be able to invest in infrastructure changes without government help. (Criteria: conserve energy; reduce impacts of food production and distribution; reduce freshwater use; decrease waste stream)

8) Develop National Inventory of Buildings for Deep Energy Retrofit Potential – categorize existing buildings according to potential and likely costs to achieve very low energy use via retrofit. (Criteria: conserve energy; increasing skills/knowledge base for climate protection; technological research to reduce climate impact)

9) Fund “Green Bank” for Zero-Interest Energy Mortgages – For qualifying buildings and owners offer zero-interest energy mortgages for ultra-low energy retrofits to EnerPhit Standard or equivalent. (Criteria: conserve energy; reduce unemployment; increase public health)

10) Build Public and Subsidized Transit-oriented Multifamily Housing to Passivhaus Standard with Wooden Structure – Increase housing supply where affordable housing is lacking or replace un-retrofittable energy-inefficient housing stock. (Criteria: conserve energy; reduce unemployment; increase public health; increase housing affordability; decrease oil dependence; fix carbon in durable structures)

11) Develop National Program to Fix Carbon in Vegetation/Soil – Research economics and technologies required to fix carbon and reduce non-energy emissions via agricultural and forestry methods. Research possible employment effects for such a program. (Criteria: increase stable fixation of carbon; reduce unemployment; develop skills/knowledge base for climate protection; technological research to reduce climate impact)

12) Program to increase Albedo of Developed Land – Increase solar reflectance of built and cultivated lands to cool climate via “cool” colored and light colored coatings – (Criteria: Investment in safer geoengineering technologies; reduce unemployment; conserve energy)

The above list is a starting place for a public discussion how the US federal, state and local governments should allocate funds to mitigate the effects of climate change, while simultaneously addressing multiple long-standing social and economic challenges. It is not meant to be a complete list but an example of what governments that are concerned about slowing or ameliorating the effects of climate change might spend money on as well as the public discussion that should accompany those deliberations.

Obviously absent from the list above are changes in regulation and taxation related to climate change and climate action. The institution of a carbon tax is one such change that would help this process. However, as this is a climate Keynesian approach, which I will expand upon in the future, I believe that government’s spending and provision of public goods is prior to and a prerequisite for the institution of an effective market regulation/incentive like a carbon tax.

If there is a common thread in the project list above, the items in the list represent vitally important physical changes in infrastructure that will not happen without governments direct involvement, i.e. they are unprofitable for businesses and private financial institutions. Even with a carbon tax or price, these projects would not appear to be first on the list of what the private sector actors effected by that tax would undertake yet not because they do not represent or enable reductions in emissions. Or, alternatively, if a private institution were given the government license and support to build and operate something like the high speed rail network or the renewable energy supergrid, they would essentially have a monopoly which would give them a too-powerful hold over society and the economy, violating even the reality-challenged standards of neoclassical economics. While the neoliberal era, the “common sense” idea has been that organizations need to be motivated by profit to do anything or do anything well, this has historically not been the case in the provision of many high-quality public goods and is dangerous when a profit seeking enterprise controls an important choke point in the economy. Independent quality and oversight safeguards need to be put in place to guide public investment but the spirit of the enterprise must foremost be public service not monetary profit.

Also obviously absent from the list are policies to support renewable energy electric generators (solar panels, wind turbines, etc.) and energy storage facilities (hydroelectric storage, battery storage, thermal storage) that will in the future form the backbone of the energy system. For the purposes of this discussion, I am assuming market regulations and incentives will enable these to be built by private sector actors, including households and businesses not in the power production as a primary business. The removal of subsidies and favorable regulations for fossil fuel extraction, transport and sales will further speed the investment in clean energy. The provision of the above items of infrastructure, make those investments then more likely and more valuable for society as a whole. In particular a continental transmission network that bridges the divisions, increases the usefulness of renewable energy generation.

A Starting Place for Public Discussion and Government Accountability

I am proposing here then a methodology to enable public discussion of and an accountability mechanism for the spending decisions of governments from the federal/national level on down. The publication of an “anatomy” of the general public purpose as viewed by a given group or political actor becomes the context within which spending decisions can be derived in all domains. This will give political constituents an ability to have a public dialogue with their representatives and have at least a chance at greater control over spending decisions based on the campaign promises or public self-representations of political leaders.

The need for this level of dialogue between political leaders and constituents is intensified by the rapid transition to a net zero carbon emissions society that will be led by government investment, in addition to private sector investment. The expanded public spending, in addition to a new energy and climate regulatory regime, in such a transition will transform ways of life and require at least the assent of if not the co-determination of the population at large. By creating a “tiered” approach to discussions of why different types of government project are occurring, the public can enter the discussion on any level of abstraction and follow the intent of policy as well as contribute to the shape of that policy under good to better political conditions.

3 responses to “Democratizing Government Spending in an Era of Climate Change: Decision Criteria and Spending Priority Lists – Pt. 2”